Psoriatic Arthritis

What is Psoriatic Arthritis?

Psoriatic arthritis (PsA) is a type of arthritis that affects about 30 percent of individuals who have psoriasis (a disease that causes red patches of skin that are topped with silvery scales). Psoriasis typically develops years before psoriatic arthritis, but this is not always the case.

Joint pain, swelling, and stiffness are the key signs of psoriatic arthritis, and these symptoms can affect any part of the body. Symptoms range from mild to severe, and often flares can be followed by periods of remission. If left untreated, psoriatic arthritis can lead to joint and tendon damage, which can cause decreased function and disability.

What are the Symptoms of Psoriatic Arthritis?

As indicated above, the primary symptoms of psoriatic arthritis are joint pain, swelling, and stiffness. Joints are affected on one or both sides of the body. Additional symptoms of psoriatic arthritis include:

- Swollen fingers and toes

- Lower back pain (specifically, some individuals may develop spondylitis)

- Foot pain

- Nail changes

- Eye inflammation

- Fatigue

A small percentage of those with psoriatic arthritis may go on to develop a condition called arthritis mutilans. This form of psoriatic arthritis leads to permanent deformity and disability in the small bones of the hands (especially in the fingers).

Unchecked psoriatic arthritis inflammation can case complications including:

- Damage to cartilage and bones

- Uveitis

- Gastrointestinal problems

- Shortness of breath and coughing

- Damage to blood vessels and the heart muscle

- Osteoporosis

- Metabolic syndrome (a group of conditions that include obesity, high blood pressure and poor cholesterol levels)

What Causes Psoriatic Arthritis?

In psoriatic arthritis, the body’s immune system attacks healthy cells and tissue, causing inflammation in the joints and the overproduction of skin cells. While both environmental and genetic factors seem to play a role in the development of psoriatic arthritis, there are several risk factors including a family history of psoriatic arthritis, psoriasis, and age. Environmental triggers, such as an infection, stress, or physical trauma can also play a role.

How is Psoriatic Arthritis Diagnosed?

There is no one test that can diagnose psoriatic arthritis, but doctors will typically perform a variety of tests, including those to rule out other conditions that cause joint pain, such as rheumatoid arthritis, including:

- Physical Exam: a doctor will typically look for signs of joint tenderness or swelling, pitting, flaking or other nail abnormalities, and tenderness on the soles of the feet or around the heels.

- X-rays: to look for joint changes

- MRIs: to look for tendon and ligament changes in the lower back and feet

- Rheumatoid factor (RF) test: RF is often found in individuals with rheumatoid arthritis, but not usually in those with psoriatic arthritis

- Joint fluid test: a test that looks for uric acid crystals in the joint fluid which, if present, may indicate a diagnosis of gout versus psoriatic arthritis

What is the Treatment for Psoriatic Arthritis?

There is no cure for psoriatic arthritis so treatments focus on managing inflammation in the joints and controlling skin involvement. Medications, physical therapy, steroid injections, and, in some cases, joint replacement therapy are all used to treat the symptoms of psoriatic arthritis. Common medications utilized include:

- NSAIDs (nonsteroidal anti-inflammatory drugs)

- Conventional and targeted synthetic DMARDs (disease-modifying antirheumatic drugs) – these types of drugs slow the progression of the disease and preserve joints from further, permanent damage.

- Biologic agents (biologic response modifiers, a type of DMARDs) – these drugs target a different pathway in the immune system than DMARDs.

- Apremilast (Otezla) – a medication that decreases the activity of a type of enzyme in the body that controls the activity of inflammation in the cells.

Psoriatic arthritis can interfere with an individual’s ability to work or carry out daily tasks. If you have been diagnosed with psoriatic arthritis and are worried that it may be impeding your ability to continue to safely practice on patients, you should speak with an experienced disability insurance attorney.

These posts are for informative purposes only and should not be used as a substitute for consultation with and diagnosis by a medical professional. If you are experiencing any of the symptoms described above and have yet to consult with a doctor, do not use this resource to self-diagnose. Please contact your doctor immediately and schedule an appointment to be evaluated for your symptoms.

Sources:

Mayo Clinic

John Hopkins

National Psoriasis Foundation

Arthritis Foundation

Guardian’s New Dentist-Specific Claim Form Are These Trick Questions?

We’ve noted before that disability policies have evolved over time to become more complex. The same holds true for disability claim forms.

Years ago, most disability insurers used fairly basic proof of loss forms, and used the same forms for various types of claims.

Over time, these claim forms have also become increasingly complex, to the point that Guardian now has a dentist-specific form with several loaded questions. These questions can be difficult to answer fully and accurately, within the parameters of the form. Many questions do not provide any room to explain your specific dental practice, instead prompting you to select options that may not apply to your situation. Many questions also have hidden objectives that are only apparent to disability attorneys familiar with “own occupation” dentist disability claims.

Guardian’s Dental Professional Occupation Assessment Form

Below are a few excerpts from Guardian’s most recent dentist-specific claim forms, along with some limited, general commentary into the purpose behind some of the questions.

When we first saw these new forms, it was immediately apparent to us that they had been drafted by Guardian’s attorneys and senior claim staff with several of Guardian’s tactics of reducing or avoiding payment in mind. It was also clear from the fine print at the bottom that Guardian is attempting to lock dentists into “complete and true” answers, in writing, early-on, before they have contacted an attorney. This form is then checked against anything you have said to Guardian before, and anything else you may say in later phone or field interviews.

We have handled numerous claims filed by dentists with Guardian and have had to get them back on track, which can be difficult if these forms are not completed in the proper manner. Most recently, we have seen Guardian delay or reduce payment on numerous dentist disability claims due to perceived “incomplete answers” to its dentist-specific proof of loss questions and/or perceived “inconsistencies” with other statements/interviews. Accordingly, we felt it important to get the word out to dentists about these new developments.

As you review, keep in mind that every dentist claim is unique. Not everything below applies to every claim, and there may be other, additional considerations that come into play under your particular circumstances. Accordingly, it is best to consult with an experienced disability insurance attorney before filing a disability claim or submitting any proof of loss to Guardian.

Table of Contents

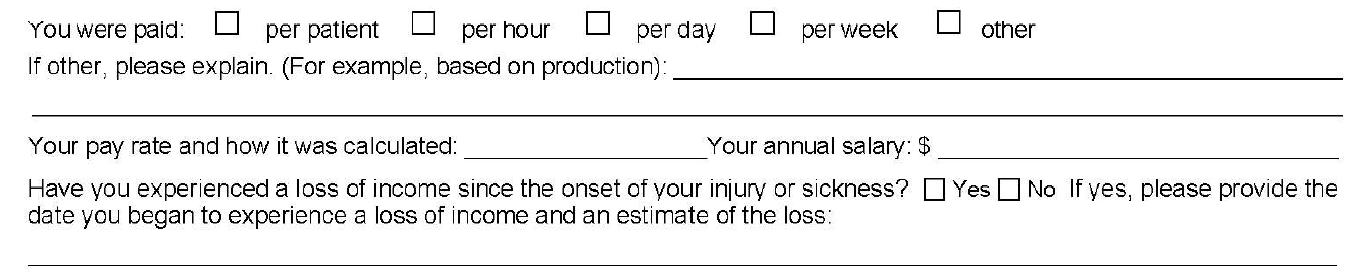

1. Why is Guardian Asking About My Pay Rate/Loss of Income?

5. Why is Guardian Asking if I Modified My Job Before Filing and How is That Relevant?

6. Why is Guardian Asking Me to Break Down the Source of Gross Receipts?

7. Why is Guardian Asking About the Dental Board/My Malpractice Insurance/Use of My NPI Number?

1. Why is Guardian Asking About My Pay Rate/Loss of Income?

Initially, you may think that loss of income is relatively straightforward; however, it can be a complicating factor in dentist claims, for a few reasons.

First, over time, disability policies have added additional requirements for establishing proof of loss that you may not be aware of. With older policies, the focus was primarily on whether the dentist met a certain loss of income percentage threshold. Then, if there was evidence of a medical condition that logically limited the dentist’s ability to work full-time, that was generally sufficient.

