Disability Insurance: What Residents Need to Know – Part 4

Previous posts in this series discussed why residents should secure disability coverage sooner rather than later and examined some important terms and provisions to look for in choosing a disability insurance policy. In this final post, we’ll be discussing some provisions that allow you to increase your monthly disability benefits.

As a medical resident, you likely will not be able to obtain a high amount of disability coverage at first, due to your limited income. Consequently, it is important to look for a disability policy that offers a way to increase your benefits in the future, as your earning capacity and expenses increase. You can also, of course, just purchase an additional disability policy if you want to increase your monthly benefit amount, but there can be certain advantages to building benefit increases into your disability insurance policy from the start. For example, if your policy has a future increase option provision, you can typically increase the monthly benefits without undergoing any additional medical underwriting (which could otherwise result in exclusions being added to your policy if you have recently suffered from a new medical condition).

Here are a few of the most common methods of increasing the monthly disability benefit of an existing disability policy:

The automatic benefit increase rider adjusts your monthly disability benefit on an annual basis to account for anticipated increases in income after you purchase your disability insurance policy. The annual increases are typically for a term of five years, after which you will generally be required to provide evidence of your increased income in order to renew the rider.

This policy rider guarantees you the right to purchase additional disability coverage at predetermined dates in the future without going back through the long and tedious process of reapplying for a disability insurance policy. These riders can be attractive because often no additional medical underwriting is required. Most insurers will not allow you to purchase this rider after age 45.

Cost-of-Living Adjustment (COLA)

A COLA rider automatically increases your disability benefit amount by a certain percentage every year to account for increased cost-of-living due to inflation.

Assuming that you will not face a short or long-term disability until you are older is not a risk you want to take. An individual disability insurance plan is a key component in making sure you are financially stable in the event you are no longer able to practice medicine in your chosen field. However, not all plans are created equal. Take the time to evaluate your financial goals and look carefully at the disability benefits provided by the basic terms, provisions, and riders of the disability insurance policy you are considering.

Disability Insurance: What Residents Need to Know – Part 3

In our previous posts in this series, we examined why residents should not wait to acquire disability coverage and discussed some key provisions to look for when selecting an individual disability policy. In this post, we’ll be taking a look at a few more provisions you may want to look for when selecting a disability insurance policy. More specifically, we are going to look at some policy provisions that can help you meet your monthly expenses in the event of disability, along with some policy provisions that can help you plan for your retirement.

Student Loan Coverage Rider

If you are like most residents, you have accrued a significant amount of student loan debt. The time it takes to pay off student loan debt varies widely based on income and other expenses. Many doctors must practice for several years before they are able to pay off all of their student loans, and student loan obligations can be a significant monthly expense to meet if you are disabled and no longer able to practice. Although not as common as other riders, a student loan coverage rider allows policy holders to insure their student loan for an additional amount each month, on top of their disability benefits.

This provision allows you to forego paying your policy premiums while you are receiving disability benefits, freeing up a substantial portion of the monthly income you would otherwise be paying back to the insurance company.

This provision, while not as common, entitles the policy holder to receive a refund of all premiums if he or she does not become disabled before the expiration of the policy term. This can be appealing to residents, whose plans will be in effect for a long time.

This important provision in a policy controls the period of time the insured is eligible to receive disability benefits. Most plans pay benefits until age 65 or 67, some pay lifetime benefits, and others pay for only a limited amount of time, even if a claim is filed decades before the policy terminates.

Retirement Income

The majority of doctors under 40 list preparing for retirement as their top financial goal.[1] There are several different disability policy riders directed towards this goal, including the following.

Graded Lifetime Benefit Rider: This provision, based on its terms, extends some or all of your disability benefits past the normal end date of age 65 or 67.

Lump Sum Rider: This rider provides for a one-time payment once the policy expiration age is reached. Typically, policy holders must have received disability benefits for at least one year and the lump sum payment is typically a percentage of the aggregate sum of disability benefits received during the policy term.

Retirement Protection Insurance: Depending on the insurer, this may be offered as a rider or a stand-alone policy. If you become disabled and your claim is approved, your insurer will establish a trust for your benefit, where disability benefits are deposited and invested (similar to an employer-sponsored 401(k)), with funds likely becoming accessible after the age of 65.

Our next post in this series will discuss the importance of choosing a plan where disability benefits increase over time.

[1] 2015 Report on U.S. Physicians’ Financial Preparedness, Young Physicians Segment, American Medical Association Insurance, https://www.amainsure.com/reports/2015-young-physician-report/index.html?page=5.

Disability Insurance: What Residents Need to Know – Part 2

In our previous post, we looked at how important it is for residents to have a plan to protect themselves financially in the unfortunate event they become disabled. In this post we will address some critical terms to look for when comparing potential disability policies.

Perhaps the most important provision in your disability insurance policy is the definition of “Total Disability.” For physicians, dentists, and other highly specialized professionals who have invested both years and hundreds of thousands of dollars in their careers, a policy that defines “Total Disability” in terms of your inability to perform the specific duties of your “own occupation” (as opposed to “any occupation”) is critical. If your policy defines “Total Disability” as being unable to work in “any occupation,” it will be much more difficult to establish that you are entitled to benefits, in the event you suffer from a disabling condition.

