Firm Named #1 Healthcare Law Firm

We are pleased to announce that we have been named Arizona’s #1 Healthcare Law Firm by Ranking Arizona: The Best of Arizona Business for 2020.

The Firm outranked other regional, national and international firms in Arizona, due to Ed Comitz’s nationally acclaimed disability insurance practice, which exclusively focuses on helping professionals (primarily physicians and dentists) collect their rightful disability benefits under private, “own-occupation” policies.

The Evolution of Disability Policies Part 2: Interviews and Examinations

In Part 2 of our series on how disability policies have evolved over time, we’ll examine provisions related to personal interviews and in-person examinations.

Most older policies give the company the right to interview you, and say something along these lines:

Personal Interview. The company may conduct a personal interview of the Insured.

Newer policies, however, are much more aggressive and can include statements like:

Examinations. You must meet with Our representative for a personal interview or review of records at such time and place, and as frequently as We reasonably require.

or:

We must be provided with satisfactory proof of loss. If the proof of loss requirements We request are not received, the claim will be denied. Proof of loss requirements include, but are not limited to:

-

-

- A personal interview with a company representative, which may include a statement under oath.

-

Sometimes these interviews are conducted over the phone, sometimes on a recorded line, and other times the company will send a field examiner out to interview you in-person at your home or office.

These interviews are often a critical factor in whether a claim is accepted or denied, and should be taken seriously—particularly if the statements are being made under oath.

Every claim is different, and these are just some examples of examination provisions taken from different policies. Your policy may contain different and/or additional language that could impact your particular situation. If you are unsure about the terms of your policy, or how a provision applies to your specific situation, you should contact an experienced disability insurance attorney.

Insurance Company Tactics: Ignoring Treating Physician Evidence

In most disability claims, insurance companies begin their investigation by requesting a report from your treating physician, along with medical records. However, if they are not happy with the treating physician’s opinion, they may turn to other tactics.

The case of Card v. Principal[1] is one example. In February 2013, registered licensed practical nurse Susan Card was diagnosed with chronic lymphocytic leukemia. Initially the condition was asymptomatic, but increasingly she began to experience worsening fatigue. She reduced her work hours and ultimately had to stop working altogether as her symptoms worsened. Card’s primary care physician noted her fatigue, easy exhaustion, chronic vaginal bleeding, feelings of depression and being wiped out, and night sweats, concluding that “she is failing work because of her disease and needs to go out on disability.” But in spite of all this, Principal denied her claim.

Due to increasing financial struggles, Card had to move states to live with her sister, having lost her house to foreclosure. Her primary care physician again informed the insurance company of Card’s inability to work and explained that, while her blood work looked better because she was no longer working, she was still dealing with chronic fatigue. He continued, “I do not see her being able to have any work capacity.” Her treating doctor then instructed her to follow up with new doctors upon her move. Card found a specialist in hematology and oncology and a gynecological oncologist, once she was able to find specialists that accepted medicaid. Card also appealed the initial denial but, again, Principal denied her claim in spite of her treating doctor’s statements that she was disabled.

In doing so, Principal essentially ignored Card’s doctor’s statements and justified their denial, in part, by claiming that Card had not submitted documentation that she was “under the regular and appropriate care of a physician” as required under the terms of her policy (Card’s policy, like most policies, contained a care provision, which establish additional requirements for qualifying for benefits). However, in this instance, Card’s physicians had told her that further appointments were not necessary in the months after her diagnosis (as is common in the early stages of chronic lymphocytic leukemia, given the nature of the disease).

Upon review, the Court found that none of the reviewers had adequately addressed Card’s specific health issue against the actual demands of her job (i.e. she could not be exposed to pathogens), nor addressed their reasoning for ignoring Card’s treating providers’ evidence and recommendations for the course/frequency of her treatment. The Court held that, while Principal was not required to give more weight to a claimant’s treating provider’s opinion, insurance companies cannot arbitrarily refuse to consider that opinion. The Court remanded the case, concluding that Principal’s decisions were not “the product of a principled and deliberative reasoning process.”

In this instance, Card was fortunate to have had supportive physicians who documented her condition and why she could no longer work in her previous occupation. However,the Court ultimately had to step in to make sure Principal did what was right, demonstrating that sometimes supportive physicians and evidence may not be enough avoid a claim denial.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If your policy’s terms are not what you expected, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Card v. Principal, No. 2019 WL 5618182 (U.S. Ct. of App. 6th Cir. Oct. 31, 2019)

The Evolution of Disability Policies Part 1: Care Requirements

In this series, we will be examining how insurance companies have changed disability policies over time to make it harder to collect benefits. In Part 1, we’ll be looking at care provisions.

