Meniere’s Disease

What is Meniere’s Disease?

Meniere’s disease is a problem of the inner ear that can lead to vertigo (dizzy spells) and hearing loss. It typically affects only one ear. Some individuals will have single attacks of vertigo separated by long periods of time, while others may experience multiple attacks over a number of days. Sometimes the vertigo is so extreme that an individual will lose their balance and fall (called “drop attacks”).

Meniere’s disease is most common in people in their 40s and 50s. Approximately 615,000 individuals in the U.S. have a current diagnosis of Meniere’s disease, with approximately 45,500 new cases diagnosed each year.

What are the Symptoms of Meniere’s Disease?

Symptoms, can include:

- Regular dizzy spells that usually last 20 minutes to 12 hours, but no more than 24 hours

- Loss of balance

- Hearing loss

- Tinnitus (ringing in the ear)

- Feeling of fullness/pressure in the ear

- Headaches

What Causes Meniere’s Disease?

While the cause of the disease is not known, symptoms may be due to extra fluid (called endolymph) in the ear. Issues that can affect this fluid includes poor fluid drainage, autoimmune disorders, genetics, and/or viral infection.

How is Meniere’s Disease Diagnosed?

In order to meet the diagnostic criteria for Meniere’s disease, an individual must have had two or more vertigo attacks, hearing loss, and tinnitus or a feeling of pressure in the ear. Tests performed by a healthcare provider will include a hearing assessment, a balance assessment, and tests that study how the inner ear is working. Often other tests, including labs and imaging, will be used to rule out other conditions.

What is the Treatment for Meniere’s Disease?

There is no cure for Meniere’s disease and no treatment for any resulting permanent hearing loss. Treatments are instead aimed at lessening vertigo attacks and preventing hearing loss from getting worse.

Treatments include:

- Motion sickness medications

- Anti-nausea medications

- Diuretics

- Lifestyle changes including a low-salt diet, consuming less caffeine and managing stress

- Vestibular rehabilitation

- Hearing aids

- Middle ear injections

- Pressure pulse treatment

- Endolymphatic sac surgery (relieves pressure around the endolymphatic sac, which can improve fluid levels)

- Labyrinthectomy (parts of the ear that cause vertigo are removed, which causes complete hearing loss in the affected ear)

- Vestibular nerve section (the vestibular nerve is cut to block information about movement for getting to the brain, to improve vertigo)

Meniere’s disease can interfere with an individual’s ability to work or carry out daily tasks. If you have been diagnosed with Meniere’s disease and are worried that it may be impeding your ability to continue to safely practice on patients, you should speak with an experienced disability insurance attorney.

These posts are for informative purposes only and should not be used as a substitute for consultation with and diagnosis by a medical professional. If you are experiencing any of the symptoms described above and have yet to consult with a doctor, do not use this resource to self-diagnose. Please contact your doctor immediately and schedule an appointment to be evaluated for your symptoms.

Sources:

Mayo Clinic

Johns Hopkins

Cleveland Clinic

National Institute of Health

Injury versus Sickness: A Case Study

While it might seem like it should be easy to determine whether a disabling condition is caused by an injury or sickness, this is not always the case, especially when it comes to repetitive stress injuries. Under some policies, the difference can be drastic in terms of how long benefits are paid.

One example is the case of Stein v. Paul Revere Life Ins. Co[1]. Dr. Stein was a specialist in interventional radiology who was diagnosed with and eventually unable to work due to spinal stenosis, lumbar osteoarthritis, lumbar spondylosis, and degenerative spondylolisthesis. Whether or not his condition was an injury or sickness was important in this case because he was eligible to receive full lifetime benefits if his condition was caused by injury (but only a portion of his benefits for life if it was due to sickness).

While he initially filled out his application for benefits, Dr. Stein filled out the sickness portion of the form, and indicated that his occupation exacerbated his condition. However, later, Dr. Stein sought to change this classification of his disability from sickness to injury, claiming that his disabling conditions were actually the result of repetitive stress injuries (caused as a result of having to wear a heavy lead apron as part of his occupation). In support of this claim, Dr. Stein submitted statements from his treating provider and medical journal articles that showed there was evidence of a relationship between wearing leaded aprons and spinal problems.

Paul Revere had three physicians review Dr. Stein’s records, and all concluded that Dr. Stein’s conditions were due to sickness, or at the very least “cannot be ascribed, beyond reasonable doubt, to repetitive stress injury more than any of the many other proposed causes of disc degeneration.” The third reviewing doctor also indicated that the medical file did not indicate that there had ever been an accident. Dr. Stein countered that Paul Revere was misinterpreting the term accident, and failing to consider repetitive stress injuries.

The Court found that Dr. Stein’s arguments were persuasive. They noted that there was not an expectation that he could have known that he was likely to become injured (thus meeting the “accidental bodily injury” requirement of his policy), and that he was suffering from a physical condition resulting from repetitive stress injuries. In finding for Dr. Stein, the Court concluded that he was entitled to a reclassification of his total disability as due to an “injury” and thus eligible for full lifetime benefits.

However, here, the Court did not award Dr. Stein attorney fees, explaining that Dr. Stein himself had originally applied to receive benefits under the “sickness” category and that Paul Revere’s interpretation of its policy language was “reasonable.”

This case highlights the importance of understanding the terms and requirements of your individual policy. If you have questions on how your policy works or how your claim is being administered, please feel free to reach out to one of our attorneys directly.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Stein v. Paul Revere Life Ins., Co., No. CV 21-3546, 2023 WL 2539004 (E.D. Pa. Mar. 16, 2023)

Relying on File Reviews: A Case Study

It is not uncommon for disability insurance companies to rely on paper-only reviews when deciding whether to deny or terminate benefits. But will the reviewing physician consider all the evidence submitted in support of a claim when making a determination on whether an insured is disabled? The answer is – not always.

One such example is the case of Caudill v. Hartford.[1] Caudill filed a claim with his insurance company, Hartford, based on fibromyalgia and chronic obstructive pulmonary disorder (CODP). Hartford initially began paying benefits but later terminated them, claiming that Caudill was no longer too disabled to work. Caudill appealed, but Hartford upheld its termination. When making this decision, Hartford relied almost solely on an independent file review conducted by a Dr. Schulman.

Dr. Schulman opined that Caudill was able to work because he could sit or stand for 8 hours a day. While his conclusion concurred with the view of a doctor who had previously conduced an independent medical examination (IME), it failed to address questions that had been raised by Caudill about the purported deficiencies in the IME. Further, Dr. Schulman did not address a functional capacity evaluation (FCE) that reached a conclusion that Caudill’s issues, even with sitting, “would not be viable in most sedentary environments.”

Neither Dr. Schulman or the Hartford addressed the notes of Caudill’s treating physicians, which included statements that Caudill “does not have good exertional tolerance” and that he has difficulties with activities of daily living.

While the Court explained that, while there was nothing inherently objectionable about a file review, in this instance Caudill had “provided credible, objective evidence that he is unable to work in even a sedentary capacity” and that Hartford “cannot arbitrarily disregard a claimant’s evidence.” The Court found for Caudill and ordered that his benefits be retroactively reinstated.

This case highlights how insurance companies may rely on their own experts over other evidence in the case file. If you believe your insurance company has conducted a file review and you have questions, please feel free to reach out to one of our attorneys directly.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Caudill v. Hartford Life & Accident Ins. Co., No. 1:19-CV-963, 2023 WL 2306666 (S.D. Ohio Mar. 1, 2023)

Complex Regional Pain Syndrome

What is Complex Regional Pain Syndrome?

