Mental Health Resources offered by Insurers May Be Used to Terminate Benefits

Deciding when, or if, it is safe to return to work after filing a disability insurance claim can be difficult and nuanced, including for mental health claims. Insurance companies, of course, have an incentive to push claimants back to work, so they may place pressure on an insured to do so.

Recently, MetLife announced that it was partnering with Lyra, a provider of workforce mental health services, to provide employees with access to mental health services as part of their recovery when they file a disability claim.

According to a recent news release, the collaboration will connect eligible individuals to Lyra’s providers at the beginning of their claim. The same release indicated that the partnership would provide claimants with more “comprehensive well-being services” during leave, “while also helping employers with the administrative tasks associated with disability claims and mental health resources.”

Depending on the circumstances, this may be helpful and beneficial for individuals facing mental health challenges. However, in our experience, mental health providers connected to a disability insurer can sometimes push for a “return to work” date before the individual is actually ready to do so. Accordingly, it is important to be mindful of ongoing limitations and communicate them effectively throughout the process.

This is important in every mental health claim, but even more so if you are working with a provider that is connected to the disability insurance company. For physicians and dentists filing disability claims, returning to work prematurely can not only be bad for their own mental health, but can also put patients at risk. If you feel that a provider or the disability insurance company are not accurately documenting or considering your limitations, it is a good idea to at least consult with a disability insurance attorney to ensure that your claim is handled fairly.

MetLife and Lyra Health Expand Access to Workforce Mental Health Solutions, Business Wire, June 14, 2023, https://finance.yahoo.com/news/metlife-lyra-health-expand-access-120000267.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAGIragDWvkC4OZlVEAoxh4wEOUspIJauIqPRA2zqzmS2Lr8KXNTggfTilfJ6iUSCGBNnY1YXsMbE9CDPeP6-tGCO7GzGy4BsIl04FE9QxIFlGiObS6yh62gvcdsbl69XomDSPNW5BtJi21BfOurMn6Ty8rlaIHRIF0FmimAj2Y0S

Defining Occupation: A Case Study

When you file an individual disability insurance claim, one of the first things the insurance company will do is define your occupation, and its job duties. They’ll often look at CDT/CPT codes and financial statements in order to try to determine your job duties. In many instances, insurance companies will seek to define your occupation as broadly as possible.

One such example of this is the case of Minzter v. Providence Life Ins. Co.[1] (Unum). Dr. Minzter, a board-certified ophthalmologist, filed a total disability insurance claim in 2019, based on significant ulnar atrophy of his left hand. According to Dr. Minzter, since 1992 his practice has been focused primarily on pediatric ophthalmology, including ophthalmic surgery (many of his parties suffered from amblyopia or strabismus, which often require surgery). In fact, when he purchased his policy from Unum in 1993, Dr. Minzter indicated that his “occupation” and “exact duties” were “ophthalmic surgeon” on his policy application.

However, in evaluating his claim, Unum deemed Dr. Minzter’s occupation to be that of an ophthalmologist, and stated that his records, including CPT codes, showed that surgery had been only a limited amount of his practice, and pointed to Dr. Minzter’s answers on his Physician Questionnaire that indicated he spend only 5% of his time in the operating room. Unum argued that Dr. Minzter was still performing other duties of an ophthalmologist, except for surgery. Dr. Minzter countered that the practice of eye surgery required a significant amount of time outside of the operating room—including assessing whether patients may need surgery.

Additionally, Unum pointed to the fact that there is no recognized subspecialty of surgery in ophthalmology. Dr. Minzter argued that even if Unum chose to consider him an ophthalmologist rather than an ophthalmic surgeon, he should still be entitled to total disability of because ophthalmology is a surgical specialty.

Because of its evaluation of Dr. Minzter’s occupation, including a review by a vocational rehabilitation consultant, Unum determined that Dr. Minzter was not totally disabled. The Court agreed with Unum, deciding that Dr. Minzter could perform all but one of the substantial and material duties of his occupation, and therefore wasn’t totally disabled. The lawsuit did not address whether Dr. Minzter might be entitled to residual disability benefits, but the Court indicated that it appeared that Dr. Minzter’s claim fell within the purview of that provision.

The takeaway from this case is that insurers (and Courts) will look to what your job duties are at the time of filing a disability claim, not what they were (or what your job title was) at the time you filled out the application for a policy.

If you have questions about whether your occupation is being correctly defined by your insurance company, please feel free to reach out to one of our attorneys directly.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Minzter v. Provident Life and Accident Ins. Co., No. CV215595MASJBD, 2023 WL 4108850 (D.N.J. June 21, 2023)

Statute of Limitations: A Case Study

As we’ve written about before, whether a disability is caused by sickness or injury can be critical in determining the duration of benefits that will be paid out under a disability insurance policy. Another component to this calculation is knowing when to sue, if your insurance company decides to classify a disabling condition as sickness versus injury.

One such example is that of Bennett v. Ohio National Life Assurance Corp[1]. Dr. Mark Bennett, an oral and maxillofacial surgeon, was injured when he was thrown from a horse in 2006, where he sustained injuries to his left shoulder and collarbone. He subsequently underwent surgery; however, he had ongoing numbness and tingling in his left hand. He was able to continue working for a while by changing operating techniques and using different tools. However, despite these changes and treatment (medications and physical therapy), he eventually developed chronic pain in his left hand. He cut down on his patient load, but then had to quit working entirely in 2014. He filed a claim with Ohio National, stating that he was unable to work as an oral surgeon because of the physical issues he developed as a result of his 2006 accident.

Ohio National approved his benefits, but noted that it would continue to evaluate whether the cause of the disability was due to sickness or injury. In this case, the distinction was important. Because he was over 55 at the age of filing, he would only be eligible to receive benefits up to age 65 if his condition was caused by sickness. However, if it was caused by injury, he would be eligible for lifetime benefits.

Eventually, on June 8, 2015, Ohio National notified Dr. Bennett that they had determined that his disability was caused by sickness, specifically degenerative disc disease, which was causing compression of nerve roots (leading to the tingling and numbness in his left hand). The letter indicated that benefits would terminate when Dr. Bennett reached age 65.

In September 2018, Dr. Bennett’s benefits stopped. Dr. Bennett sued for breach of contract and breach of the implied covenant of good faith and fair dealing in August 2019. Under the law, Dr. Bennett had four years to file a breach of contact claim and two years to file a claim for breach of implied covenant of good faith and fair dealing. Ohio National argued that the statute of limitations had passed. In other words, they alleged that Dr. Bennett had had waited too long after their initial determination (in 2015) that his disability was caused by sickness to bring a lawsuit. Dr. Bennett argued that the clock did not start running until the date his benefits stopped (in 2018).

The Court reviewed both sides’ arguments and decided in favor of Dr. Bennett. Whether Dr. Bennett is eligible for lifetime benefits remains pending before the Court at the time of this writing.

This case highlights the importance of understanding the terms and requirements of your individual policy. If you have questions about whether your disabling condition is being handled as an illness versus an injury, please feel free to reach out to one of our attorneys directly.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Bennett v. Ohio Nat’l Life Assurance Corp., No. A166049, 2023 WL 4069794 (Cal. Ct. App. June 20, 2023)

Autoimmune Diseases

What are Autoimmune Diseases?

A normal immune system protects the body from disease and infection. With an autoimmune disease, the body’s immune system begins attacking its own organs, tissues, and cells. There are over 100 known autoimmune diseases and they can affect nearly every organ in the body, as well as many tissues. Below are common autoimmune diseases based on the area of the body they affect:

Muscles and Joints:

- Rheumatoid arthritis (RA)

- Psoriatic arthritis

- Lupus

Digestive Tract:

- Celiac disease

- Crohn’s disease

- Ulcerative colitis

Skin:

- Dermatomyositis

- Psoriasis

Endocrine System:

- Hashimoto’s

- Graves’ disease

Nervous System:

- Guillain-Barre syndrome

- Multiple sclerosis (MS)

- CIDP (chronic inflammatory polyneuropathy)

Other:

- Type 1 diabetes

- Myasthenia gravis

- Pernicious anemia

Autoimmune disorders are more common in women than men, and about 1 in 15 people have an autoimmune disease.

