Firm Named #1 Law Firm for Best Workplace Culture

We are proud and honored to announce we have been named Arizona’s #1 Law Firm for Best Workplace Culture and the #2 firm in both Healthcare Law and Firm with Under 22 Lawyers by Ranking Arizona: The Best of Arizona Business. Ranking Arizona publishes the results of the largest annual poll of the Arizona business community. Residents are asked to share their opinions of the best products, services, and individuals in the state.

We’ve earned this distinction through the development and execution of studied, meticulously considered strategies aimed at obtaining optimal results for our clients. We have also remained a small firm in order to encourage the sharing of ideas and information in an environment fostered by mutual trust. We pride ourselves on recruiting only the top attorneys in education, skills, and temperament.

We offer dentists, physicians, and other professionals compassion, thoughtful and meticulous legal representation, and are dedicated to making the claims process as painless as possible for each client. Our Firm offers unparalleled strategy, advocacy, and adaptability. Our clients have immediate attorney access, including their direct telephone lines and emails. Each case has a minimum of two attorneys and a paralegal working on it, with senior partners directly involved in developing each case.

Our keen legal, medical, and disability industry insight allows us to know what really matters in a case, and we are able to leverage this experience to deliver success. We are pleased that our dedication has earned us this recognition for both our legal expertise and our firm’s collaborative ethos, which allows us to work together tirelessly in order to exceed our clients’ most optimistic expectations.

Why You Can’t Blindly Rely on Your Agent to Choose the Right Policy for You

In earlier posts we’ve discussed how agents don’t have the authority to change, delete, or add provisions to a disability insurance policy. We’ve also discussed how most disability insurance policy applications now contain language stating that you cannot rely upon representations made by agents regarding the scope of coverage, or eligibility for coverage. Thus, while agents can provide helpful advice and help to point you in the direction of a disability insurance policy that may fit your needs, it is ultimately up to you, the purchaser, to review your policy, become familiar with the provisions of the policy, and confirm that you are in fact purchasing the coverage that you expected to receive.

If you don’t take the time to do this, and blindly pay premiums without reviewing your disability insurance policy first, you could end up paying for coverage that provides less protection than you thought you were getting when you applied for the policy. For example, most physicians and dentists know that their disability insurance policies should be “own occupation”, meaning a policyholder is considered totally disabled (and eligible to collect benefits) when he or she can no longer work in his or her profession, versus being unable to work at all, in any profession. In some policies, own occupation is further defined as being unable to practice in a particular medical or dental specialty (i.e. anesthesiologist, periodontist, etc.).

Quite often physicians and dentists decide to buy another policy, either because they let a previous one lapse, or because they want to purchase additional coverage as their income increases and they can afford higher premiums, and they ask their agent for a new policy with the “same coverage”. This can be incredibly difficult or impossible to achieve, because over time disability insurance policies have evolved to become more restrictive, and each company has variations on what they deem an “own occupation” policy. Consequently, while your agent may present you with a policy that contains the phrase “own occupation”, it may not be a true own occupation policy at all.

For example, some policies are actually conversion policies, which mean they start out as “own occupation” policies, but after a certain time frame (e.g 2 years, or 5 years), they change to an “any occupation” policy, which means that, in order to continue receiving disability benefits, you would have to show that you can’t work at all. This can be very difficult to prove, particularly if you worked in another capacity for all or some of the prior “own occupation” period.

Even if your agent does locate an own occupation plan with similar premiums and benefit amounts to an older policy, there may also be provisions that cancel each other out in the new and old policies. One scenario we’ve seen is a disability insurance policy containing the provision that a claimant must not be working (a “no work” provision) in their own occupation or another profession in order to collect benefits, while the second policy states that a claimant must not be working in their own occupation but must be working in another field in order to collect benefits (a “work provision”). Under this scenario, in essence, one of the policies you’ve been paying years of premiums for is worthless, as both requirements cannot be met at once.

These examples highlight why it is important that you do more than just check an “own-occupation” box on your application and/or blindly rely on your agent’s assurance that a new policy is compatible and/or the same as an existing one. If you end up with a policy you essentially cannot use, your recourse is limited, as insurance companies have gone to significant lengths to shield themselves from any liability based on an agent’s representations of a policy. It is therefore far better to take the time to review your policy at the outset, before you pay years of premiums, to ensure that it provides the disability coverage that you applied for and need.

Diabetes: An Overview

We’ve talked before about how diabetes can occur in conjunction with other diseases, such as anxiety, or contribute to certain medical conditions, such as radiculopathy. In this post we will be taking a broader look at diabetes and its complications.

Overview:

Diabetes (diabetes mellitus) refers to a group of diseases, including prediabetes, type 1, type 2, and gestational diabetes. While prediabetes and gestational diabetes can be reversible, types 1 and 2 are chronic and there is currently no cure.

Diabetes can occur either when the pancreas produces very little or no insulin, or when the body does not respond to the insulin that the pancreas does produce. In this post we will examine only types 1 and 2.

Type 1 diabetes typically appears during childhood or adolescence (it is also called juvenile diabetes), and the symptoms come on quickly and are more severe. Type 2 diabetes is more common, and more often occurs in people over 40 (it is often referred to as adult onset diabetes). Those with type 2 diabetes may not exhibit symptoms at first.

Symptoms:

- Increased thirst

- Extreme hunger

- Frequent urination

- Unexplained weight loss

- Ketones in the urine

- Fatigue

- Irritability

- Blurred vision

- Difficulty breathing

Additional symptoms experienced in Type 2 diabetes include:

- Cuts or sores that are slow to heal

- Infections

- Itchy skin (often in the groin area)

- Recent weight gain

- Numbness or tingling of the hands and feet

- Impotence or ED

Causes:

Type 1 diabetes occurs when the body’s immune system destroys the insulin producing cells of the pancreas. Scientists believe that Type 1 is caused by genetic and environmental factors, such as exposure to certain viruses.

Type 2 diabetes is caused primarily by lifestyle factors and genes. Some risk factors include:

- Being overweight

- Lack of physical activity

- High blood pressure

- Abnormal cholesterol and/or triglyceride levels

- Family history (having a parent or sibling with diabetes increases risk)

- Age

- History of gestational diabetes while pregnant

- Polycystic ovary syndrome

Diagnosis:

Diabetes can be diagnosed based on blood tests that show a patient’s blood sugar levels, using a glycated hemoglobin (A1C) test, random blood sugar test, fasting blood sugar test, and/or an oral glucose tolerance test.

With respect to type 1 diabetes, a patient’s urine will be analyzed for ketones, a byproduct produced when muscles and fat are used for energy when the body doesn’t have enough insulin to use available glucose.

Treatment:

While there is no cure for diabetes, ongoing monitoring and management of symptoms is required to prevent serious complications from occurring. Possible treatments include:

Lifestyle changes

- Diet/healthy eating

- Exercise

- Weight loss

Medication

- Those with Type 1 diabetes must take insulin because it is no longer made by the body

- Those with Type 2 may need to take insulin, but may also take different medications (such as metformin, which lowers the amount of glucose the liver makes)

Surgery

- Bariatric surgery

- Artificial pancreas

- Pancreatic islet transplantation

Serious Complications:

Undiagnosted, untreated, or resistant to treatment, diabetes can have serious health consequences, including:

- Cardiovascular disease;

- Nerve damage (neuropathy), especially in the limbs (which left untreated can result in loss of feeling); nerve damage is also connected to problems with internal organs, weakness, weight-loss, and depression;

- Kidney damage (nephropathy), which may result in the eventual need for dialysis or kidney transplant;

- Eye damage (retinopathy), which may result in cataracts, glaucoma, or blindness;

- Skin conditions, including bacterial and fungal infections;

- Foot damage, which can often lead to the need for amputation;

- Depression; and

- Alzheimer’s disease (type 2 diabetes)—currently there is no agreed upon theory about why there is a correlation between the two diseases.

