Guardian’s New Dentist-Specific Claim Form Are These Trick Questions?

We’ve noted before that disability policies have evolved over time to become more complex. The same holds true for disability claim forms.

Years ago, most disability insurers used fairly basic proof of loss forms, and used the same forms for various types of claims.

Over time, these claim forms have also become increasingly complex, to the point that Guardian now has a dentist-specific form with several loaded questions. These questions can be difficult to answer fully and accurately, within the parameters of the form. Many questions do not provide any room to explain your specific dental practice, instead prompting you to select options that may not apply to your situation. Many questions also have hidden objectives that are only apparent to disability attorneys familiar with “own occupation” dentist disability claims.

Guardian’s Dental Professional Occupation Assessment Form

Below are a few excerpts from Guardian’s most recent dentist-specific claim forms, along with some limited, general commentary into the purpose behind some of the questions.

When we first saw these new forms, it was immediately apparent to us that they had been drafted by Guardian’s attorneys and senior claim staff with several of Guardian’s tactics of reducing or avoiding payment in mind. It was also clear from the fine print at the bottom that Guardian is attempting to lock dentists into “complete and true” answers, in writing, early-on, before they have contacted an attorney. This form is then checked against anything you have said to Guardian before, and anything else you may say in later phone or field interviews.

We have handled numerous claims filed by dentists with Guardian and have had to get them back on track, which can be difficult if these forms are not completed in the proper manner. Most recently, we have seen Guardian delay or reduce payment on numerous dentist disability claims due to perceived “incomplete answers” to its dentist-specific proof of loss questions and/or perceived “inconsistencies” with other statements/interviews. Accordingly, we felt it important to get the word out to dentists about these new developments.

As you review, keep in mind that every dentist claim is unique. Not everything below applies to every claim, and there may be other, additional considerations that come into play under your particular circumstances. Accordingly, it is best to consult with an experienced disability insurance attorney before filing a disability claim or submitting any proof of loss to Guardian.

Table of Contents

1. Why is Guardian Asking About My Pay Rate/Loss of Income?

5. Why is Guardian Asking if I Modified My Job Before Filing and How is That Relevant?

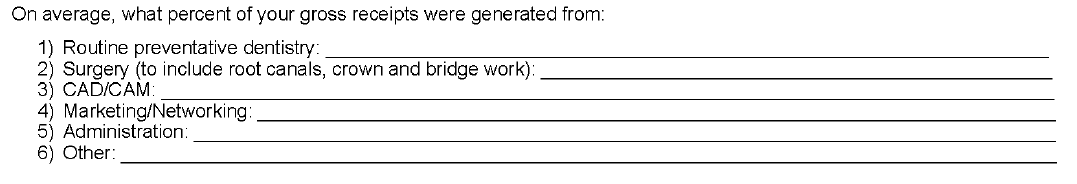

6. Why is Guardian Asking Me to Break Down the Source of Gross Receipts?

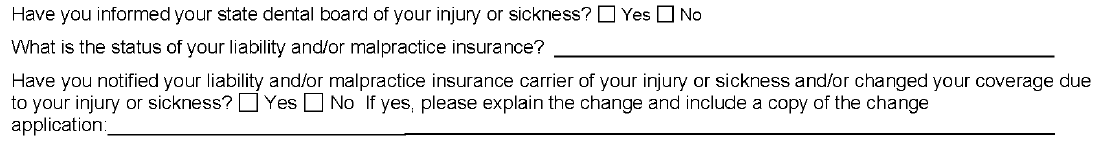

7. Why is Guardian Asking About the Dental Board/My Malpractice Insurance/Use of My NPI Number?

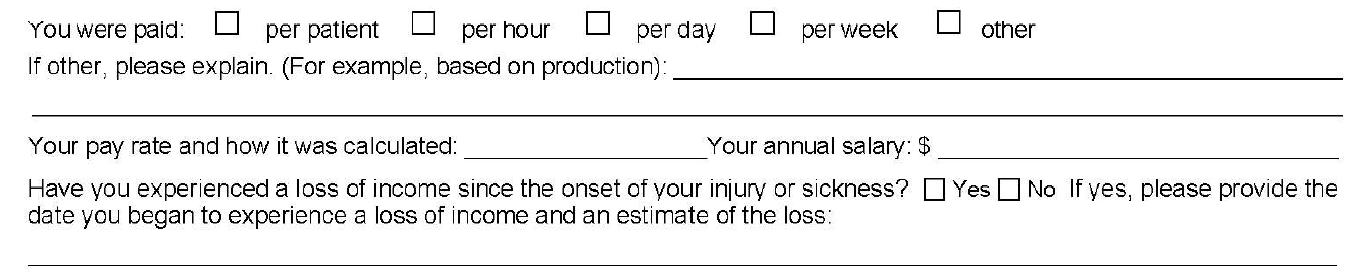

1. Why is Guardian Asking About My Pay Rate/Loss of Income?

Initially, you may think that loss of income is relatively straightforward; however, it can be a complicating factor in dentist claims, for a few reasons.

First, over time, disability policies have added additional requirements for establishing proof of loss that you may not be aware of. With older policies, the focus was primarily on whether the dentist met a certain loss of income percentage threshold. Then, if there was evidence of a medical condition that logically limited the dentist’s ability to work full-time, that was generally sufficient.

Newer Guardian disability policies have added additional hurdles, such as a requirement that the loss be “solely” due to the disabling condition. Regardless, the timeline—and date of disability selected—is critical to establishing a right to payment because, at a minimum, the loss of income must directly line up with the disabling condition.

The problem for dentists is that their disability claims are often musculoskeletal, slowly progressive, and worsen over time. Many dentists are diagnosed with a condition, yet work through the pain for a time. Sometimes there are periods of improvement even if the solutions are only short-term and the overall trend is downward. This can make selecting a proper and defensible date of disability challenging.