In addition to knowing and understanding your policy’s definition of “total disability,” it is also crucial to know how working in another profession is treated by your disability insurance policy. For instance, if you happened to be an oral surgeon with an essential tremor, you may no longer be able to operate safely on patients, but you may still be able (and want) to teach. Alternatively, if you happened to be a physician who did not take steps to increase your disability coverage to match your increases in earnings, working in another capacity may be the only way to maintain your lifestyle in the event of disability. Consequently, it is also important to know if your policy will allow you to work in another capacity and still collect disability benefits. Along those lines, here are a few other provisions you will want to watch out for:

No Work Provisions

These provisions mandate that you cannot work in another field and still receive disability benefits. This can be problematic if you do not have sufficient disability coverage to meet all of your financial needs.

These types of provisions require you to work in another occupation. This, of course, can make it impossible to collect on your disability benefits if your disability prevents you from working.

In our next post we will look at how you can select a plan that grows with you over time, as both your financial obligations and income change.

Disability Insurance: What Residents Need to Know – Part 1

As a medical resident who is just starting out, you have likely heard about disability insurance, but you may not know a lot about what it is, and why it is important. In this series of posts, we will be discussing a few things that every medical resident should know about disability insurance.

In this post we will look at the likelihood of disability, and discuss how you can begin to protect yourself now and in the future. In subsequent posts we’ll address some of the key provisions to look for in a disability insurance policy, ways to make sure your policy meets current and future expenses, and ways to increase your disability benefits over time, as both your earning potential and financial obligations expand.

Likelihood of Disability

As a resident, you are beginning what will hopefully be a long and successful career as a physician. The possibility of suffering either a short or long-term disability is probably the last thing on your mind, especially if you are still young and healthy. However, the American Medical Association (AMA) reports that 60% of surveyed physicians have a colleague who has sustained a disability accident or injury.[1] A Social Security Administration report shows that it is significantly more likely that a worker born in 1996 will become disabled during his or her career than die,[2] and just over 1 in 4 of today’s twenty-year-olds will become disabled before they retire.[3]

Protection Against Disability

The majority of young doctors under 40 are married, have children, are homeowners, and 75% report that they are their family’s primary breadwinner.[4] Young doctors also face substantial student loan debt, totaling around $166,750, on average. With a resident’s salary averaging just $50,000 a year,[5] it can be tempting to put off adding the additional expense of an insurance premium. However, with most young doctors having less than $50,000 in an emergency fund [6], it’s never too early to start planning to protect your family and provide for care in the unfortunate event you can no longer practice.

While many residents and doctors choose to take part in disability plans offered by their employers, these plans will often not provide adequate coverage, and any disability benefits you do receive will likely be taxable. In contrast, an individual plan provides coverage that is yours as you move from your residency and through (potentially) many different employers. Individual plans also typically allow you to adjust your disability coverage as your income potential grows.[7] However, not all individual policies are created equal and it is important to carefully choose a disability insurance policy.

In our next post, we’ll examine some key provisions to be aware of when shopping for an individual disability insurance policy.

[1] Robert Nagler Miller, Residents: Your disability insurance coverage may fall short, AMA Wire, April 4, 2017, https://wire.ama-assn.org/life-career/residents-your-disability-insurance-coverage-may-fall-short

[2] Johanna Maleh and Tiffany Bosley, Disability and Death Probability Tables for Insured Workers Born in 1996, Social Security Administration, Office of the Chief Actuary, Actuarial Note, No. 2016.6, October 2016.

[3] You, disabled? What are your chances?, The Council for Disability Awareness, 2015, http://www.disabilitycanhappen.org/chances_disability/

[4] 2015 Report on U.S. Physicians’ Financial Preparedness, Young Physicians Segment, American Medical Association Insurance, https://www.amainsure.com/reports/2015-young-physician-report/index.html?page=5

[5] Kathy Kristof, $1 million mistake: Becoming a doctor, CBS Money Watch, Sept. 10, 2013, http://www.cbsnews.com/news/1-million-mistake-becoming-a-doctor/

[6] 2015 Report, Supra.

[7] Miller, Supra.

[8] 2015 Report, Supra

Attorney Ed Comitz Posts CE Course on Dentaltown

Ed Comitz’s Continuing Education course “Disability Insurance Roulette: Why is it So Hard to Collect on My Policy” is now available through Dentaltown. This CE is an electronically delivered, self-instructional program and is designated for 2 hours of CE credit. In this course, Ed discusses why it is so difficult for dentists to collect disability benefits and how to avoid the most common mistakes made by dentists when filing disability claims. Ed also covers the key provisions to look for in disability insurance policies and provides an overview of the disability claims process. Finally, the course discusses how disability insurance claims are investigated and administered, and identifies common strategies used by insurance companies to deny claims.

Information on how to register can be found here.

For more information regarding what to look for in a policy, see this podcast interview where Ed Comitz discusses the importance of disability insurance with Dentaltown’s Howard Farran.

Watch Out for “Work” Provisions

In a previous post, we discussed the importance of how your disability insurance policy defines the key term “total disability,” and provides several examples of “total disability” definitions. The definition of “total disability” in your policy can be good, bad, or somewhere in-between when it comes to collecting your disability benefits.

Disability insurance policies with “true own occupation” provisions are ideal. Here’s an example of a “true own occupation” provision:

————————————————————————————————————————————

Total disability means that, because of your injury or sickness, you are unable to perform one or more of the material and substantial duties of your Own Occupation.