These posts are for informative purposes only and should not be used as a substitute for consultation with and diagnosis by a medical professional. If you are experiencing any of the symptoms described below and have yet to consult with a doctor, do not use this resource to self-diagnose. Please contact your doctor immediately and schedule an appointment to be evaluated for your symptoms.

References:

Center for Disease Control (CDC), www.cdc.gov

WebMD, webmd.com

Mayo Clinic, mayoclinic.com

National Institute of Diabetes and Digestive and Kidney Disease, www.niddk.nih.gov

American Diabetes Association, www.diabetes.org

How Do I Know if My Insurer Might Be Interested in a Lump Sum Settlement?

We are often asked whether a particular claim is the type of claim that an insurance company would be interested in settling for a lump sum buyout. The answer, as explained in more detail below, is always, it depends, because there are a number of factors that come into play, and many of those factors are not even directly related to whether the claim itself is legitimate or whether the insured’s condition is permanent (although those are important factors that impact whether a buyout is a possibility).

What is a Lump Sum Buyout?

You may be familiar with the terms of your disability policy, but you may not know that, in certain instances, insurers are willing to enter a lump sum settlement. Under a lump sum settlement, your insurer agrees to buy out your policy and, in return, you agree to surrender the policy and release the insurer from any further obligations to you going forward.

There are certain pros and cons to this sort of settlement. Some claimants prefer a lump sum settlement, because it allows them to avoid having to rely on month-to-month payments from their insurer (which may or may not arrive, or if they do arrive, may not arrive on time) and/or to avoid the hassle of dealing with claim forms, medical exams, etc. for years to come. A lump sum settlement can also allow you to take advantage of present investment opportunities that can provide for your and your family’s future. But there are also other considerations that you will need to discuss with your attorney as well as your accountant and other financial advisors. For example, if your benefit period lasts to age 65 (and you end up living to the end of the benefit period), you would likely receive more money cumulatively over time if you stayed on claim and received monthly benefits in lieu of a lump sum settlement.

Lump sum settlements can also be attractive to insurance companies. A settlement can allow insurance companies to release money from their reserves and to eliminate administrative expenses associated with the ongoing review of your claim year after year. But just as you might receive more money cumulatively over time if you stayed on the claim, the insurer might benefit financially from not offering you a lump sum settlement. For example, if your policy provided for lifetime benefits, and you met an untimely demise, your insurance company’s obligation to pay benefits would cease, and they may end up ultimately paying out a lower amount in total monthly benefits than they would have if they paid out a lump sum settlement on your claim.

Because this process is completely discretionary on their part, insurance companies are very deliberate about offering lump sum settlements. Before doing so, they must weigh multiple factors including the following:

-

- Permanency. The insurer is more likely to offer a settlement if its actuaries determine that you will likely be on claim for the maximum benefit period.

-

- Reserves. Over the course of your claim, your claim’s reserves slowly peak as you are on claim for an extended period of time (and permanency is established) and then at some point, they start to diminish as the claim is paid out, and you get closer and closer to the end of the maximum benefit period. The insurer is more likely to offer a settlement when the reserves are at their peak (typically around 3-5 years into a claim), because that is when the insurance company would improve its bottom line the most by freeing up the reserves.

-

- Mortality/Morbidity Issues. The insurer is more likely to offer a settlement if its actuaries determine that you will probably live to the end of the maximum benefit period. Or if you have lifetime benefits, the insurer will estimate your lifespan based on your health history to determine whether it is financially beneficial for the company to offer a lump sum settlement.

-

- Offsets. The insurer is more likely to offer a settlement if it determines that you will probably not receive income in the future that would offset the benefit amount before the end of the maximum benefit period.

-

- Anticipated Gain. Companies will not offer a buyout unless they stand to save money in the long run, so they have their actuaries calculate how much of a gain (percentage-wise) the company would net if they settle the claim. Insurers often have internal financial objectives that impact the amount they are willing to offer on settlements such as requiring a net gain amount of a certain percentage (e.g. 35%).

-

- Cash Outflow. The insurer will be more or less willing to offer a settlement depending on their quarterly or even annual cash outflows. Thus, if a company had paid out a lot of buyouts recently, the company may not have enough cash available to offer additional lump sum settlements.

The bottom line is that offering a lump sum settlement is completely voluntary on the part of the insurer and doing so depends on the unique factual circumstances of your claim. Nevertheless, knowing the factors that insurers consider in making this decision can help you understand whether a lump sum settlement is appropriate in your case.

The Importance of Reviewing Your Policy Application

In our last post we discussed why you should not rely solely on your agent’s representations when purchasing a new disability insurance policy. It is similarly important that you not rely solely on your agent to complete the policy application.

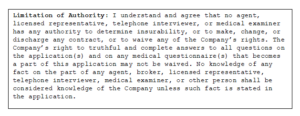

While an agent may offer to help you by filling out the disability insurance application, this could end up negatively impacting a future claim or even voiding your policy down the road, if the application contains any errors or omissions. As explained in our prior posts, while it may seem like telephone interviewers, licensed representatives, agents, and medical examiners have significant control over the application process and whether you receive a disability insurance policy, many applications have language that explicitly limits your ability to rely upon representations made by such individuals, and expressly places the burden of reviewing the application for accuracy upon you (regardless of who completed the application). Below is a sample of policy language:

Thus, you may speak with several people during the application process, and give them the requested information, but it is ultimately up to you to make sure the information provided to the insurance company is correct. It is therefore very important that you read through your disability insurance application carefully to make sure it is complete and accurate before signing.

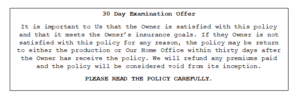

It is also very important that you carefully review your disability insurance policy when you receive it from the insurance company, and not just file it away without a second thought. When you receive your copy of the full policy, it will typically contain language stating that you have a certain time period (e.g. 10 or 30 days) to review the policy and return it to be voided if it does not contain the terms you expected. This clause will normally be found on the first page of the policy, and typically looks something like this:

If you decide to keep your disability insurance policy and do not send it back within this review period, you are bound by all provisions of the policy, regardless of whether you are actually aware of them or not. For instance, if you asked your agent for a certain provision and/or requested it on your disability insurance application, but the insurance company omits it for some reason, and you don’t catch it during this review period, you may end up paying years of premiums for coverage that is different than what you thought you had purchased. Similarly, if your policy contains an unfavorable provision that you didn’t know was going to be in the policy, you will still be bound by it unless you return the policy.

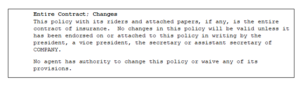

How Insurance Companies Distance Themselves from Agents (And Why It Matters)

Reading through contracts, especially lengthy insurance ones, can be time consuming. Many policies contain confusing language, terms of art, and often include supplemental riders that change the terms or definitions contained in the main body of the policy. But if you don’t read your disability insurance policy until it’s time for you to file a disability claim, you may be caught off-guard by what your policy actually says. This next series of posts will discuss the importance of taking the time to read through your policy, and will review some things to watch out for when you buy a disability insurance policy.

Dentists and physicians are often swamped with work, and rely heavily on insurance agents when selecting and purchasing a disability insurance policy. One scenario we commonly see is doctors requesting a disability insurance policy that is “the same” policy that the other doctors in the practice have. Another common scenario is the doctor who wants more disability coverage and just asks his or her agent for another disability insurance policy that is “like” his or her existing policy, or has the “same coverage” as his or her existing policy. What they don’t realize is that some of the same favorable terms may no longer be available in today’s policies. For example, while most older disability insurance policies contained “true own occupation” provisions, there are now several different variations of “own occupation” provisions, so if you just ask for an “own occupation” policy, you may not actually be receiving the disability coverage that you think you are.