Most disability policies require you to be receiving ongoing medical care in order to remain eligible for ongoing benefits. Earlier disability policies typically addressed this requirement in a short, simple manner. For example:

Benefits are provided for the Insured’s total or partial disability only if:

-

-

- the Insured is under the care of a licensed physician other than himself during the time he is disabled

-

In contrast, newer policies (particularly those sold to dentists, physicians, and other professionals) now have much more stringent care requirements. For example:

REGULAR CARE BY A DOCTOR – means:

-

-

-

- You are evaluated in person by a Doctor; and

- You receive treatment appropriate for the condition causing Your Disability; and

- Your evaluations and treatment are provided by a Doctor whose specialty is appropriate for the condition causing your Disability; and

- The evaluations and treatment must be at a frequency intended to return You to Full Time Work; and

- You must pursue reasonable treatment options or recommendations to achieve maximum medical improvement.

-

-

(emphasis added). In addition, some policies hide additional caveats related to your care in other parts of the policy. For example, a policy that contains a definition of “regular care” could also have a “duty to cooperate” provision in another part of the policy that states something like this:

You have a duty to cooperate with us concerning all matters relating to this policy and any claims thereunder. This cooperation includes, but is not limited to . . .

-

-

-

-

- securing appropriate medical treatment for condition(s) upon which your claim for benefit under this policy is based. This includes such corrective/remedial surgery or generally accepted medical procedures which to an ordinarily prudent person would appear medically reasonable for such condition(s).

-

-

-

(emphasis added). When you consider these provisions along with the fact that most disability policies allow your insurance company to request in-person medical examinations, you can see that filing a disability claim is not as simple as finding a doctor to sign off that you are disabled. The process is much more involved than that. In addition to being prepared to back up your diagnosis and limitations, you should be prepared for challenges to your doctor’s treatment plan (and be able to explain why you are not complying with your doctor’s recommendations, if there is a recommended treatment that you are not pursuing).

Every claim is different, and these are just some examples of care provisions taken from different policies. Your policy may contain different and/or additional language that could impact your particular situation. If you are unsure about the terms of your policy, or how a provision applies to your specific situation, you should contact an experienced disability insurance attorney.

Utah’s Physician Shortage

Experts with the American Association of Medical Colleges anticipate a shortage of 122,000 physicians by 2032, with the possibility that historically underserved areas may experience these shortages more acutely, both in primary and specialty care.

Utah, as with many states, is a part of this trend. Specifically, the U.S. Department of Health estimates that there will be a shortage of 600 primary care physicians by 2025. Currently, 26 of Utah’s 29 counties have shortage areas, and 18 are underserved for dental providers (shortage areas are defined as those that have 3,500 people or more to one doctor). As a result, some physicians and dentists are having to take on heavier workloads, which can make them more susceptible to disabling injury or illness, including mental health conditions like anxiety and depression.

Utah is taking steps to address this shortage, in part by establishing the Healthcare Workforce Financial Assistance Program and the Rural Physician Loan Repayment Program, which offer student loan repayments to physicians, dentists, and mid-level providers who agree to work in underserved areas. Because clinics in underserved areas, whether they be rural or urban, tend to pay less on average, experts hope the offer of loan repayment will incentivize residents and doctors to consider and accept jobs in these sectors, and hopefully choose to stay on once their obligation period passes.

Sources:

Ashley Imlay, Doctor shortage brings creative solution: Work here and we’ll help pay your student debt, Deseret News, Oct. 27, 2019

Utah Department of Health

Public Health Indicator Based Information System (IBIS), Utah’s Public Health Data Resource

New York Life Buys Group Disability Business from Cigna

New York Life Insurance Company has agreed to buy Cigna’s group life and disability insurance business for $6.3 billion. Cigna also engaged in talks with MetLife, Inc. and SunLife Financial Inc. before closing the deal with New York Life Insurance Co. in December.

Cigna reports that the proceeds will be used in 2020 for share repurchase and repayment of debt. Cigna’s debt load rose to over $40 billion after its $67 billion takeover of Express Scripts, a pharmacy-benefits manager, last year. The unit being sold generated $5.1 billion of adjusted revenue last year.

New York Life is the largest mutual life insurance company in the U.S. and it currently offers life insurance, retirement income, investments, and long-term care insurance. This deal will make New York Life one of the largest providers of non-medical insurance for group benefits programs.

Group businesses like Cigna’s can be attractive to insurance companies looking to diversify, and it is not unusual for insurers to sell portions of their businesses (including group and/or individual disability insurance policies) to other insurers or turn these businesses over to third-party administrators. Both scenarios can change how claims are administered. In this instance, Cigna and New York Life will engage in a multi-year collaboration, and Cigna employees involved in the Group Insurance block will transfer to New York Life.

Sources:

New York Life to Acquire Cigna’s Group Life and Disability Insurance Business, Cigna Newsroom, Dec. 18, 2019

New York Life to acquire Cigna’s group life and disability insurance business, New York Life Newsroom, Dec. 18, 2019

Katrina Nicholas, New York Life to Buy Cigna Unit in $6 Billion-Plus Deal, FT Says, Bloomberg, Dec. 17, 2019

Alicja Grzadkowska, Confirmed: New York Life will buy $6 billion Cigna unit, Insurance Business America, Dec. 18, 2019

Glaucoma – Part II

In part one of our series on glaucoma, we looked at some of the symptoms and causes of the disease. In part two we will review some of the different treatment options, as well important considerations physicians and dentists must take into account when considering filing a disability claim based on a diagnosis of glaucoma, or other vision-related conditions.