Newer Guardian disability policies have added additional hurdles, such as a requirement that the loss be “solely” due to the disabling condition. Regardless, the timeline—and date of disability selected—is critical to establishing a right to payment because, at a minimum, the loss of income must directly line up with the disabling condition.

The problem for dentists is that their disability claims are often musculoskeletal, slowly progressive, and worsen over time. Many dentists are diagnosed with a condition, yet work through the pain for a time. Sometimes there are periods of improvement even if the solutions are only short-term and the overall trend is downward. This can make selecting a proper and defensible date of disability challenging.

Additionally, when it comes to dentist claims, there can be gray areas under the terms of the underlying policy that must be addressed/negotiated (and sometimes litigated). For example, sometimes partial disability is also based on whether there has been a reduction of hours/time practicing; however, dentistry is not a profession where dentists “clock-in” and “clock-out” so addressing changes in “hours” can be a challenge.

Many dentists also receive income from multiple sources, and there can be several entities involved, particularly if the dentist works at a corporate dentistry practice. In some instances, the definitions in the underlying disability policy do not contemplate this level of complexity when it comes to the policyholder’s income, or give clear answers to what “counts” as income for purposes of determining the monthly losses.

Because of the above, we are seeing “loss of income” becoming an area that is increasingly being contested by insurers seeking to reduce liability or otherwise gain leverage in a disputed claim. Obviously, questions relating to loss of income are critical if you have a partial disability claim. However, even if you have a total disability claim, the period of total disability could potentially come after several months of partial disability. As such, you should consider these questions carefully even if you are planning on filing a total disability claim.

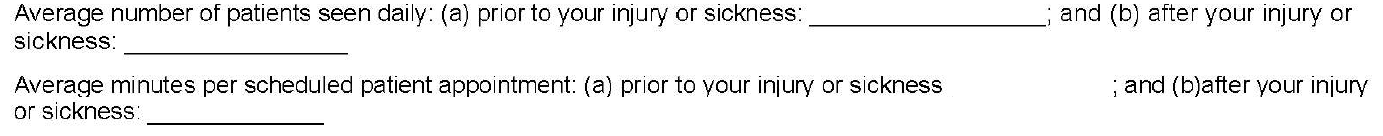

2. Why is Guardian Asking Me to Quantify Patients Per Day and Minutes Per Patient? How Do I Even Do That?

As noted above, changes in work schedule can be very important on a partial disability claim; however, these particular questions are also illustrative for another reason.

On their face, these questions seek information about the difference between the two timeframes, along the lines of what you might expect if you are filing a partial disability claim. The problem here is that the form does not allow for nuance and often these timeframes are not apples-to-apples comparisons.

For example, before your disability date, you may have been working on complex reconstruction cases, only seeing a few patients a day. Then, due to disability, you may have had to abandon the longer, more difficult (and more lucrative) procedures. As a result, you may be seeing many more patients a day, but only performing simpler tasks, such as exams or cleanings. But if you only answer what it asked, it will look like you have increased your workload because you are seeing substantially more patients after your disability.

The second question seems to address this, by asking how much time you spend on each patient appointment. However, providing a generalized answer here can also have unanticipated ramifications.

Going back to the above example, your instinct might be to put a very low number for the new time spent with patients, to highlight that you are doing easier, shorter procedures. However, this can have unanticipated long-term consequences. If you minimize or trivialize the number of hours you spend with patients when filing a partial disability claim, when you reach the point in time that you feel you are totally disabled, Guardian will refer back to this form and ask what has changed? Why can you not keep working if you are only doing simple cases, and only for short periods of time? What has happened medically to explain this change?

Sometimes, there will be a new medical event that can be pointed to. However, as noted above, most dentist claims involve slowly progressive conditions with primarily subjective symptoms (pain, numbness, etc.). As these worsen, imaging (such as MRIs) may or may not show a difference from prior imaging, even if you, as the dentist feeling the symptoms, know you are to the point that you should stop practicing for the sake of patient safety. Even if Guardian is only able to push a claim into partial disability, and reduce the monthly benefit, this can add up to a substantial amount over time.

In other instances, establishing a particular date of disability is critical (e.g. to establish notice was timely, or to lock-in certain lifetime benefits under Guardian’s graded lifetime riders). If your claim involves important timeline questions, failing to provide the appropriate level of detail and nuance can cause major problems and potentially provide Guardian with an argument to entirely avoid paying your disability claim.

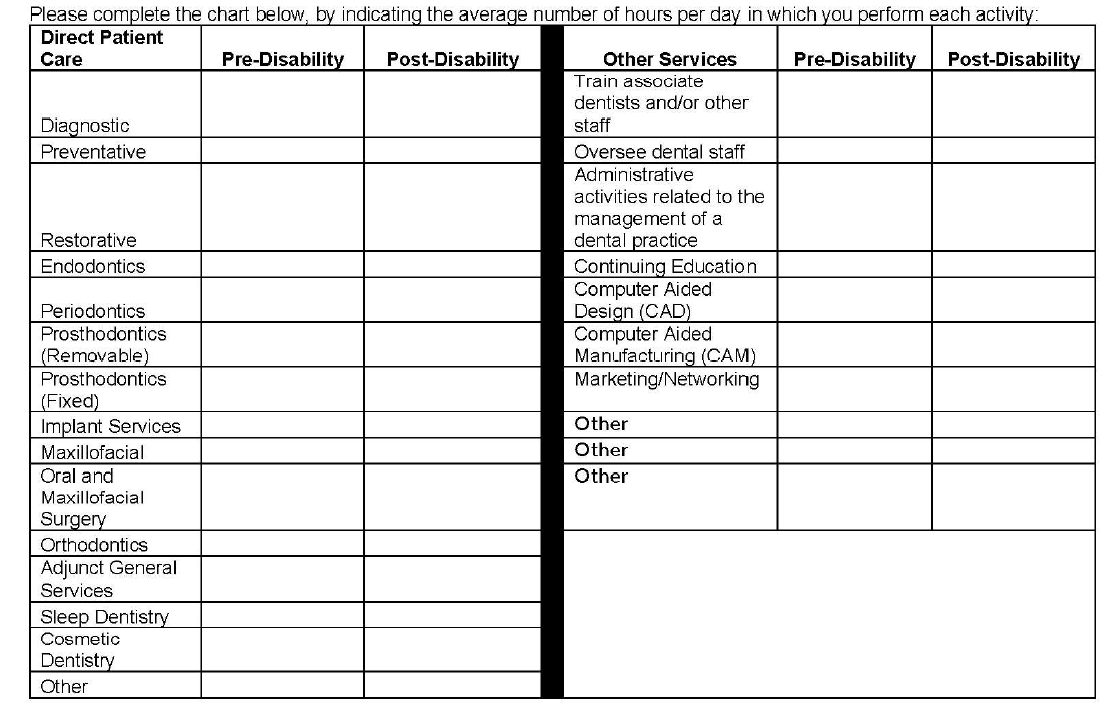

3. Why Is Guardian Asking Me to Break Down Patient Care by Hour? How Do I Do This When Many Categories Overlap and Each Day is Different and I Don’t Track Procedures by Hour? Why Is Guardian Listing Other Non-Clinical Categories?

The problems with the left column of this table should be immediately apparent to most dentists, as many categories overlap. As with the prior question, the form does not provide a means to explain important nuances. Additionally, the dentist is asked to answer the form based on “hours per day” which, for most dentists, varies widely depending on the day and is something that is not tracked on an hourly basis.

The second column is a good example of a question designed to elicit information that Guardian might seek to use in a “dual occupation” defense. As noted in prior posts, most Guardian policies have plural definitions of “occupation.” Guardian—like other disability insurers—will seek to expand your occupation to other, non-clinical roles if they think they can (e.g. practice owner, marketer, trainer/coach, supervisor/office manager, etc.).

While you must provide answers, and cannot avoid these sorts of questions, it is another area where nuance is very important and answering within the restrictions of the Guardian form itself can be harmful for a claim. The above questions may also not be particularly relevant, depending on the type of claim you are making. Or they could be very relevant, if you have future employment plans. If you start a new job in the future, at any point in your claim, Guardian will look back to prior claim forms to see if there are any overlapping duties. If you are unconcerned or imprecise when completing the forms, this can cause problems later on if you want to start other jobs related to dentistry (such as managing dental practices or teaching at a dental school/supervising dental clinics).