It is also important to be aware that, over the years, disability insurers have sought to distance themselves from agents and now often go so far as to include clauses or statements in their disability insurance policies and applications that state no agent or broker has the authority to determine insurability or make, change, or discharge any contract requirement. Here’s an example of this type of policy language:

So what does this mean? It means that, while solely relying upon an agent’s assurance of the terms of a policy may have been a more acceptable (but not advisable) option in the past (when policies were often similar and generally favorable to policyholders), you can no longer solely rely upon your agent’s description of the policy. No matter how well-meaning or knowledgeable your agent may seem, ultimately, you are going to be on the hook if your disability insurance policy doesn’t say what you thought it said, so it is crucial that you carefully review your disability policy to ensure you are receiving sufficient coverage.

Our next post will discuss the importance of the disability application process and policy review period.

Radiculopathy

In previous posts, we’ve discussed chronic pain, including how chronic conditions can affect dentists. Dentists and surgeons have strenuous jobs that require them to hold unnatural and static positions for extended periods of time, putting stress on their musculoskeletal systems. Consequently, it is not uncommon for dentists and surgeons to experience spinal issues, including radiculopathy. In this post we will examine the causes, diagnosis, symptoms, and treatment of radiculopathy.

Overview

Radiculopathy is a condition caused by a compressed nerve in the spinal column. This pinched nerve can occur at any spot in the spine, but is typically found in the cervical or lumbar portions of the back and, less frequently, in the thoracic spine. Symptoms vary based on where the nerve roots are compressed; however, the roots typically become inflamed and cause numbness, weakness, and pain. Those suffering from radiculopathy can find it difficult or impossible to function with the same level of dexterity they used to have.

Symptoms

Generalized symptoms of radiculopathy include:

- Sharp or shooting pains in the back, arms, legs, or shoulders that may worsen during certain activities

- Weakness or loss of reflexes in the arms or legs

- Numbness of the skin or “pins and needles” sensations in the arms or legs

- Some individuals develop a hypersensitivity to light touch at the affected areas

The location of and specific symptoms will vary based on where the compressed nerve occurs:

- Cervical Radiculopathy: Pressure on a nerve root in the neck. Symptoms include weakness, burning or tingling sensations, or loss of feeling in the shoulder, arm, hand, or fingers.

- Lumbar Radiculopathy: Pressure on a nerve root in the lower back. Symptoms include pain, weakness, or numbness that starts in the lower back and radiates through the buttocks down the back of the leg.

- Thoracic Radiculopathy: A pinched nerve in the upper/mid back. Symptoms include pain in the chest or torso, which can be mistaken for shingles.

Causes

Radiculopathy is caused by the irritation or compression of the nerves where they exit the spine. This compression can occur in several ways:

- Disc herniation, osteophytes (bone spurs), osteoarthritis, or the thickening of the surrounding ligaments

- Scoliosis

- Inflammation due to trauma or degeneration

- Conditions such as diabetes, rheumatoid arthritis, and obesity

- Poor posture and/or repetitive movements

- Aging

- Genetic pre-disposition

Diagnosis

In order to diagnose radiculopathy, a physician will perform a medical history review and physical examination. The examination will include an evaluation of muscle strength, sensation, and reflexes to detect any abnormalities. Additional imaging may be required, including:

- X-rays: to identify trauma, osteoarthritis, or early signs of a tumor or infection

- MRI or CT scan: to look at the soft tissues around the spine (nerves, discs, ligaments, etc.)

- Electromyogram (EMG) and nerve conduction studies: to look at electrical activity along the nerve to identify any damage

Treatments:

The course of treatment for radiculopathy will usually start out conservative, but more aggressive treatment may be needed when pain persists.

- Medications

- Weight loss (if necessary) to reduce pressure on problem areas

- Physical therapy

- Avoiding activity that causes strain on the neck or back

- Chiropractic treatment

- Epidural steroid injection

- Surgery to remove the compression on the spine

These posts are for informative purposes only and should not be used as a substitute for consultation with and diagnosis by a medical professional. If you are experiencing any of the symptoms described below and have yet to consult with a doctor, do not use this resource to self-diagnose. Please contact your doctor immediately and schedule an appointment to be evaluated for your symptoms.

References:

MedicineNet, https://www.medicinenet.com/radiculopathy/article.htm#what_is_radiculopathy

John Hopkins Medicine, https://www.hopkinsmedicine.org/healthlibrary/conditions/nervous_system_disorders/acute_radiculopathies_134,11

WebMD, https://answers.webmd.com/answers

Heathline, https://www.healthline.com/health/radiculopathy#causes

Columbia Spine, http://columbiaspine.org/condition/radiculopathy/

Medical News Today, https://www.medicalnewstoday.com/articles/318465.php

Lump Sum Disability Benefit Rider

While, hopefully, your disability policy will provide sufficient income to meet your essential expenses if you have to file a claim, benefit amounts rarely provide monthly income that is comparable to what you earned while practicing. Additionally, many disability insurance policies have maximum benefit periods that expire at age 65 or 67, which means you will be without a monthly income for the remainder of your life if you haven’t established other financial resources. As we’ve discussed in previous posts, one option to ensure continued financial stability is to purchase a policy that includes lifetime benefits rider. Another option we are beginning to see offered with some policies is the lump sum disability rider benefit.

The lump sum disability benefit rider is designed to provide a one-time lump sum payment at the end of the benefit period, much like being able to access a 401(k) or other retirement account upon reaching retirement age. This lump sum can also help to offset expenses that may be more likely to arise later in life, like the costs of needed surgeries or other medical care.

While lifetime benefits work by paying a claimant a continuing monthly benefit after the normal expiration date of a policy, under this type of rider, the insurance company pays a one-time payment at the end of the policy’s benefit period. The payout will typically be a certain percentage of the benefit payments the policyholder received prior to the end of the maximum benefit period under the policy. This calculation includes payments received both while on total disability and residual disability, over the life of the policy, whether continuous or not.

For example, say a claimant received a monthly benefit payment of $5,000 per month (or $60,000 per year) and remains on claim from age 48 to the end of the benefit period (age 65, for example) or 17 years. If the lump sum benefit is equal to 35%, the claimant would receive a one-time payment of $357,000 (17 x $60,000 x .35).

It is also important to note that these riders typically require that a claimant receive a minimum threshold amount of benefits to qualify to receive the lump sum payment. For example, the qualifying amount may be set at $60,000. If the monthly benefit payment is $5,000 a month, the policyholder won’t be eligible for a lump sum payment unless he or she remains on claim for at least 12 months over the life of the policy.

Thus, with a lump sump benefit rider, the longer a policyholder stays on claim, the larger the lump sum payment will be. It therefore stands to reason that disability insurance companies have an even stronger than normal incentive to get a claimant off claim. As insurance companies often use aggressive tactics to investigate claims in order to find justification to terminate or deny disability claims in an attempt to save money, having a lump sum benefit rider could result in greater scrutiny of a policyholder’s claim, particularly before the qualifying amount is reached. However, unlike lifetime benefit rider options (which typically require a policyholder to continue to submit proof of loss for life in order to continue receiving lifetime benefits), the insurance company’s ability to scrutinize a claim ends upon the payment of the lump sum under a lump sum disability benefit rider.

Thus, as with all policy provisions, there are pros and cons to keep in mind, and deciding whether the lump sum disability benefit rider is the right policy for you requires careful consideration of what you can afford in premiums, your age, other sources of income you and your household have, and your plans for retirement.