————————————————————————————————————————————

Under this type of provision, you are “totally disabled” if you can’t work in your occupation (for example, you can no longer perform dentistry). This means that you can still work in a different field and receive your disability benefits under this type of disability insurance policy.

Insurance companies often try to make other disability insurance policies look like true own occupation policies, and include phrases like “own occupation” or “your occupation,” but then tack on additional qualifiers to create more restrictive policies.

One common example of a restriction you should watch out for is a “no work” provision. Although these provisions can contain the phrase “your occupation” they only pay total disability benefits if you are not working in any occupation. Here’s an example from an actual policy:

————————————————————————————————————————————

Total disability means solely due to injury or sickness,

- You are unable to perform the substantial and material duties of your occupation; and

- You are not working.

————————————————————————————————————————————

As you can see, under this type of provision, you cannot work in another field and still receive disability benefits. This can be problematic if you do not have sufficient disability coverage to meet all of your monthly expenses, as you’re not able to work to supplement your income.

A “no work” provision is something that is relatively easy to recognize and catch, if you read your policy carefully. Recently, we have come across a definition of “total disability” that is not so easy to spot, but can dramatically impact you ability to collect benefits. Here’s an example, taken from a 2015 MassMutual policy:

————————————————————————————————————————————

OWN OCCUPATION RIDER

Modification to the Definitions Section of the Policy

Solely for the Monthly Benefits available under this Rider, the definition of TOTAL DISABILITY is:

TOTAL DISABILITY – The occurrence of a condition caused by a Sickness or Injury in which the Insured:

- cannot perform the main duties of his/her Occupation;

- is working in another occupation;

- must be under a Doctor’s Care and

- the Disability must begin while this Rider is In Force.

————————————————————————————————————————————

At first glance, this looks like a standard “own-occupation” provision—in fact, it is entitled “Own Occupation Rider.” But if you take the time to read it more closely, you’ll notice that the second bullet point requires you to be working in another occupation in order to receive “total disability” benefits.

Obviously, this is not a disability insurance policy you want. If you have a severely disabling condition, it may prevent you from working in any occupation, placing you in the unfortunate position of being unable to collect your disability benefits, even though you are clearly disabled and unable to work in any capacity. Additionally, many professionals have limited training or work history outside their profession, so it can be difficult for them to find alternative employment or transition into another field—particularly later in life.

These “work” provisions appear to be a relatively new phenomenon, and are becoming increasingly more common in the newer disability insurance policies being issued by insurance companies. It is crucial that you watch out for these “work” provisions and make sure to read both the policies definition of “own-occupation” and “total disability.” While many plans contain the phrase “own-occupation”, including this example, they often aren’t true own-occupation policies and you shouldn’t rely on an insurance agent to disclose this information. Oftentimes, your agent may not even realize all of the ramifications of the language and definitions in the disability insurance policy that they are selling to you.

Lastly, you’ll also note that this particular provision was not included in the standard “definitions” section of the disability insurance policy, but was instead attached to the policy as a “rider,” making it even harder to spot. It’s important to remember that many definitions and provisions that limit disability coverage are contained in riders, which typically appear at the end of your policy. Remember, you should read any disability insurance policy from start to finish before purchasing.

Can Your Disability Insurance Company Dictate The Medical Treatment You Must Receive To Collect Benefits? Part 1

Imagine that you are a dentist suffering from cervical degenerative disc disease. You can no longer perform clinical work without experiencing excruciating pain. You have been going to physical therapy and taking muscle relaxers prescribed by your primary care doctor, and you feel that these conservative treatments are helping. Like most dentists, you probably have an “own occupation” disability insurance policy. You are certain that if you file your disability claim, your insurer will approve your claim and pay you the disability benefits you need to replace your lost income and cover the costs of the medical treatment that has provided you with relief from your pain and improved your quality of life.

You file your disability claim, submit the forms and paperwork requested by the insurer, and wait for a response. To your dismay, your disability insurer informs you that its in-house physician has determined that the treatment prescribed by your doctor was inadequate. Your insurer then tells you that you should have been receiving steroid injections into your cervical spine, and tells you that if you do not submit to this unwanted, invasive medical procedure, your disability claim could be denied under the “medical care” provision in your policy.

You were not aware that such a provision existed, but, sure enough, when you review your policy more carefully, you realize that there is a provision requiring you to receive “appropriate medical care” in order to collect disability benefits. You think that your insurer is going too far by dictating what procedures you should or should not be receiving, but you are afraid that if you don’t comply with their demands, you will lose your disability benefits, which you desperately need.

This is precisely the sort of scenario presented to Richard Van Gemert, an oral surgeon who lost the vision in his left eye due to a cataract and chronic inflammation. Dr. Van Gemert’s disability insurance policies required that he receive care by a physician which is “appropriate for the condition causing the disability.” After years of resisting pressure from his insurers to undergo surgery, Dr. Van Gemert finally capitulated. Once Dr. Van Gemert received the surgery, you might expect that his insurer would pay his claim without further complaint. Instead, Dr. Van Gemert’s insurer promptly sued him to recover the years of disability benefits it had paid to him since it first asserted that he was required to undergo the surgery.[1]

Unfortunately, “appropriate care” provisions, like the provision in Dr. Van Gemert’s policy, are becoming more and more common. The language in such provisions has also evolved over time, and not for the better. In the 1980s and 1990s, the simple “regular care” standard was commonplace. In the late 1990s and into the 2000s, insurers began using the more restrictive “appropriate care” standard. And, if you were to purchase a policy today, you would find that many contain a very stringent “most appropriate care” standard.

