Guardian’s New Dentist-Specific Claim Form Are These Trick Questions?

We’ve noted before that disability policies have evolved over time to become more complex. The same holds true for disability claim forms.

Years ago, most disability insurers used fairly basic proof of loss forms, and used the same forms for various types of claims.

Over time, these claim forms have also become increasingly complex, to the point that Guardian now has a dentist-specific form with several loaded questions. These questions can be difficult to answer fully and accurately, within the parameters of the form. Many questions do not provide any room to explain your specific dental practice, instead prompting you to select options that may not apply to your situation. Many questions also have hidden objectives that are only apparent to disability attorneys familiar with “own occupation” dentist disability claims.

Guardian’s Dental Professional Occupation Assessment Form

Below are a few excerpts from Guardian’s most recent dentist-specific claim forms, along with some limited, general commentary into the purpose behind some of the questions.

When we first saw these new forms, it was immediately apparent to us that they had been drafted by Guardian’s attorneys and senior claim staff with several of Guardian’s tactics of reducing or avoiding payment in mind. It was also clear from the fine print at the bottom that Guardian is attempting to lock dentists into “complete and true” answers, in writing, early-on, before they have contacted an attorney. This form is then checked against anything you have said to Guardian before, and anything else you may say in later phone or field interviews.

We have handled numerous claims filed by dentists with Guardian and have had to get them back on track, which can be difficult if these forms are not completed in the proper manner. Most recently, we have seen Guardian delay or reduce payment on numerous dentist disability claims due to perceived “incomplete answers” to its dentist-specific proof of loss questions and/or perceived “inconsistencies” with other statements/interviews. Accordingly, we felt it important to get the word out to dentists about these new developments.

As you review, keep in mind that every dentist claim is unique. Not everything below applies to every claim, and there may be other, additional considerations that come into play under your particular circumstances. Accordingly, it is best to consult with an experienced disability insurance attorney before filing a disability claim or submitting any proof of loss to Guardian.

Table of Contents

1. Why is Guardian Asking About My Pay Rate/Loss of Income?

5. Why is Guardian Asking if I Modified My Job Before Filing and How is That Relevant?

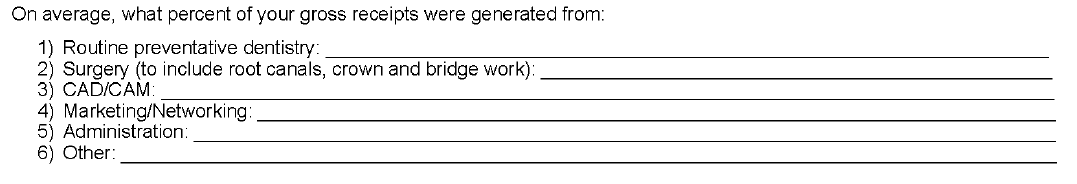

6. Why is Guardian Asking Me to Break Down the Source of Gross Receipts?

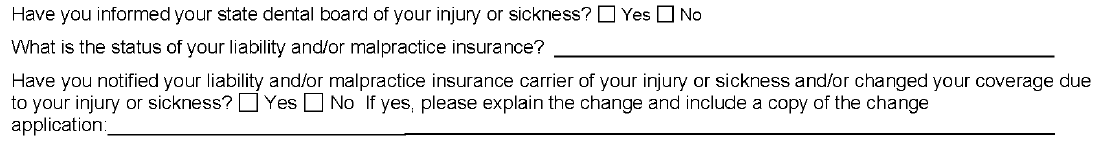

7. Why is Guardian Asking About the Dental Board/My Malpractice Insurance/Use of My NPI Number?

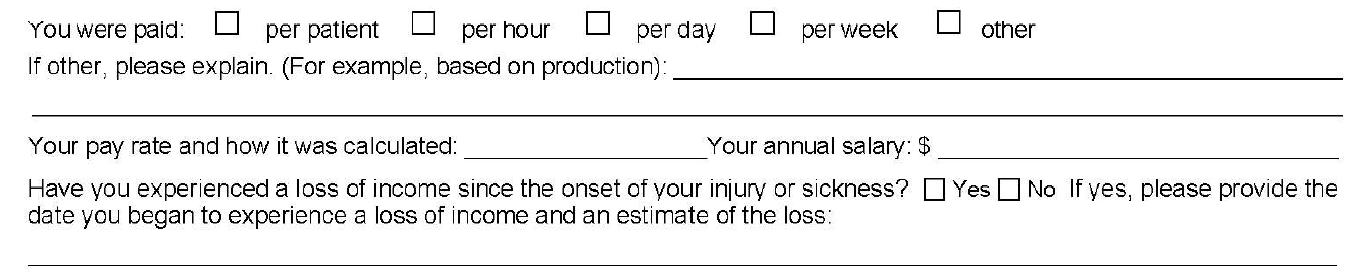

1. Why is Guardian Asking About My Pay Rate/Loss of Income?

Initially, you may think that loss of income is relatively straightforward; however, it can be a complicating factor in dentist claims, for a few reasons.