Complex regional pain syndrome (CRPS) isn’t clearly understood, but it is a form of chronic pain that usually affects an arm or a leg. CRPS usually develops after an injury, surgery, stroke or heart attack. The pain is often prolonged and out of proportion to the severity of the initial injury. CRPS can either be acute (recent, short-term) or chronic (lasting greater than six months).

CRPS is divided into two groups. The first, also called sympathetic dystrophy, develops without known nerve damage. The second, also called causalgia, occurs as a result of specific nerve damage. About 90% of cases are type 1.

While most cases of CRPS are mild and an individual recovers in a few months to a few years as the injured nerve regrows, symptoms can persist and long-term disability may result. If untreated, the disease can progress and atrophy (tissue wasting) and contracture (muscle tightening) can develop.

What are the Symptoms of Complex Regional Pain Syndrome?

Symptoms, can include:

- Continuous burning or throbbing pain, typically in an arm, leg, hand or foot (in some instances “mirror pain” may develop in a matching location on the opposite limb)

- Increased sensitivity to painful stimuli

- Feeling pain from stimuli that are not usually painful

- Sensitivity to touch or cold

- Numbness

- Joint stiffness, swelling and damage

- Muscle spasms, weakness, and tremors

- Decreased mobility in affected body part

- Swelling

- Changes in skin temperature, color, and texture

- Changes in hair and nail growth

Having CRPS is also associated with increased anxiety, depression and stress.

What Causes Complex Regional Pain Syndrome?

The exact cause of CRPS isn’t clearly understood, but it is thought to be caused by an injury to or a difference in the peripheral and central nervous system. In many causes, CRPS results after a trauma to an arm or a leg. The most common actions/activities that lead to CRPS include fractures, surgery, strains/sprains, limb immobilization (e.g., from being in cast), and lesser injuries such as burns or cuts.

Other influencing factors include poor circulation, poor nerve health, immune system involvement (for example, some individuals with CRPS have abnormal antibodies), and genetics.

How is Complex Regional Pain Syndrome Diagnosed?

There is no one test for CRPS, but the following are used in determining whether an individual may have CRPS:

- Physical exam

- Nerve conduction studies

- Ultrasound

- MRI

- Bone scans

- X-rays

- Sweat production tests

What is the Treatment for Complex Regional Pain Syndrome?

Treatments include:

- Medications (pain relievers, antidepressants and anticonvulsants, corticosteroids, bone-loss medications, synthetic nerve-block medications, intravenous ketamine, blood pressure lowering medications, topical analgesics)

- Heat therapy

- Physical or occupational therapy

- Biofeedback

- Acupuncture

- Mirror therapy

- TENS

- Spinal cord stimulation

- Intrathecal drug pumps

Outcomes for CRPS can vary widely, and early diagnosis and treatment is key. CRPS usually improves over time and goes into remission in most people; however, severe or prolonged cases can occur, and it recurs in about 10-30% of individuals.

Complex Regional Pain Syndrome can interfere with an individual’s ability to work or carry out daily tasks. If you have been diagnosed with CRPS and are worried that it may be impeding your ability to continue to safely practice on patients, you should speak with an experienced disability insurance attorney.

These posts are for informative purposes only and should not be used as a substitute for consultation with and diagnosis by a medical professional. If you are experiencing any of the symptoms described above and have yet to consult with a doctor, do not use this resource to self-diagnose. Please contact your doctor immediately and schedule an appointment to be evaluated for your symptoms.

Sources:

Mayo Clinic

National Institute of Neurological Disorders and Stroke

John Hopkins

Cleveland Clinic

Stanford

Occupation at Time of Disability:

A Case Study

Often, a definition of total disability includes a phrase along the lines of you are considered Totally Disabled “you are not able to perform all or the substantial and material duties of your regular occupation at the start of your Total Disability.” While this may seem straightforward, we’ve seen conflicts arise when it comes to defining what an insured’s regular occupation was at the start of a disability.

One such example is the case of Johnson v. Ohio National.[1] Dr. Johnson was an OB/GYN from 1993 through May 2007, with several different employers. However, from May to October 2007, he took time off and was subsequently not able to find work in the OB/GYN field, although he was actively looking for it. From October 2007 through March 2008, he worked on a temporary basis at a clinic, filling in for other doctors as needed. He also worked part-time as a physician at an Urgent Care clinic (where he did no OB/GYN-related duties).

In June of 2008, Dr. Johnson saw an internal medicine doctor for joint pain, swelling and stiffness in his hands, along with a rash. Lab tests revealed significant inflammation of the hands. Dr. Johnson was referred to and saw a rheumatologist on November 14, 2008, where he was diagnosed as having psoriatic arthritis. On December 26, 2008 he submitted a claim with Ohio National for total disability. Although Ohio National agreed on the date of disability (June 2008) and that psoriatic arthritis prevented Dr. Johnson from practicing as an OB/GYN, they claimed his occupation at the time of his disability was that of an urgent care doctor—and that he was still able to do the material and substantial job duties of an urgent care physician.

The Courts agreed with Ohio National, finding that at the time of his disability, Dr. Johnson was working as an urgent care physician, regardless of the fact that he was a Board-certified OB/GYN and had been doing that for the majority of his career.

We’ve encountered dentists and physicians who inadvertently change their occupation by starting to work in another position or role, or otherwise modify their job duties, often as a way to accommodate a disability. Since regular occupation is often defined along the lines of “the occupation (or occupations if more than one) in which you are regularly engaged at the time you become Totally Disabled,” insurance companies will typically ask for CPT or CDT codes to identify the specific job duties you are doing at the time your disability started. In some instances, this might allow an insurance company to claim you are not working in your specialty and try to claim you are doing the very broadest job possible (thus making it easier to say you are still able to work).

This case highlights the importance of understanding the terms and requirements of your individual policy when it comes to how total disability is defined. If you are worried about how your insurer is classifying your occupation and have questions, please feel free to reach out to one of our attorneys directly.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Johnson v. Ohio National Life Assurance Co., No. WD-12-029, 2014 WL 201691 (Ohio Ct. App. Jan. 17, 2014).

Psoriatic Arthritis

What is Psoriatic Arthritis?

Psoriatic arthritis (PsA) is a type of arthritis that affects about 30 percent of individuals who have psoriasis (a disease that causes red patches of skin that are topped with silvery scales). Psoriasis typically develops years before psoriatic arthritis, but this is not always the case.

Joint pain, swelling, and stiffness are the key signs of psoriatic arthritis, and these symptoms can affect any part of the body. Symptoms range from mild to severe, and often flares can be followed by periods of remission. If left untreated, psoriatic arthritis can lead to joint and tendon damage, which can cause decreased function and disability.

What are the Symptoms of Psoriatic Arthritis?

As indicated above, the primary symptoms of psoriatic arthritis are joint pain, swelling, and stiffness. Joints are affected on one or both sides of the body. Additional symptoms of psoriatic arthritis include:

- Swollen fingers and toes

- Lower back pain (specifically, some individuals may develop spondylitis)

- Foot pain

- Nail changes

- Eye inflammation

- Fatigue

A small percentage of those with psoriatic arthritis may go on to develop a condition called arthritis mutilans. This form of psoriatic arthritis leads to permanent deformity and disability in the small bones of the hands (especially in the fingers).

Unchecked psoriatic arthritis inflammation can case complications including:

- Damage to cartilage and bones

- Uveitis

- Gastrointestinal problems

- Shortness of breath and coughing

- Damage to blood vessels and the heart muscle

- Osteoporosis

- Metabolic syndrome (a group of conditions that include obesity, high blood pressure and poor cholesterol levels)

What Causes Psoriatic Arthritis?

