Lifetime Benefits, Part 2 – Graded Lifetime Benefits

In our last post we discussed how it can be difficult to save for retirement if your only income is your monthly disability benefits. One way to help ensure financial security into retirement age is to purchase a lifetime benefit option with an individual disability insurance policy. While older policies often featured full monthly disability benefit payments for life, newer policies insert qualifiers that limit whether a claimant will actually receive the full benefit amount for his or her lifetime. Our last post looked at the injury versus sickness limitation. In this post, we will be taking a look at another provision that limits lifetime benefits: the graded benefit rider.

Graded Lifetime Benefit Riders

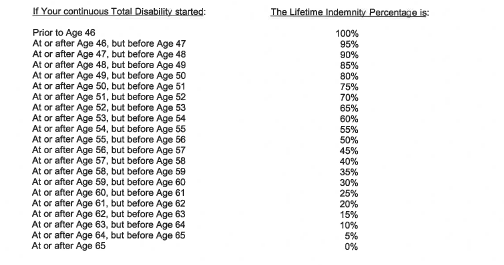

Under the graded benefit rider, claimants receive benefits for life, provided they are disabled prior to a specified age and remain continuously totally disabled. However, the amount of the monthly benefit they receive varies based on how old the claimant is at the onset of his or her disability.

For example, a disability insurance policy may have a benefit period that ends at age 65, with a graded lifetime benefit rider (sometimes called a “lifetime extension for total disability”) that will pay 100% of monthly benefits for life if the policyholder is disabled prior to age 46. However, if the policyholder becomes disabled after age 46, his or her lifetime benefits will only be a certain percentage of the monthly payment.

Below is a provision from an actual policy, illustrating how benefit amounts are calculated under this type of rider:

Using this chart as an example, if your benefit payments are $10,000 per month and you become totally disabled at age 46 (100% under the policy) your disability insurance company will continue to pay you $10,000/month after you turn 65 for the rest of your life. If you become totally disabled at age 55, the percentage of monthly indemnity payable would drop to 50% and your disability insurance company would pay you $5,000/month after you turn age 65. If you don’t become totally disabled until age 64, the amount payable would only be 5% of your monthly disability benefit. In other words, you would have a year or less of monthly payments of $10,000, followed by monthly payments of $500.

While a graded lifetime benefits rider is one way to ensure that you continue to receive disability income after your standard benefit period ends, you must keep in mind that these payments may not provide much income if you become disabled later on in life.

Further, in order to achieve lifetime benefits under this rider, you must remain totally disabled. So, for example, if you return to work, were pushed off claim, or went into residual disability claim status, you lose the lifetime benefits. And even if you are later able to reestablish total disability, the lifetime benefit will be a lower percentage of the monthly benefit, because you will have re-set your total disability date for purposes of calculating your monthly benefit under the rider.

Lifetime benefits offer a way for policyholders to continue to collect at least some income after the benefit period of their disability insurance policy ends. However, when choosing a disability insurance policy, physicians and dentists must carefully consider their age at the time of purchase, premium amounts, and the policy language before buying a policy. Knowing how your policy’s lifetime benefits work is an important step in planning for your financial future.

In our next post we will look at another option individuals have to supplement their retirement income: the lump sum benefit rider.