Treatment:

The goal of treatment is to slow the progression of the disease by lowering intraocular eye pressure, as there is no cure and no way to reverse damage that has already occurred.

In a majority of cases doctors will start out with conservative treatment, which may include:

- Prescription eye drops that work to improve how fluid drains from the eye or by decreasing the amount of fluid the eye produces

- Oral medications – typically a carbonic anhydrase inhibitor

- Additional lifestyle changes and alternative/home remedies:

- Healthy diet

- Regular exercise

- Limiting caffeine intake

- Moderate amount of fluids throughout the day (too much fluid at once can increase eye pressure)

- Sleeping with an elevated head

- Relaxation techniques

With advanced cases or if conservative treatment doesn’t work or causes side-effects, surgical options include:

- Laser therapy – a small laser beam opens clogged channels in the trabecular meshwork

- Filtering surgery – surgical procedure (trabeculectomy) where an opening is made in the white of the eye and part of the trabecular meshwork is removed

- Drainage tubes – a small tube shunt is inserted into the eye to drain excess fluid and lower the eye pressure

- Minimally invasive glaucoma surgery (MIGS) – procedures that involve microscopic-sized equipment and tiny incisions. While these procedures are considered safer than traditional surgical procedures, they also provide only moderate pressure reduction, and are therefore mainly used for the early to moderate stages of the disease.

Some risks of surgery include:

- Vision loss (either reduced or completely lost)

- Bleeding inside the eye

- Infection

- Low eye pressure – usually temporary but may require additional surgery to correct

- Scarring – may result in the operation failing

- Cataract formation

The success rate and whether conservative treatments will still be needed, or even whether procedures may need to be repeated, depend on a patient’s age, stage of the disease, and other health factors. Many individuals with glaucoma are able to continue to read, work, and even drive for some time, depending on how far the disease has progressed. However, for dentists and physicians who rely on their central and peripheral vision, depth perception, and visual acuity to practice, a diagnosis of glaucoma could potentially be (or become) totally disabling.

If you have been diagnosed with glaucoma and fear that it may be impeding your ability to continue to safely practice on patients, you should speak with an experienced disability insurance attorney. It is particularly important to speak with an attorney before changing your schedule and/or job duties or beginning to work outside your field, because making changes like these could jeopardize your ability to collect, or continue to collect, benefits under your policy.

These posts are for informative purposes only and should not be used as a substitute for consultation with and diagnosis by a medical professional. If you are experiencing any of the symptoms described above and have yet to consult with a doctor, do not use this resource to self-diagnose. Please contact your doctor immediately and schedule an appointment to be evaluated for your symptoms.

Sources:

Glaucoma Research Foundation

American Academy of Ophthalmology

National Eye Institute

BrightFocus Foundation

MedicineNet

Mayo Clinic

Glaucoma Service Foundation

Survey Looks at Individual Disability Trends

A recent news article looked at a survey conducted by Milliman, an actuarial consulting firm, of 15 U.S. individual disability insurance issuers.[1] These 15 companies made up about 90% of the individual disability insurance sales in the U.S.

Questions elicited a variety information, including coverage available, occupations of purchasers, and sales information. Based on the insurance companies’ answers, analysts found the following:

- Doctors and surgeons purchased fewer new policies (down from 31% to 30%)

- Attorneys purchased more new policies (up 6.1% to 6.4%)

- Policies sold overall increased between 2019 and 2019 (up 13%)

- Annualized premiums from new policy sales increased (up 1.5%, to $401 million)

The percentage of applicants who received “issued as applied coverage” rose slightly (about 1%) and the rate of applicants who received rates higher than expected or coverage terms that were tougher than expected dropped (about 2%). However, analysts also concluded that individual disability insurers may have rejected a high percentage of applicants in 2018 than 2017, with the percentage of those receiving flat rejections rising from 16.1% to 16.6%.

In looking at this data, analysts surmised one reason for this shift could be based on which insurance companies were selling the coverage, as each insurer has unique approaches to underwriting. For example, one insurer may reject a higher percentage of applicants, while another may reject fewer applications but provide modified coverage.

[1] Allison Bell, Individual Disability Rejection Rate Looks Higher: Milliman, Think Advisor, Nov. 27, 2019, 9:31 p.m.

Glaucoma – Part I

While glaucoma may be considered a common disease of aging, it can occur in anyone and result in potentially career-ending impairment or loss of sight, especially if left untreated. For those whose livelihood depends on good eyesight, including dentists and physicians, a diagnosis of glaucoma can be particularly overwhelming. As we’ve discussed before, filing disability claims based on vision-related conditions is possible, but presents a unique set of challenges.

In this post we will look at the different types of glaucoma and common symptoms.

What Is It?