Additionally, when it comes to dentist claims, there can be gray areas under the terms of the underlying policy that must be addressed/negotiated (and sometimes litigated). For example, sometimes partial disability is also based on whether there has been a reduction of hours/time practicing; however, dentistry is not a profession where dentists “clock-in” and “clock-out” so addressing changes in “hours” can be a challenge.

Many dentists also receive income from multiple sources, and there can be several entities involved, particularly if the dentist works at a corporate dentistry practice. In some instances, the definitions in the underlying disability policy do not contemplate this level of complexity when it comes to the policyholder’s income, or give clear answers to what “counts” as income for purposes of determining the monthly losses.

Because of the above, we are seeing “loss of income” becoming an area that is increasingly being contested by insurers seeking to reduce liability or otherwise gain leverage in a disputed claim. Obviously, questions relating to loss of income are critical if you have a partial disability claim. However, even if you have a total disability claim, the period of total disability could potentially come after several months of partial disability. As such, you should consider these questions carefully even if you are planning on filing a total disability claim.

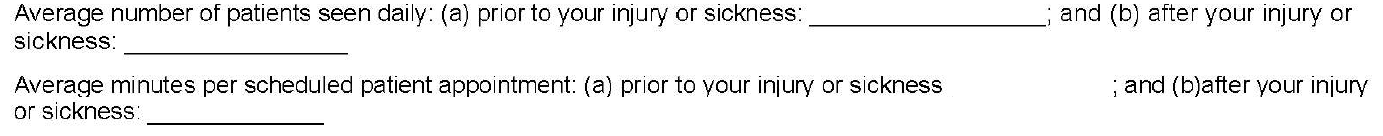

2. Why is Guardian Asking Me to Quantify Patients Per Day and Minutes Per Patient? How Do I Even Do That?

As noted above, changes in work schedule can be very important on a partial disability claim; however, these particular questions are also illustrative for another reason.

On their face, these questions seek information about the difference between the two timeframes, along the lines of what you might expect if you are filing a partial disability claim. The problem here is that the form does not allow for nuance and often these timeframes are not apples-to-apples comparisons.

For example, before your disability date, you may have been working on complex reconstruction cases, only seeing a few patients a day. Then, due to disability, you may have had to abandon the longer, more difficult (and more lucrative) procedures. As a result, you may be seeing many more patients a day, but only performing simpler tasks, such as exams or cleanings. But if you only answer what it asked, it will look like you have increased your workload because you are seeing substantially more patients after your disability.

The second question seems to address this, by asking how much time you spend on each patient appointment. However, providing a generalized answer here can also have unanticipated ramifications.

Going back to the above example, your instinct might be to put a very low number for the new time spent with patients, to highlight that you are doing easier, shorter procedures. However, this can have unanticipated long-term consequences. If you minimize or trivialize the number of hours you spend with patients when filing a partial disability claim, when you reach the point in time that you feel you are totally disabled, Guardian will refer back to this form and ask what has changed? Why can you not keep working if you are only doing simple cases, and only for short periods of time? What has happened medically to explain this change?

Sometimes, there will be a new medical event that can be pointed to. However, as noted above, most dentist claims involve slowly progressive conditions with primarily subjective symptoms (pain, numbness, etc.). As these worsen, imaging (such as MRIs) may or may not show a difference from prior imaging, even if you, as the dentist feeling the symptoms, know you are to the point that you should stop practicing for the sake of patient safety. Even if Guardian is only able to push a claim into partial disability, and reduce the monthly benefit, this can add up to a substantial amount over time.

In other instances, establishing a particular date of disability is critical (e.g. to establish notice was timely, or to lock-in certain lifetime benefits under Guardian’s graded lifetime riders). If your claim involves important timeline questions, failing to provide the appropriate level of detail and nuance can cause major problems and potentially provide Guardian with an argument to entirely avoid paying your disability claim.

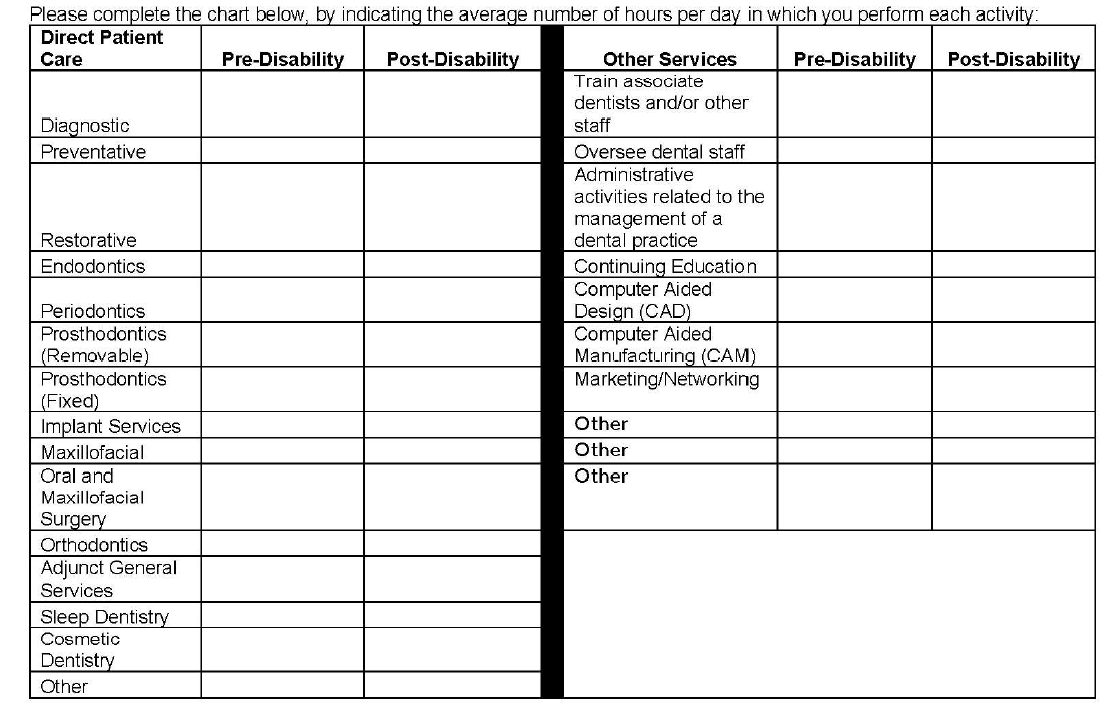

3. Why Is Guardian Asking Me to Break Down Patient Care by Hour? How Do I Do This When Many Categories Overlap and Each Day is Different and I Don’t Track Procedures by Hour? Why Is Guardian Listing Other Non-Clinical Categories?