These increasingly onerous standards have been carefully crafted to provide disability insurers with more leverage to dictate policyholders’ medical care. However, there are several reasons why your insurance company should not be the one making your medical decisions. To begin, if you undergo a surgical procedure, it is you—and not the insurance company—who is bearing both the physical risk and the financial cost of the procedure. Perhaps you have co-morbid conditions that would make an otherwise safe and routine surgical procedure extremely risky. Perhaps there are multiple treatment options that are reasonable under the circumstances. Perhaps you believe conservative treatment provides better relief for your condition than surgery would. These are decisions that you have a right to make about your own body, regardless of what your disability insurer may be telling you.

In the remaining posts in this series, we will be looking at the different types of care provisions in more detail, and how far insurance companies can go in dictating your care in exchange for the payment of your disability benefits. We will also provide you with useful information that you can use when choosing a disability insurance policy or reviewing the policy you have in place. In the next post we will be discussing the “regular care” standard found in most policies issued in the 1980s and early 1990s.

[1] See Provident Life and Accident Insurance Co. v. Van Gemert, 262 F.Supp.2d 1047 (2003).

The Devil Is In the Details: Long Term Disability Policies and Benefit Offsets

In a previous post, we discussed a feature of long-term disability insurance policies that is easily overlooked and frequently leaves policyholders feeling cheated and deceived by their insurer: the benefit offset provision. When a person signs up for a disability insurance policy, he or she expects to pay a certain premium in exchange for the assurance that the insurance company will provide the agreed-upon monthly benefit listed in the policy, should they ever become disabled. What many people do not realize is that some disability insurance policies contain language that permits the insurer to reduce the amount of monthly disability benefits it is required to pay if the policyholder receives other benefits from another source.

Worker’s compensation, supplementary disability insurance policies, state disability benefits, and social security are some of the most common “other sources” from which policyholders may unexpectedly find their disability insurance benefits subject to an offset. The frequency of offset provisions varies by policy type. They are more likely to appear in group policies and employer-sponsored ERISA policies, and are rarely found in individual disability insurance policies.

Benefit offset provisions can have significant and often unforeseen financial repercussions, as illustrated by the recent account of a couple from Fremont, Nebraska. As reported by WOWT Channel 6 News, Mike Rydel and his wife Carla were receiving monthly benefits under Mr. Rydel’s disability insurance policy with Cigna. Mr. Rydel had suffered a stroke in the fall of 2015 that had left him incapacitated and unable to work. The Rydels’ financial situation was made even more dire by Mr. Rydel’s need for 24-hour care, which prevented Mrs. Rydel from working as well.

In an effort to supplement his family’s income, Mr. Rydel applied for Social Security disability benefits. When his claim was approved, the Rydels expected a much needed boost to their monthly income. Unfortunately, due to an offset provision in Mr. Rydel’s policy, his monthly disability benefits under the Cigna policy were reduced as a result of the approved Social Security claim, and his family did not realize any increase in income.

The Rydels were understandably shocked when they were informed by Cigna that Mr. Rydel’s monthly disability insurance benefits would be reduced by the amount he was now receiving from Social Security, and that Cigna would be pocketing the difference. Perversely, the only party that benefited from Mr. Rydel’s SSDI benefits was Cigna, which was off the hook for a portion of Mr. Rydel’s monthly benefits. In response to an inquiry from WOWT, Cigna simply asserted that “coordination” of private insurance benefits and government benefits was a long-standing practice – an assurance that likely provided no solace to the Rydels.

The Rydels’ story highlights the importance of carefully reviewing every aspect of your disability insurance policy before signing. Benefit offsets, policy riders, occupational definitions, and appropriate care standards in your policy can significantly impact your ability to collect full benefits if you become disabled. You should review your disability insurance policy carefully to determine if it contains any offset provisions that may affect your benefits. If it does, you will need to take them into account when estimating your monthly benefits.

References:

http://www.wowt.com/content/news/Stroke-Victim-Suffers-Disability-Insurance-Set-Back-385758411.html