In psoriatic arthritis, the body’s immune system attacks healthy cells and tissue, causing inflammation in the joints and the overproduction of skin cells. While both environmental and genetic factors seem to play a role in the development of psoriatic arthritis, there are several risk factors including a family history of psoriatic arthritis, psoriasis, and age. Environmental triggers, such as an infection, stress, or physical trauma can also play a role.

How is Psoriatic Arthritis Diagnosed?

There is no one test that can diagnose psoriatic arthritis, but doctors will typically perform a variety of tests, including those to rule out other conditions that cause joint pain, such as rheumatoid arthritis, including:

- Physical Exam: a doctor will typically look for signs of joint tenderness or swelling, pitting, flaking or other nail abnormalities, and tenderness on the soles of the feet or around the heels.

- X-rays: to look for joint changes

- MRIs: to look for tendon and ligament changes in the lower back and feet

- Rheumatoid factor (RF) test: RF is often found in individuals with rheumatoid arthritis, but not usually in those with psoriatic arthritis

- Joint fluid test: a test that looks for uric acid crystals in the joint fluid which, if present, may indicate a diagnosis of gout versus psoriatic arthritis

What is the Treatment for Psoriatic Arthritis?

There is no cure for psoriatic arthritis so treatments focus on managing inflammation in the joints and controlling skin involvement. Medications, physical therapy, steroid injections, and, in some cases, joint replacement therapy are all used to treat the symptoms of psoriatic arthritis. Common medications utilized include:

- NSAIDs (nonsteroidal anti-inflammatory drugs)

- Conventional and targeted synthetic DMARDs (disease-modifying antirheumatic drugs) – these types of drugs slow the progression of the disease and preserve joints from further, permanent damage.

- Biologic agents (biologic response modifiers, a type of DMARDs) – these drugs target a different pathway in the immune system than DMARDs.

- Apremilast (Otezla) – a medication that decreases the activity of a type of enzyme in the body that controls the activity of inflammation in the cells.

Psoriatic arthritis can interfere with an individual’s ability to work or carry out daily tasks. If you have been diagnosed with psoriatic arthritis and are worried that it may be impeding your ability to continue to safely practice on patients, you should speak with an experienced disability insurance attorney.

These posts are for informative purposes only and should not be used as a substitute for consultation with and diagnosis by a medical professional. If you are experiencing any of the symptoms described above and have yet to consult with a doctor, do not use this resource to self-diagnose. Please contact your doctor immediately and schedule an appointment to be evaluated for your symptoms.

Sources:

Mayo Clinic

John Hopkins

National Psoriasis Foundation

Arthritis Foundation

Postural Orthostatic Tachycardia Syndrome

(POTS)

What is POTS?

Postural orthostatic tachycardia syndrome (POTS) is a group of disorders that have orthostatic intolerance (OI) as their primary symptom. It’s a condition that causes a number of symptoms when an individual transitions from laying down to standing up.

The primary symptom of OI is lightheadedness or fainting. With POTS, this is also accompanied by a rapid increase in heartbeat of more than 30 beats per minute or a heart rate that tops 120 beats per minute, within 10 minutes of standing. Laying down relieves the faintness/lightheadedness.

While normally the body’s automatic nervous system balances heart rate and blood pressure, someone with POTS can’t coordinate the balancing act of blood vessel constriction and heart rate response; therefore, the body can’t keep blood pressure stable.

POTS affects about 1 to 3 million people in the United States (although experts believe this number may have risen since COVID-19), with the majority being women between 15 and 50 years old. Those who have had a significant illness, serious infections, are pregnant, have physical trauma or surgery are at a higher risk of developing POTS.

POTS can be further divided into sub-types:

Neuropathic POTS: when peripheral enervation (loss of nerve supply) leads to poor blood vessel muscles

Hyperadrenergic POTS: when the sympathetic nervous system is overactive

Hypovolemic POTS: reduced blood volume

One of the biggest risks of POTS is falling and getting injured. In some, POTS symptoms will resolve, but they may return. About 25% of POTS patients are disabled and unable to work.

What are the Symptoms of POTS?

Thy symptoms of PTOS vary by individual, and happen immediately or within a few minutes after sitting or standing up. Symptoms can include:

- Dizziness

- Fainting

- Brain fog

- Racing heart rate or palpitations

- Chest pain

- Fatigue

- Nervousness or anxiety

- Shakiness

- Excessive sweating

- Shortness of breath

- Headaches

- Nausea or vomiting

- Bloating

- Purple discoloration of hands and feet, if they are lower than heart level, and a pale face

- Disrupted sleep

Several conditions can worsen POTS symptoms, including:

- Being in warm environments

- Standing frequently

- Being sick

- Menstruation

- Strenuous exercise

What Causes POTS?

Its not entirely clear what causes POTS, but growing evidence suggests that POTS may be an autoimmune disease.

How is POTS diagnosed?

A tilt table test is one of the primary methods a physician will use to diagnose POTS. It measures heart rate and blood pressure during changes to posture and position. Other tests that may help confirm POTS and/or rule out other conditions include blood tests, QSART (a test that measures the nerves that control sweating), automatic breathing tests, tuberculin skin tests, skin nerve biopsy, echocardiogram, and blood volume with hemodynamic studies.

What is the Treatment for POTS?

There is no cure for POTS, but there are recommendations that can help manage the symptoms of POTS, including:

- Engaging in exercise and physical activity

- Managing diet and nutrition (for example, for hypovolemic POTS, a dietician may recommend increasing salt and fluid intake)

- Certain medications including those that treat tachycardia, increase salt retention and blood volume) and/or cause vasoconstriction.

POTS can interfere with an individual’s ability to work or carry out daily tasks. If you have been diagnosed with POTS and are worried that it may be impeding your ability to continue to safely practice on patients, you should speak with an experienced disability insurance attorney.

These posts are for informative purposes only and should not be used as a substitute for consultation with and diagnosis by a medical professional. If you are experiencing any of the symptoms described above and have yet to consult with a doctor, do not use this resource to self-diagnose. Please contact your doctor immediately and schedule an appointment to be evaluated for your symptoms.

Sources:

Cleveland Clinic

National Institute of Neurological Disorders and Stroke

John Hopkins Medicine

Dysautonomia International

Do I Have to Attend an IME in Person?: A Case Study

Under many disability insurance policies, insurers can require an insured to attend an independent medical examination (IME) in order to remain eligible for benefits. While some policies may explicitly state that an IME must be in person, other are silent on this. So, what happens if you are worried about attending an in-person IME due to potential health risks and/or the COVID-19 pandemic?

One example of this scenario is the case of Masevice v. Life Ins. Co. of North America[1]. Ms. Rebecca Masevice was a marketing manager who became unable to work due to migraine headaches, cluster headaches and POTS (postural orthostatic tachycardia syndrome), dizziness, fatigue, shortness of breath and brain fog. She filed a disability claim with her insurer, Life Insurance Company of North America (LINA).

LINA requested that Masevice undergo an IME, and scheduled one. Masevice requested that this IME be held via “telemed.” LINA denied this request and re-scheduled the IME multiple times and ultimately denied her claim. Masevice pointed to the “extraordinary circumstances of the COVID-19 pandemic” and disputed that she didn’t cooperate with the scheduling of an IME. On appeal, Masevice provided updated records, letters/reports from her treating provider, an FCE, a list of medications, and a vocational report. In their decision noted that “Plaintiff’s concerns about attending the IME in person were valid, given her symptoms and her compromised immune system.”