Glaucoma is a group of eye conditions that damage the optic nerve, which is crucial for good vision. The damage is often caused by abnormally high pressure in the eye. Normally there is a balance between the amount of aqueous humor that is produced in and that leaves the eye but when the eye doesn’t drain properly or is otherwise blocked, excess fluid can back up and increase intraocular pressure (IOP). There are several forms of glaucoma, the most common include:

- Open-angle glaucoma: the most common form (70-90%). The drainage angle formed by the cornea and iris remains open, but the trabecular meshwork is partially blocked, which causes pressure in the eye to gradually increase. The pressure then damages the optic nerve. The changes often happen so slowly that vision may be lost before someone is even aware of a problem.

- Angle-closure glaucoma: also called closed-angle glaucoma, occurs when the iris bulges forward and narrows or blocks the drainage angle formed by the cornea and iris. Therefore, fluid can’t circulate through the eye and pressure increases. This type can be acute (a medical emergency) or chronic and happen gradually. Blindness more often occurs from this than open-angle glaucoma and is largely inherited.

Causes:

In adults, these chronic forms of glaucoma can be caused by:

- Having high internal eye pressure

- Age (over 40)

- Race (Asian, Black, Hispanic)

- Family history

- Certain other medical conditions (notably: diabetes, heart disease, high blood pressure, sickle cell anemia)

- Corneas that are thin at the center

- Extreme near or farsightedness

- Eye injury or certain types of eye surgery

- Taking corticosteroid medications (especially in the form of eye drops) for extended periods of time

Symptoms:

- Gradual loss of peripheral vision, typically in both eyes (open-angled)

- Patchy blind spots either in peripheral or central vision, often in both eyes (open-angled)

- Tunnel vision in advanced stages (open-angled)

- Chronic angle-closure glaucoma: similar slow progression, but 30% will have an attack of acute angle-closure

- Acute angle-closure symptoms include: severe headaches, eye pain, nausea and vomiting, blurred vision, halos around lights, eye redness

- Sometimes patients report sight difficulty (e.g. with reading) before acuity is measurably worse

Diagnosis:

An eye doctor will likely conduct several tests to assess the health of the eye–including eye pressure and the optic nerve–to determine whether glaucoma is present and, if so, how far it has progressed.

- Tonometry test – examines inner eye pressure

- Ophthalmoscopy (dilated eye exam) – to determine the shape and color of the optic nerve

- Perimetry (visual field test) – tests the complete field of vision

- Gonioscopy – looks at the angle in the eye where the iris meets the cornea

- Pachymetry – examines the thickness of the cornea

Progression:

- In advanced stages, only a small central area of vision is left, eventually the damage to the optic nerve can be severe enough to cause blindness

- Those with moderate or severe glaucoma also describe looking through a fog, which extends into central vision

- Depth perception is affected

- Untreated glaucoma will eventually cause blindness, sometimes within several years – but treated the odds of going blind are considered low

- However, even with treatment, 15% of people with glaucoma will go blind in at least one eye within 20 years

The rate of progression will depend on a variety of factors including age, overall health of the eye and amount of time elapsed before starting treatment. In the next post we will discuss common treatments for glaucoma and what a diagnosis could mean for a professional suffering from vision impairment.

These posts are for informative purposes only and should not be used as a substitute for consultation with and diagnosis by a medical professional. If you are experiencing any of the symptoms described above and have yet to consult with a doctor, do not use this resource to self-diagnose. Please contact your doctor immediately and schedule an appointment to be evaluated for your symptoms.

Sources:

Glaucoma Research Foundation

American Academy of Ophthalmology

National Eye Institute

BrightFocus Foundation

MedicineNet

Mayo Clinic

Glaucoma Service Foundation

Ed Comitz Selected as 2020 Arizona Business Leader

Ed Comitz has again been named one of the Top 500 Arizona Business Leaders in 2020 by Arizona Business Magazine.

Over 5,000 names were considered for this prestigious honor, winnowed down to only 500 of the best and brightest Arizona leaders. Ed was one of only five individuals selected as one of the best attorneys in the field of health care law, based on his nationally acclaimed disability insurance practice, which is one of the largest and most successful in the country. Ed exclusively represents professionals (primarily physicians, dentists, corporate executives, athletes and other attorneys), and tirelessly represents policyholders to overturn and avoid disability claim denials.

Editor in Chief, Michael Gossie, writes of the 500 leaders selected, “They are catalysts for Arizona’s economy. They are leaders. They are innovators. They have influence. And when they speak, they make things happen. And together, they are guiding Arizona toward greatness.”