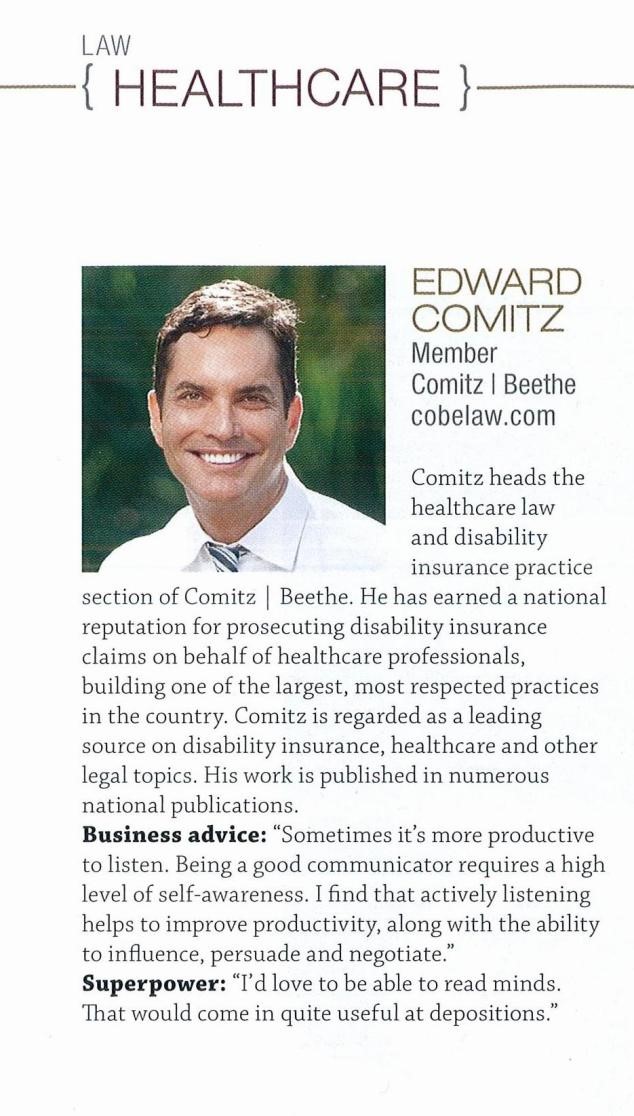

Ed Comitz selected as an Arizona Business Leader in 2017

Ed Comitz has been named as an Arizona Business Leader in 2017 by Arizona Business Magazine. The 500 business leaders were selected from a pool over of 5,000 names considered. Editor in Chief, Michael Gossie, writes of the 500 leaders selected, “They are catalysts for Arizona’s economy. They are leaders. They are innovators. They have influence. And when they speak, they make things happen.”

Ed Comitz Named as Top Lawyer in Field of Insurance Law

Ed Comitz, one of the firm’s founding members, was recently named as a Top Lawyer and one of Phoenix’s best attorneys in the field of insurance law in Phoenix Magazine’s special, 50th Anniversary Issue.

Mr. Comitz’s practice primarily focuses on helping physicians and dentists secure private disability insurance benefits. Mr. Comitz and the legal team at Comitz | Stanley also represent doctors in several other areas, including practice transitions, employment law, business litigation, estate planning, regulatory compliance, and licensing issues.

Could Your Tech Be Hurting You?: Facebook

It seems that in recent years, everything is becoming digital. You can do any number of things from your smartphone or computer that had to be accomplished with face time, or personal interactions, in the past. Everything from buying groceries to dating can be done online, and the disability insurance claims process is no exception. This week, we’re starting a series that takes a look at three ways that the modern age has changed how you and your disability insurance company can approach your claims.

First, we’re going to start with a form of social media that almost everyone has: Facebook. It may be a great way to share photos and keep in touch with old friends, but Facebook could be hurting your insurance claim in a way that perhaps you weren’t aware of.

We have written at length on ways that insurance companies can use surveillance to often unfairly deny people their benefits. From stakeouts to tailing to GPS tracking, insurance companies have been known to do some pretty unsavory things in the name of saving money. With the rise of different forms of social media, this gives insurance companies another tool to monitor you and your activities in the hope that you do something that would allow them to deny your claim.

We have also discussed how posting pictures or statuses on Facebook can lead to insurance companies denying claims because it appears that you are leading an active lifestyle, but you probably didn’t know that even a deactivated account can be brought up in litigation. In the case of a Mr. Brannon Crowe, he was ordered to bring up 4,000 pages of his entire Facebook page–one that was deactivated four days after the order.

While Mr. Crowe may not have been trying to hide anything, and most people aren’t, the message is still important. Not only is it crucial to keep your social media accounts free from any information that an insurance company can misconstrue to claim you aren’t disabled, but if you are really concerned about surveillance, deactivating won’t do the trick. Since deleting your Facebook results in a loss of all the networks and relationships that you have built over the years, we certainly aren’t saying that you should delete it and swear off of social media. We simply advise that you are careful about what you post, and if you have any questions about what this could be, feel free to comment or email us!

Unum is Making Some Changes, But Are They Good For Your Plan?

In previous posts, we have discussed how courts and juries have reprimanded Unum and its various subsidiaries for wrongfully denying disability claims. Now, Unum is once again making the headlines—this time for making significant changes to its leadership at the highest levels of the company.

What’s changing?

Essentially, Unum is undertaking a widespread overhaul of its upper management. Marco Forato is now the senior vice president for global growth strategy, Steve Mitchell is the new chief financial officer, and Steve Zabel is the new president of the U.S. closed block operations. Additionally, Vicki Gordan has been promoted to senior vice president and chief internal auditor, and Matt Royal is now the chief risk officer for Unum.

While any change of leadership can have substantial ramifications, those insured by Unum should take particular note that Unum has appointed a new “president of the U.S. closed block operations.” “Closed block” refers to Unum’s discontinued product lines, which, according to Unum’s 2014 Annual Report, include long-term care and older individual disability policies. If you are a physician or dentist with a Unum policy, your policy is probably part of Unum’s “closed block” operations.

Unum’s new president of “closed block” operations will likely face a challenging task because any losses suffered from paying out Unum’s old disability policies cannot be offset by new business. Additionally, such “closed block” operations are a relatively new phenomenon in the insurance industry, so there is a very small reserve of historical data for Unum to draw upon.

What does this mean?

Generally speaking, a company does not make such extensive changes without expecting results. Consequently, it is likely that several, if not all, of Unum’s newly appointed leaders will be under substantial pressure to perform. Because fresh leaders often want to leave their own mark on their industry, insureds should pay close attention to any new changes in policy announced by Unum during this transitional period.