What are the Symptoms of Autoimmune Diseases?

Symptoms will vary based on what part of the body is impacted, but common symptoms include pain, fatigue, dizziness, headaches, nausea, malaise, and rashes.

What Causes Autoimmune Diseases?

The exact cause of autoimmune diseases is unknown, but factors include:

- Genetics

- Certain medications

- Having one autoimmune disease already

- Exposure to toxins

- Infections

- Gender (78% of people who have autoimmune diseases are women)

- Obesity

- Smoking

How are Autoimmune Diseases Diagnosed?

Autoimmune disorders often have symptoms that are similar to other diseases, or with each other, so diagnosis can be difficult. Treating providers will generally look at symptoms and health history, and may perform blood tests to look for markers that are associated with certain autoimmune diseases. Tests that may be run include:

- Antinuclear antibody test (ANA)

- Complete blood count (CBC)

- Erythrocyte sedimentation rate (ESR)

- C-reactive protein (CRP)

- Comprehensive metabolic panel

- Urinalysis

What is the Treatment for Autoimmune Diseases?

Autoimmune disorders do not have a cure, so the focus of treatment is on managing symptoms. Types of treatment include:

- Anti-inflammatory medications

- Pain killers

- Plasma injections

- Corticosteroids

- Depression and anxiety medications

- Insulin injections

- Medications to treat rashes

- Intravenous immune globulin

- Immunosuppressive medications

- Physical therapy

Autoimmune diseases can interfere with an individual’s ability to work or carry out daily tasks. If you have been diagnosed with an autoimmune disease and are worried that it may be impeding your ability to continue to safely practice on patients, you should speak with an experienced disability insurance attorney.

These posts are for informative purposes only and should not be used as a substitute for consultation with and diagnosis by a medical professional. If you are experiencing any of the symptoms described above and have yet to consult with a doctor, do not use this resource to self-diagnose. Please contact your doctor immediately and schedule an appointment to be evaluated for your symptoms.

Sources:

Cleveland Clinic

Mount Sinai

National Institute of Health

Mental vs. Physical Condition Claims: A Case Study

In some instances, it may not be clear whether symptoms are caused by a physical or mental disability. This distinction can be important because many policies have a mental and nervous limitation, which means that benefits for mental conditions will only be paid out for a limited amount of time (typically 24 months). It’s not surprising that insurance companies may try to argue that a condition is a mental health one, even if treating providers say otherwise, in an attempt to limit the amount of benefits they have to pay out.

One such case is that of Radle v. Unum.[1] In this instance, Radle tripped and hit his head while running, which resulted in dizziness, difficulty focusing, headaches, a “buzzed” feeling, and sensitivity to noise and light. A few days after the fall, he went to the ER where he was diagnosed with post-concussive syndrome. A few months later, he was admitted to the hospital after another symptomatic episode. Here, he was diagnosed with a conversion disorder, which is defined as a mental condition where a patient shows psychological stress in physical ways. A few days later, he returned for a second opinion and was again diagnosed with conversion disorder.

However, subsequently, over the course of several years, he engaged in treatment with little to no result (including physical therapy and speech therapy). Because of his progressing symptoms, Radle’s three treating providers re-diagnosed him with delayed post-concussive syndrome. In support of their diagnoses, his providers pointed to the fact that he had an EEG positive for left temporal slowing (which would suggest a brain injury), had testing which showed a visual disability, and had a cyst located near his cerebellum.

Unum’s reviewing physicians, however, disregarded these reports form treating providers and continued to claim that his condition was subject to the mental and nervous limitation of the policy, and as a result, Radle was only entitled to 24 months of benefits.

In response, Radle underwent additional assessments including an independent medical examination (IME) and a Neuropsychological Evaluation, which both concluded that his symptoms were not psychologically based. However, Unum did not accept this evidence, and also claimed that his symptoms did not prevent him from working.

The case remains pending as of this writing, but it illustrates how insurance companies may seek to classify certain conditions as mental health conditions, in order to limit the benefit amount they will have to pay out. If you are worried about how your insurer is classifying your disabling condition and have questions, please feel free to reach out to one of our attorneys directly.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Radle v. Unum Life Ins. Co. of Am., No. 4:21CV1039 HEA, 2023 WL 2474509 (E.D. Mo. Mar. 13, 2023)

Filing a Claim Based on a Cancer Diagnosis: A Case Study

A cancer diagnosis can lead to the need to file a disability claim, not just for the disease itself but often for the severe side effects that can be experienced during chemotherapy, radiation therapy, and other cancer treatment. But will your insurer recognize this and continue to pay benefits?

You may expect that this would be a straightforward disability claim and, at least at first, it likely will be. However, in our experience, we have noted that some disability insurers may cut off benefits prematurely, in an effort to push cancer survivors back to work despite ongoing medical limitations.

The case of Hardy v. Unum Life Ins. Co.[1] provides an apt example of this. Here, the plaintiff, Mark Hardy was an attorney specializing in defense of malpractice claims. He suffered a fractured pelvis in late October 2016 and later it was discovered that he also had plasmacytoma (a tumor of the plasma cells of bony or soft tissue).

Hardy went on to have surgery to remove the tumor and repair his pelvic bone in November 2016. While he completed five weeks of radiation, it was not successful and he began a course of chemotherapy which left him unable to work a full-time schedule.

According to Hardy’s complaint in this case, the side effects of chemotherapy left him with neuropathy, fatigue, nausea, diarrhea, L pubic ramus destruction, chronic pain, lack of stamina and fatigue-related memory gaps. While he tried to return to work full-time after his initial period of disability, this became impossible and he began working part-time in February 2019, and also stopped performing the material duties of his specialty occupation (including no longer taking cases to trial). He filed a new LTD claim with Unum on February 11, 2019 and it was initially approved.

In June 2020, Unum requested updated information from Hardy regarding his work status and condition, as well as requesting an attending physician’s statement from his oncologist. On July 13, 2020, Unum recertified Hardy’s disability and let him know that they would not be reviewing his claim for another year. However, just a few weeks later, his case was transferred to a different Unum analyst for additional review. Without notifying Hardy, Unum sent another attending physician’s statement to his oncologist and began a background investigation.

As part of their investigation, Unum sought additional information from his oncologist, sent the file for a medical review, contacted his employer for a job description and had their designated medical officer review the case. They ultimately issued a letter on December 10, 2020 terminating the claim. Hardy appealed and submitted additional evidence in support of his limitations (including the ongoing support of his oncologist, updated medical records, a vocational analysis, and declarations from other attorneys at his firm). Unum employed an additional medical review and its own vocational analysis. Unum ultimately upheld their termination of the claim and Hardy filed his lawsuit.

While the lawsuit remains pending in court, it demonstrates the difficulty that cancer patients may face when filing disability claims due to a cancer diagnosis and treatment. As in the Hardy case, most often, the primary area of contention relates to the severity and permanency of ongoing complications/side effects after the cancer is in remission. If you have a question on how your insurance company is handling your claim, please feel free to reach out to one of our attorneys directly.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Hardy v. Unum Life Ins. Co. of Am., No. 23-CV-563 (JRT/JFD), 2023 WL 4841952 (D. Minn. July 28, 2023)

Meniere’s Disease

What is Meniere’s Disease?

Meniere’s disease is a problem of the inner ear that can lead to vertigo (dizzy spells) and hearing loss. It typically affects only one ear. Some individuals will have single attacks of vertigo separated by long periods of time, while others may experience multiple attacks over a number of days. Sometimes the vertigo is so extreme that an individual will lose their balance and fall (called “drop attacks”).