First, over time, disability policies have added additional requirements for establishing proof of loss that you may not be aware of. With older policies, the focus was primarily on whether the dentist met a certain loss of income percentage threshold. Then, if there was evidence of a medical condition that logically limited the dentist’s ability to work full-time, that was generally sufficient.

Newer Guardian disability policies have added additional hurdles, such as a requirement that the loss be “solely” due to the disabling condition. Regardless, the timeline—and date of disability selected—is critical to establishing a right to payment because, at a minimum, the loss of income must directly line up with the disabling condition.

The problem for dentists is that their disability claims are often musculoskeletal, slowly progressive, and worsen over time. Many dentists are diagnosed with a condition, yet work through the pain for a time. Sometimes there are periods of improvement even if the solutions are only short-term and the overall trend is downward. This can make selecting a proper and defensible date of disability challenging.

Additionally, when it comes to dentist claims, there can be gray areas under the terms of the underlying policy that must be addressed/negotiated (and sometimes litigated). For example, sometimes partial disability is also based on whether there has been a reduction of hours/time practicing; however, dentistry is not a profession where dentists “clock-in” and “clock-out” so addressing changes in “hours” can be a challenge.

Many dentists also receive income from multiple sources, and there can be several entities involved, particularly if the dentist works at a corporate dentistry practice. In some instances, the definitions in the underlying disability policy do not contemplate this level of complexity when it comes to the policyholder’s income, or give clear answers to what “counts” as income for purposes of determining the monthly losses.

Because of the above, we are seeing “loss of income” becoming an area that is increasingly being contested by insurers seeking to reduce liability or otherwise gain leverage in a disputed claim. Obviously, questions relating to loss of income are critical if you have a partial disability claim. However, even if you have a total disability claim, the period of total disability could potentially come after several months of partial disability. As such, you should consider these questions carefully even if you are planning on filing a total disability claim.

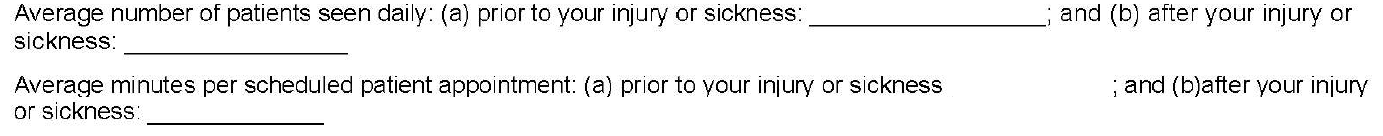

2. Why is Guardian Asking Me to Quantify Patients Per Day and Minutes Per Patient? How Do I Even Do That?

As noted above, changes in work schedule can be very important on a partial disability claim; however, these particular questions are also illustrative for another reason.

On their face, these questions seek information about the difference between the two timeframes, along the lines of what you might expect if you are filing a partial disability claim. The problem here is that the form does not allow for nuance and often these timeframes are not apples-to-apples comparisons.

For example, before your disability date, you may have been working on complex reconstruction cases, only seeing a few patients a day. Then, due to disability, you may have had to abandon the longer, more difficult (and more lucrative) procedures. As a result, you may be seeing many more patients a day, but only performing simpler tasks, such as exams or cleanings. But if you only answer what it asked, it will look like you have increased your workload because you are seeing substantially more patients after your disability.

The second question seems to address this, by asking how much time you spend on each patient appointment. However, providing a generalized answer here can also have unanticipated ramifications.

Going back to the above example, your instinct might be to put a very low number for the new time spent with patients, to highlight that you are doing easier, shorter procedures. However, this can have unanticipated long-term consequences. If you minimize or trivialize the number of hours you spend with patients when filing a partial disability claim, when you reach the point in time that you feel you are totally disabled, Guardian will refer back to this form and ask what has changed? Why can you not keep working if you are only doing simple cases, and only for short periods of time? What has happened medically to explain this change?