4. Why is Guardian Asking for an Hourly Breakdown of All of the Tools I Am Still “Able to Use” Each Day?

This question is another one that initially seems innocuous, but there is a high likelihood that the response will be used unfairly. This is evident when you consider what is actually being asked, particularly if a dentist is filing a total disability claim.

Essentially, the question asks for the minimum number of hours a dentist can still “use” a dental tool in a given day. But it leaves out critical details and qualifiers, and can be taken in several different directions. One dentist might answer based upon the number of hours they think they can work on a live-patient, factoring in patient safety risks. Alternatively, another dentist might take it literally and think it is asking whether the tool can be physically used/manipulated in any capacity, regardless of patient risk.

Additionally, this question simply asks for “hours per day” without clarifying whether this is with breaks, or without breaks, or what the tool is being used to accomplish.

The absence of these additional clarifying details makes it clear that Guardian is seeking responses to muddy the waters when it comes to assessing capacity to work and total versus partial disability.

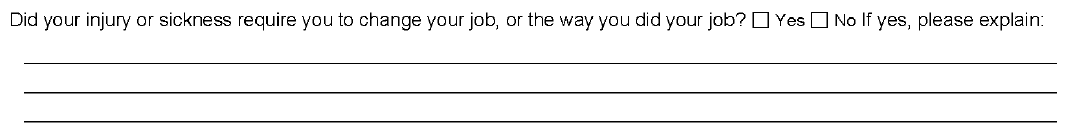

5. Why is Guardian Asking if I Modified My Job Before Filing and How is That Relevant?

While this question provides some room for explanation, it does not ask the critical follow-up question—i.e. whether modifications were effective, or remain effective. Absent an appropriately detailed explanation, Guardian may suggest the dentist could continue to work with the same modifications, even if the dentist is not actually working anymore or the modifications are no longer effective.

This question is also important from an “occupation” standpoint, and is another example of why timeline and the date of disability are so critical. Under most disability policies, including Guardian policies, your “occupation” is defined as of your date of disability. If you modified your duties or changed your schedule prior to your date of disability, this can make it more difficult to collect disability benefits.

This can be addressed by selecting earlier disability dates, but that may not be possible if there are late notice problems with the claim. Similarly, there are scenarios where modified schedules do not necessarily translate into loss of income sufficient to trigger a partial disability clause—for example, where a practice owner cuts back and brings in associates to keep up the practice’s production. This is why it is important to carefully review your policy and pick an appropriate disability date prior to filing; otherwise, questions like the above can become problematic without you even realizing it.

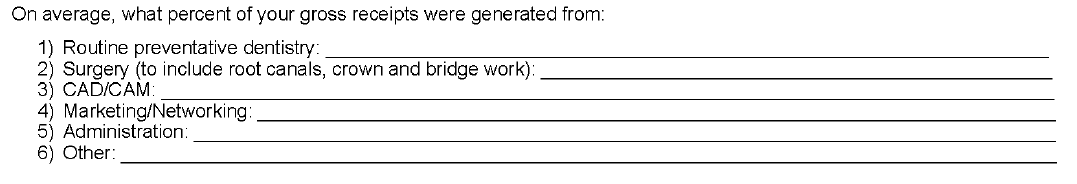

6. Why is Guardian Asking Me to Break Down the Source of Gross Receipts?

This question has several implications and, by now, you can likely guess why Guardian might be asking for this information.

Most Guardian policies define total disability based on an inability to perform the “material and substantial” duties of your occupation. A common tactic used by Guardian (and other insurers) is to ascribe a dollar value to certain things, then characterize them as “major” or “minor” duties. Sometimes this makes sense, but a “material and substantial” duties analysis—particularly for dentists—is claim specific, and involves a host of factors beyond “gross receipts” (e.g. time, complexity, patient expectations, nature of practice, specialty, etc.). As with other questions in the form, the provided categories also overlap to some extent, making it difficult to respond in a precise manner.

Additionally, this is another example of a question that can have ramifications later on if you start a new job. Most Guardian policies are “true own occupation,” in the sense that they let you work in a different occupation and still collect total disability benefits. However, as discussed above, occupation is defined in the plural and disability insurers seek to expand it as much as possible beyond clinical duties.

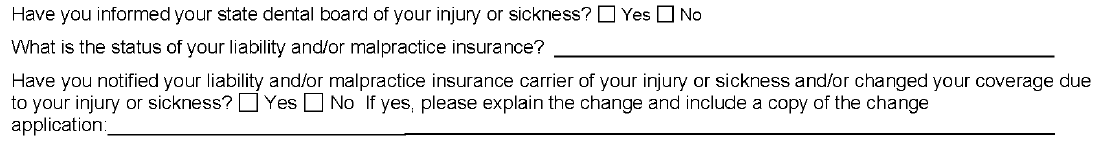

7. Why is Guardian Asking About the Dental Board/My Malpractice Insurance/Use of my NPI Number?

As evident from the above questions, Guardian is aware that, as a dentist, there are other legal documents that you must complete that directly relate to your capacity to practice dentistry safely.

At the outset of any disability claim, the initial claim packet includes an authorization that Guardian uses to look for anything that might be inconsistent with your claim, including statements made to your dental board or malpractice insurance. Guardian will consider the timing of those statements, in relation to the timing of your disability claim/selected date of disability. If they are inconsistent, Guardian may be more emboldened to deny your claim, as that sort of inconsistency could be used to undermine your credibility with a judge or jury.

The Takeaway

In short, Guardian wrote the policy and crafted the claim forms, so the process is designed to be as favorable to Guardian’s interests as possible.

This does not mean that it is impossible to collect, but it does mean that you should approach your claim in a serious, proactive matter and that you should become as informed as possible before filing your claim. If you do not have experience with the disability industry, it is advisable to consult with a disability attorney before submitting any proof of loss to Guardian.

Every claim is unique and the discussion above is only a limited summary of how Guardian approaches dentist disability claims. If you are concerned that Guardian is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

Does Arizona Require My Disability Insurer to Respond to My Letters?

Disability insurers often utilize the tactic of sending request after request for additional information for you to respond to. But what happens if you have a question for your insurer? Does your insurer have to respond?

Although it may feel that you are simply sending a letter into the void, Arizona actually requires your insurance company to respond to you. Specifically, your insurer must acknowledge receipt of correspondence within ten days, unless payment is made within this period of time. See Ariz. Admin. Code § 20-6-801(E)(1).

Further, in Arizona, “an appropriate reply [must] be made within 10 working days on all other pertinent communications from a claimant which reasonable suggest that a response is expected.” Ariz. Admin. Code § 20-6-801(E)(3).

In our experience, insurance companies often drag their feet in making a claim decision, especially in high dollar claims filed by dentists, physicians and other professionals. One way to ensure your case doesn’t end up on the back burner is to continue to engage with your insurance company.

If you have communicated with your insurance company, but aren’t receiving timely replies, please feel free to reach out to one of our attorneys directly.

Can You File a Disability Claim for Hearing Loss?

According to the CDC and the National Institute for Occupational Safety and Health (NIOSH), hearing loss is the third most common physical condition among adults, with 24% of hearing difficulty among U.S. workers caused by occupational exposure.[1]

While one associates work-related hearing loss with careers like construction, studies have shown that the rates of hearing loss and tinnitus among dentists are double that of the general population, as a result of noise exposure from dental tools (such as high-speed handpieces).[2] Unaided hearing loss has also been linked to increased depression, social isolation, and hospitalization. Further, it can result in reduced motor coordination, impaired cognition, learning, and memory.[3]

Like the two other most common disabling conditions experienced by dentists, musculoskeletal issues and vision loss, hearing loss and tinnitus are often slowly progressive and degenerative conditions—making it difficult to determine when and if symptoms have reached a level to prevent a dentist from safely practicing.