Lifetime Benefits, Part 2 – Graded Lifetime Benefits

In our last post we discussed how it can be difficult to save for retirement if your only income is your monthly disability benefits. One way to help ensure financial security into retirement age is to purchase a lifetime benefit option with an individual disability insurance policy. While older policies often featured full monthly disability benefit payments for life, newer policies insert qualifiers that limit whether a claimant will actually receive the full benefit amount for his or her lifetime. Our last post looked at the injury versus sickness limitation. In this post, we will be taking a look at another provision that limits lifetime benefits: the graded benefit rider.

Graded Lifetime Benefit Riders

Under the graded benefit rider, claimants receive benefits for life, provided they are disabled prior to a specified age and remain continuously totally disabled. However, the amount of the monthly benefit they receive varies based on how old the claimant is at the onset of his or her disability.

For example, a disability insurance policy may have a benefit period that ends at age 65, with a graded lifetime benefit rider (sometimes called a “lifetime extension for total disability”) that will pay 100% of monthly benefits for life if the policyholder is disabled prior to age 46. However, if the policyholder becomes disabled after age 46, his or her lifetime benefits will only be a certain percentage of the monthly payment.

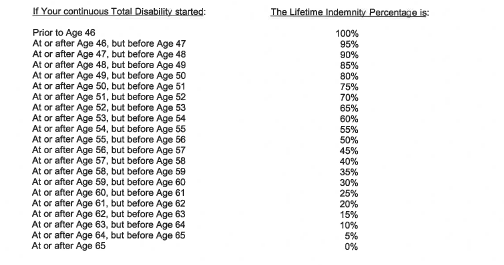

Below is a provision from an actual policy, illustrating how benefit amounts are calculated under this type of rider:

Using this chart as an example, if your benefit payments are $10,000 per month and you become totally disabled at age 46 (100% under the policy) your disability insurance company will continue to pay you $10,000/month after you turn 65 for the rest of your life. If you become totally disabled at age 55, the percentage of monthly indemnity payable would drop to 50% and your disability insurance company would pay you $5,000/month after you turn age 65. If you don’t become totally disabled until age 64, the amount payable would only be 5% of your monthly disability benefit. In other words, you would have a year or less of monthly payments of $10,000, followed by monthly payments of $500.

While a graded lifetime benefits rider is one way to ensure that you continue to receive disability income after your standard benefit period ends, you must keep in mind that these payments may not provide much income if you become disabled later on in life.

Further, in order to achieve lifetime benefits under this rider, you must remain totally disabled. So, for example, if you return to work, were pushed off claim, or went into residual disability claim status, you lose the lifetime benefits. And even if you are later able to reestablish total disability, the lifetime benefit will be a lower percentage of the monthly benefit, because you will have re-set your total disability date for purposes of calculating your monthly benefit under the rider.

Lifetime benefits offer a way for policyholders to continue to collect at least some income after the benefit period of their disability insurance policy ends. However, when choosing a disability insurance policy, physicians and dentists must carefully consider their age at the time of purchase, premium amounts, and the policy language before buying a policy. Knowing how your policy’s lifetime benefits work is an important step in planning for your financial future.

In our next post we will look at another option individuals have to supplement their retirement income: the lump sum benefit rider.

Lifetime Benefits, Part 1 – Injury v. Sickness Limitation

Having a disability insurance policy is an important step in protecting your financial security and ensuring a monthly source of income if you are forced to step away from practicing as a dentist or physician and file a claim due to a disability. However, as we’ve discussed before, your monthly disability benefits typically will not match the monthly income you were earning as a doctor, dollar for dollar. As a result, you may not have any funds left over, after your monthly expenses, to save for retirement. This can be problematic since many plans have a benefit period ending at age 65 or 67, but the average American life expectancy is around 79.[1]

There are a few options residents or doctors have when buying a disability insurance policy that can help ensure financial stability past retirement age. One option is selecting a policy with a lifetime benefit rider. Older disability insurance policies, from the 80’s and 90’s, were often drafted in policyholders’ favor and a lifetime benefit provision meant just that—full monthly benefits would be paid out until a claimant’s death. Many newer disability insurance policies still offer an option to purchase “lifetime benefits”, but there are additional qualifiers in the policy language that dictate the amount of the disability benefit the claimant will receive, or whether he or she will receive lifetime benefits at all. In our next few posts, we will look at two common lifetime benefit limitations that are common in newer disability insurance policies. In this post we will examine the injury versus sickness limitation.

Injury v. Sickness Limitation

Under some policies, the nature of your disability (i.e. whether your disability is caused by an “injury” or by “sickness”) can determine whether your benefits will last a lifetime. Here’s an example of such a provision, taken from an actual policy:

As you can see, under this policy’s language, you only receive lifetime benefits if your disability stems from an injury occurring before age 65. Further, no matter how permanent a sickness is, the policyholder will not be eligible to receive lifetime benefits under this disability insurance policy.

In some instances, it is very straightforward to determine when a disabling condition will be classified as an injury (e.g. the inability to walk after a car accident) or as a sickness (e.g. Parkinson’s disease). But in other instances, the distinction between the two becomes less clear and, in many instances, litigation is required to resolve the issue. If the date of an injury is not well-documented, or your limitations arguably have multiple causes, the insurance company will oftentimes elect to pay disability benefits under the sickness provision of your disability insurance policy, so they don’t have to pay lifetime benefits.

This provision highlights the importance of carefully documenting and filing your disability claim from the outset, in order to prevent any ambiguity in the nature of a disabling condition. It also highlights the importance of understanding the provisions of your disability insurance policy you are being paid under, so that you are not caught unawares when your benefits (which you thought were lifetime benefits) are cut off after years of receiving benefits.

In our next post we will discuss another provision that limits lifetime benefits—the graded lifetime benefit rider.

[1] The World Bank, Life expectancy at birth, total (years), https://data.worldbank.org/indicator/SP.DYN.LE00.IN

The Importance of Regularly Reviewing Your Disability Policy

The new year is often a time for making resolutions and planning for the future. This should include reviewing your financial situation, including assessing whether you will be adequately prepared in the event that you become disabled and have to stop practicing. We recommend that you make a periodic review of your disability policies and evaluate:

- What type of policy(ies) do I have?

- Do I understand the terms and provisions of my policy(ies)?

- How much coverage do I have?

- Do I have enough coverage?

- Do I qualify for any increase options?

- Should I buy an additional policy(ies)?

Many physicians and dentists purchase their policies as residents or when they are first establishing their practice, and then file their disability insurance policies away and don’t think about them again until the unexpected happens and they need to file a disability claim. This is problematic, because financial needs and obligations change over time, and the income and standard of living for a resident is vastly different than that of a physician with a family 20 years down the road.

While insurance companies’ underwriting standards are typically structured in a way that prevents you from collecting the exact same amount of monthly income you were making pre-disability, your goal should be to get as close as possible. In other words, if you are a dentist earning $20,000 a month and need to file a claim, you don’t want to have to end up relying on a disability policy with a monthly benefit of $5,000 as your primary source of income.

Often disability insurance policies have future increase options that allow you to purchase additional coverage without changes to the terms of the existing policy. Typically, these options will only be available during certain discrete time periods set forth in the policy, so it’s important to read your disability insurance policy carefully to make sure you don’t miss out on the opportunity to take advantage of an increase option.

If your disability insurance policy does not have increase options and you’ve outgrown the monthly benefit amount, you can also purchase another policy to increase the total coverage you would receive if you filed a disability claim. However, if you’re going to be purchasing a new policy, you need to keep in mind that you must purchase a disability insurance policy that compliments you’re existing coverage, and does not cancel out your other policy or policies.

