How Do I Know if My Insurer Might Be Interested in a Lump Sum Settlement?

We are often asked whether a particular claim is the type of claim that an insurance company would be interested in settling for a lump sum buyout. The answer, as explained in more detail below, is always, it depends, because there are a number of factors that come into play, and many of those factors are not even directly related to whether the claim itself is legitimate or whether the insured’s condition is permanent (although those are important factors that impact whether a buyout is a possibility).

What is a Lump Sum Buyout?

You may be familiar with the terms of your disability policy, but you may not know that, in certain instances, insurers are willing to enter a lump sum settlement. Under a lump sum settlement, your insurer agrees to buy out your policy and, in return, you agree to surrender the policy and release the insurer from any further obligations to you going forward.

There are certain pros and cons to this sort of settlement. Some claimants prefer a lump sum settlement, because it allows them to avoid having to rely on month-to-month payments from their insurer (which may or may not arrive, or if they do arrive, may not arrive on time) and/or to avoid the hassle of dealing with claim forms, medical exams, etc. for years to come. A lump sum settlement can also allow you to take advantage of present investment opportunities that can provide for your and your family’s future. But there are also other considerations that you will need to discuss with your attorney as well as your accountant and other financial advisors. For example, if your benefit period lasts to age 65 (and you end up living to the end of the benefit period), you would likely receive more money cumulatively over time if you stayed on claim and received monthly benefits in lieu of a lump sum settlement.

Lump sum settlements can also be attractive to insurance companies. A settlement can allow insurance companies to release money from their reserves and to eliminate administrative expenses associated with the ongoing review of your claim year after year. But just as you might receive more money cumulatively over time if you stayed on the claim, the insurer might benefit financially from not offering you a lump sum settlement. For example, if your policy provided for lifetime benefits, and you met an untimely demise, your insurance company’s obligation to pay benefits would cease, and they may end up ultimately paying out a lower amount in total monthly benefits than they would have if they paid out a lump sum settlement on your claim.

Because this process is completely discretionary on their part, insurance companies are very deliberate about offering lump sum settlements. Before doing so, they must weigh multiple factors including the following:

-

- Permanency. The insurer is more likely to offer a settlement if its actuaries determine that you will likely be on claim for the maximum benefit period.

-

- Reserves. Over the course of your claim, your claim’s reserves slowly peak as you are on claim for an extended period of time (and permanency is established) and then at some point, they start to diminish as the claim is paid out, and you get closer and closer to the end of the maximum benefit period. The insurer is more likely to offer a settlement when the reserves are at their peak (typically around 3-5 years into a claim), because that is when the insurance company would improve its bottom line the most by freeing up the reserves.

-

- Mortality/Morbidity Issues. The insurer is more likely to offer a settlement if its actuaries determine that you will probably live to the end of the maximum benefit period. Or if you have lifetime benefits, the insurer will estimate your lifespan based on your health history to determine whether it is financially beneficial for the company to offer a lump sum settlement.

-

- Offsets. The insurer is more likely to offer a settlement if it determines that you will probably not receive income in the future that would offset the benefit amount before the end of the maximum benefit period.

-

- Anticipated Gain. Companies will not offer a buyout unless they stand to save money in the long run, so they have their actuaries calculate how much of a gain (percentage-wise) the company would net if they settle the claim. Insurers often have internal financial objectives that impact the amount they are willing to offer on settlements such as requiring a net gain amount of a certain percentage (e.g. 35%).

-

- Cash Outflow. The insurer will be more or less willing to offer a settlement depending on their quarterly or even annual cash outflows. Thus, if a company had paid out a lot of buyouts recently, the company may not have enough cash available to offer additional lump sum settlements.

The bottom line is that offering a lump sum settlement is completely voluntary on the part of the insurer and doing so depends on the unique factual circumstances of your claim. Nevertheless, knowing the factors that insurers consider in making this decision can help you understand whether a lump sum settlement is appropriate in your case.

The Importance of Reviewing Your Policy Application

In our last post we discussed why you should not rely solely on your agent’s representations when purchasing a new disability insurance policy. It is similarly important that you not rely solely on your agent to complete the policy application.