Meniere’s disease is most common in people in their 40s and 50s. Approximately 615,000 individuals in the U.S. have a current diagnosis of Meniere’s disease, with approximately 45,500 new cases diagnosed each year.

What are the Symptoms of Meniere’s Disease?

Symptoms, can include:

- Regular dizzy spells that usually last 20 minutes to 12 hours, but no more than 24 hours

- Loss of balance

- Hearing loss

- Tinnitus (ringing in the ear)

- Feeling of fullness/pressure in the ear

- Headaches

What Causes Meniere’s Disease?

While the cause of the disease is not known, symptoms may be due to extra fluid (called endolymph) in the ear. Issues that can affect this fluid includes poor fluid drainage, autoimmune disorders, genetics, and/or viral infection.

How is Meniere’s Disease Diagnosed?

In order to meet the diagnostic criteria for Meniere’s disease, an individual must have had two or more vertigo attacks, hearing loss, and tinnitus or a feeling of pressure in the ear. Tests performed by a healthcare provider will include a hearing assessment, a balance assessment, and tests that study how the inner ear is working. Often other tests, including labs and imaging, will be used to rule out other conditions.

What is the Treatment for Meniere’s Disease?

There is no cure for Meniere’s disease and no treatment for any resulting permanent hearing loss. Treatments are instead aimed at lessening vertigo attacks and preventing hearing loss from getting worse.

Treatments include:

- Motion sickness medications

- Anti-nausea medications

- Diuretics

- Lifestyle changes including a low-salt diet, consuming less caffeine and managing stress

- Vestibular rehabilitation

- Hearing aids

- Middle ear injections

- Pressure pulse treatment

- Endolymphatic sac surgery (relieves pressure around the endolymphatic sac, which can improve fluid levels)

- Labyrinthectomy (parts of the ear that cause vertigo are removed, which causes complete hearing loss in the affected ear)

- Vestibular nerve section (the vestibular nerve is cut to block information about movement for getting to the brain, to improve vertigo)

Meniere’s disease can interfere with an individual’s ability to work or carry out daily tasks. If you have been diagnosed with Meniere’s disease and are worried that it may be impeding your ability to continue to safely practice on patients, you should speak with an experienced disability insurance attorney.

These posts are for informative purposes only and should not be used as a substitute for consultation with and diagnosis by a medical professional. If you are experiencing any of the symptoms described above and have yet to consult with a doctor, do not use this resource to self-diagnose. Please contact your doctor immediately and schedule an appointment to be evaluated for your symptoms.

Sources:

Mayo Clinic

Johns Hopkins

Cleveland Clinic

National Institute of Health

Injury versus Sickness: A Case Study

While it might seem like it should be easy to determine whether a disabling condition is caused by an injury or sickness, this is not always the case, especially when it comes to repetitive stress injuries. Under some policies, the difference can be drastic in terms of how long benefits are paid.

One example is the case of Stein v. Paul Revere Life Ins. Co[1]. Dr. Stein was a specialist in interventional radiology who was diagnosed with and eventually unable to work due to spinal stenosis, lumbar osteoarthritis, lumbar spondylosis, and degenerative spondylolisthesis. Whether or not his condition was an injury or sickness was important in this case because he was eligible to receive full lifetime benefits if his condition was caused by injury (but only a portion of his benefits for life if it was due to sickness).

While he initially filled out his application for benefits, Dr. Stein filled out the sickness portion of the form, and indicated that his occupation exacerbated his condition. However, later, Dr. Stein sought to change this classification of his disability from sickness to injury, claiming that his disabling conditions were actually the result of repetitive stress injuries (caused as a result of having to wear a heavy lead apron as part of his occupation). In support of this claim, Dr. Stein submitted statements from his treating provider and medical journal articles that showed there was evidence of a relationship between wearing leaded aprons and spinal problems.

Paul Revere had three physicians review Dr. Stein’s records, and all concluded that Dr. Stein’s conditions were due to sickness, or at the very least “cannot be ascribed, beyond reasonable doubt, to repetitive stress injury more than any of the many other proposed causes of disc degeneration.” The third reviewing doctor also indicated that the medical file did not indicate that there had ever been an accident. Dr. Stein countered that Paul Revere was misinterpreting the term accident, and failing to consider repetitive stress injuries.

The Court found that Dr. Stein’s arguments were persuasive. They noted that there was not an expectation that he could have known that he was likely to become injured (thus meeting the “accidental bodily injury” requirement of his policy), and that he was suffering from a physical condition resulting from repetitive stress injuries. In finding for Dr. Stein, the Court concluded that he was entitled to a reclassification of his total disability as due to an “injury” and thus eligible for full lifetime benefits.

However, here, the Court did not award Dr. Stein attorney fees, explaining that Dr. Stein himself had originally applied to receive benefits under the “sickness” category and that Paul Revere’s interpretation of its policy language was “reasonable.”

This case highlights the importance of understanding the terms and requirements of your individual policy. If you have questions on how your policy works or how your claim is being administered, please feel free to reach out to one of our attorneys directly.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Stein v. Paul Revere Life Ins., Co., No. CV 21-3546, 2023 WL 2539004 (E.D. Pa. Mar. 16, 2023)

Relying on File Reviews: A Case Study

It is not uncommon for disability insurance companies to rely on paper-only reviews when deciding whether to deny or terminate benefits. But will the reviewing physician consider all the evidence submitted in support of a claim when making a determination on whether an insured is disabled? The answer is – not always.

One such example is the case of Caudill v. Hartford.[1] Caudill filed a claim with his insurance company, Hartford, based on fibromyalgia and chronic obstructive pulmonary disorder (CODP). Hartford initially began paying benefits but later terminated them, claiming that Caudill was no longer too disabled to work. Caudill appealed, but Hartford upheld its termination. When making this decision, Hartford relied almost solely on an independent file review conducted by a Dr. Schulman.

Dr. Schulman opined that Caudill was able to work because he could sit or stand for 8 hours a day. While his conclusion concurred with the view of a doctor who had previously conduced an independent medical examination (IME), it failed to address questions that had been raised by Caudill about the purported deficiencies in the IME. Further, Dr. Schulman did not address a functional capacity evaluation (FCE) that reached a conclusion that Caudill’s issues, even with sitting, “would not be viable in most sedentary environments.”

Neither Dr. Schulman or the Hartford addressed the notes of Caudill’s treating physicians, which included statements that Caudill “does not have good exertional tolerance” and that he has difficulties with activities of daily living.

While the Court explained that, while there was nothing inherently objectionable about a file review, in this instance Caudill had “provided credible, objective evidence that he is unable to work in even a sedentary capacity” and that Hartford “cannot arbitrarily disregard a claimant’s evidence.” The Court found for Caudill and ordered that his benefits be retroactively reinstated.

This case highlights how insurance companies may rely on their own experts over other evidence in the case file. If you believe your insurance company has conducted a file review and you have questions, please feel free to reach out to one of our attorneys directly.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Caudill v. Hartford Life & Accident Ins. Co., No. 1:19-CV-963, 2023 WL 2306666 (S.D. Ohio Mar. 1, 2023)

Complex Regional Pain Syndrome

What is Complex Regional Pain Syndrome?

Complex regional pain syndrome (CRPS) isn’t clearly understood, but it is a form of chronic pain that usually affects an arm or a leg. CRPS usually develops after an injury, surgery, stroke or heart attack. The pain is often prolonged and out of proportion to the severity of the initial injury. CRPS can either be acute (recent, short-term) or chronic (lasting greater than six months).

CRPS is divided into two groups. The first, also called sympathetic dystrophy, develops without known nerve damage. The second, also called causalgia, occurs as a result of specific nerve damage. About 90% of cases are type 1.

While most cases of CRPS are mild and an individual recovers in a few months to a few years as the injured nerve regrows, symptoms can persist and long-term disability may result. If untreated, the disease can progress and atrophy (tissue wasting) and contracture (muscle tightening) can develop.