However, the Court further ruled that more fact-finding was needed in order to determine whether Masevice was eligible for benefits. The Court remanded the case, indicating that Masevice be given the opportunity to submit additional, current medical evidence and that LINA may require that Masevice undergo an in-person IME “now that the COVID-19 crisis has been alleviated.”

This case highlights the importance of understanding the terms and requirements of your individual policy. If you are facing an IME and have questions, please feel free to reach out to one of our attorneys directly.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Masevice v. Life Ins. Co. of North America, Case No. 1:22CV223, 2023 WL 2534042 (N.D. Ohio March 16, 2023).

Guardian’s New Dentist-Specific Claim Form Are These Trick Questions?

We’ve noted before that disability policies have evolved over time to become more complex. The same holds true for disability claim forms.

Years ago, most disability insurers used fairly basic proof of loss forms, and used the same forms for various types of claims.

Over time, these claim forms have also become increasingly complex, to the point that Guardian now has a dentist-specific form with several loaded questions. These questions can be difficult to answer fully and accurately, within the parameters of the form. Many questions do not provide any room to explain your specific dental practice, instead prompting you to select options that may not apply to your situation. Many questions also have hidden objectives that are only apparent to disability attorneys familiar with “own occupation” dentist disability claims.

Guardian’s Dental Professional Occupation Assessment Form

Below are a few excerpts from Guardian’s most recent dentist-specific claim forms, along with some limited, general commentary into the purpose behind some of the questions.

When we first saw these new forms, it was immediately apparent to us that they had been drafted by Guardian’s attorneys and senior claim staff with several of Guardian’s tactics of reducing or avoiding payment in mind. It was also clear from the fine print at the bottom that Guardian is attempting to lock dentists into “complete and true” answers, in writing, early-on, before they have contacted an attorney. This form is then checked against anything you have said to Guardian before, and anything else you may say in later phone or field interviews.

We have handled numerous claims filed by dentists with Guardian and have had to get them back on track, which can be difficult if these forms are not completed in the proper manner. Most recently, we have seen Guardian delay or reduce payment on numerous dentist disability claims due to perceived “incomplete answers” to its dentist-specific proof of loss questions and/or perceived “inconsistencies” with other statements/interviews. Accordingly, we felt it important to get the word out to dentists about these new developments.

As you review, keep in mind that every dentist claim is unique. Not everything below applies to every claim, and there may be other, additional considerations that come into play under your particular circumstances. Accordingly, it is best to consult with an experienced disability insurance attorney before filing a disability claim or submitting any proof of loss to Guardian.

Table of Contents

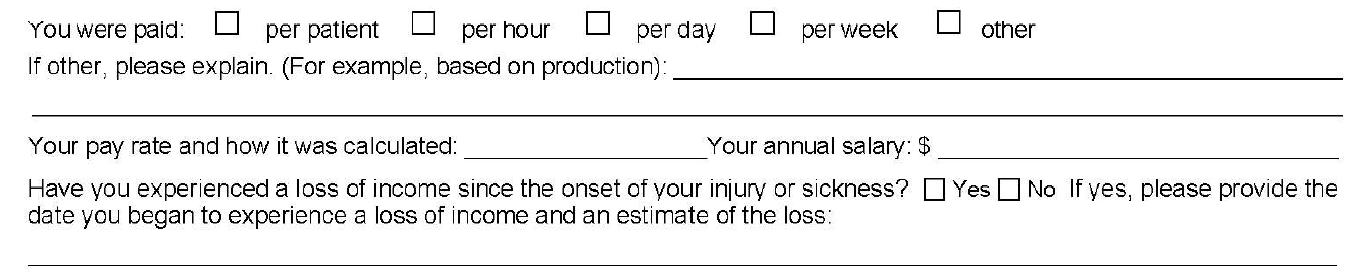

1. Why is Guardian Asking About My Pay Rate/Loss of Income?

5. Why is Guardian Asking if I Modified My Job Before Filing and How is That Relevant?

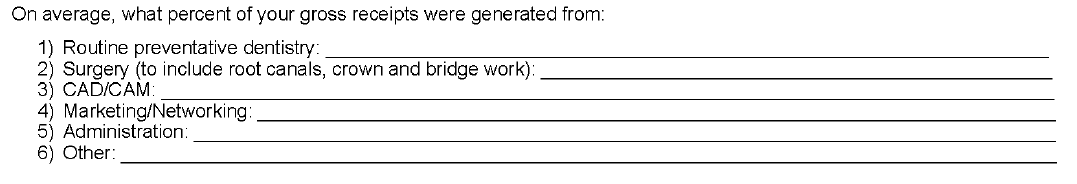

6. Why is Guardian Asking Me to Break Down the Source of Gross Receipts?

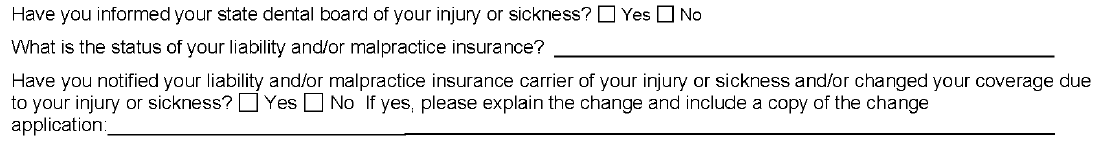

7. Why is Guardian Asking About the Dental Board/My Malpractice Insurance/Use of My NPI Number?

1. Why is Guardian Asking About My Pay Rate/Loss of Income?

Initially, you may think that loss of income is relatively straightforward; however, it can be a complicating factor in dentist claims, for a few reasons.

First, over time, disability policies have added additional requirements for establishing proof of loss that you may not be aware of. With older policies, the focus was primarily on whether the dentist met a certain loss of income percentage threshold. Then, if there was evidence of a medical condition that logically limited the dentist’s ability to work full-time, that was generally sufficient.

Newer Guardian disability policies have added additional hurdles, such as a requirement that the loss be “solely” due to the disabling condition. Regardless, the timeline—and date of disability selected—is critical to establishing a right to payment because, at a minimum, the loss of income must directly line up with the disabling condition.

The problem for dentists is that their disability claims are often musculoskeletal, slowly progressive, and worsen over time. Many dentists are diagnosed with a condition, yet work through the pain for a time. Sometimes there are periods of improvement even if the solutions are only short-term and the overall trend is downward. This can make selecting a proper and defensible date of disability challenging.

Additionally, when it comes to dentist claims, there can be gray areas under the terms of the underlying policy that must be addressed/negotiated (and sometimes litigated). For example, sometimes partial disability is also based on whether there has been a reduction of hours/time practicing; however, dentistry is not a profession where dentists “clock-in” and “clock-out” so addressing changes in “hours” can be a challenge.

Many dentists also receive income from multiple sources, and there can be several entities involved, particularly if the dentist works at a corporate dentistry practice. In some instances, the definitions in the underlying disability policy do not contemplate this level of complexity when it comes to the policyholder’s income, or give clear answers to what “counts” as income for purposes of determining the monthly losses.

Because of the above, we are seeing “loss of income” becoming an area that is increasingly being contested by insurers seeking to reduce liability or otherwise gain leverage in a disputed claim. Obviously, questions relating to loss of income are critical if you have a partial disability claim. However, even if you have a total disability claim, the period of total disability could potentially come after several months of partial disability. As such, you should consider these questions carefully even if you are planning on filing a total disability claim.