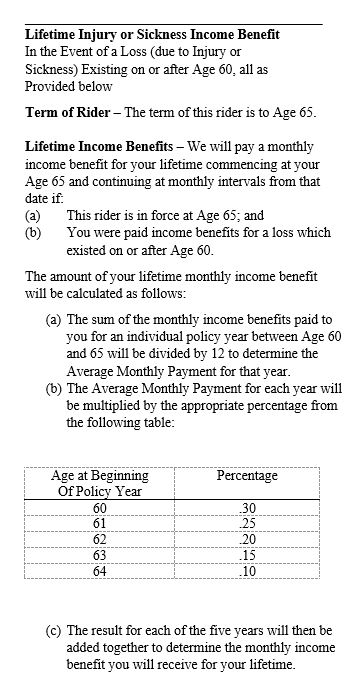

Why You Must Read Your Riders: Graded Lifetime Benefits

We have stressed in prior posts the importance of reading and understanding your policy before filing for disability insurance benefits. A failure to understand and abide by the provisions in your policy can lead to the denial of your disability insurance claim or termination of your benefits.

When reviewing their coverage, many physicians and dentists merely review the short, summary pages (or schedules) that are usually found at the front of a disability policy. The schedule of benefits section can contain plenty of important information, such as the maximum monthly benefit, the premium amounts, a list of the riders attached to the policy, and the benefit period. But it is only a small snapshot of your policy.

For example, your policy schedule may state that you have “lifetime” benefits and, if that is all you look at, you may assume that you will receive the full benefit for your lifetime if you file a disability claim. However, oftentimes, there are specific requirements for obtaining lifetime benefits and/or restrictions on the amount of the lifetime benefit. These additional restrictions and limitations may not become apparent until you read the full lifetime benefit provision within the policy itself.

Here is one example of a particularly complex lifetime benefit rider taken from an actual policy:

This rider is not only hard to understand—it provides underwhelming coverage that is much different than what you might expect if you only read the policy schedule. Accordingly, it is important to read your entire policy, and not simply the schedule pages, to make sure that your coverage is in line with your expectations.

Insurance Company Tactics: IMEs, Rushed Exams and Piecemeal Testing

Many policies allow insurers to conduct Independent Medical Examinations (IMEs) throughout the course of a claim. While the stated goal of an IME is usually to “verify” your disabling condition, insurance companies often use IMEs as a tactic for denying or terminating claims.

One such example of this is the case of Hughes v. Hartford.[1] Patricia Hughes was working as a registered nurse when she began to experience vertigo and was diagnosed with Meniere’s disease. She ultimately filed a claim with her disability insurance carrier, Hartford. Hartford initially approved the claim; however, a few years later, they became particularly aggressive, interviewed her treating provider, conducted a field interview, hired an in-house doctor to review records, hired a surveillance company to follow Hughes, and terminated her benefits.

When Hughes appealed the denial, Hartford scheduled her to undergo an IME with a neurologist, Dr. Schiff, who concluded that Hughes’ test results were normal and that her diagnosis of vestibular dysfunction was inconsistent with the previously gathered surveillance footage. Hartford then used the report as a basis for upholding the denial, in spite of the fact that a nurse who accompanied Hughes to the exam stated that the examination was “very elementary,” “limited”, and “rushed”. Hartford also ignored concerns Hughes’s treating doctor raised about the exam—namely that Dr. Schiff was not trained in vestibular disorders and that Dr. Schiff notably “did not perform any of the tests which actually [had] been historically abnormal for Ms. Hughes including audiogram, video ENG, or posturography, so he seems to have omitted the most relevant data from his examination.”

Upon reviewing Hartford’s conduct, the judge determined that, under the circumstances, Hartford had not conducted a “full and fair review” and required Hartford to reconsider its denial of Hughes’s claim.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you feel that your insurer is not giving your claim a full and fair review, an experienced disability insurance attorney can help you assess your particular situation and determine whether your insurer’s actions are appropriate.

[1] Patricia Hughes v. Hartford Life and Accident Insurance Co., No. 3:17-cv-1561 (JAM), 2019 WL 1324947 (D. Conn. March 25, 2019)

Disability Insurance Roulette with Edward O. Comitz: Dentistry Uncensored with Howard Farran

Founding member Ed Comitz recently sat down with Howard Farran, DDS, MBA of Farran Media to discuss the issues dentists face when filing “own occupation” disability claims.

Dentists are uniquely susceptible to slowly progressive, degenerative disabling conditions (such as musculoskeletal conditions like degenerative disc disease) due to the physical stressors of the job. Dentists’ claims are also often targeted for denial because of high benefit amounts, particularly if they have a condition that is difficult to prove up with objective medical evidence and testing.

During the podcast, Ed addressed several topics, including:

- Why are most of your clients dentists?

- When am I “sick enough” to file a claim?

- What is a true own occupation policy? Are there different types of own occupation policies?

- What should I expect if I file a claim?

For more information,watch the podcast below

Why You Should Read Your Policy Carefully: A Case Study

In prior posts, we’ve discussed the importance of thinking through the pros and cons of replacing an older policy with a newer one. We’ve also cautioned against blindly relying on agents when selecting a policy, without taking the time to read through what you are purchasing yourself.