What are the Symptoms of Complex Regional Pain Syndrome?

Symptoms, can include:

- Continuous burning or throbbing pain, typically in an arm, leg, hand or foot (in some instances “mirror pain” may develop in a matching location on the opposite limb)

- Increased sensitivity to painful stimuli

- Feeling pain from stimuli that are not usually painful

- Sensitivity to touch or cold

- Numbness

- Joint stiffness, swelling and damage

- Muscle spasms, weakness, and tremors

- Decreased mobility in affected body part

- Swelling

- Changes in skin temperature, color, and texture

- Changes in hair and nail growth

Having CRPS is also associated with increased anxiety, depression and stress.

What Causes Complex Regional Pain Syndrome?

The exact cause of CRPS isn’t clearly understood, but it is thought to be caused by an injury to or a difference in the peripheral and central nervous system. In many causes, CRPS results after a trauma to an arm or a leg. The most common actions/activities that lead to CRPS include fractures, surgery, strains/sprains, limb immobilization (e.g., from being in cast), and lesser injuries such as burns or cuts.

Other influencing factors include poor circulation, poor nerve health, immune system involvement (for example, some individuals with CRPS have abnormal antibodies), and genetics.

How is Complex Regional Pain Syndrome Diagnosed?

There is no one test for CRPS, but the following are used in determining whether an individual may have CRPS:

- Physical exam

- Nerve conduction studies

- Ultrasound

- MRI

- Bone scans

- X-rays

- Sweat production tests

What is the Treatment for Complex Regional Pain Syndrome?

Treatments include:

- Medications (pain relievers, antidepressants and anticonvulsants, corticosteroids, bone-loss medications, synthetic nerve-block medications, intravenous ketamine, blood pressure lowering medications, topical analgesics)

- Heat therapy

- Physical or occupational therapy

- Biofeedback

- Acupuncture

- Mirror therapy

- TENS

- Spinal cord stimulation

- Intrathecal drug pumps

Outcomes for CRPS can vary widely, and early diagnosis and treatment is key. CRPS usually improves over time and goes into remission in most people; however, severe or prolonged cases can occur, and it recurs in about 10-30% of individuals.

Complex Regional Pain Syndrome can interfere with an individual’s ability to work or carry out daily tasks. If you have been diagnosed with CRPS and are worried that it may be impeding your ability to continue to safely practice on patients, you should speak with an experienced disability insurance attorney.

These posts are for informative purposes only and should not be used as a substitute for consultation with and diagnosis by a medical professional. If you are experiencing any of the symptoms described above and have yet to consult with a doctor, do not use this resource to self-diagnose. Please contact your doctor immediately and schedule an appointment to be evaluated for your symptoms.

Sources:

Mayo Clinic

National Institute of Neurological Disorders and Stroke

John Hopkins

Cleveland Clinic

Stanford

Occupation at Time of Disability:

A Case Study

Often, a definition of total disability includes a phrase along the lines of you are considered Totally Disabled “you are not able to perform all or the substantial and material duties of your regular occupation at the start of your Total Disability.” While this may seem straightforward, we’ve seen conflicts arise when it comes to defining what an insured’s regular occupation was at the start of a disability.

One such example is the case of Johnson v. Ohio National.[1] Dr. Johnson was an OB/GYN from 1993 through May 2007, with several different employers. However, from May to October 2007, he took time off and was subsequently not able to find work in the OB/GYN field, although he was actively looking for it. From October 2007 through March 2008, he worked on a temporary basis at a clinic, filling in for other doctors as needed. He also worked part-time as a physician at an Urgent Care clinic (where he did no OB/GYN-related duties).

In June of 2008, Dr. Johnson saw an internal medicine doctor for joint pain, swelling and stiffness in his hands, along with a rash. Lab tests revealed significant inflammation of the hands. Dr. Johnson was referred to and saw a rheumatologist on November 14, 2008, where he was diagnosed as having psoriatic arthritis. On December 26, 2008 he submitted a claim with Ohio National for total disability. Although Ohio National agreed on the date of disability (June 2008) and that psoriatic arthritis prevented Dr. Johnson from practicing as an OB/GYN, they claimed his occupation at the time of his disability was that of an urgent care doctor—and that he was still able to do the material and substantial job duties of an urgent care physician.

The Courts agreed with Ohio National, finding that at the time of his disability, Dr. Johnson was working as an urgent care physician, regardless of the fact that he was a Board-certified OB/GYN and had been doing that for the majority of his career.

We’ve encountered dentists and physicians who inadvertently change their occupation by starting to work in another position or role, or otherwise modify their job duties, often as a way to accommodate a disability. Since regular occupation is often defined along the lines of “the occupation (or occupations if more than one) in which you are regularly engaged at the time you become Totally Disabled,” insurance companies will typically ask for CPT or CDT codes to identify the specific job duties you are doing at the time your disability started. In some instances, this might allow an insurance company to claim you are not working in your specialty and try to claim you are doing the very broadest job possible (thus making it easier to say you are still able to work).

This case highlights the importance of understanding the terms and requirements of your individual policy when it comes to how total disability is defined. If you are worried about how your insurer is classifying your occupation and have questions, please feel free to reach out to one of our attorneys directly.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Johnson v. Ohio National Life Assurance Co., No. WD-12-029, 2014 WL 201691 (Ohio Ct. App. Jan. 17, 2014).

Psoriatic Arthritis

What is Psoriatic Arthritis?

Psoriatic arthritis (PsA) is a type of arthritis that affects about 30 percent of individuals who have psoriasis (a disease that causes red patches of skin that are topped with silvery scales). Psoriasis typically develops years before psoriatic arthritis, but this is not always the case.

Joint pain, swelling, and stiffness are the key signs of psoriatic arthritis, and these symptoms can affect any part of the body. Symptoms range from mild to severe, and often flares can be followed by periods of remission. If left untreated, psoriatic arthritis can lead to joint and tendon damage, which can cause decreased function and disability.

What are the Symptoms of Psoriatic Arthritis?

As indicated above, the primary symptoms of psoriatic arthritis are joint pain, swelling, and stiffness. Joints are affected on one or both sides of the body. Additional symptoms of psoriatic arthritis include:

- Swollen fingers and toes

- Lower back pain (specifically, some individuals may develop spondylitis)

- Foot pain

- Nail changes

- Eye inflammation

- Fatigue

A small percentage of those with psoriatic arthritis may go on to develop a condition called arthritis mutilans. This form of psoriatic arthritis leads to permanent deformity and disability in the small bones of the hands (especially in the fingers).

Unchecked psoriatic arthritis inflammation can case complications including:

- Damage to cartilage and bones

- Uveitis

- Gastrointestinal problems

- Shortness of breath and coughing

- Damage to blood vessels and the heart muscle

- Osteoporosis

- Metabolic syndrome (a group of conditions that include obesity, high blood pressure and poor cholesterol levels)

What Causes Psoriatic Arthritis?

In psoriatic arthritis, the body’s immune system attacks healthy cells and tissue, causing inflammation in the joints and the overproduction of skin cells. While both environmental and genetic factors seem to play a role in the development of psoriatic arthritis, there are several risk factors including a family history of psoriatic arthritis, psoriasis, and age. Environmental triggers, such as an infection, stress, or physical trauma can also play a role.

How is Psoriatic Arthritis Diagnosed?

There is no one test that can diagnose psoriatic arthritis, but doctors will typically perform a variety of tests, including those to rule out other conditions that cause joint pain, such as rheumatoid arthritis, including:

- Physical Exam: a doctor will typically look for signs of joint tenderness or swelling, pitting, flaking or other nail abnormalities, and tenderness on the soles of the feet or around the heels.