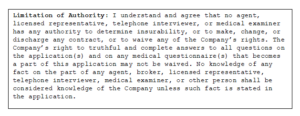

While an agent may offer to help you by filling out the disability insurance application, this could end up negatively impacting a future claim or even voiding your policy down the road, if the application contains any errors or omissions. As explained in our prior posts, while it may seem like telephone interviewers, licensed representatives, agents, and medical examiners have significant control over the application process and whether you receive a disability insurance policy, many applications have language that explicitly limits your ability to rely upon representations made by such individuals, and expressly places the burden of reviewing the application for accuracy upon you (regardless of who completed the application). Below is a sample of policy language:

Thus, you may speak with several people during the application process, and give them the requested information, but it is ultimately up to you to make sure the information provided to the insurance company is correct. It is therefore very important that you read through your disability insurance application carefully to make sure it is complete and accurate before signing.

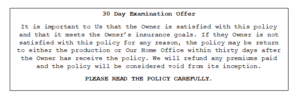

It is also very important that you carefully review your disability insurance policy when you receive it from the insurance company, and not just file it away without a second thought. When you receive your copy of the full policy, it will typically contain language stating that you have a certain time period (e.g. 10 or 30 days) to review the policy and return it to be voided if it does not contain the terms you expected. This clause will normally be found on the first page of the policy, and typically looks something like this:

If you decide to keep your disability insurance policy and do not send it back within this review period, you are bound by all provisions of the policy, regardless of whether you are actually aware of them or not. For instance, if you asked your agent for a certain provision and/or requested it on your disability insurance application, but the insurance company omits it for some reason, and you don’t catch it during this review period, you may end up paying years of premiums for coverage that is different than what you thought you had purchased. Similarly, if your policy contains an unfavorable provision that you didn’t know was going to be in the policy, you will still be bound by it unless you return the policy.

How Insurance Companies Distance Themselves from Agents (And Why It Matters)

Reading through contracts, especially lengthy insurance ones, can be time consuming. Many policies contain confusing language, terms of art, and often include supplemental riders that change the terms or definitions contained in the main body of the policy. But if you don’t read your disability insurance policy until it’s time for you to file a disability claim, you may be caught off-guard by what your policy actually says. This next series of posts will discuss the importance of taking the time to read through your policy, and will review some things to watch out for when you buy a disability insurance policy.

Dentists and physicians are often swamped with work, and rely heavily on insurance agents when selecting and purchasing a disability insurance policy. One scenario we commonly see is doctors requesting a disability insurance policy that is “the same” policy that the other doctors in the practice have. Another common scenario is the doctor who wants more disability coverage and just asks his or her agent for another disability insurance policy that is “like” his or her existing policy, or has the “same coverage” as his or her existing policy. What they don’t realize is that some of the same favorable terms may no longer be available in today’s policies. For example, while most older disability insurance policies contained “true own occupation” provisions, there are now several different variations of “own occupation” provisions, so if you just ask for an “own occupation” policy, you may not actually be receiving the disability coverage that you think you are.

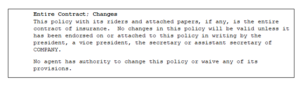

It is also important to be aware that, over the years, disability insurers have sought to distance themselves from agents and now often go so far as to include clauses or statements in their disability insurance policies and applications that state no agent or broker has the authority to determine insurability or make, change, or discharge any contract requirement. Here’s an example of this type of policy language:

So what does this mean? It means that, while solely relying upon an agent’s assurance of the terms of a policy may have been a more acceptable (but not advisable) option in the past (when policies were often similar and generally favorable to policyholders), you can no longer solely rely upon your agent’s description of the policy. No matter how well-meaning or knowledgeable your agent may seem, ultimately, you are going to be on the hook if your disability insurance policy doesn’t say what you thought it said, so it is crucial that you carefully review your disability policy to ensure you are receiving sufficient coverage.

Our next post will discuss the importance of the disability application process and policy review period.

What is a Neuropsychological Evaluation? – Part 1

We’ve talked before about how your insurance company may require you to undergo an independent medical examination (IME) by a physician of their choosing and how they may also ask for a Functional Capacity Evaluation (FCE).

Neuropsychological evaluations are another tool insurers utilize when investigating disability claims. A neuropsychological evaluation is also something that a claimant filing a disability claim may choose to undergo independently, to provide additional proof of his or her disability. In this series of posts, we will be talking about what a neuropsychological evaluation is, what to expect during an examination, and how an exam could affect your disability claim.

What is a Neuropsychological Evaluation?

Neuropsychology is the study of the relationship between the brain and behavior. A neuropsychological evaluation is a method of testing where a neuropsychologist seeks to obtain data about a subject’s cognitive, behavioral, linguistic, motor, and executive functioning in order to identify changes that are, often, the result of a disease or injury. The evaluation can lead to the diagnosis of a cognitive deficit or the confirmation of a diagnosis, as well as provide differential diagnoses.