The recent case of Mathis v. MetLife[1] illustrates why this is so important. Dr. Mathis, an orthopedic surgeon, had a Standard policy that he decided to replace in order to protect his increased income and earning ability. At the suggestion of his insurance broker, Dr. Mathis purchased a MetLife policy to replace the Standard policy. While the benefit amount of this new policy was higher and the MetLife policy was marketed as an “own-occupation” policy, it had additional terms that limited Dr. Mathis’s ability to work in a different capacity and collect disability benefits, if he could no longer be a surgeon.

Over ten years after purchasing this MetLife policy, Dr. Mathis became disabled and was no longer able to practice as an orthopedic surgeon. Believing that he had a policy that allowed him to collect benefits as long as he couldn’t do his prior occupation (and under the assumption that it didn’t matter if he was employed in a different profession), he took a job at an orthopedic device manufacturer.

Upon learning of this new job, MetLife informed Dr. Mathis that, in addition to being unable to perform the material and substantial duties of his regular occupation (orthopedic surgeon) he also had to demonstrate he was “not gainfully employed” in order to qualify for total disability benefits.

At that point, Dr. Mathis could not undo the decision to start the new job, so Dr. Mathis and his lawyer sued MetLife, the brokerage firm, and his insurance broker for breach of contract, alleging that they were negligent in becoming familiar with the MetLife policy and negligently failed to insure him for total disability within his occupation (without the need to be gainfully employed), which was the coverage he thought he was getting. In response, the defendants argued that Dr. Mathis had had the policy for over ten years, and that he had a duty to read the policy when he first received it.

To date, the dispute is still ongoing and has not been fully resolved by the courts. However, so far, Dr. Mathis has had to deal with the additional initial headache of arguing over which state law applies to the dispute, since Dr. Mathis had been living and practicing in Alabama when he bought the policy (but now lives in Massachusetts), MetLife is headquartered in New York, and the broker’s company is headquartered in Indiana. It remains to be seen whether Dr. Mathis ultimately prevails, but at the very least, he would have saved significant expense and stress if he had simply read the terms of the MetLife policy carefully before paying years of premiums for coverage that he did not want.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If your policy’s terms are not what you expected, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Mathis v. MetLife, No. 1:18-cv-01893-JRS-DLP, 2019 WL 1409464 (S.D. Ind. March 28, 2019).

Insurance Company Tactics: Overemphasizing Daily Activities

In prior posts, we’ve discussed how insurers conduct surveillance to determine if you can go back to work. Insurers also gather information about your daily activities through field interviews, claim forms and looking through your medical records for statements about your activity levels.

Many dentists and physicians with “own occupation” policies wonder why they are being asked these questions. In their minds, their hobbies and activities are completely unrelated to whether they can return to practice. However, to an insurer, gathering this information is often the first step towards challenging (and potentially denying) a claim. Insurers like to use reports or surveillance footage of daily activities to argue that a claimant’s condition has improved—particularly when a claim involves subjective symptoms, such as pain or numbness, that may be difficult to objectively verify.

The recent case of Dewsnup v. Unum[1] illustrates how insurers attempt to use information about claimants’ daily activities against them. Dewsnup was trial attorney who underwent quadruple bypass surgery after suffering a heart attack. Although the surgery was successful as far as his heart was concerned, he developed a constant burning pain across his chest at the incision site.

When he was not able to return to work after the surgery due to pain and fatigue, Dewsnup filed a total disability claim with Unum. Unum initially approved Dewsnup’s claim, but when Dewsnup eventually returned to the office part-time, Unum conducted a renewed, in-depth investigation of his claim and ordered a review of his medical records. When Unum contacted him, Dewsnup explained that his time in the office was limited, that he was only there to interact with clients, and that he was in no condition to go back to the rigors of practicing as a trial attorney (such as staying up all night, dealing with other attorneys, etc.).

Although Dewsnup had an own-occupation policy, Unum terminated Dewsnup’s benefits. When Dewsnup sued Unum, Unum argued that he could return full-time to the demanding and stressful work of a trial attorney, in part because he’d told Unum in phone interviews and other forms that he was able to wear his seatbelt when in a car, help his wife with chores, walk on a treadmill most days of the week, and had carved a wooden mantle.

Fortunately, the court was familiar with the duties of a trial attorney and held Unum in check. The court reversed the claim denial, observing that “Mr. Dewsnup never claimed that his pain was completely disabling in every facet of his life. . . . It is probable that his pain would prevent him completing the mentally-taxing work of trial attorney, but not prevent him from accomplishing relatively simple and low-stress daily tasks.”

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you feel that your insurer is improperly targeting your claim for denial, an experienced disability insurance attorney can help you assess your particular situation and determine whether the insurer’s action is appropriate.

[1] Dewsnup v. Unum Life Ins., 2018 WL 6478886 (D. Utah)

Arizona’s Doctor Shortage Highest in Rural Areas

In a prior post, we discussed Arizona’s new universal licensing law that allows certain professionals from other states to relocate to Arizona without additional licensing requirements. A recent study by the Arizona Hospital and Healthcare association found that Arizona ranks 44th out of 50 in its ratio of active primary care doctors to population, and Arizona’s shortage of about 600 doctors is more pronounced in rural and remote parts of the state.