- X-rays: to look for joint changes

- MRIs: to look for tendon and ligament changes in the lower back and feet

- Rheumatoid factor (RF) test: RF is often found in individuals with rheumatoid arthritis, but not usually in those with psoriatic arthritis

- Joint fluid test: a test that looks for uric acid crystals in the joint fluid which, if present, may indicate a diagnosis of gout versus psoriatic arthritis

What is the Treatment for Psoriatic Arthritis?

There is no cure for psoriatic arthritis so treatments focus on managing inflammation in the joints and controlling skin involvement. Medications, physical therapy, steroid injections, and, in some cases, joint replacement therapy are all used to treat the symptoms of psoriatic arthritis. Common medications utilized include:

- NSAIDs (nonsteroidal anti-inflammatory drugs)

- Conventional and targeted synthetic DMARDs (disease-modifying antirheumatic drugs) – these types of drugs slow the progression of the disease and preserve joints from further, permanent damage.

- Biologic agents (biologic response modifiers, a type of DMARDs) – these drugs target a different pathway in the immune system than DMARDs.

- Apremilast (Otezla) – a medication that decreases the activity of a type of enzyme in the body that controls the activity of inflammation in the cells.

Psoriatic arthritis can interfere with an individual’s ability to work or carry out daily tasks. If you have been diagnosed with psoriatic arthritis and are worried that it may be impeding your ability to continue to safely practice on patients, you should speak with an experienced disability insurance attorney.

These posts are for informative purposes only and should not be used as a substitute for consultation with and diagnosis by a medical professional. If you are experiencing any of the symptoms described above and have yet to consult with a doctor, do not use this resource to self-diagnose. Please contact your doctor immediately and schedule an appointment to be evaluated for your symptoms.

Sources:

Mayo Clinic

John Hopkins

National Psoriasis Foundation

Arthritis Foundation

Postural Orthostatic Tachycardia Syndrome

(POTS)

What is POTS?

Postural orthostatic tachycardia syndrome (POTS) is a group of disorders that have orthostatic intolerance (OI) as their primary symptom. It’s a condition that causes a number of symptoms when an individual transitions from laying down to standing up.

The primary symptom of OI is lightheadedness or fainting. With POTS, this is also accompanied by a rapid increase in heartbeat of more than 30 beats per minute or a heart rate that tops 120 beats per minute, within 10 minutes of standing. Laying down relieves the faintness/lightheadedness.

While normally the body’s automatic nervous system balances heart rate and blood pressure, someone with POTS can’t coordinate the balancing act of blood vessel constriction and heart rate response; therefore, the body can’t keep blood pressure stable.

POTS affects about 1 to 3 million people in the United States (although experts believe this number may have risen since COVID-19), with the majority being women between 15 and 50 years old. Those who have had a significant illness, serious infections, are pregnant, have physical trauma or surgery are at a higher risk of developing POTS.

POTS can be further divided into sub-types:

Neuropathic POTS: when peripheral enervation (loss of nerve supply) leads to poor blood vessel muscles

Hyperadrenergic POTS: when the sympathetic nervous system is overactive

Hypovolemic POTS: reduced blood volume

One of the biggest risks of POTS is falling and getting injured. In some, POTS symptoms will resolve, but they may return. About 25% of POTS patients are disabled and unable to work.

What are the Symptoms of POTS?

Thy symptoms of PTOS vary by individual, and happen immediately or within a few minutes after sitting or standing up. Symptoms can include:

- Dizziness

- Fainting

- Brain fog

- Racing heart rate or palpitations

- Chest pain

- Fatigue

- Nervousness or anxiety

- Shakiness

- Excessive sweating

- Shortness of breath

- Headaches

- Nausea or vomiting

- Bloating

- Purple discoloration of hands and feet, if they are lower than heart level, and a pale face

- Disrupted sleep

Several conditions can worsen POTS symptoms, including:

- Being in warm environments

- Standing frequently

- Being sick

- Menstruation

- Strenuous exercise

What Causes POTS?

Its not entirely clear what causes POTS, but growing evidence suggests that POTS may be an autoimmune disease.

How is POTS diagnosed?

A tilt table test is one of the primary methods a physician will use to diagnose POTS. It measures heart rate and blood pressure during changes to posture and position. Other tests that may help confirm POTS and/or rule out other conditions include blood tests, QSART (a test that measures the nerves that control sweating), automatic breathing tests, tuberculin skin tests, skin nerve biopsy, echocardiogram, and blood volume with hemodynamic studies.

What is the Treatment for POTS?

There is no cure for POTS, but there are recommendations that can help manage the symptoms of POTS, including:

- Engaging in exercise and physical activity

- Managing diet and nutrition (for example, for hypovolemic POTS, a dietician may recommend increasing salt and fluid intake)

- Certain medications including those that treat tachycardia, increase salt retention and blood volume) and/or cause vasoconstriction.

POTS can interfere with an individual’s ability to work or carry out daily tasks. If you have been diagnosed with POTS and are worried that it may be impeding your ability to continue to safely practice on patients, you should speak with an experienced disability insurance attorney.

These posts are for informative purposes only and should not be used as a substitute for consultation with and diagnosis by a medical professional. If you are experiencing any of the symptoms described above and have yet to consult with a doctor, do not use this resource to self-diagnose. Please contact your doctor immediately and schedule an appointment to be evaluated for your symptoms.

Sources:

Cleveland Clinic

National Institute of Neurological Disorders and Stroke

John Hopkins Medicine

Dysautonomia International

Do I Have to Attend an IME in Person?: A Case Study

Under many disability insurance policies, insurers can require an insured to attend an independent medical examination (IME) in order to remain eligible for benefits. While some policies may explicitly state that an IME must be in person, other are silent on this. So, what happens if you are worried about attending an in-person IME due to potential health risks and/or the COVID-19 pandemic?

One example of this scenario is the case of Masevice v. Life Ins. Co. of North America[1]. Ms. Rebecca Masevice was a marketing manager who became unable to work due to migraine headaches, cluster headaches and POTS (postural orthostatic tachycardia syndrome), dizziness, fatigue, shortness of breath and brain fog. She filed a disability claim with her insurer, Life Insurance Company of North America (LINA).

LINA requested that Masevice undergo an IME, and scheduled one. Masevice requested that this IME be held via “telemed.” LINA denied this request and re-scheduled the IME multiple times and ultimately denied her claim. Masevice pointed to the “extraordinary circumstances of the COVID-19 pandemic” and disputed that she didn’t cooperate with the scheduling of an IME. On appeal, Masevice provided updated records, letters/reports from her treating provider, an FCE, a list of medications, and a vocational report. In their decision noted that “Plaintiff’s concerns about attending the IME in person were valid, given her symptoms and her compromised immune system.”

However, the Court further ruled that more fact-finding was needed in order to determine whether Masevice was eligible for benefits. The Court remanded the case, indicating that Masevice be given the opportunity to submit additional, current medical evidence and that LINA may require that Masevice undergo an in-person IME “now that the COVID-19 crisis has been alleviated.”

This case highlights the importance of understanding the terms and requirements of your individual policy. If you are facing an IME and have questions, please feel free to reach out to one of our attorneys directly.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Masevice v. Life Ins. Co. of North America, Case No. 1:22CV223, 2023 WL 2534042 (N.D. Ohio March 16, 2023).

Guardian’s New Dentist-Specific Claim Form Are These Trick Questions?

We’ve noted before that disability policies have evolved over time to become more complex. The same holds true for disability claim forms.

Years ago, most disability insurers used fairly basic proof of loss forms, and used the same forms for various types of claims.

Over time, these claim forms have also become increasingly complex, to the point that Guardian now has a dentist-specific form with several loaded questions. These questions can be difficult to answer fully and accurately, within the parameters of the form. Many questions do not provide any room to explain your specific dental practice, instead prompting you to select options that may not apply to your situation. Many questions also have hidden objectives that are only apparent to disability attorneys familiar with “own occupation” dentist disability claims.

