The Importance of Reviewing Your Policy Application

In our last post we discussed why you should not rely solely on your agent’s representations when purchasing a new disability insurance policy. It is similarly important that you not rely solely on your agent to complete the policy application.

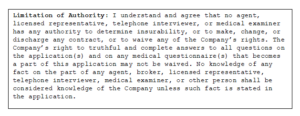

While an agent may offer to help you by filling out the disability insurance application, this could end up negatively impacting a future claim or even voiding your policy down the road, if the application contains any errors or omissions. As explained in our prior posts, while it may seem like telephone interviewers, licensed representatives, agents, and medical examiners have significant control over the application process and whether you receive a disability insurance policy, many applications have language that explicitly limits your ability to rely upon representations made by such individuals, and expressly places the burden of reviewing the application for accuracy upon you (regardless of who completed the application). Below is a sample of policy language:

Thus, you may speak with several people during the application process, and give them the requested information, but it is ultimately up to you to make sure the information provided to the insurance company is correct. It is therefore very important that you read through your disability insurance application carefully to make sure it is complete and accurate before signing.

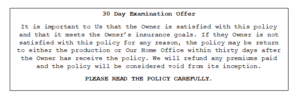

It is also very important that you carefully review your disability insurance policy when you receive it from the insurance company, and not just file it away without a second thought. When you receive your copy of the full policy, it will typically contain language stating that you have a certain time period (e.g. 10 or 30 days) to review the policy and return it to be voided if it does not contain the terms you expected. This clause will normally be found on the first page of the policy, and typically looks something like this:

If you decide to keep your disability insurance policy and do not send it back within this review period, you are bound by all provisions of the policy, regardless of whether you are actually aware of them or not. For instance, if you asked your agent for a certain provision and/or requested it on your disability insurance application, but the insurance company omits it for some reason, and you don’t catch it during this review period, you may end up paying years of premiums for coverage that is different than what you thought you had purchased. Similarly, if your policy contains an unfavorable provision that you didn’t know was going to be in the policy, you will still be bound by it unless you return the policy.