The problems with the left column of this table should be immediately apparent to most dentists, as many categories overlap. As with the prior question, the form does not provide a means to explain important nuances. Additionally, the dentist is asked to answer the form based on “hours per day” which, for most dentists, varies widely depending on the day and is something that is not tracked on an hourly basis.

The second column is a good example of a question designed to elicit information that Guardian might seek to use in a “dual occupation” defense. As noted in prior posts, most Guardian policies have plural definitions of “occupation.” Guardian—like other disability insurers—will seek to expand your occupation to other, non-clinical roles if they think they can (e.g. practice owner, marketer, trainer/coach, supervisor/office manager, etc.).

While you must provide answers, and cannot avoid these sorts of questions, it is another area where nuance is very important and answering within the restrictions of the Guardian form itself can be harmful for a claim. The above questions may also not be particularly relevant, depending on the type of claim you are making. Or they could be very relevant, if you have future employment plans. If you start a new job in the future, at any point in your claim, Guardian will look back to prior claim forms to see if there are any overlapping duties. If you are unconcerned or imprecise when completing the forms, this can cause problems later on if you want to start other jobs related to dentistry (such as managing dental practices or teaching at a dental school/supervising dental clinics).

4. Why is Guardian Asking for an Hourly Breakdown of All of the Tools I Am Still “Able to Use” Each Day?

This question is another one that initially seems innocuous, but there is a high likelihood that the response will be used unfairly. This is evident when you consider what is actually being asked, particularly if a dentist is filing a total disability claim.

Essentially, the question asks for the minimum number of hours a dentist can still “use” a dental tool in a given day. But it leaves out critical details and qualifiers, and can be taken in several different directions. One dentist might answer based upon the number of hours they think they can work on a live-patient, factoring in patient safety risks. Alternatively, another dentist might take it literally and think it is asking whether the tool can be physically used/manipulated in any capacity, regardless of patient risk.

Additionally, this question simply asks for “hours per day” without clarifying whether this is with breaks, or without breaks, or what the tool is being used to accomplish.

The absence of these additional clarifying details makes it clear that Guardian is seeking responses to muddy the waters when it comes to assessing capacity to work and total versus partial disability.

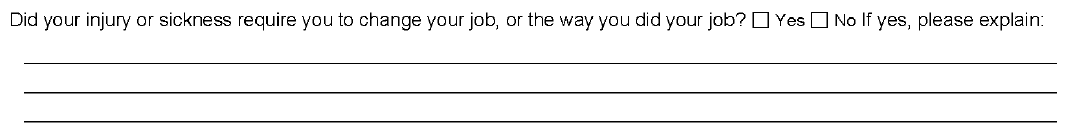

5. Why is Guardian Asking if I Modified My Job Before Filing and How is That Relevant?

While this question provides some room for explanation, it does not ask the critical follow-up question—i.e. whether modifications were effective, or remain effective. Absent an appropriately detailed explanation, Guardian may suggest the dentist could continue to work with the same modifications, even if the dentist is not actually working anymore or the modifications are no longer effective.

This question is also important from an “occupation” standpoint, and is another example of why timeline and the date of disability are so critical. Under most disability policies, including Guardian policies, your “occupation” is defined as of your date of disability. If you modified your duties or changed your schedule prior to your date of disability, this can make it more difficult to collect disability benefits.

This can be addressed by selecting earlier disability dates, but that may not be possible if there are late notice problems with the claim. Similarly, there are scenarios where modified schedules do not necessarily translate into loss of income sufficient to trigger a partial disability clause—for example, where a practice owner cuts back and brings in associates to keep up the practice’s production. This is why it is important to carefully review your policy and pick an appropriate disability date prior to filing; otherwise, questions like the above can become problematic without you even realizing it.

6. Why is Guardian Asking Me to Break Down the Source of Gross Receipts?

This question has several implications and, by now, you can likely guess why Guardian might be asking for this information.

Most Guardian policies define total disability based on an inability to perform the “material and substantial” duties of your occupation. A common tactic used by Guardian (and other insurers) is to ascribe a dollar value to certain things, then characterize them as “major” or “minor” duties. Sometimes this makes sense, but a “material and substantial” duties analysis—particularly for dentists—is claim specific, and involves a host of factors beyond “gross receipts” (e.g. time, complexity, patient expectations, nature of practice, specialty, etc.). As with other questions in the form, the provided categories also overlap to some extent, making it difficult to respond in a precise manner.

Additionally, this is another example of a question that can have ramifications later on if you start a new job. Most Guardian policies are “true own occupation,” in the sense that they let you work in a different occupation and still collect total disability benefits. However, as discussed above, occupation is defined in the plural and disability insurers seek to expand it as much as possible beyond clinical duties.

7. Why is Guardian Asking About the Dental Board/My Malpractice Insurance/Use of my NPI Number?

As evident from the above questions, Guardian is aware that, as a dentist, there are other legal documents that you must complete that directly relate to your capacity to practice dentistry safely.

At the outset of any disability claim, the initial claim packet includes an authorization that Guardian uses to look for anything that might be inconsistent with your claim, including statements made to your dental board or malpractice insurance. Guardian will consider the timing of those statements, in relation to the timing of your disability claim/selected date of disability. If they are inconsistent, Guardian may be more emboldened to deny your claim, as that sort of inconsistency could be used to undermine your credibility with a judge or jury.

The Takeaway

In short, Guardian wrote the policy and crafted the claim forms, so the process is designed to be as favorable to Guardian’s interests as possible.