Guardian’s Dental Professional Occupation Assessment Form

Below are a few excerpts from Guardian’s most recent dentist-specific claim forms, along with some limited, general commentary into the purpose behind some of the questions.

When we first saw these new forms, it was immediately apparent to us that they had been drafted by Guardian’s attorneys and senior claim staff with several of Guardian’s tactics of reducing or avoiding payment in mind. It was also clear from the fine print at the bottom that Guardian is attempting to lock dentists into “complete and true” answers, in writing, early-on, before they have contacted an attorney. This form is then checked against anything you have said to Guardian before, and anything else you may say in later phone or field interviews.

We have handled numerous claims filed by dentists with Guardian and have had to get them back on track, which can be difficult if these forms are not completed in the proper manner. Most recently, we have seen Guardian delay or reduce payment on numerous dentist disability claims due to perceived “incomplete answers” to its dentist-specific proof of loss questions and/or perceived “inconsistencies” with other statements/interviews. Accordingly, we felt it important to get the word out to dentists about these new developments.

As you review, keep in mind that every dentist claim is unique. Not everything below applies to every claim, and there may be other, additional considerations that come into play under your particular circumstances. Accordingly, it is best to consult with an experienced disability insurance attorney before filing a disability claim or submitting any proof of loss to Guardian.

Table of Contents

1. Why is Guardian Asking About My Pay Rate/Loss of Income?

5. Why is Guardian Asking if I Modified My Job Before Filing and How is That Relevant?

6. Why is Guardian Asking Me to Break Down the Source of Gross Receipts?

7. Why is Guardian Asking About the Dental Board/My Malpractice Insurance/Use of My NPI Number?

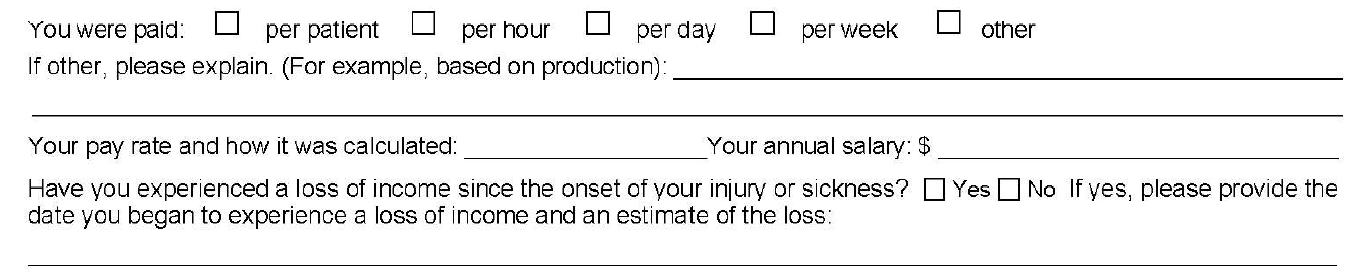

1. Why is Guardian Asking About My Pay Rate/Loss of Income?

Initially, you may think that loss of income is relatively straightforward; however, it can be a complicating factor in dentist claims, for a few reasons.

First, over time, disability policies have added additional requirements for establishing proof of loss that you may not be aware of. With older policies, the focus was primarily on whether the dentist met a certain loss of income percentage threshold. Then, if there was evidence of a medical condition that logically limited the dentist’s ability to work full-time, that was generally sufficient.

Newer Guardian disability policies have added additional hurdles, such as a requirement that the loss be “solely” due to the disabling condition. Regardless, the timeline—and date of disability selected—is critical to establishing a right to payment because, at a minimum, the loss of income must directly line up with the disabling condition.

The problem for dentists is that their disability claims are often musculoskeletal, slowly progressive, and worsen over time. Many dentists are diagnosed with a condition, yet work through the pain for a time. Sometimes there are periods of improvement even if the solutions are only short-term and the overall trend is downward. This can make selecting a proper and defensible date of disability challenging.

Additionally, when it comes to dentist claims, there can be gray areas under the terms of the underlying policy that must be addressed/negotiated (and sometimes litigated). For example, sometimes partial disability is also based on whether there has been a reduction of hours/time practicing; however, dentistry is not a profession where dentists “clock-in” and “clock-out” so addressing changes in “hours” can be a challenge.

Many dentists also receive income from multiple sources, and there can be several entities involved, particularly if the dentist works at a corporate dentistry practice. In some instances, the definitions in the underlying disability policy do not contemplate this level of complexity when it comes to the policyholder’s income, or give clear answers to what “counts” as income for purposes of determining the monthly losses.

Because of the above, we are seeing “loss of income” becoming an area that is increasingly being contested by insurers seeking to reduce liability or otherwise gain leverage in a disputed claim. Obviously, questions relating to loss of income are critical if you have a partial disability claim. However, even if you have a total disability claim, the period of total disability could potentially come after several months of partial disability. As such, you should consider these questions carefully even if you are planning on filing a total disability claim.

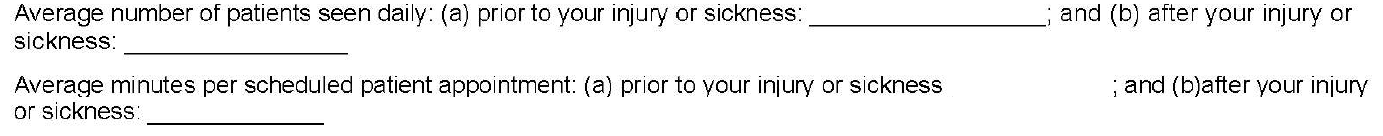

2. Why is Guardian Asking Me to Quantify Patients Per Day and Minutes Per Patient? How Do I Even Do That?

As noted above, changes in work schedule can be very important on a partial disability claim; however, these particular questions are also illustrative for another reason.

On their face, these questions seek information about the difference between the two timeframes, along the lines of what you might expect if you are filing a partial disability claim. The problem here is that the form does not allow for nuance and often these timeframes are not apples-to-apples comparisons.

For example, before your disability date, you may have been working on complex reconstruction cases, only seeing a few patients a day. Then, due to disability, you may have had to abandon the longer, more difficult (and more lucrative) procedures. As a result, you may be seeing many more patients a day, but only performing simpler tasks, such as exams or cleanings. But if you only answer what it asked, it will look like you have increased your workload because you are seeing substantially more patients after your disability.

The second question seems to address this, by asking how much time you spend on each patient appointment. However, providing a generalized answer here can also have unanticipated ramifications.

Going back to the above example, your instinct might be to put a very low number for the new time spent with patients, to highlight that you are doing easier, shorter procedures. However, this can have unanticipated long-term consequences. If you minimize or trivialize the number of hours you spend with patients when filing a partial disability claim, when you reach the point in time that you feel you are totally disabled, Guardian will refer back to this form and ask what has changed? Why can you not keep working if you are only doing simple cases, and only for short periods of time? What has happened medically to explain this change?

Sometimes, there will be a new medical event that can be pointed to. However, as noted above, most dentist claims involve slowly progressive conditions with primarily subjective symptoms (pain, numbness, etc.). As these worsen, imaging (such as MRIs) may or may not show a difference from prior imaging, even if you, as the dentist feeling the symptoms, know you are to the point that you should stop practicing for the sake of patient safety. Even if Guardian is only able to push a claim into partial disability, and reduce the monthly benefit, this can add up to a substantial amount over time.

In other instances, establishing a particular date of disability is critical (e.g. to establish notice was timely, or to lock-in certain lifetime benefits under Guardian’s graded lifetime riders). If your claim involves important timeline questions, failing to provide the appropriate level of detail and nuance can cause major problems and potentially provide Guardian with an argument to entirely avoid paying your disability claim.