Hearing loss typically comes on gradually and, as it worsens, dentists may take steps to mitigate exacerbation of symptoms by either reducing the hours they work or avoiding doing procedures that exacerbate symptoms. However, this can be problematic from a claims perspective because insurance companies will typically review dentists’ CDT codes to determine if they can argue that the dentist has modified his or her occupation.

If you are a dentist with a hearing condition that you feel may begin to compromise your ability to work, an experienced disability insurance attorney can help you evaluate whether you have a claim under your policy and guide you in preparing a transition plan so that, in the event you have to file a claim down the road, you are prepared and have not jeopardized your ability to collect.

These posts are for informative purposes only and should not be used as a substitute for consultation with and diagnosis by a medical professional. If you are experiencing any of the symptoms described above and have yet to consult with a doctor, do not use this resource to self-diagnose. Please contact your doctor immediately and schedule an appointment to be evaluated for your symptoms.

[1] Occupational Hearing Loss (OHL) Surveillance National Inst. for Occ. Safety and Health, last reviewed Dec. 9, 2019, https://www.cdc.gov/niosh/topics/ohl/default.html

[2] Ian D. Murray, BA, HIS, AHIP, IHS, Hearing Loss and Tinnitus Among Dentists, 73 The Hearing Journal, 10, January 2020, https://journals.lww.com/thehearingjournal/fulltext/2020/01000/hearing_loss_and_tinnitus_among_dentists.3.aspx

[3] Id.

Filing for Disability Insurance Benefits In the Wake of Coronavirus: What Every Physician Should Know

Physicians across the country are experiencing heightened levels of anxiety and stress in the face of the coronavirus pandemic. They are bracing for a spike in cases that the U.S. healthcare system will not be prepared to face, and some are already running out of supplies. Others are working in hospitals that are short-staffed, tending to both sick and anxious patients. And many physicians are balancing their desire to help patients with the risk of becoming a potential sources of contagion to their loved ones and community.

One doctor described this unique type of stress as “pre-traumatic stress disorder” as doctors brace for an outbreak that seems inevitable.[1] Another doctor observed “[m]ost physicians have never seen this level of angst and anxiety in their careers.” [2]

These unprecedented stressors can have a significant impact on physicians already dealing with mental health issues like depression, anxiety, panic disorder, or similar conditions. Physicians currently are experiencing increased distress and worry over physician shortages[3], shortages of supplies[4], and fears of becoming ill and/or quarantined themselves.

Organizational psychologist Adam Grant, in a piece in The New York Times, also recently explained that over half of doctors experience “burnout,” and risks of stress/burnout become even “more acute” during a pandemic because medical professionals are “braving high disease exposure, long hours and inadequate resources.”[5]

Even for those physicians not on the front lines, this pandemic has drastically impacted their bottom lines and work schedules as they have to postpone procedures, and potentially cut back on hours or close their practices entirely to preserve personal protective equipment (PPE). However, as we’ve noted in prior posts, unemployment programs typically do not provide high enough benefits for doctors to meet their obligations and expenses.[6]

In light of all of this uncertainty, many physicians have been reaching out to us to see if it is possible to file disability claims under their own-occupation disability policies. We’ve answered the most common questions we’ve been receiving from doctors, below, and will be updating this post throughout the coronavirus crisis as we receive more questions from physicians.

Each physician’s claim for disability benefits involves different facts, disabling conditions, policy requirements, insurance companies, etc. While our attorneys are making an effort to share general knowledge with the medical community and answer physician’s questions about the impact of the coronavirus, this not a substitute for individualized advice from an experienced disability insurance lawyer. If you would like to speak with our attorneys and have them take an in-depth look at your particular situation, please feel free to contact us directly.

Can I File A Claim for “Burnout”?

It depends on what you mean by “burnout,” and whether you have an actual, underlying mental health condition that has been treated by a mental health professional. Most disability policies require you to provide evidence of either a “sickness” or an “injury” that prevents you from being able to perform the material and substantial duties of your occupation.

If you file a claim based on increased stress levels and fatigue and label it “burnout,” we’ve seen insurers seek to minimize these things as “just part of the job,” determine that this does not qualify as a disabling condition and deny the claim. Some policies also specifically exclude coverage for mental health conditions, or limit benefits for mental health claims to a shorter time frame (usually around 24 months). So the first step is to determine whether your policy provides coverage for mental health claims.

If your policy covers mental health claims and you have a diagnosed condition, it is possible to file a disability claim; however, mental health claims are also some of the most challenging disability claims. They receive a high level of scrutiny, and can be difficult to prove up since most mental health conditions are diagnosed based upon subjective symptoms that are reported to your treating providers.

As a result, insurer’s medical consultants and in-house doctors often challenge and second-guess the diagnoses and treatment plans submitted by your providers. Oftentimes, an insurer will suggest more aggressive treatment because they want you to go back to work so they can save money. But if work is a trigger for you, that may not be in the best interest of your mental health.

Additionally, while some policies expressly require you to pursue treatment that would lead to a “return to work” and/or “maximum medical improvement,” other policies simply require you to be under the “regular” care of a provider, or require you to receive “appropriate” care. Where your policy falls on this spectrum typically informs how aggressive an insurer will be about challenging your treatment, and if there is a disagreement over whether a certain treatment is required by your policy, it may require the intervention of a disability insurance attorney and/or court involvement to resolve.

Our office has dealt with these issues before and has helped numerous professionals successfully navigate their mental health claims. While it can be a difficult process, it is possible to collect, if you have a legitimate mental health condition, an understanding of how your policy works and supporting documentation of your condition.

For a more detailed discussion of the challenges physician’s face when filing mental health claims, see our article in MD Magazine, “Can You Collect Disability Benefits For Burnout?”

Each physician’s claim for disability benefits involves different facts, disabling conditions, policy requirements, insurance companies, etc. While our attorneys are making an effort to share general knowledge with the medical community and answer physician’s questions about the impact of the coronavirus, this not a substitute for individualized advice from an experienced disability insurance lawyer. If you would like to speak with our attorneys and have them take an in-depth look at your particular situation, please feel free to contact us directly.

I Am a High-Risk Individual. Can I File a Disability Claim if My Office Environment Places My Health at Risk?

This is an interesting legal question that has not been fully developed in the context of a national pandemic. Most legal questions are resolved by consulting precedent and since, in many ways, the current COVID-19/coronavirus in unprecedented (particularly in the last 30 or so years when private disability insurance policies for professionals have been the most prominent) this is a open question that would likely require a disability lawyer and court involvement to resolve.

The strength of this sort of claim would largely depend on the physician’s specialty, the underlying policy, and the law of the jurisdiction in question. While most disability policies do not directly address what happens if there is a national epidemic, like the coronavirus, some policies do address situations that could be pointed to by analogy.

For example, some physician policies have riders that state that the company will recognize disability if the physician contracts a sickness or disease that could place the physician’s patients at risk (for instance, if a physician tests positive for HIV and there is a risk that the virus could be transmitted to patients in the course of the physician’s normal duties). If a physician has coronavirus, one could argue that practicing similarly places patients at risk and arguably falls under this sort of rider.

There is a fundamental difference, however, because the coronavirus is not something that is normally expected to be contagious for an extended period of time. If it is something that passes in a few weeks, then it is unlikely that any benefits would be due, because most policies require the disability to last for a specific elimination period before benefits are payable, and those waiting periods usually last at least three months (or longer).

Looking at it from another perspective, some courts have held that a physician should be considered disabled if the physician’s work environment places the physician’s health at risk. For example, if a physician were diagnosed with a heart condition and the stress and demands of practicing could cause a heart attack, a court might recognize such a condition to be totally disabling. By analogy, if a physician’s health were at risk due to coronavirus, one could argue that the physician is disabled from practicing for as long as that risk is present.

Again, these are untested waters, and there is no guarantee that a court would approve such a disability. Most likely, if the risk were just the general risk of contracting coronavirus, we expect that the insurer would deny the claim and a court would most likely uphold the denial. However, if there is an underlying health condition that places the physician at heightened risk of mortality if exposed to coronavirus (for example, the physician had a compromised immune system due to another condition, like leukemia) courts may be more sympathetic and more willing to recognize disability.