More specifically, insureds with older individual disability policies with Unum should be aware that Unum will likely be looking for new, creative ways to deny their claims. If you have such a policy and you feel that Unum has arbitrarily changed your policy’s terms and/or wrongfully denied your disability claim, you should consult with an experienced disability insurance attorney to ensure that Unum’s leadership is not improperly exceeding the scope of their newly acquired authority.

Do You Need Disability Insurance for More than Just Yourself?

We spend a lot of time talking about disability insurance claims and mostly focus on the big one: personal disability insurance. However, there are three other types of insurance that you may not have been aware of, and could be potentially helpful to you and your practice. Today, we’ll be taking a look at key-person disability insurance, buyout disability insurance, disability insurance for overhead, and, of course, personal disability insurance.

Personal Disability Insurance

Essentially, disability insurance is insurance that you buy for yourself in the event that you become disabled while working. If you work in a profession where disability is a possibility, it is important to have personal disability insurance for the sake of your future. For instance, dentists are at higher risk for disability due to repetitive movements and static positions, so it is crucial for them to have a disability policy.

Further, we recommend that you purchase an individual disability insurance policy for yourself, and not through an employer-sponsored program. This makes sure that the policy is not covered by ERISA in the event that you do have to file a disability claim.

Key-Person Disability Insurance

Key-person disability insurance is a type of coverage for those that own their own business or practice. This form of insurance covers an employee that is “key” to your business: someone who would be impossible to replace due to their skill, customer base, knowledge or burden of responsibility. If this person was to become disabled, and you had key-person disability insurance, the business would receive disability income checks. These checks could be used to cover the financial loss of the missing employee, or it could pay for a temporary worker while the insured person recovers from the disability.

There are several things to consider when determining if you should buy key-person disability insurance. These include the contingencies for the company if a key employee is disabled, the time to find and train a suitable replacement, the amount of revenue directly attributable to the key person, whether or not the key person’s disability will result in the loss of clients, and whether your company is willing to self-insure.

Unlike personal disability insurance policies, key-person policies are limited in their features and options. Often, they are custom designed for the company so that they meet specific needs, and are also often very short term, lasting between 12–24 months. This is because it is usually assumed that you could find and train a replacement in that time span.

Continue reading “Do You Need Disability Insurance for More than Just Yourself?”

Protecting the Protectors: Depression, Medical Professionals, and the Conflicts Involved with Under-reporting

Today we’re taking a closer look at how depression can affect doctors and dentists, their practices, and the way they file for disability insurance. We examine how the medical community’s approach toward mental health is perhaps preventing some doctors from reporting illness, and how this changes a doctor’s ability to obtain adequate treatment and secure disability insurance benefits.

Depression and anxiety are undeniably prevalent among physicians and dentists. For instance, a study in Australia showed that the rates of depression in doctors is four times higher than the general population and in a British study, 60% of dentists surveyed reported being anxious, tense, or depressed.

Simply looking at the daily life of doctors, and comparing that to the risk factors for depression shows some striking connections between the two. Some of the risk factors associated with depression (as outlined by the Mayo Clinic) include being overly self-critical, having serious or chronic illness and dealing with traumatic or stressful events. Interestingly, these are many things that doctors and dentists struggle with; indeed, probably more often than the average person. Doctors and dentists have to be self-critical because if they aren’t, lives could be at stake. In addition, doctors and dentists often suffer from chronic illness and pain due to the physically and emotionally taxing nature of their work. Worrying about patients, running a practice, and working long hours are all part of the job description for the average doctor.

While physicians and dentists commonly have symptoms of depression, they often don’t report their issues due to the stigma of mental health issues within the medical community. Lay people look to doctors and dentists as the paragon of health, and physicians take the same approach: while their patients are characterized by their illness, physicians are supposed to be the ones who cure them. While the general populace’s approach to mental illness has improved greatly over time (we no longer lock people in tiny jail cells simply because they are mentally ill), the negative stigma attached to depression and anxiety in the medical and dental community is still present. In the Australian study noted above, half of the respondents reported thinking that they were less likely to be appointed to a new position if they had a history of mental illness, and 40% admitted thinking less of doctors that have a history of depression or anxiety.

Nevertheless, it is important for doctors to recognize whether they exhibit signs of mental illness. Aside from needing to be mindful of their own health and well-being, doctors are responsible for the health and well-being of their patients, too. Physicians and dentists both are in the unique position that a mistake that they make at work could endanger a life. Attempting to work through depression and anxiety symptoms that impair the doctor’s ability to provide responsible patient care could lead to a malpractice suit. Perhaps the solution to this issue is a re-evaluation of the medical community’s approach to mental illness. While that seems like a large task to take on, it starts with each individual doctor either seeking treatment for mental health, or supporting those that do.

For physicians, states have programs in place called Physician Health Programs (PHPs) that are supposed to support the health, including mental health, of medical licensees. A PHP is advertised as a way to get the help one needs, while avoiding disciplinary action such as a loss of license. Physicians should be aware, however, that PHPs are often connected to the licensing boards, and non-compliance with the PHP can lead to disciplinary action. For example, in Arizona, while the PHP is operated by an independent agency, it does have a formal contractual relationship with the state licensing board.