Neuropsychological evaluations are most often associated with conditions that exhibit cognitive dysfunctions, such as:

- Multiple sclerosis

- Alzheimer’s

- Epilepsy or seizures

- Psychological and mental health disorders

- Chronic pain

- Head injuries

- Stroke

- Parkinson’s disease

- Neurodegenerative diseases

- Side effects of medication

Conditions such as those enumerated above often have symptoms that vary person by person, and the amount of cognitive impairment can often not be fully assessed by other diagnostic tools such as an MRI, or a traditional psychological evaluation.

Neuropsychological tests are standardized tests that are given and scored in a similar manner each time they are used. The tests are designed to evaluate the following:

- Intellectual Functioning

- Academic Achievement

- Language Processing

- Visuospatial Processing

- Attention/Concentration

- Verbal Learning and Memory

- Executive Functions

- Speed of Processing

- Sensory-Perceptual Functions

- Motor Speed and Strength

- Motivation

- Personality

There are many different accepted tests for each domain listed above. Accordingly, an examiner will likely not perform every test, but rather select tests from each category that will best evaluate the particular question posed by the referrer.

The goal of these neuropsychological tests is to produce raw data. The results are then evaluated by comparing test scores to healthy individuals of a similar background (age, education, gender, ethnic background, etc.) and to expected levels of cognitive functioning. The data is then interpreted by the neuropsychologist, and perhaps other providers, to determine the strengths and weaknesses of the subject’s brain, provide suggestions for potential treatment options, set a standard for any future testing, evaluate a course of treatment, make recommendations on steps and modifications that can improve daily living, and evaluate whether a subject can return to work with or without modifications.

In our next post we will go look at what you can expect during a neurospychological evaluation.

Sources:

Atif B. Malike, MD; Chief Editor, et al., Neuropsychological Evaluation, Medscape, http://emedicine.medscape.com/article/317596-overview, updated May 18, 2017.

Neuropsychological Evaluation FAQ, University of North Carolina School of Medicine Department of Neurology, https://www.med.unc.edu/neurology/divisions/movement-disorders/npsycheval

Kathryn Wilder Schaaf, PhD, et al, Frequently Asked Questions About Neuropsychological Evaluation, Virginia Commonwealth University Department of Physical Medicine and Rehabilitation.

Can You Move Out of the Country and Still Receive Disability Benefits?

The answer depends on what your disability policy says. Many people don’t realize that their disability insurance policy may limit their ability to receive disability benefits if they move out of the country. If you’ve ever wondered why claims forms ask for your updated address, one of the reasons might be that your disability policy contains a foreign residency limitation, and your insurance company is trying to figure out if they can suspend your disability benefits.

Foreign residency limitations allow disability insurance companies to stop paying benefits under your policy if you move out of the country. These limitations may be especially relevant if you have dual citizenship, you want to visit family living abroad, or you plan to obtain medical care in another country. A foreign residency limitation may also affect you if your disability insurance policy allows you to work in another occupation and you have a job opportunity in another country that you want to pursue. For instance, if you are a dentist and can receive disability benefits while working in another occupation, your insurance company may suspend your benefits if the opportunity you pursue is in another country.

Foreign residency limitations benefit disability insurance companies in several ways. By requiring you to remain mostly in the country while receiving benefits, these limitations simplify the payment process and reduce the possibility that insurers will need to communicate with doctors in other countries to manage your claim. They also make it easier for insurance companies to schedule field interviews and conduct surveillance of you to find out if you have done something that could be interpreted as inconsistent with your claim.

While these limitations are not included in every disability insurance policy, it is important to check if your policy—or a policy you are considering purchasing—contains a foreign residency limitation, because it could limit your ability to collect benefits later on.

Foreign residency limitations vary by policy. Here is an example of one foreign residency limitation from a Guardian policy:

————————————————————————————————————————————

Limitation While Outside the United States or Canada

You must be living full time in the 50 United States of America, the District of Columbia or Canada in order to receive benefits under the Policy, except for incidental travel or vacation, otherwise benefits will cease. Incidental travel or vacation means being outside of the 50 United States of America, the District of Columbia or Canada for not more than two non-consecutive months in a 12-month period. You may not recover benefits that have ceased pursuant to this limitation.

If benefits under the Policy have ceased pursuant to this limitation and You return to the 50 United States of America, the District of Columbia or Canada, You may become eligible to resume receiving benefits under the Policy. You must satisfy all terms and conditions of the Policy in order to be eligible to resume receiving benefits under the Policy.