For example, some disability insurance policies contain provisions stating that a claimant cannot collect total disability benefits if he or she is working in another profession (a “no-work” provision). Other policies require the policyholder to work in some other capacity, in order to collect total disability benefits (a “work” provision). Thus, if you were to purchase a new disability insurance policy with a “work” provision, and your old disability insurance policy had a “no work” provision, one of the policies would be rendered useless (because it would be impossible to collect total disability benefits under both policies).

When purchasing a new disability insurance policy, it’s also important to keep in mind that disability policies have become increasingly more complex, restrictive and less favorable to policyholders over time. There is no longer a “standard” policy that every company sells—each policy will have it’s pros and cons, and it is therefore important to take your time to familiarize yourself with the disability insurance policy at the point of sale, so that you know what you’re purchasing. And if you didn’t pay close attention when you purchased the policy, or you can’t remember exactly what your policy says, you should review your disability insurance policy to assess whether it still meets your needs and make sure that you have an accurate understanding of the scope of your coverage.

Are There Options Besides A Trial When My Claim is Denied?

Reducing the risk of having to fight for disability benefits requires understanding the terms of your disability insurance policy from the beginning, carefully and thoroughly filling out the application, and ensuring accuracy and consistency in your claim packet and subsequent filings. As the saying goes, the best defense is a good offense, and the best way to avoid litigation is to file the disability claim correctly the first time.

Although filing a successful disability claim is not easy, it is the ideal. Unfortunately, insurance companies have a strong incentive to increase their bottom lines and often they practice aggressive tactics in improper attempts to justify the denial or termination of even a wholly legitimate disability claim. If your disability claim has been terminated or denied, it can seem overwhelming or hopeless to try to reverse the decision. In the event of a denial or termination, many insureds know they can sue their disability insurer and go to trial. Yet, even if you are ultimately successful in a lawsuit, litigation can sometimes drag on for years. While a lawsuit is pending, you’ll not only have legal expenses, but will also not be receiving disability benefits (and likely not be in a position to work to offset your expenses, due to the nature of your disability or your policy’s language). There are, however, some alternative options that can be attractive to both parties that policyholders may not be aware of, namely mediation and lump sum settlements.

Mediation

All too often we see legitimate disability claims denied or terminated, with the insurance company refusing to reconsider their position. If your disability claim is terminated, the company knows that it wields a lot of power over the denied individual, including the power of money, the power of time, the power of institutional knowledge, and the power to tolerate litigation. In other words, insurers calculate that spending money on even protracted litigation will end up being cheaper than continuing to pay disability benefits, and they know that many claimants will just give up and go away if they draw out court proceedings long enough.

While this might sound bleak, there can be alternatives to a full-fledged lawsuit that culminates in a trial (and potentially drawn-out appeals). One such method is mediation. Mediation is where the parties to a lawsuit meet with a neutral third party in an effort to settle the case.

For the most part, mediators are retired judges, or active or retired attorneys. The mediator reviews the case file and then meets with both parties, seeking to facilitate discussions between the parties and try to find common ground in order to reach an acceptable compromise. Because mediation is not binding, the mediator’s recommendation and any subsequent agreement between the parties is not final until the parties memorialize it by putting all the agreed upon terms in writing and signing the document.

Often the insurance company will offer to draft the agreement so they can have control over what the agreement says, and so it is important to stay engaged in the process even after the mediation has ended, in order to ensure that the parties’ agreement is accurately documented. The settlement agreement itself is a very important document, so you should be sure to take the time to carefully review it before signing, to be sure it encapsulates all the agreed upon terms.

It is also important to keep in mind that mediation typically does not result in a full restoration of disability benefits nor is not always successful. The non-binding nature of mediation means that if the insurance company low-balls and refuses to budge in its offer, the claimant may need to just walk away and resume litigation.

Lump Sum Settlement

Another way of avoiding trial is through negotiating a lump sum settlement. This typically occurs outside of the mediation setting, but sometimes requires the filing of a lawsuit before the insurance company is willing to come to the table. When this happens, your insurer agrees to buy out your disability insurance policy and you release your right to collect disability benefits under your policy and your insurer from any obligation to you. The buyout amount will be your disability insurance policy’s “present value” (i.e. the amount of money you could invest upon receipt, based on a determined interest rate, and end up with the same amount of money you would have received in disability benefits at the end of your policy), discounted by a percentage that is negotiated by the parties.

A buyout can be an attractive offer and can occur at any stage of the litigation process. A lump sum buyout could even be a preferable alternative to having disability benefits reinstated, as you would no longer have to deal with your insurer. Your disability benefit payments would cease being on hold pending the outcome of a trial and you could invest the lump sum in order to provide for your and your family’s future. In addition, unlike monthly disability benefits, the lump sum settlement you receive would be inheritable and available to be passed on to your heirs, should something happen to you.

There are, however, certain drawbacks to a lump sum buyout, including the fact that you and your disability insurers cannot accurately predict the future of the market with 100% certainty, so the calculations will only be a best estimate. If you are healthy and have lifetime benefits, you could also receive more money cumulatively over time if you were to stay on claim. So, while attractive, especially when faced with litigation, the pros and cons must be carefully weighted when considering lump sum buyouts during the litigation process.

We often see claimants who face the loss of their disability benefits simply give up and accept a denial, daunted by the thought of protracted litigation. While litigation may sometimes be the most advisable way to get benefits, and possibly punitive damages, there are other avenues to explore, advisably with the help of a disability insurance attorney, that can end in your retaining at least some of the disability benefits you stand to lose completely when an insurance company denies your disability claim.

Can A New Blood Test Objectively Prove Fibromyalgia?

As we’ve discussed in more detail in a previous post, fibromyalgia is a syndrome characterized by chronic, wide-spread muscle pain as well as fatigue, difficulty sleeping, depression or anxiety, muscle knots, cramping, or weakness, painful trigger points, and headaches. Fibromyalgia can be difficult to diagnose, given the relative or subjective nature of most symptoms. Symptoms can also mimic those of rheumatoid arthritis and other diseases, so often a diagnosis is established after other causes of symptoms are ruled out. Doctors will examine a patient’s history, conduct a physical examination, as well as evaluate X-rays and blood work. Doctors will also test patients for 18 tender points. The American College of Rheumatology guidelines suggest that those with fibromyalgia have pain in at least 11 of these tender points.[1]

Although the majority of fibromyalgia cases are diagnosed chiefly by ruling out other conditions, many patients may now have access to a blood test that may diagnose the disease. In 2012 a privately held biomedical company, EpicGenetics, released the FM/a® Test, which is an FDA-compliant blood test designed to diagnosis fibromyalgia. The test identifies the presence of certain white blood cell abnormalities.[2] The use and accessibility of the test has been growing, as Medicare and an increasing number of private insurance providers have begun covering the costs,[3] and the Civilian Health and Medical Program of the Department of Veterans Affairs (CHAMPVA) has also recently agreed to cover the cost of testing.[4]

The blood test works by analyzing protein molecules in the blood called chemokines and cytokines. Founder and CEO of EpicGenetics, Bruce Gillis, MD, explains that those with fibromyalgia have a lower count of these protein molecules in their blood, leading to weaker immune systems.[5] A diagnosis of fibromyalgia the traditional way can take, on average, more than two years.[6] Many believe that FM/a® offers an objective and concrete diagnosis that allows sufferers to more quickly find adequate resources and treatment.

However, others argue that the test does not offer the diagnosis it promises. Some argue that fibromyalgia is not a discrete medical condition but rather a “symptom cluster” or that the biomarkers the test identifies are also found in people with different illnesses, such rheumatoid arthritis.[7] As of this writing, major medical resource databases such as MedLine Plus, the CDC, and the Mayo Clinic continue to state that there is no lab test or definitive way to diagnose fibromyalgia.