This shortage is expected to triple in the next decade, attributed, in part, to a growing state population and an aging population that is outliving their predecessors (and thus needing more medical care). Current conditions (such as run-down facilities) make it hard to attract replacements, especially in these already under-served areas. In remote locations, one physician can serve thousands of residents. Such an overwhelming workload puts physicians at risk for burnout, mental health conditions like anxiety or depression, illnesses, and injury. It also can result in presenteeism—doctors working in spite of their own health conditions, and ignoring the risk to patients and their own health.

One solution the state is exploring is the expansion of local residency programs for general surgery and internal medicine, with the hope that those who complete their residency in Arizona will ultimately choose to stay and set up practice.

Sources:

Arizona’s Rural Hospitals Facing Severe Doctor Shortage, Associated Press, Sept. 7, 2019.

CNBC: Solving the Doctor Shortage, CNBC, Sept. 6, 2019.

The Importance of Having a Transition Plan: Part II

Physicians and dentists with slowly progressive conditions face unique challenges and hurdles when it comes to filing a claim with their disability insurance company. In the previous post in this series, we looked at a few things doctors should take into account when deciding what to do with their practice in the event they need to file a disability claim. Another important part of a transition plan is determining an appropriate work schedule, given your condition, symptoms and policy requirements.

Should I Keep Working?

This is another question that we are asked a lot and, again, the answer is, it depends. There are risks associated with continuing to practice, but you can also prejudice your chances of collecting benefits if you make changes to your work schedule or take on another job without taking the requirements of your particular policy into account.

The primary factor is, of course, whether it is safe for you to be treating patients. If it’s not safe to practice, you shouldn’t be practicing. But with slowly progressive conditions, this can be a difficult thing to assess. There are usually good days and bad days. There may be remedies (like stretching, or ice/heat) that initially help, but over time lose effectiveness. Or in certain situations (such as progressive neuropathy or an essential tremor) the changes may happen so slowly that it is hard to perceive the day-to-day progression.

In addition, your policy may have certain definitions or requirements that set certain parameters for filing a successful claim that you can run afoul of if you are not careful. Some of the most common mistakes we see include:

- Reducing work hours. While working shorter hours may make symptoms more bearable, doing this for too long could prompt your insurance company to change your classification from “full-time” to “part-time.” This becomes problematic because it is more difficult to prove you are totally disabled from working part-time. For example, if you stop taking on-call shifts and file a claim several months later, the company may argue that your previous on-call hours should no longer be considered part of your occupational definition for purposes of your disability claim.

- Reducing procedures. Similarly, changing the types of tasks you perform can also prompt insurers to maintain that you have changed the material and substantial duties of your job. For example, if you’re a dentist and you stop performing root canals, your insurer may argue that your occupation is “a dentist who doesn’t perform root canals.” Again, this makes it more difficult for you to establish total disability because the more difficult procedures/duties are removed from the equation.

- Taking a side job. Cutting hours or lightening work load can lead to a significant loss of income, so doctors often turn to side jobs that don’t exacerbate their symptoms, such as teaching part time at a local dental or medical school, financial advising, consulting, or perhaps selling real estate. However, what many don’t realize is that newer disability insurance policies often have plural definitions of occupation that define your occupation as everything you are doing immediately prior to the onset of disability. Again, an insurer can use the (lighter) duties of a second job to argue that you can still work as say, a real estate agent, and are therefore not eligible for total disability benefits, even if you can no longer practice as a doctor.

These are just a few examples of occupational changes that can have a dramatic impact on the future success of a disability claim. How much of an impact depends on the particular language of your policy, and this is not intended to be an exhaustive list of all of the issues that can arise during the transition out of practice. The above examples are merely intended as examples of why it is important to have a transition plan and know what your policy(ies) say before filing a claim. Conversely, if you put off these important questions for too long, you can make it much more difficult (and, in some cases) impossible to collect total disability benefits.

If you are considering filing a claim, or wondering how a transition plan would work for you, an experienced disability insurance attorney can help you understand the terms of your policy and apply it to your particular situation.

SEAK Inc.’s 16th Annual Non-Clinical Careers for Physicians Conference, Oct. 19-20, 2019

Many doctors and dentists find themselves unable to practice, whether due to a disability, burnout, loss of mobility or opportunity, wanting more control over their schedule, the desire for financial gain, or wanting to pursue different interests. Doctors with own occupation disability policies may be able to work in a different career and collect disability benefits, if their policies allow for that. But sometimes it can be hard for doctors to make the transition to a new career.

SEAK, Inc.’s 16th Annual Non-Clinical Careers for Physicians Conference is one resource for physicians looking to explore careers outside of the clinical setting, either full or part-time. This year, SEAK’s conference will be October 19 -20, 2019 in Chicago, Illinois, The attendees (over 400+ physicians in a variety of specialties) will participate in courses with over 40 faculty members, as well as attend free one-on-one mentoring sessions to explore dozens of non-clinical opportunities, and potentially meet with recruiters and employers. Industries that have recruited in the past include biotechnology, pharmaceuticals, medical devices, and healthcare consulting, among many others.