Each physician’s claim for disability benefits involves different facts, disabling conditions, policy requirements, insurance companies, etc. While our attorneys are making an effort to share general knowledge with the medical community and answer physician’s questions about the impact of the coronavirus, this not a substitute for individualized advice from an experienced disability insurance lawyer. If you would like to speak with our attorneys and have them take an in-depth look at your particular situation, please feel free to contact us directly.

I Can’t Focus and Am Afraid I’m Going to Hurt Somebody. Can I File a Claim?

If you are a physician and your ability to focus and think critically is compromised, you may qualify for disability benefits. However, mental health claims are often subject to policy exclusions and limitations, and are some of the most difficult claims to make.

For frame of reference, our physician clients who have filed claims for anxiety typically have a history of panic attacks that were non-responsive to treatment. Their specialties required a high degree of attention to detail and critical thinking, and often there is an underlying event or specific trigger that is work-related. Additionally, they take medication for their condition and that medication impacts their ability to think clearly and concentrate to a degree that it is not possible for them to safely practice their specialty when they are taking the medication.

So, in sum, whether you can file a claim depends on factors such as the severity of your condition, whether you have a history of receiving treatment for the condition, whether the anxiety is triggered by something that is work/occupation related, whether you are taking medication for the condition, and the nature of your specialty and job duties.

See also Can I File A Claim for “Burnout”?

Each physician’s claim for disability benefits involves different facts, disabling conditions, policy requirements, insurance companies, etc. While our attorneys are making an effort to share general knowledge with the medical community and answer physician’s questions about the impact of the coronavirus, this not a substitute for individualized advice from an experienced disability insurance lawyer. If you would like to speak with our attorneys and have them take an in-depth look at your particular situation, please feel free to contact us directly.

I Have Had to Isolate from My Family Because I’m Afraid to Get them Sick. Can I File a Claim for Depression?

If you are a physician suffering from severe depression, to the point where you would be putting patients at risk by practicing, you may be able to file a disability claim, as long as your policy provides coverage for mental health conditions.

As with a disability claim based upon anxiety/panic disorder, whether you can file a claim depends on factors such as the severity of your condition, whether you have a history of receiving treatment for the condition, whether the depression is triggered by something that is work/occupation related, whether you are taking medication for the condition, and the nature of your specialty and job duties.

See also Can I File A Claim for “Burnout”?

Each physician’s claim for disability benefits involves different facts, disabling conditions, policy requirements, insurance companies, etc. While our attorneys are making an effort to share general knowledge with the medical community and answer physician’s questions about the impact of the coronavirus, this not a substitute for individualized advice from an experienced disability insurance lawyer. If you would like to speak with our attorneys and have them take an in-depth look at your particular situation, please feel free to contact us directly.

References:

[1] Alison Block, Doctors and nurses are already feeling the psychic shock of treating the coronavirus, The Washington Post, March 18, 2020, https://www.washingtonpost.com/outlook/2020/03/18/doctors-nurses-are-already-feeling-psychic-shock-treating-coronavirus/.

[2] Karen Weise, Doctors Fear Bringing Cornavirus Home: ‘I am Sort of a Pariah in My Family’, The New York Times, March 16, 2020 (updated March 17, 2020), https://www.nytimes.com/2020/03/16/us/coronavirus-doctors-nurses.html.

[3] Stephanie Innes, Number of hospital beds, doctors in Arizona are low compared with rest of U.S., Arizona Republic, March 15, 2020 (updated March 16, 2020), https://www.azcentral.com/story/news/local/arizona-health/2020/03/15/number-hospital-beds-doctors-arizona-low-compared-rest-u-s/5038216002/.

[4] As an example, The Utah Department of Health, according to a news article in The Salt Lake Tribune, announced on March 24th a halt to nonurgent medical, dental, and veterinary procedures in order to preserve protective gear for health professionals. The order currently runs through April 25th. See Sean P. Means, Lee Davidson, Bethany Rodgers, Utah increases COVID-19 testing, halts non-urgent care – but some doctors urge stay-at-home orders, The Salt Lake Tribune, March 24, 2020, https://www.sltrib.com/news/2020/03/24/utah-increases-covid/.

[5] Adam Grant, Burnout Isn’t Just in Your Head. It’s in Your Circumstances, The New York Times, March 19, 2020, https://www.nytimes.com/2020/03/19/smarter-living/coronavirus-emotional-support.html.

[6] For example, the maximum weekly unemployment benefit insurance in Utah is $580, with a total maximum benefit of $15,080.00.

See Unemployment Insurance Benefit Schedule, January 2020, Workforce Services Unemployment Insurance, https://jobs.utah.gov/ui/UIShared/PDFs/BenefitCalculation.pdf.

Filing for Disability Insurance Benefits In the Wake of Coronavirus: What Every Dentist Should Know

Now that the COVID-19/Coronavirus epidemic has reached the U.S. and spread throughout the country with no end in sight, dentists are being forced to face the reality that they may have to go without income for weeks, or maybe even months.

Some states, like California and New York are ordering dentists (and everyone else) to close their offices and shelter-in-place. And the American Dental Association (ADA) has called upon dentists to postpone elective procedures for the next three weeks.

In Utah, many dental offices have closed or drastically cut back on seeing patients following the ADA’s statement and the Utah Dental Association’s warning that dentists are “one of the highest risk categories for transmission and contraction of the virus, with many routine dental procedures potentially transmitting the virus.”

Similarly, in Arizona, Governor Doug Ducey has discontinued “all non-essential or elective surgeries, including elective dental surgeries, that utilize personal protective equipment or ventilators” in an effort to preserve PPE for an anticipated spike in the pandemic. Dr. Jennifer Enos, president of the Arizona Dental Association, has also issued a statement asking “dentists to donate available supplies of personal protective equipment, such as medical gloves and masks,” which effectively would mean that dentists would need to close their offices until those supplies become generally available again.

Given all of this uncertainty, our attorneys have been receiving a host of questions from dentists who are trying to determine if they can file a disability insurance claim and/or how the coronavirus developments impact their disability claim/benefits. So, for the next several weeks our disability attorneys are going to dedicate our blog to answering dentist’s questions about coronavirus and disability claims under their private, own-occupation policies, in an effort to help the dental community be more informed on these important and complex legal/disability industry issues.

Each dentist’s claim for disability benefits involves different facts, disabling conditions, policy requirements, insurance companies, etc. While our attorneys are making an effort to share general knowledge with the dental community and answer dentists’ questions about the impact of the coronavirus, this not a substitute for individualized advice from an experienced disability insurance lawyer. If you would like to speak with our attorneys and have them take an in-depth look at your particular situation, please feel free to contact us directly.

Sources:

ADA Calls Upon Dentists to Postpone Elective Procedures, American Dental Association, March 16, 2020, https://www.ada.org/en/press-room/news-releases/2020-archives/march/ada-calls-upon-dentists-to-postpone-elective-procedures.

UPDATE on COVID-19 , Arizona Board of Dental Examiners, March 19, 2020, https://dentalboard.az.gov/.

The Latest on COVID-19 from AzDA, Arizona Dental Association, https://www.azda.org/news-publications/the-latest-on-covid-19.

Utah Dental Association, https://www.uda.org/.

Hannah Tiede, Dental surgeons postpone elective procedures to combat COVID-19 spread, KOLD, March 18, 2020, https://www.kold.com/2020/03/19/dental-surgeons-limit-elective-procedures-combat-covid-spread/.

Hannah Miller, Dentists reduce hours, postpone elective procedures to combat coronavirus, CNBC, March 19, 2020, https://www.cnbc.com/2020/03/19/coronavirus-dentists-reduce-hours-postpone-elective-procedures.html.

Paighten Harkins, Some Utah dentists are closing because of coronavirus. Others don’t think they can., The Salt Lake Tribune, published March 17, 2020 (updated March 18, 2020), https://www.sltrib.com/news/2020/03/17/some-utah-dentists-are/.

Do I Lose My Disability Coverage If I’m Not Working?

It depends. Some disability policies (most often employer policies or group/association policies) have a requirement that you must remain “actively at work” or working “full-time” in order to stay eligible for coverage.

