Do You Have A Specialty-Specific Policy?

Your ability to collect disability benefits under your insurance policy depends first and foremost on how “total disability” is defined under your policy. As we have previously discussed, if you are a professional choosing a policy, you will want to look for a policy that defines “total disability” in terms of your inability to perform your “own occupation,” and you will want to be sure to look for a true “own-occupation” policy.

While most professionals are aware of the importance of seeking out an “own-occupation” policy, you may not be aware that insurance companies also offer specialty-specific own occupation policies that are tailored to physicians and dentists who are specialists. These policies have a more precise definition of “total disability” that requires the insurance company to not only consider your occupation, but also your specialty when assessing eligibility for disability benefits.

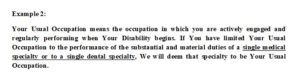

Here’s a few examples of what these specialty-specific policies look like:

Oftentimes, the premiums charged for these types of policies are higher than other policies, but if you end up needing to file a claim down the road, and you are a physician or dentist with a board recognized specialty, this type of “total disability” provision can help ensure that your specialty (and corresponding job duties) are given proper weight. If you have a specialty-specific definition, and your insurance company is not taking into consideration the unique demands and duties of your specialty, you should contact an experienced disability insurance attorney and he or she can ensure that this important provision is enforced.