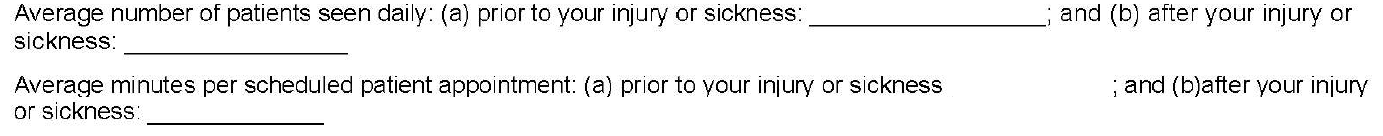

2. Why is Guardian Asking Me to Quantify Patients Per Day and Minutes Per Patient? How Do I Even Do That?

As noted above, changes in work schedule can be very important on a partial disability claim; however, these particular questions are also illustrative for another reason.

On their face, these questions seek information about the difference between the two timeframes, along the lines of what you might expect if you are filing a partial disability claim. The problem here is that the form does not allow for nuance and often these timeframes are not apples-to-apples comparisons.

For example, before your disability date, you may have been working on complex reconstruction cases, only seeing a few patients a day. Then, due to disability, you may have had to abandon the longer, more difficult (and more lucrative) procedures. As a result, you may be seeing many more patients a day, but only performing simpler tasks, such as exams or cleanings. But if you only answer what it asked, it will look like you have increased your workload because you are seeing substantially more patients after your disability.

The second question seems to address this, by asking how much time you spend on each patient appointment. However, providing a generalized answer here can also have unanticipated ramifications.

Going back to the above example, your instinct might be to put a very low number for the new time spent with patients, to highlight that you are doing easier, shorter procedures. However, this can have unanticipated long-term consequences. If you minimize or trivialize the number of hours you spend with patients when filing a partial disability claim, when you reach the point in time that you feel you are totally disabled, Guardian will refer back to this form and ask what has changed? Why can you not keep working if you are only doing simple cases, and only for short periods of time? What has happened medically to explain this change?

Sometimes, there will be a new medical event that can be pointed to. However, as noted above, most dentist claims involve slowly progressive conditions with primarily subjective symptoms (pain, numbness, etc.). As these worsen, imaging (such as MRIs) may or may not show a difference from prior imaging, even if you, as the dentist feeling the symptoms, know you are to the point that you should stop practicing for the sake of patient safety. Even if Guardian is only able to push a claim into partial disability, and reduce the monthly benefit, this can add up to a substantial amount over time.

In other instances, establishing a particular date of disability is critical (e.g. to establish notice was timely, or to lock-in certain lifetime benefits under Guardian’s graded lifetime riders). If your claim involves important timeline questions, failing to provide the appropriate level of detail and nuance can cause major problems and potentially provide Guardian with an argument to entirely avoid paying your disability claim.

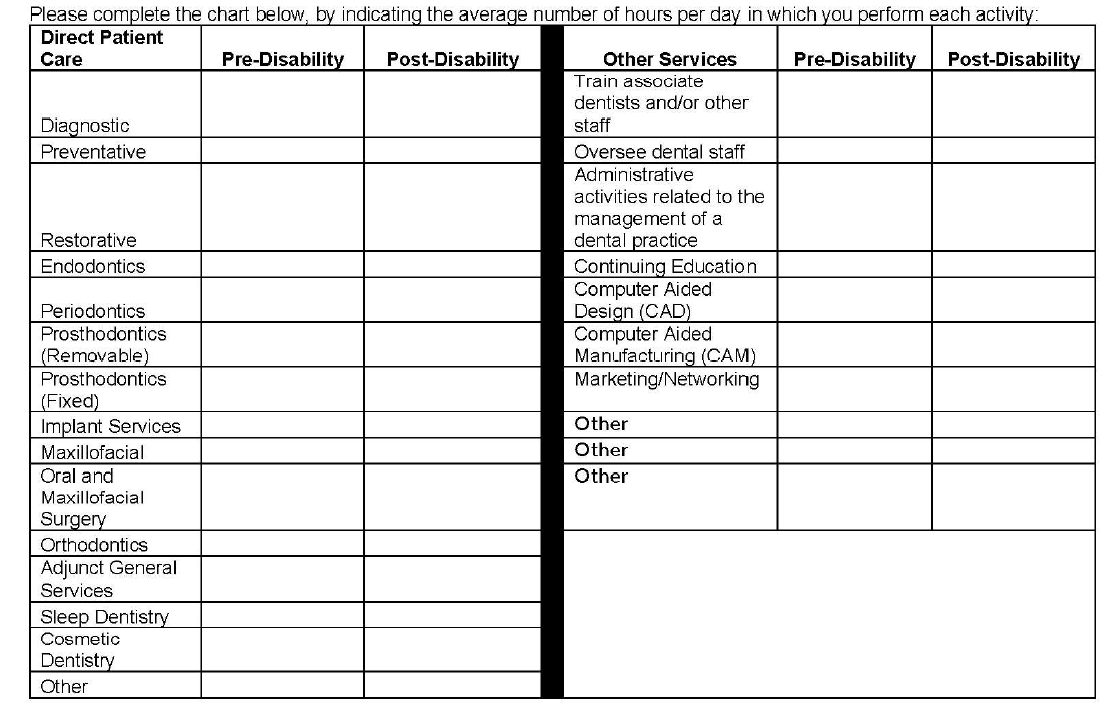

3. Why Is Guardian Asking Me to Break Down Patient Care by Hour? How Do I Do This When Many Categories Overlap and Each Day is Different and I Don’t Track Procedures by Hour? Why Is Guardian Listing Other Non-Clinical Categories?

The problems with the left column of this table should be immediately apparent to most dentists, as many categories overlap. As with the prior question, the form does not provide a means to explain important nuances. Additionally, the dentist is asked to answer the form based on “hours per day” which, for most dentists, varies widely depending on the day and is something that is not tracked on an hourly basis.

The second column is a good example of a question designed to elicit information that Guardian might seek to use in a “dual occupation” defense. As noted in prior posts, most Guardian policies have plural definitions of “occupation.” Guardian—like other disability insurers—will seek to expand your occupation to other, non-clinical roles if they think they can (e.g. practice owner, marketer, trainer/coach, supervisor/office manager, etc.).

While you must provide answers, and cannot avoid these sorts of questions, it is another area where nuance is very important and answering within the restrictions of the Guardian form itself can be harmful for a claim. The above questions may also not be particularly relevant, depending on the type of claim you are making. Or they could be very relevant, if you have future employment plans. If you start a new job in the future, at any point in your claim, Guardian will look back to prior claim forms to see if there are any overlapping duties. If you are unconcerned or imprecise when completing the forms, this can cause problems later on if you want to start other jobs related to dentistry (such as managing dental practices or teaching at a dental school/supervising dental clinics).

4. Why is Guardian Asking for an Hourly Breakdown of All of the Tools I Am Still “Able to Use” Each Day?

This question is another one that initially seems innocuous, but there is a high likelihood that the response will be used unfairly. This is evident when you consider what is actually being asked, particularly if a dentist is filing a total disability claim.

Essentially, the question asks for the minimum number of hours a dentist can still “use” a dental tool in a given day. But it leaves out critical details and qualifiers, and can be taken in several different directions. One dentist might answer based upon the number of hours they think they can work on a live-patient, factoring in patient safety risks. Alternatively, another dentist might take it literally and think it is asking whether the tool can be physically used/manipulated in any capacity, regardless of patient risk.

Additionally, this question simply asks for “hours per day” without clarifying whether this is with breaks, or without breaks, or what the tool is being used to accomplish.

