How Insurance Companies Distance Themselves from Agents (And Why It Matters)

Reading through contracts, especially lengthy insurance ones, can be time consuming. Many policies contain confusing language, terms of art, and often include supplemental riders that change the terms or definitions contained in the main body of the policy. But if you don’t read your disability insurance policy until it’s time for you to file a disability claim, you may be caught off-guard by what your policy actually says. This next series of posts will discuss the importance of taking the time to read through your policy, and will review some things to watch out for when you buy a disability insurance policy.

Dentists and physicians are often swamped with work, and rely heavily on insurance agents when selecting and purchasing a disability insurance policy. One scenario we commonly see is doctors requesting a disability insurance policy that is “the same” policy that the other doctors in the practice have. Another common scenario is the doctor who wants more disability coverage and just asks his or her agent for another disability insurance policy that is “like” his or her existing policy, or has the “same coverage” as his or her existing policy. What they don’t realize is that some of the same favorable terms may no longer be available in today’s policies. For example, while most older disability insurance policies contained “true own occupation” provisions, there are now several different variations of “own occupation” provisions, so if you just ask for an “own occupation” policy, you may not actually be receiving the disability coverage that you think you are.

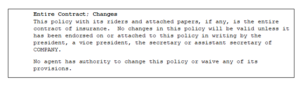

It is also important to be aware that, over the years, disability insurers have sought to distance themselves from agents and now often go so far as to include clauses or statements in their disability insurance policies and applications that state no agent or broker has the authority to determine insurability or make, change, or discharge any contract requirement. Here’s an example of this type of policy language:

So what does this mean? It means that, while solely relying upon an agent’s assurance of the terms of a policy may have been a more acceptable (but not advisable) option in the past (when policies were often similar and generally favorable to policyholders), you can no longer solely rely upon your agent’s description of the policy. No matter how well-meaning or knowledgeable your agent may seem, ultimately, you are going to be on the hook if your disability insurance policy doesn’t say what you thought it said, so it is crucial that you carefully review your disability policy to ensure you are receiving sufficient coverage.

Our next post will discuss the importance of the disability application process and policy review period.