Sometimes, there will be a new medical event that can be pointed to. However, as noted above, most dentist claims involve slowly progressive conditions with primarily subjective symptoms (pain, numbness, etc.). As these worsen, imaging (such as MRIs) may or may not show a difference from prior imaging, even if you, as the dentist feeling the symptoms, know you are to the point that you should stop practicing for the sake of patient safety. Even if Guardian is only able to push a claim into partial disability, and reduce the monthly benefit, this can add up to a substantial amount over time.

In other instances, establishing a particular date of disability is critical (e.g. to establish notice was timely, or to lock-in certain lifetime benefits under Guardian’s graded lifetime riders). If your claim involves important timeline questions, failing to provide the appropriate level of detail and nuance can cause major problems and potentially provide Guardian with an argument to entirely avoid paying your disability claim.

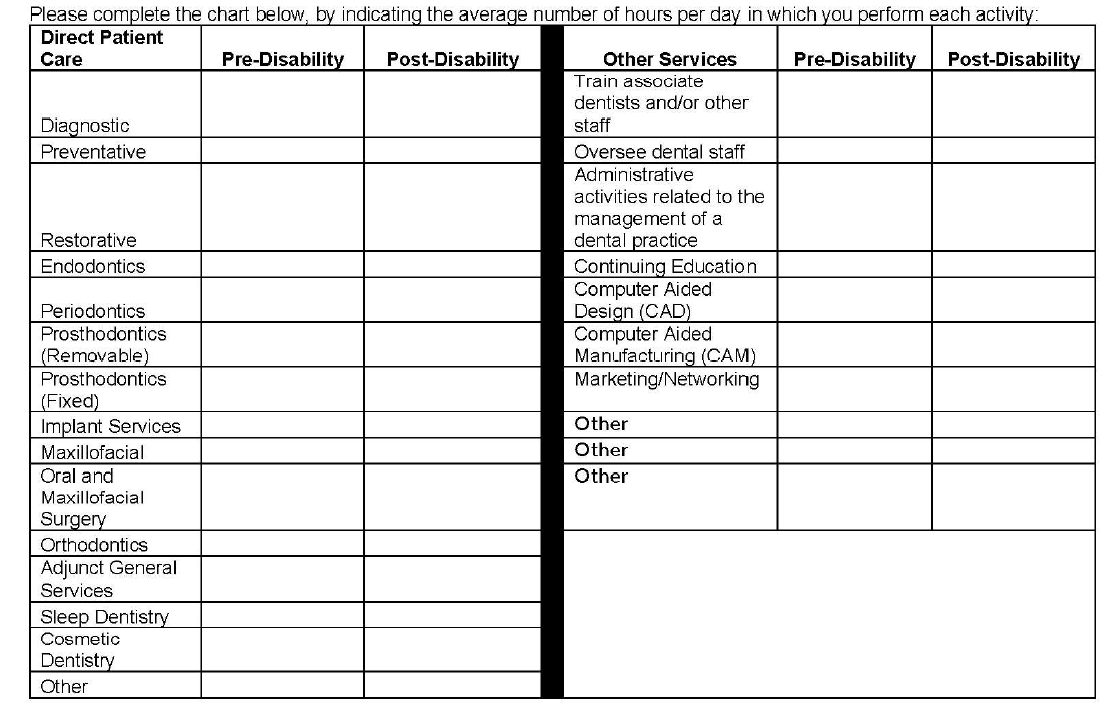

3. Why Is Guardian Asking Me to Break Down Patient Care by Hour? How Do I Do This When Many Categories Overlap and Each Day is Different and I Don’t Track Procedures by Hour? Why Is Guardian Listing Other Non-Clinical Categories?

The problems with the left column of this table should be immediately apparent to most dentists, as many categories overlap. As with the prior question, the form does not provide a means to explain important nuances. Additionally, the dentist is asked to answer the form based on “hours per day” which, for most dentists, varies widely depending on the day and is something that is not tracked on an hourly basis.

The second column is a good example of a question designed to elicit information that Guardian might seek to use in a “dual occupation” defense. As noted in prior posts, most Guardian policies have plural definitions of “occupation.” Guardian—like other disability insurers—will seek to expand your occupation to other, non-clinical roles if they think they can (e.g. practice owner, marketer, trainer/coach, supervisor/office manager, etc.).

While you must provide answers, and cannot avoid these sorts of questions, it is another area where nuance is very important and answering within the restrictions of the Guardian form itself can be harmful for a claim. The above questions may also not be particularly relevant, depending on the type of claim you are making. Or they could be very relevant, if you have future employment plans. If you start a new job in the future, at any point in your claim, Guardian will look back to prior claim forms to see if there are any overlapping duties. If you are unconcerned or imprecise when completing the forms, this can cause problems later on if you want to start other jobs related to dentistry (such as managing dental practices or teaching at a dental school/supervising dental clinics).