This does not mean that it is impossible to collect, but it does mean that you should approach your claim in a serious, proactive matter and that you should become as informed as possible before filing your claim. If you do not have experience with the disability industry, it is advisable to consult with a disability attorney before submitting any proof of loss to Guardian.

Every claim is unique and the discussion above is only a limited summary of how Guardian approaches dentist disability claims. If you are concerned that Guardian is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

Disability Insurer Profiles #10: Unum

Unum, originally called Union Mutual, was founded in 1848. Over the years, Unum has merged with additional companies such as Colonial Life and Provident (which had acquired Paul Revere) to form one of the largest insurance companies in America.[1] In 2017, Unum’s total revenue reached $11.3 billion, with total assets of $64 billion.[2]

In 2004, Unum was the subject of a multistate market conduct examination which identified the following inappropriate claims handling practices: (1) excessive reliance on in-house medical staff; (2) unfair evaluation of attending medical examiner notes; (3) failure to evaluate the totality of the claimant’s medical condition; and (4) an inappropriate burden placed on the claimants to justify eligibility for benefits. Following the 2004 investigation, Unum was required to reform its claims practices and pay a fine of $15 million. Unum was also required to reassess certain denied claims stretching over a seven year period. It is estimated that compliance with the settlement cost Unum around $120 million.[3]

If you are a dentist or physician with a Unum policy and are thinking about filing a disability claim, you should be prepared for an in-depth evaluation of your occupational duties. When a disability claim is filed by a professional, the amount of money at stake is significant. One way for the companies to save money is to deny the claim. Another is to maintain that the claim is not a “total disability” claim, but rather a “residual disability” claim, so they only have to pay a fraction of the full monthly benefit amount.

Whether a claim is a “total” or “residual” disability claim often come down to how the duties of your pre-disability occupation are defined in the context of your claim. Then, the insurer assesses whether it can argue that you can still perform any of those duties, taking into account what your medical records report regarding your limitations and any post-disability job or volunteer activities you may be engaging in. Even if your policy allows you to work in another occupation and still collect benefits, the insurance company may argue that your new job has overlapping job duties with your prior occupation, and therefore you are only partially disabled.

For example, in Ogborne v. Unum[4], a dentist filed a disability claim with Unum after suffering a ligament injury to his right index finger. His doctors told him that his injury would be slow healing, and eventually told him that his injury was permanent. Unum denied his claim, stating that he had given untimely notice of the claim and that the dentist was not “totally disabled” because his particular injury only prevented him from performing “two types of procedures.” Unum also relied on the fact that the dentist had returned to work and was making more money than he had before the injury.

The dentist and his attorneys sued to challenge the denial, and the court determined that Unum was improperly interpreting the definition of “total disability” under the policy, which defined “total disability” as “the inability of the Insured to perform the duties of his regular occupation.” The court observed that “[t]his definition is susceptible to two different, yet reasonable, interpretations: namely, that the insured is totally disabled if he cannot perform either more than one of his pre-injury duties or all such duties.” Then the court determined that the ambiguous language should be construed against Unum, as the drafter of the contract.

Next, the court determined that the dentist had, in fact, produced evidence demonstrating that he was unable to perform several of the duties of dentistry, including root canals, periodontal work, and root scaling. Ultimately, the court ordered Unum to overturn the denial, but it took several years and a favorable decision from a judge to get Unum to pay benefits.[5]

These are just a few examples of things to be aware of if you have a Unum policy or claim with Unum. Unum policies are not all identical, and they are updated frequently. Your policy may or may not include the provisions mentioned above. If you are considering filing a disability claim, you should consult with an experienced disability insurance attorney to learn more about your policy and any potential issues related to your particular claim.

[1] https://www.unum.com/about/corporate/history.

[2] https://investors.unum.com/Cache/1001235181.PDF?O=PDF&T=&Y=&D=&FID=1001235181&iid=103324.

[3] https://www.insurancejournal.com/news/national/2004/11/18/47854.htm.

[4] Ogborne v. UNUM Life Ins. Co. of Am., No. 3:04CV7231, 2006 WL 2505905, at *2 (N.D. Ohio Aug. 28, 2006).

[5] It should be noted that this particular case was also decided under Ohio law. As the law regarding how disability policies are interpreted varies from state to state, this case could have come out differently in a different jurisdiction.

Disability Insurer Profiles #9: Standard

Standard Insurance Company (also branded as “The Standard”) is one of the largest disability insurance companies in operation, with over $4.3 billion collected annually from premiums.[1]

If you have a Standard policy, you will want to pay close attention to how disability is defined under the policy, as Standard policies can contain provisions that shift from “own occupation” coverage to “any occupation” coverage after a certain period of time.[2] Because of this, Standard will sometimes approve a claim initially, but then reassess and terminate the claim when the more stringent “any occupation” provisions kicks-in later on.

For example, in Pringle v. Standard Insurance Company, Standard initially found the claimant to be disabled due to bilateral shoulder pain, bilateral knee pain, and numbness in his legs, feet and toes. Later on, after the “any occupation” definition replaced the “own occupation” definition of disability, Standard terminated the claim (and subsequently denied the claimant’s appeal of the claim termination) even though the claimant’s treating physicians had all opined that he could not work.

In support of its termination decision in Pringle, Standard relied on memos produced by its physician consultants after file reviews of the medical records. Notably, while other companies often only have one doctor conduct a file review of the record when evaluating whether to deny a claim, Standard in this case paid three doctors of various specialties to review the record and author peer review reports. Accordingly, if you have a Standard policy, it is important that you have supportive doctors and accurate and up-to-date medical records that support your claim, because you may have to go up against multiple physician reports if your claim is denied.

Another tool that Standard uses is the peer-to-peer call, where it assigns a doctor to contact your treating physicians to discuss your claim. This can be problematic, because the doctors hired by Standard (and other insurers) are often adept at asking trick questions, and don’t always explain the significance of how key terms like “own occupation” or “total disability” are defined in your particular claim. After the call, the insurance company’s doctor will typically prepare a letter “summarizing” the call in a way that favors the insurance company, in the hopes that your doctor (who is likely very busy) signs off on it without reading it carefully.