The absence of these additional clarifying details makes it clear that Guardian is seeking responses to muddy the waters when it comes to assessing capacity to work and total versus partial disability.

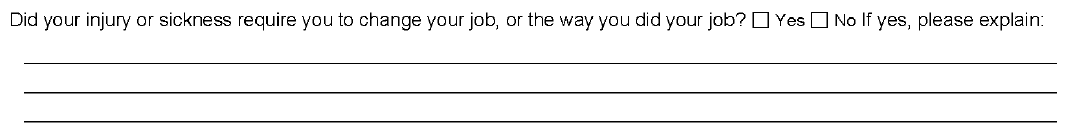

5. Why is Guardian Asking if I Modified My Job Before Filing and How is That Relevant?

While this question provides some room for explanation, it does not ask the critical follow-up question—i.e. whether modifications were effective, or remain effective. Absent an appropriately detailed explanation, Guardian may suggest the dentist could continue to work with the same modifications, even if the dentist is not actually working anymore or the modifications are no longer effective.

This question is also important from an “occupation” standpoint, and is another example of why timeline and the date of disability are so critical. Under most disability policies, including Guardian policies, your “occupation” is defined as of your date of disability. If you modified your duties or changed your schedule prior to your date of disability, this can make it more difficult to collect disability benefits.

This can be addressed by selecting earlier disability dates, but that may not be possible if there are late notice problems with the claim. Similarly, there are scenarios where modified schedules do not necessarily translate into loss of income sufficient to trigger a partial disability clause—for example, where a practice owner cuts back and brings in associates to keep up the practice’s production. This is why it is important to carefully review your policy and pick an appropriate disability date prior to filing; otherwise, questions like the above can become problematic without you even realizing it.

6. Why is Guardian Asking Me to Break Down the Source of Gross Receipts?

This question has several implications and, by now, you can likely guess why Guardian might be asking for this information.

Most Guardian policies define total disability based on an inability to perform the “material and substantial” duties of your occupation. A common tactic used by Guardian (and other insurers) is to ascribe a dollar value to certain things, then characterize them as “major” or “minor” duties. Sometimes this makes sense, but a “material and substantial” duties analysis—particularly for dentists—is claim specific, and involves a host of factors beyond “gross receipts” (e.g. time, complexity, patient expectations, nature of practice, specialty, etc.). As with other questions in the form, the provided categories also overlap to some extent, making it difficult to respond in a precise manner.

Additionally, this is another example of a question that can have ramifications later on if you start a new job. Most Guardian policies are “true own occupation,” in the sense that they let you work in a different occupation and still collect total disability benefits. However, as discussed above, occupation is defined in the plural and disability insurers seek to expand it as much as possible beyond clinical duties.

7. Why is Guardian Asking About the Dental Board/My Malpractice Insurance/Use of my NPI Number?

As evident from the above questions, Guardian is aware that, as a dentist, there are other legal documents that you must complete that directly relate to your capacity to practice dentistry safely.

At the outset of any disability claim, the initial claim packet includes an authorization that Guardian uses to look for anything that might be inconsistent with your claim, including statements made to your dental board or malpractice insurance. Guardian will consider the timing of those statements, in relation to the timing of your disability claim/selected date of disability. If they are inconsistent, Guardian may be more emboldened to deny your claim, as that sort of inconsistency could be used to undermine your credibility with a judge or jury.

The Takeaway

In short, Guardian wrote the policy and crafted the claim forms, so the process is designed to be as favorable to Guardian’s interests as possible.

This does not mean that it is impossible to collect, but it does mean that you should approach your claim in a serious, proactive matter and that you should become as informed as possible before filing your claim. If you do not have experience with the disability industry, it is advisable to consult with a disability attorney before submitting any proof of loss to Guardian.

Every claim is unique and the discussion above is only a limited summary of how Guardian approaches dentist disability claims. If you are concerned that Guardian is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

Attorneys Edward O. Comitz and Derek R. Funk Recognized by Super Lawyers for 2023

Attorney Ed Comitz has been named a Southwest Super Lawyer for 2023 for the twelfth consecutive year for excellence in the field of insurance coverage. Attorney Derek Funk has also been recognized as a Rising Star in the field of insurance coverage by Super Lawyers.

Super Lawyers is a rating service of outstanding lawyers from more than 70 practice areas who have attained a high-degree of peer recognition and professional achievement. The selection is a multiphase process comprised of independent research, peer nominations and peer evaluations. Only 5% of attorneys receive a Super Lawyers distinction, and only 2.5% of attorneys receive the Rising Star distinction.

Firm Named #1 Healthcare Law Firm

We are pleased to announce that we have been named Arizona’s #1 Healthcare Law Firm by Ranking Arizona: The Best of Arizona Business for 2023.

The Firm outranked other regional, national and international firms in Arizona, due to Ed Comitz’s nationally acclaimed disability insurance practice, which exclusively focuses on helping professionals (primarily physicians and dentists) collect their rightful disability benefits under private, “own-occupation” policies.

What are “Material and Substantial Duties”? A Case Study

Most “own occupation” disability insurance policies will address “material and substantial duties” in their definitions of total and partial disability. The exact definition (and whether or not you need to be disabled from one or all material and substantial duties) will depend on the language of your specific policy. However, what is and is not a material and substantial duty is not always clear-cut.

One example of this is the case of Vossberg v. Northwestern Mutual.[1] Dr. Vossberg was a physiatrist with a speech disorder (diagnosed as dysarthria). Dr. Vossberg filed a claim for partial disability with Northwestern Mutual, claiming that he could no longer make medical records because he was required to use electronic transcription software at his long-time hospital employer.

Under Dr. Vossberg’s policy, he would be considered partially disabled if he was “unable to perform one or more but not all of the principal duties of his occupation.” In this instance, both parties agreed that one of Dr. Vossberg’s principal duties was to “make medical records that document his interaction with patients.”

In reviewing the case, the Court found that “using electronic transcription software is not required to be a physiatrist.” The Court found that Dr. Vossberg had not presented evidence that his hospital employer had required the use of transcription software and pointed to the fact that he was currently working in private practice where he made his records by dictating patient notes into a tape record and having a person transcribe them. Further, other employers that Dr. Vossberg considered applying to testified that there was no requirement for him to use electronic transcription software. Thus, the Court concluded that Dr. Vossberg was not partially disabled under the terms of his policy.

Often, policies will even go so far to say that what is and is not a material and substantial duty is not based on what is done for any one employer, but for the national economy as a whole. So, even if Dr. Vossberg’s employer had actually required him to use transcription software, he may still not be considered disabled, depending on the exact language in his policy.

This case highlights the importance of carefully reading and understanding the terms of your specific policy and how it addresses material and substantial duties. If you fee that you are unable to do the material and substantial duties of your occupation, and are considering filing a disability insurance claim, please feel free to reach out to one of our attorneys directly.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Vossberg v. Northwestern Mutual Life Ins. Co., No. 1:22-cv-00364-JRS-KMB, 2023 WL 167460 (S.D. Ind. Jan. 12, 2023).

Long COVID: A Case Study

Some people infected with COVID-19 may go on to experience long COVID, which can cause a wide range of health issues that can last anywhere from several weeks to even years. Symptoms vary widely and can include fatigue, respiratory and heart symptoms, neurological symptoms, fever, joint pain and/or muscle pain.

Those afflicted with long COVID may find themselves unable to work and needing to file a long-term disability claim. However, it can be difficult to prevail on these types of claims, as insurers will often try to get out of paying claims based on long COVID.