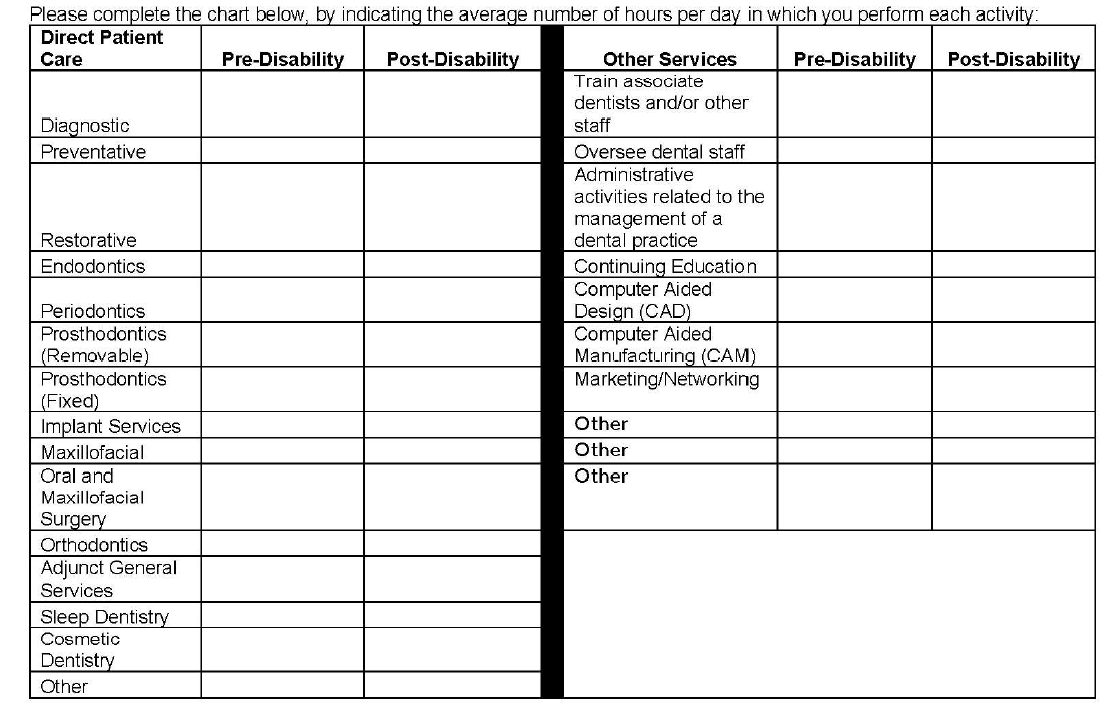

3. Why Is Guardian Asking Me to Break Down Patient Care by Hour? How Do I Do This When Many Categories Overlap and Each Day is Different and I Don’t Track Procedures by Hour? Why Is Guardian Listing Other Non-Clinical Categories?

The problems with the left column of this table should be immediately apparent to most dentists, as many categories overlap. As with the prior question, the form does not provide a means to explain important nuances. Additionally, the dentist is asked to answer the form based on “hours per day” which, for most dentists, varies widely depending on the day and is something that is not tracked on an hourly basis.

The second column is a good example of a question designed to elicit information that Guardian might seek to use in a “dual occupation” defense. As noted in prior posts, most Guardian policies have plural definitions of “occupation.” Guardian—like other disability insurers—will seek to expand your occupation to other, non-clinical roles if they think they can (e.g. practice owner, marketer, trainer/coach, supervisor/office manager, etc.).

While you must provide answers, and cannot avoid these sorts of questions, it is another area where nuance is very important and answering within the restrictions of the Guardian form itself can be harmful for a claim. The above questions may also not be particularly relevant, depending on the type of claim you are making. Or they could be very relevant, if you have future employment plans. If you start a new job in the future, at any point in your claim, Guardian will look back to prior claim forms to see if there are any overlapping duties. If you are unconcerned or imprecise when completing the forms, this can cause problems later on if you want to start other jobs related to dentistry (such as managing dental practices or teaching at a dental school/supervising dental clinics).

4. Why is Guardian Asking for an Hourly Breakdown of All of the Tools I Am Still “Able to Use” Each Day?

This question is another one that initially seems innocuous, but there is a high likelihood that the response will be used unfairly. This is evident when you consider what is actually being asked, particularly if a dentist is filing a total disability claim.

Essentially, the question asks for the minimum number of hours a dentist can still “use” a dental tool in a given day. But it leaves out critical details and qualifiers, and can be taken in several different directions. One dentist might answer based upon the number of hours they think they can work on a live-patient, factoring in patient safety risks. Alternatively, another dentist might take it literally and think it is asking whether the tool can be physically used/manipulated in any capacity, regardless of patient risk.

Additionally, this question simply asks for “hours per day” without clarifying whether this is with breaks, or without breaks, or what the tool is being used to accomplish.

The absence of these additional clarifying details makes it clear that Guardian is seeking responses to muddy the waters when it comes to assessing capacity to work and total versus partial disability.

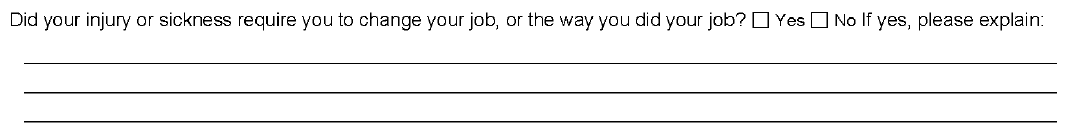

5. Why is Guardian Asking if I Modified My Job Before Filing and How is That Relevant?

While this question provides some room for explanation, it does not ask the critical follow-up question—i.e. whether modifications were effective, or remain effective. Absent an appropriately detailed explanation, Guardian may suggest the dentist could continue to work with the same modifications, even if the dentist is not actually working anymore or the modifications are no longer effective.

This question is also important from an “occupation” standpoint, and is another example of why timeline and the date of disability are so critical. Under most disability policies, including Guardian policies, your “occupation” is defined as of your date of disability. If you modified your duties or changed your schedule prior to your date of disability, this can make it more difficult to collect disability benefits.

This can be addressed by selecting earlier disability dates, but that may not be possible if there are late notice problems with the claim. Similarly, there are scenarios where modified schedules do not necessarily translate into loss of income sufficient to trigger a partial disability clause—for example, where a practice owner cuts back and brings in associates to keep up the practice’s production. This is why it is important to carefully review your policy and pick an appropriate disability date prior to filing; otherwise, questions like the above can become problematic without you even realizing it.

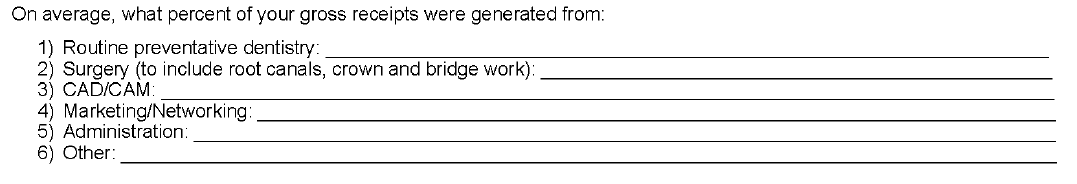

6. Why is Guardian Asking Me to Break Down the Source of Gross Receipts?

This question has several implications and, by now, you can likely guess why Guardian might be asking for this information.

Most Guardian policies define total disability based on an inability to perform the “material and substantial” duties of your occupation. A common tactic used by Guardian (and other insurers) is to ascribe a dollar value to certain things, then characterize them as “major” or “minor” duties. Sometimes this makes sense, but a “material and substantial” duties analysis—particularly for dentists—is claim specific, and involves a host of factors beyond “gross receipts” (e.g. time, complexity, patient expectations, nature of practice, specialty, etc.). As with other questions in the form, the provided categories also overlap to some extent, making it difficult to respond in a precise manner.

Additionally, this is another example of a question that can have ramifications later on if you start a new job. Most Guardian policies are “true own occupation,” in the sense that they let you work in a different occupation and still collect total disability benefits. However, as discussed above, occupation is defined in the plural and disability insurers seek to expand it as much as possible beyond clinical duties.