In the Pringle case, mentioned above, Standard’s doctor conducted this sort of call and the follow-up letter to the primary care doctor stated, in part, “you indicated the claimant was a ‘muscular guy’ and that, from your perspective, the claimant could function at a sedentary capacity as people in wheelchairs and who have had amputations are capable of working at a sedentary capacity.” According to the case record, the primary care doctor ended up signing off on this statement, even though it is arguably inconsistent with what the primary care doctor stated in his prior records and opinions (raising the question of whether he, in fact, read it before signing and sending it back to Standard). Ultimately, in Pringle, the court reversed the termination and required Standard to pay back benefits, but it took several years of costly litigation in order to get the denial reversed and the benefits reinstated.

These are just a few examples of things to be aware of if you have a Standard policy or claim with Standard. Standard policies are not all identical, and they are updated frequently. Your policy may or may not include the provisions mentioned above. If you are considering filing a disability claim, you should consult with an experienced disability insurance attorney to learn more about your policy and any potential issues related to your particular claim.

[1] https://www.standard.com/sites/default/files/2017annual_statement_sic.pdf.

[2] See, e.g., Pringle v. Standard Ins. Co., No. 3:18-CV-05025-RBL, 2019 WL 912297 (W.D. Wash. Feb. 25, 2019).

Disability Insurer Profiles #8: Mutual of Omaha

Mutual of Omaha (also known as United of Omaha Life Insurance) was founded in 1909 and is now one of the largest insurance carriers in the United States, with an operating income of $554.8 million and revenues of $8.7 billion in 2017.[1]

If you have a claim with Mutual of Omaha, you may be asked to produce “objective” evidence of your disability. Sometimes, this is an express requirement of the policy. In other instances it is simply a question asked on the claim forms (for example, an attending physician statement). Or sometimes it is question asked in a peer-to-peer call from the insurance company’s doctor to your doctor. Regardless of how it comes up, characterizing a claim as being based on purely “subjective” reports (as opposed to being based on “objective” evidence) is a common tactic that Mutual of Omaha (and other insurance companies) use to deny and terminate claims.

For example, in Schatz v. Mutual of Omaha[2], a nurse filed a disability claim due to chronic back pain. Notably, at the time she filed for disability, the nurse was working as a medical review nurse for Mutual of Omaha. Nevertheless, Mutual of Omaha denied her claim and refused to pay her benefits under her policy.

In fact, when the nurse and her attorney sued Mutual of Omaha to challenge the denial, the fact that she worked for Mutual of Omaha ended up hurting her case, to some extent, because the court assumed that Mutual of Omaha understood her particular job duties. Consequently, the court excused Mutual of Omaha’s failure to conduct a detailed inquiry into the physical demands of her position—an omission that otherwise may have proved significant.

In addition, Mutual of Omaha claimed that the nurse’s medical records were not “consistent” or “conclusive,” pointing to a statement from the nurse’s long-time treating physician stating that his opinion that she should not work was not based on “some new objective finding” but was based on the nurse’s reports that “she couldn’t tolerate the pain, that she couldn’t do it and it wasn’t getting better.”

Similarly, the physician selected to perform an independent medical exam stated that, although the nurse reported “multiple subjective complaints,” the physical exam was “essentially normal.” In light of these statements, the court ultimately held that Mutual of Omaha’s denial of benefit was proper, under an abuse of discretion standard.

These are just a few examples of things to be aware of if you have a Mutual of Omaha policy or claim with Mutual of Omaha. Mutual of Omaha policies are not all identical, and they are updated frequently. Your policy may or may not include the provisions mentioned above. If you are considering filing a disability claim, you should consult with an experienced disability insurance attorney to learn more about your policy and any potential issues related to your particular claim.

[1] https://www.mutualofomaha.com/our-story/newsroom/article/mutual-of-omaha-reports-2017-financial-results.

[2] Schatz v. Mut. of Omaha Ins. Co., 220 F.3d 944 (8th Cir. 2000).

Disability Insurer Profiles #7: MetLife

Metropolitan Life Insurance Company, or MetLife, is one of the largest insurance providers in the world. Originally founded in 1868, the company now employees almost 50,000 people, services over forty national markets, and reported $22.925 billion in revenue from premiums alone in 2017.[1] MetLife discontinued the sale of individual disability policies in March 2017 and now only sells group policies.[2]

If you have a MetLife policy and are considering filing a claim, it is important to recognize that a disability claim is an ongoing evaluation. Even if your claim is initially approved, the disability company has a right under most disability policies to continuously re-assess whether you remain “totally disabled.” Given the amount of money on the line, MetLife (like other insurance companies) will typically review its claims periodically, to see if there is any basis to terminate benefits. This can be problematic for physicians and dentists who are not anticipating this degree of ongoing scrutiny, and have not taken the time to understand how their policy works.

One common mistake that physicians and dentists make is going back to work in a new job, without understanding how that will impact their claim. For example, in Abena v. MetLife[3], a dentist filed a disability claim due to pain and numbness in his hands and arms. MetLife initially approved his claim, but roughly a year after his disability date, MetLife learned that the dentist has started a new job as the director of the dental clinic at a university.

MetLife investigated the new position, and determined that the job responsibilities of the clinic director at that particular university included providing direct patient care, which MetLife maintained was inconsistent with the dentist’s disability claim. Next, MetLife hired an investigator to conduct surveillance of the dentist over a three day period, and concluded that the dentist was able to engage in a variety of daily activities and tasks without any apparent limitations or problems. Finally, MetLife hired a doctor to review the dentist’s medical records, and the consultant doctor determined that the dentist had no physical impairments that would preclude him from practicing dentistry.

