Why You Must Read Your Riders: Graded Lifetime Benefits

We have stressed in prior posts the importance of reading and understanding your policy before filing for disability insurance benefits. A failure to understand and abide by the provisions in your policy can lead to the denial of your disability insurance claim or termination of your benefits.

When reviewing their coverage, many physicians and dentists merely review the short, summary pages (or schedules) that are usually found at the front of a disability policy. The schedule of benefits section can contain plenty of important information, such as the maximum monthly benefit, the premium amounts, a list of the riders attached to the policy, and the benefit period. But it is only a small snapshot of your policy.

For example, your policy schedule may state that you have “lifetime” benefits and, if that is all you look at, you may assume that you will receive the full benefit for your lifetime if you file a disability claim. However, oftentimes, there are specific requirements for obtaining lifetime benefits and/or restrictions on the amount of the lifetime benefit. These additional restrictions and limitations may not become apparent until you read the full lifetime benefit provision within the policy itself.

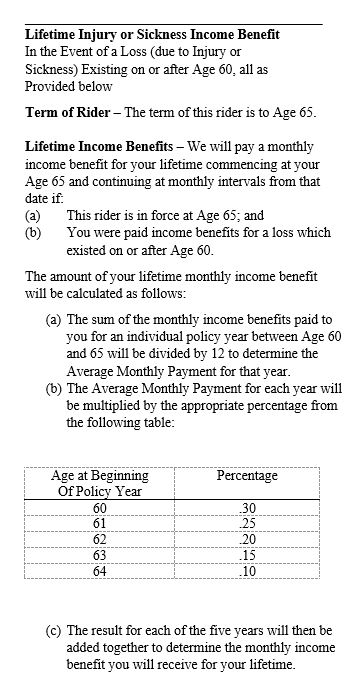

Here is one example of a particularly complex lifetime benefit rider taken from an actual policy:

This rider is not only hard to understand—it provides underwhelming coverage that is much different than what you might expect if you only read the policy schedule. Accordingly, it is important to read your entire policy, and not simply the schedule pages, to make sure that your coverage is in line with your expectations.