As we’ve previously discussed, disability insurance policy holders can often face challenges with they go to file a claim based on disabilities, such as fibromyalgia, that are considered “subjective conditions.” A test promising objective proof may remove some of these challenges. However, it remains to be seen how insurance companies and the medical community as a whole will agree on what constitutes objective proof of fibromyalgia, whether via this test or other medical advances down the road.

[1] 18 Points Used to Diagnose Fibromyalgia, Health, http://www.health.com/health/gallery/0,,20345635,00.html#where-does-it-hurt–1

[2] Businesswire, EpicGenetics with the Assistance of Leading Medical Centers, Expands Clinical Study of FM/a® Test to Diagnose Fibromyalgia, Identify Genetic Markers Unique to the Disorder and Explore Direct Treatment Approaches, Yahoo! Finance, Apr. 19, 2017, https://finance.yahoo.com/news/epicgenetics-assistance-leading-medical-centers-120000519.html

[3] Pat Anson, Fibromyalgia Blood Test Gets Insurance, Pain News Network, May 27, 2015, https://www.painnewsnetwork.org/stories/2015/5/27/fibromyalgia-blood-test-gets-insurance-coverage

[4] Emily Riemer, Mass General researcher investigating possible fibromyalgia vaccine, WCVB5, July 27, 2017, 6:05 p.m., http://www.wcvb.com/article/mass-general-researcher-investigating-possible-fibromyalgia-vaccine/10364683

[5] Anson, id.

[6] Getting a Diagnosis, Fibrocenter, http://www.fibrocenter.com/pain

[7] Anson, id.

Myofascial Pain Syndrome

In previous posts, we have discussed the challenges attendant to chronic pain, including how dentists often experience pain due to the unnatural and static positions they must maintain for extended periods of time (which place stress on their musculoskeletal and muscular systems). This post will delve further into one such chronic pain condition, myofascial pain syndrome (MPS).

Overview

Myofascial pain syndrome is a chronic pain condition that affects the fascia (the connective tissues that spreads throughout the body). Specifically, myofascial pain syndrome refers to the pain and inflammation of muscles and soft tissue.

With someone suffering from myofascial pain syndrome, pressure on sensitive points in muscles (trigger points) can cause pain in seemingly unrelated parts of their body (called referred pain). A single muscle or a muscle group may be involved. Typically, the pain affects one side of the body only, or one side significantly more than the other. There may also be tenderness in areas not experiencing chronic pain.

Symptoms

While many people experience muscle pain or tension, those who suffer from myofascial pain syndrome experience persistent and worsening pain. Additional symptoms include:

- Deep and aching pain at specific trigger or tender points

- Spasms

- Tenderness

- A knot or clump in a muscle area

- Insomnia or sleep disturbances

- Fatigue

- Depression (which often co-occurs with MPS)

Causes

The pain and strain in a muscle caused by a trigger point associated with MPS can be attributed to numerous sources, including:

- Injury or prior injury

- Excessive strain or overuse of a muscle or muscle group

- Unnatural movements

- Repetitive motions

- Poor sleep schedules and sleeping positions

- Fatigue

- Certain medical conditions (e.g. heart attack)

- Lack of activity

- Stress or anxiety

Diagnosis

Because there are no visual indicators such as redness or swelling associated with MPS, doctors typically will perform a physical exam that includes applying pressure to the painful area. A doctor will feel for trigger points, which are divided into four types:

- Active – an area of extreme tenderness associated with local or regional pain.

- Latent – a dormant area that has the potential to act like a trigger point, and may be associated with numbness or restriction of movement.

- Secondary – a highly irritable spot in a muscle that may become active due to a trigger point, or if there is overload on another muscle.

- Satellite Myofascial Point – a highly irritable spot that becomes inactive because the muscle is in the region of another trigger point.

Although not as common, physicians may use Electromyography (EMG) to locate trigger points. In addition, doctors will usually conduct additional tests and procedures to rule out other causes of the muscle pain (e.g., lab tests to rule out vitamin deficiency).

Treatments:

Myofascial pain is treated using a variety of techniques, often in conjunction, such as:

- Medication (e.g. pain medications, medication for muscle spasm, antidepressants)

- Trigger point injections (which typically contain a local anesthetic or saline, sometimes with corticosteroid)

- Physical Therapy

- Spray and stretch (a treatment where a cooling agent is sprayed on the sore muscle, followed by gentle stretching)

- Massage Therapy

- Acupuncture

- Heat Therapy

- Ultrasound

- Posture and Stretching Training

Exercise, relaxation, and a healthy diet are also recommended techniques to help alleviate MPS pain.

These posts are for informative purposes only and should not be used as a substitute for consultation with and diagnosis by a medical professional. If you are experiencing any of the symptoms described below and have yet to consult with a doctor, do not use this resource to self-diagnose. Please contact your doctor immediately and schedule an appointment to be evaluated for your symptoms.

References:

Mayo Clinic, http://www.mayoclinic.org/

WebMD, http://www.webmd.com/

Cleveland Clinic, clevelandclinic.org

MedicineNet, https://www.medicinenet.com/script/main/hp.asp

Chowdhury, Nayeema, OMS IV and Leonard Be. Goldstein, DDS, PhD, Diagnosis and Management Of Myofascial Pain Syndrome, Practical Pain Management, last updated March 19, 2012, https://www.practicalpainmanagement.com/pain/myofascial/diagnosis-management-myofascial-pain-syndrome.

Post-Traumatic Stress Disorder (PTSD)

In prior posts, we’ve examined how the demands of practicing render physicians and dentists uniquely susceptible to anxiety and depression. In this post, we are going to examine Post-Traumatic Stress Disorder (PTSD), another serious condition that often affects doctors—particularly doctors who work in high stress environments and who are repeatedly exposed to trauma on a daily basis.

What is PTSD?

PTSD is a mental health disorder caused by exposure to a shocking or dangerous event. Although most people who experience a traumatic event experience an immediate emotional response when they are experiencing the event, those who develop PTSD continue to experience the symptoms of exposure to trauma after the event, and feel stressed or panicked even when there is no danger. While some of the symptoms are similar to other anxiety disorders, PTSD is categorized as a particular type of anxiety that is caused by a specific external catalyst. The onset of PTSD can occur within months after a traumatic event; however, in some cases symptoms may not appear until years later.

Prevalence

PTSD is associated with those who have been exposed to a traumatic event, such as combat, violence, serious accidents, or natural disasters. Approximately seven to eight percent of the U.S. population will have PTSD at some point in their lives, with about eight million adults suffering from PTSD in any given year.[1]

PTSD can be caused by one event, or by prolonged exposure to trauma over time. This exposure can be experienced directly, and through indirect exposure (i.e. witnessing the event).[2]

Many physicians, depending on their specialty, interact on a daily basis with traumatic situations from early on in their careers, and sometimes encounter events where patients die or are seriously harmed in a way that is very distressing to a practitioner. Significantly, research has shown that 13 percent of medical residents meet the diagnostic criteria for PTSD.[3] Emergency physicians, physicians practicing in remote or under-served areas, and physicians in training (i.e. residents) are particularly prone to developing PTSD.[4]

The prevalence of PTSD is also substantially elevated in individuals who are also suffering from chronic pain. While only 3.5% of the general population has a current PTSD diagnosis, one study found that 35% of a sample of chronic pain patients had PTSD. Another study of patients with chronic back pain showed that 51% experienced significant PTSD symptoms. In instances where the chronic pain is caused by the traumatic event (e.g. someone involved in a motorcycle accident or someone injured during the course of a violent crime), the pain can serve as a reminder of the event and worsen the PTSD.[5]

Symptoms

Physicians who suffer from PTSD may lose this ability to confidently react, which can impair their ability to safely practice. Untreated, PTSD can also lead to a marked decline in quality of life, and potentially other mental health disorders or medical issues. Some common symptoms of PTSD include:

Re-experiencing symptoms:

- Flashbacks

- Nightmares

- Frightening thoughts

- Physical reactions or emotional distress after exposure to reminders

- Intrusive thoughts

Avoidance symptoms:

- Staying away from places, events, or objects that are reminders to the traumatic experience

- Avoiding thoughts or feelings related to the traumatic event

Arousal and reactivity symptoms:

- Being easily startled

- Feeling tense and “on edge”

- Having difficulty sleeping

- Being irritable or aggressive

- Heightened startle reaction

Cognition and mood symptoms:

- Trouble remembering key events of the traumatic event

- Negative thoughts about the world, and oneself

- Distorted feelings of guilt or blame

- Loss of interest in previously enjoyed activities

- Negative affect

Diagnosis

PTSD is typically diagnosed by a clinical psychiatrist or psychologist. A diagnosis is made when an individual meets the criteria for exposure, and has at least one re-experiencing symptom, one avoidance symptom, two arousal and reactivity symptoms, and two cognition and mood symptoms.