While sometimes “full-time” is defined, other policies, like the ADA/Great-West policy, have an hourly work requirement that must be met to maintain eligibility. For example, you may need to work 20 hours a week, or 30 hours a week, depending on the disability policy.

Many times, there are exceptions that can be utilized to maintain eligibility, but it may require further action, like obtaining a formal leave of absence from your employer or getting approval for FMLA leave. However, these are things that need to be done proactively, to preserve eligibility.

Additionally, if you lose eligibility and regain it later (say, after the national coronavirus epidemic has passed), this can re-set the coverage date and preexisting condition provisions under some policies. As a result, your claim could be denied on the basis that your disabling condition pre-dates the new coverage date, even if you technically regain the ability to file a claim under the policy upon returning to work.

There are certain legal principles that will work in tandem with the provisions of your policy, and that may help you, especially in circumstance like coronavirus pandemic. However, the administrators of your policy may or may not believe that it is in their best interest to voluntarily assist you, notwithstanding these laws.

Action Step: Locate your disability policies and become familiar with the requirements for maintaining eligibility. If necessary, take additional steps to preserve your eligibility during periods where you are not able to meet the normal hourly work requirements. Talk to a disability attorney if you have questions about ways to maintain your eligibility during the coronavirus crisis.

Each dentist’s claim for disability benefits involves different facts, disabling conditions, policy requirements, insurance companies, etc. While our attorneys are making an effort to share general knowledge with the dental community and answer dentists’ questions about the impact of the coronavirus, this not a substitute for individualized advice from an experienced disability insurance lawyer. If you would like to speak with our attorneys and have them take an in-depth look at your particular situation, please feel free to contact us directly.

Can I File a Disability Claim if My Office Has Already Closed?

Yes, but your claim will likely receive heightened scrutiny—particularly if you worked normal hours seeing roughly the same number of dental patients up until your office was closed due to coronavirus.

Many disability policies require you to prove that your disability (or loss of income resulting from disability) was caused “solely” by an underlying sickness/injury, and not by other secondary causes. Other policies require you to show a “demonstrated relationship” between the disabling condition and your inability to practice dentistry. And some newer disability policies even exclude disabilities if they are “caused or contributed to” by something other than your underlying medical condition. If your disability policy contains such language, your insurer may deny or reduce your benefits on the grounds that your loss of income/inability to practice is due to causes other than your disabling condition.

Additionally, if you can’t work because you were forced to close your office or give away your supplies, or your employer sent you home and you can’t work for other dentists because of a non-compete agreement, your insurer may also try to use that as a basis to deny your claim.

This is called the “legal disability” defense and is usually used in situations where a dentist has legally lost the ability to practice—for example, if the dentist lost his/her license. Courts have addressed this differently in different jurisdictions, but generally the defense—where recognized—allows the insurer to avoid payment if it can show that you lost the legal ability to practice before you became disabled.

If your disability insurance company raises this legal defense, it typically results in a “chicken v. egg” scenario where your medical records and the timeline is parsed to determine what came first. And, while it is certainly possible to prevail, these claims may require court involvement to resolve—particularly if care is not taken at the outset to ensure that the timeline and facts are properly submitted with the original notice of claim.

Action Step: If you are considering filing a disability claim during the national coronavirus epidemic, recognize that your claim will be subjected to close scrutiny and make sure that you carefully review and double-check your responses when submitting your proof of loss to ensure that the timeline is accurate. If you are concerned about your insurer asserting a “legal disability” defense, speak with an experienced disability lawyer about your situation.

Each dentist’s claim for disability benefits involves different facts, disabling conditions, policy requirements, insurance companies, etc. While our attorneys are making an effort to share general knowledge with the dental community and answer dentists’ questions about the impact of the coronavirus, this not a substitute for individualized advice from an experienced disability insurance lawyer. If you would like to speak with our attorneys and have them take an in-depth look at your particular situation, please feel free to contact us directly.

If I Close My Office Will That Hurt My Chances of Using My Disability Policy?

It could. See Can I File a Disability Claim if My Office Has Already Closed?

If I Change the Volume and/or Types of Procedures I’m Doing, Will that Hurt My Chances of Using My Disability Policy?

It could. While most policies sold to dentist are “own occupation” policies, the term “occupation” is a malleable term. Typically, “occupation” is defined as the “occupation or occupations” you were engaged in immediately prior to your date of disability.

As we’ve explained in our prior articles, this means that you can modify your occupation and hurt your chances of collecting if you change the types of procedures you are doing. If you reduce your hours, stop doing certain dental procedures and/or focus more on office administration and are not able to resume your normal schedule before filing a claim, your disability insurance company may determine your occupation is a “part-time dentist” and “part-time administrator,” determine that you can still do office administration, and refuse to pay total disability benefits.

Action Step: If you think that you may need to file a disability claim in the future, carefully weigh the risk of modifying your occupation against the risk of your future claim being evaluated based upon a modified occupation. If appropriate, consider filing a disability claim prior to pursuing non-clinical options, but discuss this first with an experienced disability insurance lawyer.

Each dentist’s claim for disability benefits involves different facts, disabling conditions, policy requirements, insurance companies, etc. While our attorneys are making an effort to share general knowledge with the dental community and answer dentists’ questions about the impact of the coronavirus, this not a substitute for individualized advice from an experienced disability insurance lawyer. If you would like to speak with our attorneys and have them take an in-depth look at your particular situation, please feel free to contact us directly.

How Do I File a Disability Claim if I Can’t Get in to See My Doctor?

Most disability insurance policies require you to produce proof of loss within a limited time frame and state that the company can limit or deny providing you with disability benefits if you do not provide the information within that time frame. However, there are legal rules that allow for delay if it would be impossible or unreasonable for you to produce the proof within the required time frame.

These same exceptions also may apply in instances where you are already on claim and the disability insurance company is requiring an update from your doctor. Whether these exceptions are available to you will depend on what your policy says and the law in your jurisdiction. An experienced disability attorney can help you request an extension if you need it.

Action Step. Speak with an experienced disability lawyer to assess whether it would be appropriate to file a claim and start the process prior to obtaining your doctor’s statement. If you are already on claim, ask for an extension and if the insurance company refuses to grant one, speak with a disability lawyer.

Each dentist’s claim for disability benefits involves different facts, disabling conditions, policy requirements, insurance companies, etc. While our attorneys are making an effort to share general knowledge with the dental community and answer dentists’ questions about the impact of the coronavirus, this not a substitute for individualized advice from an experienced disability insurance lawyer. If you would like to speak with our attorneys and have them take an in-depth look at your particular situation, please feel free to contact us directly.

If I file a Partial Disability Claim How Do They Calculate Loss of Income? What If My Income Goes Down Because of Coronavirus?

Each disability insurance policy has a different formula for calculating prior income and loss of income. Some policies look to the year or 24 months immediately prior to date the disability claim was filed, other policies use averages over a several year period, and some policies give dentists the option to pick between the two.

Once your prior income is determined, it is typically averaged out on a monthly basis and compared to your actual monthly income to determine the loss of income, expressed as a percentage. If you meet a certain percentage loss, usually 15% or 20%, you are eligible for benefits.

If your disability policy averages out prior income over a period of several years, the impact on prior income will likely not be that significant if the drop in income dips for a few months and then recovers. However, if the policy looks to the period immediately prior to filing the claim, a series of a few months with little to no income could have a more drastic impact on how prior income is calculated. And if your prior income remains low when you ultimately file a partial disability claim, it becomes much harder to meet the threshold loss of income to qualify for partial disability benefits.

See also Can I File a Disability Claim if My Office Has Already Closed?

Action Step: If you are considering filing a partial disability claim, review your policy’s partial disability provision and become familiar with how “prior income” and “loss of income” are calculated under your policy. If you had a drop in income related a disabling condition prior to the loss of income from the coronavirus, and you are able to back that up with documentation, evaluate whether it would be appropriate under your policy to file partial disability claim based upon that loss of income.

Each dentist’s claim for disability benefits involves different facts, disabling conditions, policy requirements, insurance companies, etc. While our attorneys are making an effort to share general knowledge with the dental community and answer dentists’ questions about the impact of the coronavirus, this not a substitute for individualized advice from an experienced disability insurance lawyer. If you would like to speak with our attorneys and have them take an in-depth look at your particular situation, please feel free to contact us directly.