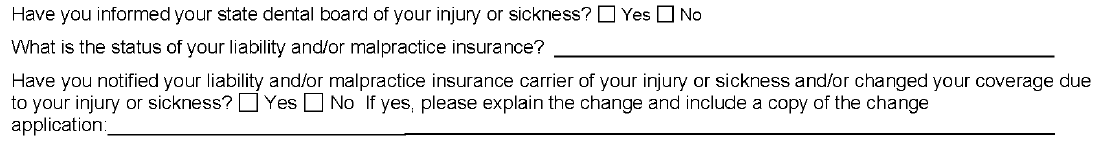

7. Why is Guardian Asking About the Dental Board/My Malpractice Insurance/Use of my NPI Number?

As evident from the above questions, Guardian is aware that, as a dentist, there are other legal documents that you must complete that directly relate to your capacity to practice dentistry safely.

At the outset of any disability claim, the initial claim packet includes an authorization that Guardian uses to look for anything that might be inconsistent with your claim, including statements made to your dental board or malpractice insurance. Guardian will consider the timing of those statements, in relation to the timing of your disability claim/selected date of disability. If they are inconsistent, Guardian may be more emboldened to deny your claim, as that sort of inconsistency could be used to undermine your credibility with a judge or jury.

The Takeaway

In short, Guardian wrote the policy and crafted the claim forms, so the process is designed to be as favorable to Guardian’s interests as possible.

This does not mean that it is impossible to collect, but it does mean that you should approach your claim in a serious, proactive matter and that you should become as informed as possible before filing your claim. If you do not have experience with the disability industry, it is advisable to consult with a disability attorney before submitting any proof of loss to Guardian.

Every claim is unique and the discussion above is only a limited summary of how Guardian approaches dentist disability claims. If you are concerned that Guardian is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

Attorneys Edward O. Comitz and Derek R. Funk Recognized by Super Lawyers for 2023

Attorney Ed Comitz has been named a Southwest Super Lawyer for 2023 for the twelfth consecutive year for excellence in the field of insurance coverage. Attorney Derek Funk has also been recognized as a Rising Star in the field of insurance coverage by Super Lawyers.

Super Lawyers is a rating service of outstanding lawyers from more than 70 practice areas who have attained a high-degree of peer recognition and professional achievement. The selection is a multiphase process comprised of independent research, peer nominations and peer evaluations. Only 5% of attorneys receive a Super Lawyers distinction, and only 2.5% of attorneys receive the Rising Star distinction.

Firm Named #1 Healthcare Law Firm

We are pleased to announce that we have been named Arizona’s #1 Healthcare Law Firm by Ranking Arizona: The Best of Arizona Business for 2023.

The Firm outranked other regional, national and international firms in Arizona, due to Ed Comitz’s nationally acclaimed disability insurance practice, which exclusively focuses on helping professionals (primarily physicians and dentists) collect their rightful disability benefits under private, “own-occupation” policies.

What are “Material and Substantial Duties”? A Case Study

Most “own occupation” disability insurance policies will address “material and substantial duties” in their definitions of total and partial disability. The exact definition (and whether or not you need to be disabled from one or all material and substantial duties) will depend on the language of your specific policy. However, what is and is not a material and substantial duty is not always clear-cut.

One example of this is the case of Vossberg v. Northwestern Mutual.[1] Dr. Vossberg was a physiatrist with a speech disorder (diagnosed as dysarthria). Dr. Vossberg filed a claim for partial disability with Northwestern Mutual, claiming that he could no longer make medical records because he was required to use electronic transcription software at his long-time hospital employer.

Under Dr. Vossberg’s policy, he would be considered partially disabled if he was “unable to perform one or more but not all of the principal duties of his occupation.” In this instance, both parties agreed that one of Dr. Vossberg’s principal duties was to “make medical records that document his interaction with patients.”

In reviewing the case, the Court found that “using electronic transcription software is not required to be a physiatrist.” The Court found that Dr. Vossberg had not presented evidence that his hospital employer had required the use of transcription software and pointed to the fact that he was currently working in private practice where he made his records by dictating patient notes into a tape record and having a person transcribe them. Further, other employers that Dr. Vossberg considered applying to testified that there was no requirement for him to use electronic transcription software. Thus, the Court concluded that Dr. Vossberg was not partially disabled under the terms of his policy.

Often, policies will even go so far to say that what is and is not a material and substantial duty is not based on what is done for any one employer, but for the national economy as a whole. So, even if Dr. Vossberg’s employer had actually required him to use transcription software, he may still not be considered disabled, depending on the exact language in his policy.

This case highlights the importance of carefully reading and understanding the terms of your specific policy and how it addresses material and substantial duties. If you fee that you are unable to do the material and substantial duties of your occupation, and are considering filing a disability insurance claim, please feel free to reach out to one of our attorneys directly.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Vossberg v. Northwestern Mutual Life Ins. Co., No. 1:22-cv-00364-JRS-KMB, 2023 WL 167460 (S.D. Ind. Jan. 12, 2023).

Long COVID: A Case Study

Some people infected with COVID-19 may go on to experience long COVID, which can cause a wide range of health issues that can last anywhere from several weeks to even years. Symptoms vary widely and can include fatigue, respiratory and heart symptoms, neurological symptoms, fever, joint pain and/or muscle pain.

Those afflicted with long COVID may find themselves unable to work and needing to file a long-term disability claim. However, it can be difficult to prevail on these types of claims, as insurers will often try to get out of paying claims based on long COVID.

One such example is the case of Abrams v. Unum.[1] Here, plaintiff William Abrams was an appellate lawyer who was experiencing “brain fog, fatigue, decreased attention and concentration, and fevers” starting in April 2020. After Unum initially denied his claim, Abrams appealed and went to seven different medical doctors, three of whom diagnosed plaintiff with long COVID with the remaining four diagnosing him as having chronic fatigue syndrome (CFS).

Unum continued to deny his claim, stating that a mental status exam did not show the necessary cognitive deficits needed to confirm the diagnosis of CFS, and that he had not submitted enough proof that he suffered from long COVID. While the Court agreed that there may be a paucity of evidence to confirm a diagnosis of long COVID, they pointed to the fact that all of Abrams’s providers confirmed that he was indeed sick and unable to meet the demands of his prior occupation.

The Court explained that “[b]eing a trial lawyer is akin to writing, directing, producing, and starring in a play simultaneously. The work is mentally and physically grueling. A reviewer must take that complexity into account when reviewing a claim.” The record shows that prior to his illness, Abrams was an avid marathon runner and worked 12-hour days. However, after his illness commenced, his primary care doctor noted that Abrams would “not be able to put together 1-2 workdays or partial workdays in a given week.” The Court further noted that if Abrams could not follow movie plots, he “cannot be expected to plan out trial strategies for multiple, complex cases.”

While Abrams was ultimately successful with his claim, the matter required costly and time-consuming litigation before the matter was resolved in his favor. This case highlights the challenges those with long COVID face when trying to collect benefits, and the need for strong medical records and supportive physicians. If you are experiencing long COVID and feel that you might need to file a claim, please feel free to reach out to one of our attorneys directly.

Every claim is unique and the discussion above is only a limited summary of the court’s ruling in this case. If you are concerned that your insurer is not evaluating your claim under the proper standard, an experienced disability insurance attorney can help you assess the situation and determine what options, if any, are available.

[1] Abrams v. Unum Life Ins. Co., C21-0980 TSC, 2022 WL 17960616 (W.D. Wash. Dec. 27, 2022).

Ed Comitz and Patrick Stanley Named Top Lawyers in Arizona

Members Ed Comitz and Pat Stanley have been named two of Arizona’s top 100 lawyers for 2023 by AZ Business Magazine.

Selections were made in conjunction with industry experts, with an algorithm that ranked the attorneys based on professional ratings, impact on their law firm, impact on the profession and community involvement.