At this point, MetLife terminated the dentist’s claim. The dentist appealed, but MetLife upheld its decision on appeal. The dentist and his attorney eventually sued MetLife, but did not file the lawsuit until three years after the MetLife’s decision to uphold the termination. Because the dentist waited too long to file the lawsuit, the court dismissed the lawsuit without even considering whether the termination was improper.

These are just a few examples of things to be aware of if you have a MetLife policy or claim with MetLife. MetLife policies are not all identical and they are updated frequently. Your policy may or may not include the provisions mentioned above. If you are considering filing a disability claim, you should consult with an experienced disability insurance attorney to learn more about your policy and any potential issues related to your particular claim. And if your claim has been denied or terminated, you should talk with an attorney as soon as possible, to ensure that you do not forfeit your right to challenge the insurance company’s decision.

[1] https://investor.metlife.com/node/30501/html.

[2] https://www.metlife.com/support-and-manage/current-customers/individual-disability-insurance/.

[3] Abena v. Metro. Life Ins. Co., No. 06-C-495, 2007 WL 1575354, at *1 (E.D. Wis. May 29, 2007), aff’d, 544 F.3d 880 (7th Cir. 2008).

Disability Insurer Profiles #6: MassMutual

Founded in 1851, Massachusetts Mutual, more commonly referred to as MassMutual, is one of the oldest insurance providers still in operation today. Currently, MassMutual is also one of the largest providers of insurance policies, with assets valued at about $247 billion and a total revenue of $21.7 billion in 2017.[1]

If you have a MassMutual policy, it is important to carefully evaluate and understand your policy’s riders and evaluate whether they apply to the entire monthly benefit or a smaller subset of the monthly benefit. For example, in the case of Colt v. MassMutual[2], the policyholder, a licensed pharmacist, developed a debilitating bone disease and subsequently filed a disability claim under his policy with MassMutual.

Prior to the onset of his disease, the pharmacist had purchased a Cost of Living Rider and a Lifetime Benefits Rider. After the claim was filed, the pharmacist argued that the Cost of Living increases should continue for the remainder of the claim, while MassMutual argued that the Lifetime Benefits Rider did not extend the Cost of Living increases beyond age 65.

After a complex analysis, the court ultimately determined that the pharmacist’s Cost of Living Rider was extended by the Lifetime Benefit Rider. However, this case illustrates why it is important to read your policy carefully when you receive it, to ensure that you have a clear understanding of the scope of your coverage.

Similarly, if your policy has multiple riders that provide additional benefits or features to the policy and you later on increase the base benefit amount under the policy, you should pay close attention to whether the additional benefits and features are being extended to the benefit increase as well as the base policy amount.

These are just a few examples of things to be aware of if you have a MassMutual policy or claim with MassMutual. MassMutual policies are not all identical, and they are updated frequently. Your policy may or may not include the provisions mentioned above. If you are considering filing a disability claim, you should consult with an experienced disability insurance attorney to learn more about your policy and any potential issues related to your particular claim.

[1] https://www.massmutual.com/~/media/files/financial%20documents/Statutory%20financial%20statements/Massachusetts%20Mutual%20Life%20Insurance%20Company/2017Q3_mmsub_stat.pdf.

[2] Colt v. Massachusetts Mut. Life Ins. Co., 29 Mass.L.Rptr. 547 (Super. Ct. 2012).

Disability Insurer Profiles #5: Hartford

The Hartford (“Hartford”) insurance company can reasonably be considered one of the oldest and largest insurance companies. Hartford was founded over two-hundred years ago and has acquired myriad assets valued at around $225 billion in 2017.[1]

If you have a Hartford policy, you should be aware that Hartford (like most other insurance companies) will likely review and investigate your claim at multiple times throughout the claim—particularly if you have a policy that shifts from “own occupation” to “any occupation” after a certain time frame.

Hartford has also shown that it will go to great lengths to defend claim terminations. For example, in Post v. Hartford[2], a dentist, who also worked as a pharmacist, filed a disability claim after she suffered traumatic cervical and lumbar strain as a result of a car accident. She made an attempt to go back to work following the accident, but eventually the neck pain and lumbar radiculopathy became so bad that she could no longer continue working.

Hartford initially paid the claim, but after a few years had passed, Hartford terminated the dentist’s benefits. Prior to terminating the claim, Hartford conducted surveillance of the dentist’s home, sought to obtain the dentist’s tax returns from prior years, attempted to schedule a functional capacity evaluation (FCE), and hired a doctor to conduct a file review of the dentist’s medical records. Hartford based its decision to terminate the claim on the medical record, its consultant doctor’s report, and its claim that the dentist refused to undergo the FCE.

The dentist appealed the denial and disagreed with Hartford’s position that she had refused to undergo an FCE. The dentist’s treating physician also sent a letter to Harford stating that the dentist suffered from myofascial pain syndrome, chronic fatigue syndrome and chronic headaches and was on narcotic medications. The treating physician also advised that the dentist should not undergo an FCE, as that would exacerbate her symptoms. Hartford gave no weight to this letter, and upheld its termination.

The dentist and her attorney then sued Hartford, and the parties agreed to dismiss the case, agreeing that Hartford would reconsider the dentist’s claim if the dentist underwent an independent medical exam (IME). Following the IME, the IME doctor’s report stated that the dentist’s complaints were solely subjective, and Harford again upheld its termination.

Next, the dentist sued Hartford (for a second time), and the court upheld Hartford’s denial. The dentist appealed the decision, and the appellate court partially vacated the lower court decision, noting several concerns about how Hartford had handled the claim, including:

-

- “Hartford’s attempt to use Post’s Social Security benefits to offset her disability benefits, despite the plan not allowing for such an offset”;

-

- The fact that “Post had not refused the FCE, but that Hartford was quick to conclude that she had, despite never making a written request for her to undergo a FCE”;

-

- The fact that “Hartford did not allow Post to see [the IME report] before making its final decision to terminate,” giving the dentist “no opportunity to allow her treating physicians to comment on it”;

-

- The fact that Hartford’s decision to terminate relied heavily on [its consulting doctor’s] report, which was not based on a physical examination”;

-

- Hartford’s “aggressive tactic” of pursuing the dentist’s tax returns “in the face of ambiguous Plan language”; and

-

- The fact that “Hartford continued to investigate her claim despite using surveillance which revealed that she did not leave her home.”