Should I Try to File for Unemployment or Get Another Job Until I Can Go Back to Dentistry?

If you try to find another non-clinical job, you risk modifying your occupation. See If I Change the Volume and/or Types of Procedures I’m Doing Will that Hurt My Chances of Using My Disability Policy?

While unemployment benefits vary from state to state, barring significant changes to the programs, it is unlikely that these sorts of benefits will allow dentists to meet their expenses if dentists are forced to close their offices for extended periods of time. For example, in Arizona, the maximum weekly benefit is $240, or roughly $960/month. Additionally, there is a chance that the various programs will not be able to address the spike in people filing for benefits. In just Arizona alone, the non-partisan Economic Policy Institute released a new study showing that Arizona will lose more than 100,000 jobs by this summer related to COVID-19, including 4.2% of private sector jobs, which will place significant strain on the unemployment benefit program.

Obviously, you should not file a disability claim if you do not have a medical condition that limits you from practicing. However, if you are a dentist with a slowly progressive condition, like degenerative disc disease or an essential tremor and you have been considering filing a disability claim, your disability claim may be a better option than seeking unemployment benefits. While there are some new considerations when filing a disability claim in this environment, your policy probably provides greater financial protection than unemployment benefits, if you have a legitimate disability claim.

Action Step: Learn more about your state’s unemployment benefits and how they compare to your disability policy’s benefits. If appropriate, consider filing a disability claim.

Each dentist’s claim for disability benefits involves different facts, disabling conditions, policy requirements, insurance companies, etc. While our attorneys are making an effort to share general knowledge with the dental community and answer dentists’ questions about the impact of the coronavirus, this not a substitute for individualized advice from an experienced disability insurance lawyer. If you would like to speak with our attorneys and have them take an in-depth look at your particular situation, please feel free to contact us directly.

Sources:

Eligibility for Unemployment Insurance Benefits – How much will my weekly benefit amount be? https://des.az.gov/services/employment/unemployment-individual/eligibility-unemployment-insurance-benefits.

Steve Irvin, Analysis: Arizona will face huge job losses because of coronavirus, ABC 15, March 19, 2020

https://www.abc15.com/news/state/analysis-arizona-will-face-huge-job-losses-because-of-coronavirus.

Arizona increases access to unemployment benefits, moves tax deadline due to coronavirus, 12 News, March 20, 2020 (updated March 21, 2020)

https://www.12news.com/article/news/health/coronavirus/az-unemployment-benefits-tax-deadline-covid-19/75-d8a15335-2560-460c-89f2-1bdf7f52f412.

The Latest on COVID-19 from AzDA, Arizona Dental Association, https://www.azda.org/news-publications/the-latest-on-covid-19.

I Filed a Disability Insurance Claim Months Ago and Still Do Not Have a Decision – What Is Taking So Long?

While it is not unusual for a disability insurance company to take several months to make a benefits decision, it is important (and particularly important now) to be following up so that your disability claim is not placed on the back burner, particularly when insurers may be operating with limited staff.

If you feel your claim decision is being delayed, you have submitted all requested information, and you are in need of income for a particular reason (like the coronavirus) disability insurers will sometimes make advance payments under a “reservation of rights.” However, this money can be clawed back, so it is important to carefully evaluate whether this sort of thing is appropriate, and it may require the involvement of an experienced disability attorney to secure the advance payment.

Action Step: Be proactive and follow-up with your disability insurance company to determine when they will be making a benefits decision. If you feel that a decision is being wrongfully delayed, speak with a disability lawyer.

Each dentist’s claim for disability benefits involves different facts, disabling conditions, policy requirements, insurance companies, etc. While our attorneys are making an effort to share general knowledge with the dental community and answer dentists’ questions about the impact of the coronavirus, this not a substitute for individualized advice from an experienced disability insurance lawyer. If you would like to speak with our attorneys and have them take an in-depth look at your particular situation, please feel free to contact us directly.

I Am Stuck Out of the Country and Can’t Get Back – Can My Disability Insurance Company Cut Off My Disability Benefits?

Some policies, particularly newer policies, contain “foreign residency” provisions that require you to be in the U.S. (or sometimes, the U.S., Canada or Mexico) in order to remain eligible to receive disability benefits. Oftentimes, the disability policy will allow for a certain period of time that you can be out of the country and then cut off benefits if you do not return.

At the same time, these provisions do not say what happens if your failure to return is due to something that is not your fault—like the coronavirus, quarantines or travel bans. Consequently, this is a difficult question that would likely hinge on the legal interpretation of the exact language in your policy, the law of your jurisdiction, and the court who is asked to resolve the issue, if the insurer is not willing to waive the terms of the contract or come to a compromise.

Action Step: Review your policy to determine whether it has a foreign residency provision. If it does and you are concerned that you may not be able to return to the U.S. in time to comply with its provisions, contact a disability lawyer.

Each dentist’s claim for disability benefits involves different facts, disabling conditions, policy requirements, insurance companies, etc. While our attorneys are making an effort to share general knowledge with the dental community and answer dentists’ questions about the impact of the coronavirus, this not a substitute for individualized advice from an experienced disability insurance lawyer. If you would like to speak with our attorneys and have them take an in-depth look at your particular situation, please feel free to contact us directly.

My Insurer Says I Have to Undergo an IME But I Don’t Want to Get Coronavirus

Most policies contain provisions that require you to submit to medical examinations and allow the company to terminate benefits if you do not attend. Some policies only allow for a limited type of exams, while others contain provisions that go on for several paragraphs outlining the several types of tests and exams that the company can require. So the first step is assessing whether the exam that is being required is appropriate under the terms of your policy.

If so, then the second question is whether you should be forced to put your health at risk to secure or maintain your disability benefits. Again, this is something that may require the intervention of an experienced disability attorney to resolve, as it will likely initially require an in-depth assessment of whether the insurer can obtain the relevant information by other means. Other options include negotiating a postponement of the IME or, if the insurer is particularly aggressive, taking the insurer to court to determine whether these provisions are enforceable under these particular circumstances.

Action Step: If you are concerned about your insurer requiring an in-person IME, speak with a disability lawyer and have him or her evaluate whether the IME is required under your policy and whether there are other means to provide the requested information.

Each dentist’s claim for disability benefits involves different facts, disabling conditions, policy requirements, insurance companies, etc. While our attorneys are making an effort to share general knowledge with the dental community and answer dentists’ questions about the impact of the coronavirus, this not a substitute for individualized advice from an experienced disability insurance lawyer. If you would like to speak with our attorneys and have them take an in-depth look at your particular situation, please feel free to contact us directly.

My Disability Insurance Company Wants to Send A Field Examiner to My House – Do I Have to Let Them In?

See My Insurer Says I Have to Undergo an IME But I Don’t Want to Get Coronavirus.

Most policies do require provisions that require you to submit to in-person examinations. However, there is also typically a “reasonableness” requirement. An experienced disability attorney can evaluate your claim to determine whether an examination is appropriate under the circumstance and/or whether there are alternative methods of obtaining the relevant information that do not place your health at risk.

Action Step: If you are concerned about your insurer requiring and in-person field interview, speak with a disability lawyer and have him or her evaluate whether the field exam is required under your policy and whether there are other means to provide the requested information.

Each dentist’s claim for disability benefits involves different facts, disabling conditions, policy requirements, insurance companies, etc. While our attorneys are making an effort to share general knowledge with the dental community and answer dentists’ questions about the impact of the coronavirus, this not a substitute for individualized advice from an experienced disability insurance lawyer. If you would like to speak with our attorneys and have them take an in-depth look at your particular situation, please feel free to contact us directly.

I Can’t Get My Doctor to Complete My Disability Paperwork – What Do I Do?

See How Do I File a Disability Claim if I Can’t Get in to See My Doctor to get Claim Forms Completed?

Under certain circumstances it may be possible to request extensions and/or get the insurer to agree to accept proof of loss in other formats, such as medical records, test results, etc. However, it is important to be wary of the disability insurance company offering to do peer-to-peer calls with your doctor in lieu of reports.