One such example is the case of Abrams v. Unum.[1] Here, plaintiff William Abrams was an appellate lawyer who was experiencing “brain fog, fatigue, decreased attention and concentration, and fevers” starting in April 2020. After Unum initially denied his claim, Abrams appealed and went to seven different medical doctors, three of whom diagnosed plaintiff with long COVID with the remaining four diagnosing him as having chronic fatigue syndrome (CFS).

Unum continued to deny his claim, stating that a mental status exam did not show the necessary cognitive deficits needed to confirm the diagnosis of CFS, and that he had not submitted enough proof that he suffered from long COVID. While the Court agreed that there may be a paucity of evidence to confirm a diagnosis of long COVID, they pointed to the fact that all of Abrams’s providers confirmed that he was indeed sick and unable to meet the demands of his prior occupation.

The Court explained that “[b]eing a trial lawyer is akin to writing, directing, producing, and starring in a play simultaneously. The work is mentally and physically grueling. A reviewer must take that complexity into account when reviewing a claim.” The record shows that prior to his illness, Abrams was an avid marathon runner and worked 12-hour days. However, after his illness commenced, his primary care doctor noted that Abrams would “not be able to put together 1-2 workdays or partial workdays in a given week.” The Court further noted that if Abrams could not follow movie plots, he “cannot be expected to plan out trial strategies for multiple, complex cases.”

While Abrams was ultimately successful with his claim, the matter required costly and time-consuming litigation before the matter was resolved in his favor. This case highlights the challenges those with long COVID face when trying to collect benefits, and the need for strong medical records and supportive physicians. If you are experiencing long COVID and feel that you might need to file a claim, please feel free to reach out to one of our attorneys directly.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Abrams v. Unum Life Ins. Co., C21-0980 TSC, 2022 WL 17960616 (W.D. Wash. Dec. 27, 2022).

Ed Comitz and Patrick Stanley Named Top Lawyers in Arizona

Members Ed Comitz and Pat Stanley have been named two of Arizona’s top 100 lawyers for 2023 by AZ Business Magazine.

Selections were made in conjunction with industry experts, with an algorithm that ranked the attorneys based on professional ratings, impact on their law firm, impact on the profession and community involvement.

Can Your Insurer Deny Benefits After Years of Paying Out Claims? A Case Study

You’ve been receiving benefits for years—can your insurance company just change its mind and decide to suddenly deny benefits? That’s what happened in the case of Roehr v. Sun Life.[1] Dr. Roehr was a practicing, board-certified anesthesiologist who began experiencing intermittent tremors in his hands and fingers in 2004. While he was initially concerned that he had Parkinson’s disease, due to a family history, subsequent examinations by neurologists indicated that it was not Parkinson’s disease, rather he was diagnosed as having “a tremor of unclear etiology.”

In October 2006, Dr. Roehr stopped practicing out of concern for patient safety and filed a claim under the “own occupation” provision of his Sun Life policy. While none of the neurologists Dr. Roehr had seen were able to give a specific diagnosis related to his tremors, he continued to receive follow up care from his primary care physician, and Sun Life paid benefits for the next ten years. This was the case even though his primary care physician’s records failed to sometimes note an observation of tremors (usually when the record was dealing with a separate medical issue). Over these ten years, Sun Life occasionally requested medical updates from Dr. Roehr’s primary care physician.

In 2017, Sun Life retained a neurologist to review Dr. Roehr’s claim. The neurologist confirmed that Dr. Roehr did not have Parkinson’s disease and questioned whether Dr. Roehr’s condition might not have improved, based on the available medical records. Sun Life subsequently terminated Dr. Roehr’s benefits and upheld this decision on appeal in 2018.

In its review, the court acknowledged that review of the case was complicated by the facts that Dr. Roehr’s tremors were unexplained, his physician had observed temporary improvement in his condition, and he had not completed neuropsychological or other testing that had been suggested early on by a neurologist. However, the court ultimately sided with Dr. Roehr, indicating that Sun Life had not conducted an assessment by a neurologist/movement disorder specialist, even though their reviewing neurologist had recommended it. Further, the court explained that “Sun Life relied on virtually the same medical records for a decade and has pointed to no information available to it that altered in some significant way its previous decision to pay benefits.”

While Dr. Roehr was successful, the case had to proceed to costly litigation in order for him to prevail. The case is an example of why it is important to have carefully detailed medical records that clearly document a disability and stands as an important reminder that insurance companies are often looking for ways to deny claims, even those they have been paying out for years.

If you are on claim and feel that your insurance company has begun questioning your claim, please feel free to reach out to one of our attorneys directly.

[1] Roehr v. Sun Life Assurance Co., No. 21-1559, 2021 WL 6109959 (8th Cir. Dec. 27, 2021)

Traveling for Treatment A Case Study

What if you have to travel for treatment? Can your insurance company use that to question if you really are disabled? That is exactly what happened in the case of Sherrell v. Sun Life.[1] Sherrell was a research coordinator who filed for disability with her insurer, Sun Life Assurance Company of Canada, based on anxiety, depression and agoraphobia.

Shortly after filing for disability, Sherrell began receiving electroconvulsive therapy (ECT). In order to participate in ECT, Sherrell traveled to Minneapolis to stay with her daughter while receiving treatment, as she would not be able to drive while receiving the ECT treatments.

Sun Life denied Sherrell’s claim, indicating that they did not believe she was unable to work. In part they based this decision on a medical review they sought out by a physician certified in psychiatry and neurology. As part of his review, this doctor indicated, in part, that it was “inconsistent” that Sherrell was able to travel to Minnesota despite her condition. The original report also incorrectly stated that Sherrell had traveled “back and forth” to Minnesota.

The Court found this argument to be less than persuasive, stating that it failed to see how someone traveling to get needed medical treatment suggests that she is able to perform the tasks of her job.

We’ve seen insurance companies often overemphasize travel or other non-work-related activities in their denial of claims. If you feel your insurance company has overstressed your activities, such as traveling for treatment, in assessing your claim, please feel free reach out to one of our attorneys directly.

[1] Sherrell v. Sun Life Assurance Co., No. 20 C 7519, 2022 WL 474206 (N.D. Ill. Feb. 16, 2022)

Insurance Company Tactics: Ignoring Cognitive Deficits

It is not uncommon for those experiencing debilitating physical conditions, such as musculoskeletal issues, to experience cognitive impairments as well, resulting from both pain levels and side effects of medications. In fact, these cognitive impairments may even be the basis for continuing disability benefits—but will your insurance company recognize this?

One such example is the case of Sisung v. Unum[1]. Dr. Sisung, a pharmacist, became unable to practice when she was injured at work in 2006. Her injury resulted in lower back and neck pain. She treated with physical therapy, radiofrequency ablation, and medications. While the medications helped, they caused her problems with cognitive functioning, as her physician reported to Unum.

While Unum paid benefits to Dr. Sisung for the own-occupation period of her policy, they denied her claim when she reached the “any-occupation” period of her policy, when she would only be considered disabled if she was unable to perform the duties of “any gainful occupation” for which she was “reasonably fitted by education, training or experience.” Unum argued that Dr. Sisung’s physical condition had improved to the point that she was able to return to work in another occupation, and suggested that other professions she may be able to work in a sedentary-level occupation, such as a pharmacy area supervisor, a pharmacy manager or a pharmacy supervisor. Unum argued that Dr. Sisung did not have any cognitive impairment that would prevent her from performing these jobs.