Arthritis and Its Many Forms: How It Affects Dental Professionals

The number one cause of disability in America is arthritis, which afflicts over 50 million people. With a U.S. population of 320 million this means that 1 person in every 6 has arthritis. These large numbers could be due to the fact that there are over 100 different types of arthritis ranging from lupus to gout. In this post, we will look to focus on the three most prevalent types of arthritis: osteoarthritis, rheumatoid arthritis and psoriatic arthritis. We will also discuss how they can affect your practice as a dentist, and how to approach a disability insurance claim for arthritis.

The Basics: Symptoms, Causes & Treatment

Osteoarthritis (OA) is the arthritis that arises simply from the overuse of joints, and for this reason it is known as “wear and tear” arthritis. Symptoms include pain, swelling and stiffness in the joints after either overuse or long periods of inactivity. It is most commonly developed as people naturally age and their bodies reflect that age, but can also be found in professions with repetitive movements, such as dentistry.

Since OA is due to aging or the effects of repetitive motion, OA is often progressive. It is the most common form of arthritis, and treatment can range from added exercise and weight loss (where the main cause of the OA is obesity), to taking various pain relievers, and even surgery.

Rheumatoid arthritis (RA), on the other hand, is an autoimmune disease, and is three times more common in women than it is in men. The body’s immune system mistakenly attacks joints, which leads to inflammation that causes further damage. While the symptoms are similar to OA in that there is joint pain and swelling, rheumatoid arthritis also can bring about fevers, fatigue, and weight loss. The joint pain you may be experiencing is often symmetrical, meaning both sides of the body are affected, in RA.

Unfortunately, the causes of RA aren’t fully understood. Symptoms can start and stop, occasionally going into remission, but RA is usually progressive. Risk factors for RA include family history of the disease, smoking, periodontal disease, and microbes in the bowels. There is no cure for RA, and it is treated somewhat similarly to OA in that pain medication, increased exercise, and surgery can be used to try to alleviate symptoms.

Continue reading “Arthritis and Its Many Forms: How It Affects Dental Professionals”

Patrick Stanley Selected as a Sustaining Member of Arizona’s Finest Lawyers

Firm member Patrick Stanley, whose practice areas include disability insurance and healthcare litigation, was selected as a Sustaining Member of Arizona’s Finest Lawyers. Nominations to Arizona’s Finest Lawyers are governed by strict ideologies and are made by Sustaining Members, selectees, and members of the Executive and Advisory Boards. The AFL seeks to build a diverse membership of individuals who, through noteworthy achievement, have reached positions of honor and trust. A Sustaining Member must be highly skilled, have a well-known reputation for honor and professional behavior, and be dedicated to AFL’s mission and goals.

What to Do When Your

Disability Insurance Claim Is Denied

A large part of our practice consists of helping physicians and dentists whose disability insurance claims have been denied or terminated. When our clients come to us, we carefully analyze their medical records, the claim file, and the law to craft a specific strategy for getting the disability insurer to reverse its adverse determination. Unfortunately, we sometimes find that in between receiving notice that their claim has been denied or terminated and getting in touch with our firm, doctors will inadvertently take actions that prejudice their disability claims. With that in mind, it’s important to review what to do and what not to do in the first few days after your claim is denied or terminated.

- In all likelihood, you will first find out that your insurer is denying or ending your disability benefits via a telephone call from the claims consultant who analyzed your claim. As we’ve explained before, the consultant will be taking detailed notes about anything you say during that call. Therefore, even if you are justifiably upset or angry, be very mindful of what you say. Anything you tell the consultant will certainly be written down and saved in your file.

- During the call with your consultant, make your own notes. You don’t have to ask a lot of questions at this stage, but you do want to make sure to record whatever information the consultant gives you.

- Following the phone call, you should receive a letter from the insurance company stating that it has denied your disability claim or discontinued your disability benefit payments. According to most state and federal law, the letter should have a detailed explanation of the evidence the company reviewed and why the insurer thinks that evidence shows you aren’t entitled to disability benefits. When you receive the letter, read through it carefully. Make notes on a separate document about any inaccuracies you identify.

- Make sure you keep a copy of the denial or termination letter as well as the envelope it came in. You should also make a note of the date on which you received the letter. The date the letter was actually mailed and received could be important to your legal rights in the future. Then, the best thing to do is to scan the documents electronically or make a photocopy for your file, just in case the original denial letter gets lost or damaged.

- Once you find out that your disability claim has been denied or terminated, you should contact a disability insurance attorney. Some doctors and dentists attempt to handle an appeal of their claim on their own, but we strongly suggest at least consulting with a law firm. Every insurance company has its own team of highly-trained claims analysts, in-house doctors, and specialized insurance lawyers to help it support the denial of your claim. Having your own counsel can level the playing field by making sure you know your rights under your policy and what leverage the applicable law provides you, and help you avoid the common traps that insurance companies lay for claimants on appeal.

- The lawyer you consult can be in your area, or it can be a firm with a national practice that’s physically located in another state. You may want to review these questions to ask potential attorneys before you decide who you would like to represent you.

- Whatever attorney you choose to contact, make sure you do so as soon as possible. In many circumstances, you will only have a limited amount of time to appeal the insurance company’s decision. Particularly in claims governed by the federal law ERISA, the clock starts ticking as soon as you find out your disability claim has been denied or terminated.

- It’s usually best to contact a disability insurance attorney before you respond to the denial letter, to avoid saying anything that could prejudice your appeal. For instance, if you have a disability insurance policy that is governed by ERISA, and you submit some additional information, the insurance company may not allow you to submit any additional information after your initial response.