4. Why is Guardian Asking for an Hourly Breakdown of All of the Tools I Am Still “Able to Use” Each Day?

This question is another one that initially seems innocuous, but there is a high likelihood that the response will be used unfairly. This is evident when you consider what is actually being asked, particularly if a dentist is filing a total disability claim.

Essentially, the question asks for the minimum number of hours a dentist can still “use” a dental tool in a given day. But it leaves out critical details and qualifiers, and can be taken in several different directions. One dentist might answer based upon the number of hours they think they can work on a live-patient, factoring in patient safety risks. Alternatively, another dentist might take it literally and think it is asking whether the tool can be physically used/manipulated in any capacity, regardless of patient risk.

Additionally, this question simply asks for “hours per day” without clarifying whether this is with breaks, or without breaks, or what the tool is being used to accomplish.

The absence of these additional clarifying details makes it clear that Guardian is seeking responses to muddy the waters when it comes to assessing capacity to work and total versus partial disability.

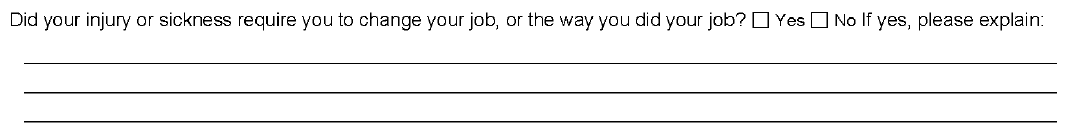

5. Why is Guardian Asking if I Modified My Job Before Filing and How is That Relevant?

While this question provides some room for explanation, it does not ask the critical follow-up question—i.e. whether modifications were effective, or remain effective. Absent an appropriately detailed explanation, Guardian may suggest the dentist could continue to work with the same modifications, even if the dentist is not actually working anymore or the modifications are no longer effective.

This question is also important from an “occupation” standpoint, and is another example of why timeline and the date of disability are so critical. Under most disability policies, including Guardian policies, your “occupation” is defined as of your date of disability. If you modified your duties or changed your schedule prior to your date of disability, this can make it more difficult to collect disability benefits.

This can be addressed by selecting earlier disability dates, but that may not be possible if there are late notice problems with the claim. Similarly, there are scenarios where modified schedules do not necessarily translate into loss of income sufficient to trigger a partial disability clause—for example, where a practice owner cuts back and brings in associates to keep up the practice’s production. This is why it is important to carefully review your policy and pick an appropriate disability date prior to filing; otherwise, questions like the above can become problematic without you even realizing it.

6. Why is Guardian Asking Me to Break Down the Source of Gross Receipts?

This question has several implications and, by now, you can likely guess why Guardian might be asking for this information.

Most Guardian policies define total disability based on an inability to perform the “material and substantial” duties of your occupation. A common tactic used by Guardian (and other insurers) is to ascribe a dollar value to certain things, then characterize them as “major” or “minor” duties. Sometimes this makes sense, but a “material and substantial” duties analysis—particularly for dentists—is claim specific, and involves a host of factors beyond “gross receipts” (e.g. time, complexity, patient expectations, nature of practice, specialty, etc.). As with other questions in the form, the provided categories also overlap to some extent, making it difficult to respond in a precise manner.

Additionally, this is another example of a question that can have ramifications later on if you start a new job. Most Guardian policies are “true own occupation,” in the sense that they let you work in a different occupation and still collect total disability benefits. However, as discussed above, occupation is defined in the plural and disability insurers seek to expand it as much as possible beyond clinical duties.

7. Why is Guardian Asking About the Dental Board/My Malpractice Insurance/Use of my NPI Number?

As evident from the above questions, Guardian is aware that, as a dentist, there are other legal documents that you must complete that directly relate to your capacity to practice dentistry safely.

At the outset of any disability claim, the initial claim packet includes an authorization that Guardian uses to look for anything that might be inconsistent with your claim, including statements made to your dental board or malpractice insurance. Guardian will consider the timing of those statements, in relation to the timing of your disability claim/selected date of disability. If they are inconsistent, Guardian may be more emboldened to deny your claim, as that sort of inconsistency could be used to undermine your credibility with a judge or jury.

The Takeaway

In short, Guardian wrote the policy and crafted the claim forms, so the process is designed to be as favorable to Guardian’s interests as possible.

This does not mean that it is impossible to collect, but it does mean that you should approach your claim in a serious, proactive matter and that you should become as informed as possible before filing your claim. If you do not have experience with the disability industry, it is advisable to consult with a disability attorney before submitting any proof of loss to Guardian.