The Court also observed that the surveillance Hartford obtained was “consistent with, and corroborative of her claim of disability” and concluded that “the very fact that [Hartford’s] employees characterized the results of the surveillance as ‘unsuccessful’ suggests that its motive was to find evidence to deny Post’s claim.”

The appellate court sent the case back to the lower court for further proceedings, and the lower court held in favor of the dentist and overturned Hartford’s denial of benefits. Although the denial was ultimately overturned, it took over six years from the date of the initial benefit termination and multiple lawsuits to get Hartford to pay the dentist her benefits.

These are just a few examples of things to be aware of if you have a Hartford policy or claim with Hartford. Hartford policies are not all identical, and they are updated frequently. Your policy may or may not include the provisions mentioned above. If you are considering filing a disability claim, you should consult with an experienced disability insurance attorney to learn more about your policy and any potential issues related to your particular claim.

[1] https://ir.thehartford.com/~/media/Files/T/Thehartford-IR/documents/annual-reports-and-proxy-statements/2017-annual-report.pdf.

[2] Post v. Hartford Ins. Co., No. CIV.A. 04-3230, 2008 WL 4444240, at *3 (E.D. Pa. Oct. 2, 2008).

Disability Insurer Profiles #4: Guardian/Berkshire

The Guardian Life Insurance Company has been in existence since 1860 and it merged with Berkshire Life in 2001, making it one of the largest disability insurance companies. The company now has about 9,000 employees nationwide, and receives $9.4 billion annually in premiums.[1]

If you are a professional with a Guardian or Berkshire policy, it is important to understand how “occupation” is defined under your policy. Guardian will typically take a very close look at what you were doing immediately prior to disability, to determine if they can either deny the claim or pay a lower “residual disability” benefit, by arguing that you can still perform some of your pre-disability duties.

For example, the case of Shapiro v. Berkshire[2] involved a dentist who filed a disability claim with Berkshire due to neck pain, joint pain and osteoarthritis in his elbow. Berkshire agreed to pay him “total disability” benefits for a very limited period following his arm surgery; however, Guardian also maintained that, after he recovered from the surgery, he would only be entitled to “residual disability” benefits, and only if he had the required threshold loss in income.

Although the dentist had an “own occupation” definition of disability, Berkshire maintained that he was both a “dentist” and a “business owner,” because he owned a second practice that he rarely treated patients at and a for-profit organization that provided personnel for his dental office. Berkshire acknowledged that the dentist could no longer do chair dentistry, but argued that he was not “totally disabled” because he could still perform administrative duties.

Fortunately, in this particular case, the dentist had still been practicing four to five days a week prior to his date of disability. Consequently, when the dentist’s attorneys sued Berkshire, the court held that the dentist’s occupation was “chair dentistry” and ordered Berkshire to pay the dentist “total disability” benefits. While things ultimately worked out for this dentist (albeit only after costly and time consuming litigation), in our experience, many dentists prejudice their ability to collect by modifying their job duties prior to filing and not understanding what their policy says.

In addition, in Shapiro, the dentist’s policy defined “occupation” as “the occupation you are engaged in immediately preceding the onset of disability.” Notably, many of the newer disability policies (including Guardian/Berkshire policies) now contain a broader definition that defines “occupation” as “the regular occupation (or occupations, if more than one), in which you are engaged in at the time you become disabled” (emphasis added).

These are just a few examples of things to be aware of if you have a Guardian/Berkshire policy or claim with Guardian/Berkshire. Guardian/Berkshire policies are not all identical, and they are updated frequently. Your policy may or may not include the provisions mentioned above. If you are considering filing a disability claim, you should consult with an experienced disability insurance attorney to learn more about your policy and any potential issues related to your particular claim.

[1]

https://www.guardianlife.com/s3fs-public/downloads/Guardian_2017_Fact%20Sheet.pdf?f96r91a.aNjb75tKlnKbV2Ylf9inNPQA.

[2] Shapiro v. Berkshire Life Ins. Co., 212 F.3d 121, 123 (2d Cir. 2000).

Disability Insurer Profiles #3: Cigna/LINA

Cigna is one of the largest disability insurance companies, reporting total revenues of $41.6 billion and assets of $61.8 billion in 2017.[1] Notably, in 2013, Cigna entered into a Regulatory Settlement Agreement, which required Cigna to pay a fine of $1.6 million dollars and reevaluate past claims that had been denied due to improper claims practices.[2]

If you have a Cigna/LINA policy, it is important to read how disability is defined because, in some Cigna policies, the definition of disability changes after a certain period of time. For example, in Teague v. LINA[3], a case involving a registered nurse with Chrohn’s disease and arthritis, the LINA policy provided:

The Employee is considered Disabled if, solely because of Injury or Sickness, he or she is unable to perform all the material duties of his or her Regular Occupation or a Qualified Alternative.

After Disability Benefits have been payable for 18 continuous months, the Employee is considered Disabled if, solely due to Injury or Sickness, he or she is unable to perform all the material duties of any occupation for which he or she is, or may reasonably become, qualified based on education, training or experience (emphasis added).

Additionally, Cigna policies sometimes define disability differently for different classes of covered employees.[4] Accordingly, if you have a Cigna policy, there is sometimes an additional, threshold determination that must be made regarding what class you fall under, before the applicable definition of disability can be determined.

These are just a few examples of things to be aware of if you have a Cigna policy or claim with Cigna. Not all Cigna policies are identical, and they are updated frequently. Your policy may or may not include the provisions mentioned above. If you are considering filing a disability claim, you should consult with an experienced disability insurance attorney to learn more about your policy and any potential issues related to your particular claim.

[1] https://www.cigna.com/assets/docs/annual-reports-and-proxy-statements/cigna-2017-annual-report.pdf.