Potential opportunities discussed will include medical expert witnessing, writing (medical and non), conducting independent medical exams, file and peer reviews, consulting, life care planning, and inventing. Several of the presenters have transitioned out of clinical practice themselves and have gone on to become medical writers, work for agencies like the FDA, become physician or career coaches, CEOs, and entrepreneurs, among many other varied careers. The conference aims to show physicians that switching to a non-clinical career is an opportunity that “is in fact a step forward, not a step backwards,” and that it is possible to be financially successful when transitioning away from clinical practice, either partially or completely.

Additional information regarding the conference, and related materials from SEAK, and job postings can be found here.

If you are a physician thinking of transitioning to a new career it is important to consult with an experienced disability attorney in advance to ensure you will not be jeopardizing your ability to receive, or continue to receive, benefits under the terms of your policy.

The Importance of Having a Transition Plan: Part I

Many of the physicians and dentists we work with have slowly progressive conditions. When they initially reach out to us, they are often facing the difficult dilemma of weighing the risk of hurting a patient against the ramifications of ending the career that they worked so hard to build. Often, they are unfamiliar with the terms of their disability policies (and, in some cases, don’t even have copies of their policies). And most of the time, they are also unfamiliar with how the disability claims process works and not sure if it is appropriate (or if it is even possible) to file a claim with their disability insurance company if they have a medical condition that progresses gradually (as opposed to something like being injured in an accident). Our next two posts will look at important considerations that must go into a transition plan.

While it is possible to collect on a claim involving slowly progressive conditions (such as degenerative disc disease or an essential tremor), these types of claims present unique challenges and hurdles that doctors must be aware of—ideally well before they file.

With any disability claim involving a physician or dentist, the number one factor is patient safety. Whether or not it is safe for you to continue to practice depends on your particular symptoms and the progression of your condition—factors that are typically outside your control. Other factors that are not entirely within your control include whether/how soon you can find a buyer if you need to sell your practice, whether new treatments are developed for your condition, whether your health insurance covers a needed medical treatment, whether your doctor is willing to support your claim—and the list goes on.

These “unknowns” often prove to be the most daunting and frustrating aspect of filing a disability claim, particularly for our clients who are used to diagnosing and solving problems. Filing a successful disability claim requires patience and the ability to adapt and react appropriately, which can prove particularly difficult if you do not have experience with the disability process or the industry knowledge required to recognize the issues in play.

So where do you start? The first step is understanding your policy requirements and taking the time to make a transition plan that fits within the parameters of your particular policy(ies). There are a lot of different components to a transition plan, but in these next few posts, we are going to be focusing on issues related to your practice.

What Do I Do With My Practice?

If you own your own practice, a major part of your transition plan will be determining what to do with your practice. This is one of the more common questions we are asked and, unfortunately, like many questions in the area of law, there is no one-size-fits-all answer. The best course of action depends on a number of factors, including:

- How your policy defines key terms, like “total disability” and “your occupation”;

- Whether you have partners or associates that are able to buy your practice interest;

- Whether you live in a large metropolitan area where there is a large pool of potential buyers or a rural area where there are very few potential buyers;

- How long you think you can go on practicing (taking into account patient safety concerns);

- Whether you can find a buyer who is understanding of your situation (as opposed to buyers who would seek to low-ball you/negotiate the price down if they became aware of your medical condition);

- Whether there is an expectation that you will work in a different capacity following the sale (e.g. as an associate or consultant);

- Whether your policy allows you to work in a different capacity and collect benefits;

- Whether your policy offsets your benefits if you receive any post-disability income.

These are just a few of the issues that need to be considered, and oftentimes determining the best course of action is an ongoing process as new information is learned about the progression of your symptoms, the state of the market, the number of potential buyers, the needs/personality of interested buyers, etc. If you are considering filing a claim, or wondering how a transition plan would work for you, an experienced disability insurance attorney can help you understand the terms of your policy and apply it to your particular situation.

In part two of this series, we’ll look at another important part of any transition plan—whether you should continue to work in the face of slowly progressive condition.

Attorney Derek Funk to Participate in St. Jude Research Hospital’s Swing FORE Charity Golf Tournament

Attorney Derek Funk will be playing in the upcoming, inaugural Swing FORE St. Jude charity golf tournament at Mountain Shadows Resort in Scottsdale, Arizona on Saturday, September 14, 2019.

September is National Childhood Cancer Awareness Month and you can see gold ribbons all around Phoenix raising awareness. The doctors and physicians at St. Jude Research Hospital seek to advance cures and means of prevention for pediatric diseases through research and treatment and have pioneered new surgeries, treatments, and cures used all around the world. All proceeds from the event benefit St. Jude to help ensure that patients and their families don’t have to pay for treatment, travel, housing, or food.