Treatments

Some of treatments that are used, either alone or in conjunction, to treat PTSD include;

- Cognitive Behavioral Therapy

- Eye Movement Desensitization and Reprocessing (EMDR)

- Prolonged Exposure Therapy

- Antidepressants

- Anti-anxiety medication

- Medication for insomnia

The intensity and duration of PTSD symptoms vary. Individuals who recognize any of the above-referenced symptoms in themselves should talk to a treatment provider right away.

These posts are for informative purposes only and should not be used as a substitute for consultation with and diagnosis by a medical professional. If you are experiencing any of the symptoms described above and have yet to consult with a doctor, do not use this resource to self-diagnose. Please contact your doctor immediately and schedule an appointment to be evaluated for your symptoms.

References:

Medscape, http://emedicine.medscape.com

National Institute of Mental Health, https://www.nimh.nih.gov

WebMD, http://www/webmd.com/

[1] U.S. Department of Veterans Affairs, PTSD: National Center for PTSD, How Common Is PTSD?, https://www.ptsd.va.gov/public/ptsd-overview/basics/how-common-is-ptsd.asp

[2] U.S. Department of Veterans Affairs, PTSD: National Center for PTSD, PTSD and DSM-5, https://www.ptsd.va.gov/professional/PTSD-overview/dsm5_criteria_ptsd.asp

[3] Myers, Michael, MD, PTSD in Physicians, Psych Congress Network, Sept. 16, 2015, https://www.psychcongress.com/blog/ptsd-physicians

[4] Lazarus, A., Traumatized by practice: PTSD in physicians, J Med. Pract. Manage., 2014 Sept-Oct; 30(2): 131-4.

[5] DeCarvalho, Lorie T., PhD, U.S. Department of Veterans Affairs, PTSD: National Center for PTSD, The Experience of Chronic Pain and PTSD: A Guide for Health Care Providers, https://www.ptsd.va.gov/professional/co-occurring/chronic-pain-ptsd-providers.asp

How Long Does It Take to Get Benefits? – Part 2

In an ideal world, you’d receive a favorable decision and your first benefit check shortly after your disability insurance policy’s elimination period is satisfied. Unfortunately, even wholly legitimate disability claims get scrutinized, questioned, delayed, and in some cases, denied. Below are a few common reasons disability benefit payments are delayed, particularly at the outset of a disability claim.

Improperly Completed/Partially Completed Forms

If your initial claim forms are missing information, unreadable, or incomplete, your disability insurer will likely issue additional forms for completion or use the missing information as an excuse to delay processing the disability claim. This applies to both the forms that you are required to complete and sign and the forms the insurer gives you to give to your doctor to fill out, so it is important to follow up with your doctor and make sure that all of the necessary forms are completed and returned in a timely fashion. If you do not carefully document your disability claim, and you do not promptly respond to requests for follow-up information, most insurers will delay making a claim decision until you provide them with the requested information.

Pending Requests for Information

At the outset of your disability insurance claim, your insurer will require you to sign an authorization that allows them to request a wide range of information from a wide range of sources, including your doctors and employer. Oftentimes, the insurer will request information from these other sources (without telling you) and then will delay making a decision on your disability claim if any of these requests remain pending.

This means that even if you provide the insurance company with everything they requested from you, there may be other information that the company is waiting that is holding up the claims decision. Consequently, it’s important to ask the insurance company to find out if there are any pending requests, adn then follow up with your doctors, employers, etc. as needed to ensure that the information is provided.

It’s also important to keep tabs on the pending requests, to determine whether the scope of the disability insurer’s investigation is appropriate. An experienced disability attorney can advise you on whether a particular request for information is warranted under the circumstances of your particular claim.

Failure to Schedule Medical Examinations/Interviews

When you file a disability claim, insurers will almost always require that you participate in a detailed interview and/or undergo an independent medical examination (IME). While the stated point of these requests is to confirm or verify your disability, they can often be an attempt by your insurer to discredit your own doctor or medical records and generate fodder to deny your disability claim. Depending on the nature of your condition, your disability insurer might also request other types of interviews or exams—such as a functional capacity evaluation (FCE) or neuropsychological evaluation.

Some claimants (mistakenly) believe that if they keep putting off these exams, then they’ll be able to avoid the exams. However, most disability policies contain a provision that expressly requires the policyholder to submit to exams, and states that failure to do so is grounds for denying a claim or terminating disability benefits. So if you put off these exams, it’s only going to delay the company’s claim decision, and possibly result in a claim denial. However, keep in mind that going into a medical examination, IME, or interview unprepared can be just as bad for your claim, so it’s very important to prepare beforehand. Once again, an experienced disability attorney can advise you regarding the proper scope of an interview or IME, and can also be present for the interview or IME, if desired.

How Long Does It Take to Get Benefits? – Part 1

You’ve made the difficult decision to give up practicing medicine or dentistry and file a disability claim. You’re not working and you need to collect the disability benefits you’ve likely paid years of high premiums for. So how long will you have to wait until your first benefit check arrives?

Unfortunately, the answer is not clear cut—it depends on the terms of your disability insurance policy, your insurance company, the assigned benefits analyst, and the complexity of your disability claim, among other things.

Filing a Claim

Your disability insurance policy should outline the requirements for filing a disability claim. Typically, you must give notice of your disability claim to your insurer within a certain time frame. If you miss this important deadline, the insurance company will typically claim that you have prejudiced its ability to investigate your claim, and use this as an excuse to delay making a decision on your disability claim. Significantly, if you don’t provide timely notice, it can also foreclose your ability to collect disability benefits (depending on the circumstances, and the reason for the delay).

Once you file your disability claim with your insurer, they will then send disability claim forms to be completed by you and your physician. Your policy should include a deadline for when your insurer must provide you with these forms (e.g. 15 days). If they don’t provide you with forms within this time frame, most disability insurance policies allow you to submit a written statement documenting your proof of loss, in lieu of the forms. Again, there is a deadline to return these forms and failing to do so gives your disability insurer an excuse to prolong the decision-making process.

Elimination and Accumulation Periods

Your disability insurance policy will also contain details about your elimination period. This is the period of time that must pass between your disability date and eligibility for payment on a disability claim. Generally, you must be disabled (as defined in your policy) and not working in your occupation during this time period.

Depending on the terms of your disability insurance policy, this period does not necessarily have to be consecutive, but it does need to occur within the accumulation period also set out in your policy (for example, your policy might require a 90 day elimination period that must be met within a 7 month accumulation period). You will not be eligible for payment until the elimination period has been fulfilled. Typically, disability insurers won’t provide you with a claim decision until after this date has passed.