Action Step. Ask for an extension and if the insurance company refuses to grant one, speak with a disability lawyer.

Each dentist’s claim for disability benefits involves different facts, disabling conditions, policy requirements, insurance companies, etc. While our attorneys are making an effort to share general knowledge with the dental community and answer dentists’ questions about the impact of the coronavirus, this not a substitute for individualized advice from an experienced disability insurance lawyer. If you would like to speak with our attorneys and have them take an in-depth look at your particular situation, please feel free to contact us directly.

I’ve Been On Claim With Reduced Reporting and Now My Disability Insurance Company Wants to Do an Interview/IME – Is My Claim Being Targeted for Denial?

Historically, disability insurers have engaged in bad faith more frequently when they faced sustained periods of financial loss. Additionally, during the last recession, we noted that many companies began revisiting claims that had been ongoing for years, and subjecting them to in-depths reviews to see if there had been any improvement or if they could find any basis for termination.

At the very least, disability claims—particularly high-dollar claims filed by dentists—are going to be receiving heightened scrutiny during this time. Field examiners, IME doctors, and other third parties who work with insurance companies, as well as the companies’ own analysts and in-house doctors conducting medical records reviews, will all be under substantial pressure to keep their jobs by saving costs for the insurance company.

Action Step: If you feel that your disability insurance company is improperly targeting your claim for denial, an experienced disability insurance attorney can help you assess your particular situation and determine whether the insurer’s action is appropriate.

Each dentist’s claim for disability benefits involves different facts, disabling conditions, policy requirements, insurance companies, etc. While our attorneys are making an effort to share general knowledge with the dental community and answer dentists’ questions about the impact of the coronavirus, this not a substitute for individualized advice from an experienced disability insurance lawyer. If you would like to speak with our attorneys and have them take an in-depth look at your particular situation, please feel free to contact us directly.

The Importance of Having a Transition Plan: Part II

Physicians and dentists with slowly progressive conditions face unique challenges and hurdles when it comes to filing a claim with their disability insurance company. In the previous post in this series, we looked at a few things doctors should take into account when deciding what to do with their practice in the event they need to file a disability claim. Another important part of a transition plan is determining an appropriate work schedule, given your condition, symptoms and policy requirements.

Should I Keep Working?

This is another question that we are asked a lot and, again, the answer is, it depends. There are risks associated with continuing to practice, but you can also prejudice your chances of collecting benefits if you make changes to your work schedule or take on another job without taking the requirements of your particular policy into account.

The primary factor is, of course, whether it is safe for you to be treating patients. If it’s not safe to practice, you shouldn’t be practicing. But with slowly progressive conditions, this can be a difficult thing to assess. There are usually good days and bad days. There may be remedies (like stretching, or ice/heat) that initially help, but over time lose effectiveness. Or in certain situations (such as progressive neuropathy or an essential tremor) the changes may happen so slowly that it is hard to perceive the day-to-day progression.

In addition, your policy may have certain definitions or requirements that set certain parameters for filing a successful claim that you can run afoul of if you are not careful. Some of the most common mistakes we see include:

- Reducing work hours. While working shorter hours may make symptoms more bearable, doing this for too long could prompt your insurance company to change your classification from “full-time” to “part-time.” This becomes problematic because it is more difficult to prove you are totally disabled from working part-time. For example, if you stop taking on-call shifts and file a claim several months later, the company may argue that your previous on-call hours should no longer be considered part of your occupational definition for purposes of your disability claim.

- Reducing procedures. Similarly, changing the types of tasks you perform can also prompt insurers to maintain that you have changed the material and substantial duties of your job. For example, if you’re a dentist and you stop performing root canals, your insurer may argue that your occupation is “a dentist who doesn’t perform root canals.” Again, this makes it more difficult for you to establish total disability because the more difficult procedures/duties are removed from the equation.

- Taking a side job. Cutting hours or lightening work load can lead to a significant loss of income, so doctors often turn to side jobs that don’t exacerbate their symptoms, such as teaching part time at a local dental or medical school, financial advising, consulting, or perhaps selling real estate. However, what many don’t realize is that newer disability insurance policies often have plural definitions of occupation that define your occupation as everything you are doing immediately prior to the onset of disability. Again, an insurer can use the (lighter) duties of a second job to argue that you can still work as say, a real estate agent, and are therefore not eligible for total disability benefits, even if you can no longer practice as a doctor.

These are just a few examples of occupational changes that can have a dramatic impact on the future success of a disability claim. How much of an impact depends on the particular language of your policy, and this is not intended to be an exhaustive list of all of the issues that can arise during the transition out of practice. The above examples are merely intended as examples of why it is important to have a transition plan and know what your policy(ies) say before filing a claim. Conversely, if you put off these important questions for too long, you can make it much more difficult (and, in some cases) impossible to collect total disability benefits.

If you are considering filing a claim, or wondering how a transition plan would work for you, an experienced disability insurance attorney can help you understand the terms of your policy and apply it to your particular situation.

The Importance of Having a Transition Plan: Part I

Many of the physicians and dentists we work with have slowly progressive conditions. When they initially reach out to us, they are often facing the difficult dilemma of weighing the risk of hurting a patient against the ramifications of ending the career that they worked so hard to build. Often, they are unfamiliar with the terms of their disability policies (and, in some cases, don’t even have copies of their policies). And most of the time, they are also unfamiliar with how the disability claims process works and not sure if it is appropriate (or if it is even possible) to file a claim with their disability insurance company if they have a medical condition that progresses gradually (as opposed to something like being injured in an accident). Our next two posts will look at important considerations that must go into a transition plan.

While it is possible to collect on a claim involving slowly progressive conditions (such as degenerative disc disease or an essential tremor), these types of claims present unique challenges and hurdles that doctors must be aware of—ideally well before they file.

With any disability claim involving a physician or dentist, the number one factor is patient safety. Whether or not it is safe for you to continue to practice depends on your particular symptoms and the progression of your condition—factors that are typically outside your control. Other factors that are not entirely within your control include whether/how soon you can find a buyer if you need to sell your practice, whether new treatments are developed for your condition, whether your health insurance covers a needed medical treatment, whether your doctor is willing to support your claim—and the list goes on.

These “unknowns” often prove to be the most daunting and frustrating aspect of filing a disability claim, particularly for our clients who are used to diagnosing and solving problems. Filing a successful disability claim requires patience and the ability to adapt and react appropriately, which can prove particularly difficult if you do not have experience with the disability process or the industry knowledge required to recognize the issues in play.

So where do you start? The first step is understanding your policy requirements and taking the time to make a transition plan that fits within the parameters of your particular policy(ies). There are a lot of different components to a transition plan, but in these next few posts, we are going to be focusing on issues related to your practice.

What Do I Do With My Practice?

If you own your own practice, a major part of your transition plan will be determining what to do with your practice. This is one of the more common questions we are asked and, unfortunately, like many questions in the area of law, there is no one-size-fits-all answer. The best course of action depends on a number of factors, including:

- How your policy defines key terms, like “total disability” and “your occupation”;

- Whether you have partners or associates that are able to buy your practice interest;

- Whether you live in a large metropolitan area where there is a large pool of potential buyers or a rural area where there are very few potential buyers;

- How long you think you can go on practicing (taking into account patient safety concerns);

- Whether you can find a buyer who is understanding of your situation (as opposed to buyers who would seek to low-ball you/negotiate the price down if they became aware of your medical condition);

- Whether there is an expectation that you will work in a different capacity following the sale (e.g. as an associate or consultant);

- Whether your policy allows you to work in a different capacity and collect benefits;

- Whether your policy offsets your benefits if you receive any post-disability income.

These are just a few of the issues that need to be considered, and oftentimes determining the best course of action is an ongoing process as new information is learned about the progression of your symptoms, the state of the market, the number of potential buyers, the needs/personality of interested buyers, etc. If you are considering filing a claim, or wondering how a transition plan would work for you, an experienced disability insurance attorney can help you understand the terms of your policy and apply it to your particular situation.

In part two of this series, we’ll look at another important part of any transition plan—whether you should continue to work in the face of slowly progressive condition.

When Does a Disability Claim Investigation Begin?