Every claim is unique and the discussion above is only a limited summary of how Guardian approaches dentist disability claims. If you are concerned that Guardian is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

Disability Insurance Q&A: How Should Doctors Approach Their Treating Physicians About a Disability Claim?

Question: How should doctors approach their treating physicians about a disability claim?

Answer: Your treating physician’s support can often be critical to getting your claim approved. A hurried, uninterested physician may not have time to devote to your claim. In addition, fully discussing your condition with a professional, compassionate treating physician will help ensure supportive medical records. When to discuss your potential claim with a physician is an important timing issue. Also, when the time comes to speak to the treating physician about the claim, a disabled dentist or doctor should ensure that the treating physician understands the definition of “disability” under the insurance policy, so that he or she can accurately opine as to the inability of the doctor or dentist to work.

Some of our previous blog posts on this important issue are available here and here.

Disability Insurance Q&A: Why Do So Many Doctors’ Claims Get Denied, and How Can a Law Firm Help?

Question: Why do many doctors’ disability claims get denied, and how can a law firm help?

Answer: Doctors’ and dentists’ disability claims can be expensive for insurance companies to accept. The troubled economy and the rising number of disability claims filed by healthcare professionals have led to financial hardship. This strain on resources creates an incentive for insurance companies to deny medical professionals’ claims. Thus, many insurers closely scrutinize the terms of doctors’ and dentists’ policies in order to find ways to deny disability insurance benefits, as the long-term financial benefit to the insurance company is significant.

Our firm has years of experience in cases in which disability benefits have been rescinded based on alleged misrepresentation or non-disclosure in the original policy application. We also have a strong history of prosecuting cases in which benefits have been denied based on the insurance company’s insistence that a dentist’s or doctor’s “subjective claim” doesn’t provide objective evidence of disability.

Further information on our law firm’s services and what you can expect when filing a disability claim is available on our website at this link.

Disability Insurance Q&A: What Does Your Firm Do To Help Doctors File a Successful Claim for Disability Insurance Benefits?

Question: What does your law firm do to help doctors file a successful claim for disability insurance benefits?

Answer: From the beginning of the process, we help doctors, dentists and other professionals by analyzing complex claims applications and disability insurance policies and identifying potential coverage issues. We have particular skill in documenting claims, completing claim forms, and communicating with treating physicians. Once the claims process begins, we fiercely protect our clients against unreasonable delays and abuse by the disability insurer. We also provide knowledgeable advice and practical guidelines on how to handle an independent medical examination or other testing that may be required by the disability insurance carrier.

Further information about what we do and what to expect is available on our website at this link.

Disability Insurance Q&A: When Should I Contact An Attorney About My Claim?

Question: When should I contact an attorney about my claim?

Answer: Doctors and dentists who are considering filing a claim for disability insurance benefits should meet with an attorney experienced in the area well before submitting a claim. Each disability policy has different, complex language that insurance companies may manipulate to circumscribe and restrict coverage. A physician or dentist should make a coordinated effort with an attorney’s assistance to determine whether a particular claim is covered, and if so, how that claim is best presented to ensure payment.

Coming soon, we will be distributing a monthly e-mail newsletter. The newsletter will contain information not included on this blog, such as:

- Detailed tips for filing disability insurance claims with various carriers;

- Examples of best practices vs. worst practices when interacting with your insurer;

- Updates on recent disability cases relevant to your claim or potential claim;

- Specific answers to common questions, which newsletter recipients can submit anonymously; and

- Information on lectures and classes you can attend to hear the firm’s attorneys speak about choosing disability insurance policies and filing claims.

If you are interested in subscribing (at no cost, of course), please sign up here:

Disability Insurance Newsletter

Your name is not required. Please rest assured that we will not use or distribute your e-mail address for any other reason.

Disability Insurance Q&A: What is the Difference between “Own Occupation” and “Any Occupation” in Disability Insurance?

Question: What is the difference between “own occupation” and “any occupation” in disability insurance?

Answer: Most doctors purchase an “own-occupation” policy, which provides compensation following a disability that prevents the insured from performing his or her particular duties. If an insured doctor or dentist does not have an “own-occupation” policy, he or she must be disabled from performing the duties of any occupation for which he or she is reasonably qualified in order to receive disability benefits.

Some disability insurance policies are a hybrid, providing own-occupation benefits for a limited period of time, and then converting coverage to the “any occupation” standard.

Some of our previous blog posts analyzing some of the potential loopholes that disability insurers will try to apply to an own-occupation policy can be read here and here.