It is important to be aware of your elimination period, so that you can plan accordingly (and are not expecting a benefit payment to arrive right way when you are budgeting to meet living expenses, or debts like student loans). Also, it’s important to keep in mind that receiving a benefit payment immediately following the elimination period is the ideal scenario. In many disability claims, it takes much longer for a benefit to be issued. In our next post, we will address some of the most common reasons disability benefit payments are delayed.

Policy Riders: Social Insurance Substitute Rider

In prior posts we’ve talked about riders and how they can modify the terms of a disability policy. In this post, we will be looking at a rider we sometimes see in individual disability policies called a Social Insurance Substitute rider.

A Social Insurance Substitute (SIS) rider is an optional rider that provides a monthly benefit that works a little differently than a standard base benefit. Generally speaking, SIS benefits can be reduced if you are eligible for and receiving social insurance benefits (e.g. Social Security retirement or disability benefits, workers’ compensation benefits, etc.).

SIS riders can operate differently, depending on the terms of your disability insurance policy. In some instances, the disability benefit paid by the insurer will be reduced by the amount received from social insurance (usually up to a certain amount). In other disability insurance policies, a certain percentage is subtracted from the benefits based on how many different forms of social insurance you are receiving (e.g. if you are receiving Social Security benefits, you might only receive two-thirds of your monthly benefit amount, and your monthly benefits might be further reduced if you started receiving benefits from a second source, like worker’s compensation).

The appeal of the SIS rider is that including it in a policy will typically result in a lower premium. The logic behind this is that the insurance company shares the risk of payment with the government. The primary downside to an SIS rider is the fact that your disability benefits will be reduced in some fashion if you obtain social insurance benefits.

In addition, policies with an SIS rider can also place additional requirements on policyholders by:

- Requiring policyholders to apply for social insurance benefits;

- Requiring policy holders to reimburse them if a lump sum payment is received from social insurance(s); and

- Requiring policyholders to go through the entire appeals process following any social insurance denials and/or re-apply for social insurance benefits periodically.

When choosing a disability insurance policy, it is important to weigh what you can afford in premiums now with potential future benefits. If you can afford a higher premium, it is often in your best interest to choose a disability insurance policy without an SIS rider and with a higher base benefit. As we have discussed previously, there are also certain riders that you can purchase that will automatically increase your monthly disability benefit (and premiums) by a certain amount each year and/or allow you to apply to increase your monthly benefit in the future, without undergoing additional medical underwriting. Whether you are shopping for a disability insurance policy, or evaluating your existing policy, you should always keep in mind that the cost of the premium is not the only consideration. There are other factors in play that you must consider when purchasing a disability insurance policy, and the type of insurance that you purchase can have a significant impact upon your financial position if you should become disabled.

Migraine Headaches

Migraine headaches can be debilitating, and, in some cases, chronic. In this post, we will look at some of the symptoms of migraines, how they are diagnosed, and some common treatments for migraines.

Overview

Migraines are characterized by severe headaches that usually involve throbbing pain felt on one side of the head, and can be accompanied by symptoms such as nausea, vomiting, and/or sensitivity to light and sound.

Migraines are the third most prevalent illness in the world, and can interfere with an individual’s ability to work and complete day-to-day activities, especially for those suffering from chronic migraines. Some studies have determined that healthcare and lost productivity costs associated with migraines may be as high as $36 billion annually. Migraines can affect anyone—in the U.S. 18% of migraine sufferers are women, 6% are men, and 10% are children. They are more common in individuals aged 25 to 55 and in those with family members that also suffer from migraines.[1]

Symptoms

Migraine symptoms, frequency, and length vary from person to person. However, they usually have four stages:

Prodrome: This occurs one or two days before a migraine attack and can include mood changes, food cravings, neck stiffness, frequent yawning, increased thirst and urination, and constipation.

Aura: This stage can occur before or during a migraine attack. Auras are usually visual disturbances (flashes of light, wavy or zigzag vision, seeing spots or other shapes, or vision loss. There can also be sensory (pins and needles, numbness or weakness on one side of the body, hearing noises), motor (jerking), or speech (difficulty speaking) disturbances. While auras often occur 10 to 15 minutes before a headache, they can occur anywhere from a day to a few minutes before a migraine attack. Typically, an aura goes away after the migraine attack, but in some cases, it lasts for a week or more afterwards (this is called persistent aura without infarction).

Migraine: The migraine itself consists of some or all of the following symptoms:

- Pain on one or both sides of the head that often begins as a dull pain but becomes throbbing

- Sensitivity to light, sound, odors, or sensations

- Nausea and vomiting

- Blurred vision

- Dizziness and/or fainting

- Migrainous stroke or migrainous infraction (in rare cases)

Post-drome: This stage follows a migraine and can include confusion, mental dullness, dizziness, neck pain, and the need for more sleep.

A migraine can last anywhere from a few hours to several days, and there are several classifications of migraines, including:

- Classic migraine – migraine with aura

- Common migraine – migraine without aura

- Chronic migraine – a headache occurring at least 15 days per month, for at least three months,

eight of which have features of a migraine - Status migraine – (status migrainosus) a severe migraine attack that lasts for longer than 3 days

Causes

The exact causes of migraines are not clearly understood but involve abnormal brain activity, including (1) changes in the brain stem and its interactions with the trigeminal nerve and (2) imbalances in brain chemicals, including serotonin. Migraines are most often triggered by:

- Food and food additives (often salty or aged food, MSG, meats with nitrites, aspartame)

- Skipping meals

- Drink (alcohol, caffeine, caffeine withdrawal)

- Sensory stimuli (bright or flashing lights, strong odors, loud noises)

- Hormonal changes or hormone medication such as birth control

- Certain other medications

- Stress or anxiety

- Strenuous exercise or other physical stress

- Change in sleep patterns

- Changes in weather

Co-occurrence

Migraines have been shown to co-occur with several other conditions[2], including:

- Cardiovascular disorders, coronary heart disease, and hypertension

- Stroke

- Psychiatric disorders (anxiety, depression, bipolar disorder)

- Restless leg syndrome

- Epilepsy

- Chronic pain such as musculoskeletal pain[3]

Treatment

There are a variety of options that doctors employ to both treat and prevent migraine attacks.

- Pain-relieving medications (both over the counter and prescription)

- Preventative medications (which can include antidepressants, blood pressure

medications, and seizure medications) - Botox

- Transcutaneous supraorbital nerve stimulation (t-SNS)

(a headband-like device with attached electrodes) - Acupuncture

- Biofeedback

- Massage therapy

- Cognitive behavioral therapy (CBT)

- Herbs, vitamins, and minerals

- Relaxation exercises

- Sticking to a sleep schedule

- Exercise

- Avoidance of known triggers

Doctors also sometimes recommend keeping a headache diary, similar to a pain journal, which can help you track the frequency of your migraines and may help identify triggers.

These posts are for informative purposes only and should not be used as a substitute for consultation with and diagnosis by a medical professional. If you are experiencing any of the symptoms described below and have yet to consult with a doctor, do not use this resource to self-diagnose. Please contact your doctor immediately and schedule an appointment to be evaluated for your symptoms.

References:

Cedars-Sinai, https://www.cedars-sinai.edu

Healthline, www.healthline.com

Mayo Clinic, www.mayoclinic.org

MedlinePlus, www.medlineplus.gov

[1] Migraine Research Foundation, About Migraine, http://migraineresearchfoundation.org/about-migraine/migraine-facts/

[2] Wang, Shuu-Jiun, et. al., Comorbidities of Migraine, Frontiers in Neurology, Aug. 23, 2010, http://journal.frontiersin.org/article/10.3389/fneur.2010.00016/full

[3] Id. (citing Von Korff M., et. al., Chronic spinal pain and physical-mental comorbidity in the United States: results from the national comorbidity survey replication, Pain 113, 331-330 (2005).