[2] http://www.insurance.ca.gov/0400-news/0100-press-releases/2013/release044-13.cfm.

[3] Teague v. Life Ins. Co. of N. Am., No. 1:08-CV-3228-CAP, 2010 WL 11603074, at *1 (N.D. Ga. Aug. 20, 2010).

[4] See, e.g., Hodges v. Life Ins. Co. of N. Am., No. 14-CV-00958-WYD-NYW, 2018 WL 2753077 (D. Colo. June 7, 2018).

Disability Insurer Profiles #2: Ameritas

Ameritas Life Insurance Corporation is headquartered in Lincoln, Nebraska and sells a number of different types of insurance. In 2006, Ameritas merged with Union Central Mutual Holding Company, acquiring the disability insurance policies previously sold by Union Central and their claims personnel. In 2017, Ameritas reported assets worth $23.1 billion and $2.2 billion in revenue.[1]

If you have an Ameritas policy, it is important to read your policy carefully, so that you understand the scope of your coverage and how your policy works. For example, while most disability policies provide benefits to age 65 or age 67, we have seen some Ameritas policies that have a “to age 65” benefit period, but also contain additional language that limits the maximum number of years you can recover benefits to 10 years. If you have one of these policies, and don’t take the time to review it in detail, you may mistakenly think that you have coverage to age 65, but, in reality, the policy only pays benefits for a max of 10 years.

As another example, some Ameritas policies have a “total disability” definition that changes over time. In Hopkins v. Ameritas[2], an endodontist filed a “total disability” claim under a policy that shifted from “own occupation” coverage to “any occupation” coverage after 60 months. The endodontist tried to argue that the provision was ambiguous, but when his attorney sued Ameritas, the court agreed with Ameritas’s interpretation and held that, after the initial 60 month period, the endodontist could only receive benefits “if the same disability rendered him unable to perform any reasonable occupation.”

This sort of shifting definition of “total disability” can be particularly problematic for professionals with conditions that significantly impact their ability to perform their occupation, but have a lesser impact on their ability to perform other work (e.g. a dentist with a tremor that makes it unsafe for him or her to practice clinical dentistry).

These are just a few examples of things to be aware of if you have an Ameritas policy or claim with Ameritas. Not all Ameritas policies are identical, and they are updated frequently. Your policy may or may not include the provisions mentioned above. If you are considering filing a disability claim, you should consult with an experienced disability insurance attorney to learn more about your policy and any potential issues related to your particular claim.

[1] https://www.ameritas.com; https://www.ameritas.com/OCM/GetFile?doc=408267.

[2] See, e.g., Hopkins v. Ameritas Life Insurance Corp., 2016 WL 3748518 (Dist. Ken. July 8, 2016).

Disability Insurer Profiles #1: AIG

The American International Group first began operating as a small general insurance business in Shanghai, China. Since then, AIG has acquired at least nine major insurance companies and now operates worldwide. AIG was frequently in the news about ten years ago, when the United States government paid $182 billion to bail out the company.[1] AIG has since recovered, reporting about $498.3 billion in total assets in 2017.[2]

If you have an AIG policy, it is important that you review and understand how the policy defines your “occupation” in the context of a disability claim. Many physicians think their occupation will be defined as what they put down on the initial policy applications, or think it means the “primary” occupation that they are engaged in. However, under most disability policies (particularly newer disability policies), that is not how “occupation” is defined. Under most disability policies, your occupation can change if you take on new responsibilities and/or new positions prior to filing your disability claim.

For example, the case of Hayes v. AIG[3] involved a physician who filed a “total disability” claim for severe back pain, neck pain, and numbness following a head injury. When he filed his claim, the doctor identified his occupation as “physician” with a specialty of “occupation medicine.” However, in addition to his duties at the hospital, the doctor also worked part-time performing acupuncture. At some point after being awarded “total disability” benefits, the doctor returned to work. The doctor maintained he was working in a different capacity than his specialty of “occupation medicine”; however, the work included acupuncture.

The policy defined “current occupation” as “the duties of the medical specialty then being practiced or of the occupation being performed immediately prior to the disability” (emphasis added). AIG argued that this definition encompassed all of the duties the doctor engaged in prior to disability, including acupuncture, and maintained that the doctor’s return to acupuncture precluded a finding of “total disability.”

This particular case was hard-fought by both sides, and when the doctor’s attorney sued AIG, the court ultimately ruled against the doctor on several other legal issues. But this back-and-forth regarding how this definition of “occupation” should be interpreted illustrates why it is important to understand what your policy says before filing, if you want to avoid costly, time-consuming litigation.

With respect to AIG’s claim administration, AIG often pays doctors to evaluate claims made under its policies. These doctors are usually asked to conduct “file reviews” of the available medical records and render an opinion, without personally examining the claimant.[4]

In some instances, insurance companies use these “file reviews” as a basis for generating follow-up questions and/or justifying requests for in-person medical examinations. But, in other instances, you may not find out that the reviewing doctor was looking at your records until you receive notice that your claim is being terminated or denied. Accordingly, it is important that your symptoms, limitations and treatment are all consistently and accurately reported in your medical records.

These are just a few examples of things to be aware of if you have an AIG policy or claim with AIG. Not all AIG policies are identical, and they are updated frequently. Your policy may or may not include the provisions mentioned above. If you are considering filing a disability claim, you should consult with an experienced disability insurance attorney to learn more about your policy and any potential issues related to your particular claim.

[1] https://www.treasury.gov/press-center/press-releases/Pages/tg1703.aspx

[2] http://annual.aig.com/ui/2017/docs/AIG-2017-Final-Annual-Report.pdf

[3] See Hayes v. Am. Intern. Group, 2014 WL 3746813 (E.D. Penn. July 29, 2014).

[4] See, e.g., Adair v. El Pueblo Boys & Girls Ranch, Inc., No. 11-CV-02749-WYD-KLM, 2013 WL 4775927 (D. Colo. Sept. 5, 2013).