- Before you meet with potential disability insurance lawyers, gather whatever documents you can to help them evaluate what’s going on with your claim. Our firm will always want to review the insurance policy or policies. (Here’s information on how to get a copy of your policy). We typically also like to see your relevant medical records and any correspondence between you and your insurance company. If you aren’t able to locate this information, it could cause delays in starting the appeal process.

- If you are a physician or dentist that is totally disabled, you should not try to go back to work just because your insurance company thinks you don’t qualify for disability benefits. Trying to practice when you aren’t in a physical or mental condition to do so could cause you to re-injure yourself or accidentally harm your patients. Of course, trying to work on patients after you’ve claimed that you are totally disabled can expose you to professional liability as well. Further, trying to return to work could impair your ability to collect your disability benefits upon appeal.

Field Interviews: What to Expect After the Interview Ends

We’ve discussed why a disability insurer might want to schedule a field interview and what to expect before and during the interview itself. Now we review what claimants can expect can expect after the interview ends. Again, the process is usually different depending on whether not a disability insurance attorney is involved.

After the Field Interview

After your interview ends, the field representative will leave to do some additional reconnaissance. Without telling you, the representative may drive to your office to talk to people on your staff. He or she will see what the office looks like, if it’s busy, and whether your name is still listed on the door. If you have a disability insurance attorney, the attorney will have discussed this with you ahead of time, and together you will have taken steps to make sure the representative doesn’t bother your staff or catch them off guard.

Some days after the field interview, the representative will send you a copy of his or her report, which purports to summarize your conversation. The report will ordinarily be 8 to 10 pages or more. He or she will ask you to review the report, make any changes you see fit, and return it. The representative will advise that if you don’t make any changes by a certain date, he or she will assume that everything in the report is accurate.

For claimants with legal representation, the report will be sent to your attorney’s office. Your attorney will review the report to make sure that it accurately reflects the facts of your disability claim. He or she should be able to correct any seemingly harmless statements that a claims adjuster may take out of context to support denying or terminating your disability claim. If any important information is missing, your attorney will make sure to include it along with the report.

Meanwhile, the field representative will usually send a separate report to the insurance company. This second report will have the representative’s personal observations about you, their conversations with your staff, and any other information he or she was able to gather about your outside of the interview. You will not be provided with a copy of this report unless you’re able to obtain the claim file after your disability claim has been terminated or denied. If you have an attorney, this second report will be much more limited, as the representative will not have had the opportunity to visit your home or to pry into irrelevant or confidential information. If your disability claim is denied or terminated, your attorney will obtain and review this report for any inaccuracies or misstatements.

A field interview can be intimidating, but knowing why the interview is being conducted and what to expect during the process can make you better prepared to handle it in a way that doesn’t prejudice your claim. If you have questions or concerns about a field visit, contact a disability insurance lawyer right away.

Field Interviews:

What to Expect Before and During the Interview

Our last post discussed why an insurance company might want to conduct a field visit or field interview. Now that you know what the insurer is trying to accomplish, we’ll discuss what exactly to expect before the interview, during the interview, and afterwards. As with many aspects of the disability claims process, the field interview will be different depending on whether or not you have a disability insurance attorney involved. First, what to expect before and during the interview:

Setting Up the Field Interview

Initially, the field representative will call or e-mail you personally to set up a time to meet. He or she will ask to come to your home, or sometimes your office (particularly if you have been practicing as a dentist or physician), and talk one-on-one. If you’re being represented by a disability insurance lawyer, the field representative will call or write a letter to the lawyer’s office to request a field interview. Your attorney will evaluate whether the in-person interview is necessary and appropriate under the terms of your policy and your particular claim situation. If so, your attorney will likely ask the field interviewer to meet at the attorney’s office, rather than in your home or office. Your attorney, and sometimes an assistant as well, will attend the interview. The attorney and/or his or her assistant will take careful notes of the entire conversation.

During the Field Interview

When the representative arrives, he or she may ask to take your photograph. The representative may also ask to audio-record your conversation. If an attorney is present, the representative will usually refrain from asking to take a photograph or audio-record the conversation, knowing that your legal counsel will likely determine it unnecessary and/or inappropriate.

The field representative will sit down and talk with you for an hour or more. He or she will have an extensive list of questions to ask you, most of which your claims analyst will have specifically requested the representative address. For those with legal representation, your attorney will have prepared you for each of the questions the representative will ask, so you’ll be ready to give accurate and well-considered answers.

During your conversation, the representative will be very warm and friendly. The representative will normally try to establish a rapport so that you’ll relax and talk openly. He or she will try to get you to talk without thinking, encourage you to go into unnecessary detail, and may ask personal questions that a claims adjuster would normally avoid.

The representative often acts somewhat more reserved when a disability insurance attorney is present. Field representatives know that if they ask any questions that are irrelevant, seek confidential information, or are otherwise inappropriate, your attorney will intervene and let you and the representative know that you don’t need to answer the question.

While you’re talking, the field interviewer will take copious notes. These notes will include the interviewer’s own observations about your appearance, how well you move, how long you were able to sit or stand, what your house looks like (if in your home), and whether you seem nervous or not. If your attorney attends, the representative will know that his or her notes will be compared against the attorney’s, so he or she will be especially careful to document the circumstances accurately.

In our next post, we’ll talk about what happens after the field interview ends.