If You remain outside of the 50 United States of America, the District of Columbia or Canada, premiums will become due beginning six months after benefits cease.

————————————————————————————————————————————

This limitation highlights several details you should look for if your disability policy contains a foreign residency limitation, including the length of time you can spend in another country before your insurance company will suspend your disability benefits, whether you can resume receiving disability benefits if you return to the country, and when you will have to resume paying premiums if your insurance company suspends your disability benefits. Another important consideration is the effect a foreign residency limitation will have on your policy’s waiver of premium provision. Under the policy above, premiums will continue to be waived for six months after benefits are suspended. However, your disability insurance policy may have a different requirement regarding payment of premiums, so it’s important to read your policy carefully.

Here is an example of another foreign residency limitation from a different Guardian policy:

————————————————————————————————————————————

Foreign Residency Limitation

We will not pay benefits for more than twelve months during the lifetime of this policy when you are not a resident of the United States or Canada.

————————————————————————————————————————————

This limitation contains much less detail than the first limitation. For instance, it does not clarify how suspension of disability benefits will affect waiver of premium. If your disability policy contains a foreign residency limitation that does not discuss waiver of premium, you should look to your policy’s waiver of premium provision to find out when premiums will become due after disability benefits are suspended. The policy above also defines foreign residency differently than the first policy. At first glance, it may seem that you can continue to receive disability benefits any time you leave the country for twelve months or less. What the policy actually says, though, is that the insurance company will only pay benefits for twelve months that you are out of the country at any time you are covered by the policy. So, if you have received disability benefits for twelve months while living in another country—even if those months were spread out over several years—your insurance company will not pay benefits in the future unless you are in the United States or Canada.

As you can see, foreign residency limitations vary among disability policies. If you are thinking about leaving the country, it is important to read your disability insurance policy carefully first so that you understand how leaving the country may affect your ability to recover disability benefits.

Can You Sue Your Insurance Company for Invasion of Privacy?

We’ve talked before about how insurers often hire private investigators to follow and investigate claimants. While the purported goal is to find claimants who are “scamming the system” and faking a disability, investigators often employ invasive tactics in their attempts to gather videos and other information requested by insurers.

Unfortunately, all too often investigators go too far and claimants feel threatened or endangered by these investigators’ actions. The question then arises–at what point do insurance companies become legally liable for the actions of investigators that they hired? Can you sue your insurance company for invasion of privacy?

At least one court thinks so. In Dishman v. Unum Life Insurance Company of America, 269 F.3d 974 (9th Cir. 2001), the Court agreed with Dishman that he could sue Unum for tortious invasion of privacy committed by investigative firms hired by Unum. In this case, the investigative firms in question aggressively attempted to find out employment information on Dishman by (1) falsely claiming to be a bank loan officer; (2) telling neighbors and acquaintances that Dishman had volunteered to coach a basketball team and using that as a pretext to request background information about Dishman; (3) successfully obtaining personal credit card information and travel itineraries by impersonating Dishman; (4) falsely identifying themselves when they were caught photographing Dishman’s residence; and (5) repeatedly calling Dishman’s house and either hanging up or harassing the person who answered for information about Dishman.

Because the underlying Unum disability insurance policy was an ERISA policy, the Court assessed whether Dishman’s invasion of privacy claim (which was based on California law) was precluded by statutory language which states that ERISA “shall supersede any and all state laws insofar as they . . . relate to any employee benefit plan.” 29 U.S.C. Sec. 1144 (a). The Court, in its decision, went on to discuss a lack of consensus on this issue, but ultimately ruled that, in this particular instance, “[t]hough there is clearly some relationship between the conduct alleged and the administration of the plan, it is not enough of a relationship to warrant preemption” of state tort law, because Dishman’s “damages for invasion of privacy remain whether or not Unum ultimately pays his claim.” In other words, the Court explained, ERISA law does not provide Unum with blanket immunity for “garden variety tort[s] which only peripherally impact plan administration.”

It should be noted the Court in Dishman cautioned that there is no consensus regarding how far ERISA reaches, and not every disability is governed by ERISA, so not every court will necessarily reach the same conclusion as the Dishman court. This is a complicated area of the law, and whether or not you can sue your insurer for invasion of privacy will largely depend on the facts of the case, the type of policy you have, whether your jurisdiction recognizes an “invasion of privacy” cause of action, and the existing case law in your jurisdiction.

Information offered purely for general informational purposes and not intended to create an attorney-client relationship. Anyone reading this post should not act on any information contained herein without seeking professional counsel from an attorney.