The Court found otherwise—concluding that Unum’s determination was not supported. In part, they said that there were no conflicting statements in Dr. Sisung’s medical records regarding her cognitive impairment, Unum didn’t pursue their option of obtaining a second opinion through an Independent Medical Examination (IME), and Dr. Sisung had presented a neuropsychological examination which supported her claims of impairment.

This case demonstrates the uphill battle that claimants can face when a claim is based on cognitive impairments. If you have filed a claim and feel like your insurance is ignoring your diagnosis, please feel free to contact our attorneys directly to set up a consult.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Sisung v. Unum Life Ins. Co., No. 1:20-cv-00497-WMR, 2022 WL 1772273 (11th Cir. June 1, 2022).

Looking for Inconsistencies in Physician’s Statements: A Case Study

When you go to file a disability insurance claim, you will be required to submit evidence, usually including a statement signed by your treating physician, of your disability. What many don’t realize is that insurance companies will often require updated statements from treating physicians, and may even reach out to your physician directly with additional questions. What happens if your physician doesn’t fill out the form correctly, or somehow indicates you can return to work when you really can’t?

One such example of this is the case of Curiale v. Hartford.[1] Mr. Curiale was a vice president at Bear Sterns when he was injured in a motor vehicle accident and suffered head, shoulder and back injuries. As a result of his injuries, Mr. Curiale was no longer to perform sedentary work. He saw several physicians, many who completed physician’s statements that were submitted to Hartford.

One of Mr. Curiale’s doctors was a Dr Francis, who confirmed Mr. Curiale’s herniated discs and spondylolisthesis and noted several limitations including Mr. Curiale’s inability to bend at the waist, kneel, crouch or reach above his shoulder. On one physician’s statement, Dr. Francis opined that the limitations were expected to last for a year, but he also indicated on the form that there was an expected return to work date of six months. Hartford keyed in on this statement and sent a follow up letter to Dr. Francis. On this follow-up form, Hartford provided the definition of sedentary work and asked if Dr. Francis agreed that Mr. Curiale could perform such work on a full-time basis. Dr. Francis placed an x on the line indicating that he agreed with this statement. In a subsequent APS form, Dr. Francis opined on Mr. Curiale’s limitations again, indicating that they had improved. Based in part on this statement, Hartford terminated benefits.

However, Mr. Curiale underwent a functional capacity evaluation (FCE) which found that he would be unable to return to work in a sedentary position. When they received this FCE, Hartford again reached out to Dr. Francis. Dr. Francis indicated that Mr. Curiale’s functionality as represented on his previous APS did not remain “valid and accurate” and he indicated that he deferred to the expertise of the FCE clinician. However, Hartford still chose to uphold its denial of the claim.

The Court noted that the denial of benefits was triggered by comments by Dr. Francis that were subsequently withdrawn. Given this retraction, the court found that “the longitudinal medical record supports a finding of disability” and they found in favor of Mr. Curiale; however, not before the parties had had to engage in costly litigation. This case highlights how insurance companies will often cherry-pick statements from medical records and/or physician statements in order to find a basis to deny a claim—even in the face of other records or statements that consistently back up a finding of disability.

If you feel that your insurance company is looking to deny your claim based on an incomplete review of your medical records or physician’s statements, please feel free to reach out to one of our attorneys directly.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Curiale v. Hartford Life and Accident Ins. Co., No. 2:21-cv-54, 2022 WL 2063261 (D. Vt. June 8, 2022).

Multiple Disabling Conditions: A Case Study

It is not uncommon for individuals to have multiple disabling conditions that contributes to their need to file a claim. But will your insurance company take each diagnosis into consideration when determining eligibility for benefits?

One such case is that of Sorensen v. Hartford[1]. Ms. Sorensen sued Hartford after being denied long-term disability benefits. She suffered from a multitude of conditions, including (but not limited to) chronic fatigue syndrome, fibromyalgia, chronic pain and dysphasia, cervical and lumbar spine degenerative disc disease, Hashimoto’s thyroiditis, prediabetes, irritable bowel syndrome, rheumatoid arthritis, depression and anxiety. For these conditions she saw numerous medical professionals, many of whom had contact with Hartford during the claims process, whether via interviews or submitting an attending physician’s statement. The Social Security Administration awarded Ms. Sorensen disability benefits for multiple conditions, both physical and mental.

After having their own doctors review Ms. Sorensen’s medical records, Hartford determined that Ms. Sorensen met the definition of disability based on a mental illness and awarded benefits for 24 months (because her policy had a mental illness limitation on benefits). However, in their findings, these reviewing doctors concluded that any restrictions and limitations of her medical conditions would not prevent her from working in “any occupation”.

Upon review, the Court found that Hartford had erred in its denial for several reasons. In part, the Court criticized Hartford for not completing an in-person medical evaluation, especially given that many of Ms. Sorensen’s health conditions were not “susceptible to objective verification” (such as fibromyalgia). Further, a Hartford reviewing doctor cherry-picked medical records, looking at five office visits rather than the entire medical file, and was never given a copy of the SSA’s decision granting Ms. Sorensen Social Security benefits in order to distinguish his conclusions.

If you feel that your insurer is not fully considering your disabling medical conditions, please feel free to reach out to one of our attorneys directly.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is using any of the tactics above to evaluate your claim, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Sorensen v. Hartford Life Ins. Co., No. 4:21-cv-00286, 2022 WL 2135811 (D. Idaho June 14, 2022).

Rescission: A Case Study

Recently we’ve seen that insurance companies are conducting more rescission reviews. Rescission is a legal principle where insurance companies can avoid payment and even void a policy if there were any misstatements made in a policy application. We typically see this happening when it comes to the health questionnaire portion of policies. Insurance companies may even sue a policyholder in order to rescind a policy, and seek attorney fees and costs.

One such example is the case of Principal v. Hill[1]. Principal sued Ms. Hill seeking to rescind her deceased husband’s life insurance policy, after Principal discovered that the husband had made material misrepresentations and omissions on his life insurance application within the policy’s two-year contestability period. As part of the application, Mr. Hill was required to submit a Statement of Health. According to Principal’s complaint, Mr. Hill did not disclose consultations with physicians, tests, treatments, medications, symptoms and medical conditions. The Statement of Health also contained language to the effect that, by signing it, the Hills were confirming that the answers “were complete and true to the best of my knowledge” and that “any false statements, omissions or material misrepresentations regarding age or health information could cause coverage, if issued, to be cancelled as never effective.” Principal asked the Court to rescind the policy as to amounts over the guaranteed issue amount of $20,000.00, stating that it had relied on these misrepresentations when it issued the policy.

In this instance, the policy was an ERISA policy, and ERISA law allows for the rescission of insurance contracts entered into under false representations of health. Here, the Court found in favor of Principal and rescinded the policy. The Court also awarded attorney fees and costs, as Principal had demonstrated that they achieved “some degree of success on the merits” of the case, including that they had shown a valid basis for rescission.

While this is a life insurance case, we often seen similar situations when it comes to disability insurance cases. More and more, insurers are going through policy applications with a fine-toothed comb, looking for any misrepresentations. They may even request medical records from decades earlier in an attempt to find discrepancies. The takeaway is that it is imperative to be careful and accurate when filling out applications, or you may find yourself without coverage when needing to file a claim. If your insurance company has mentioned rescission, it is important to speak with an experienced disability insurance attorney right away.

If you have questions regarding how rescission works, or fear your insurance company may be seeking to rescind your policy, please feel free to reach out to one of our attorneys directly.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is using any of the tactics above to evaluate your claim, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Principal Life Ins. Co. v. Hill, No. C21-1716 MJP, 2022 WL 2718087 (W.D. Wash. July 13, 2022).